InvestNow Market Wrap-Up: September 2024

Introducing Aaron Klee, General Manager, Investment Management & Services at AMP, this month’s guest author of the InvestNow Market Wrap-Up.

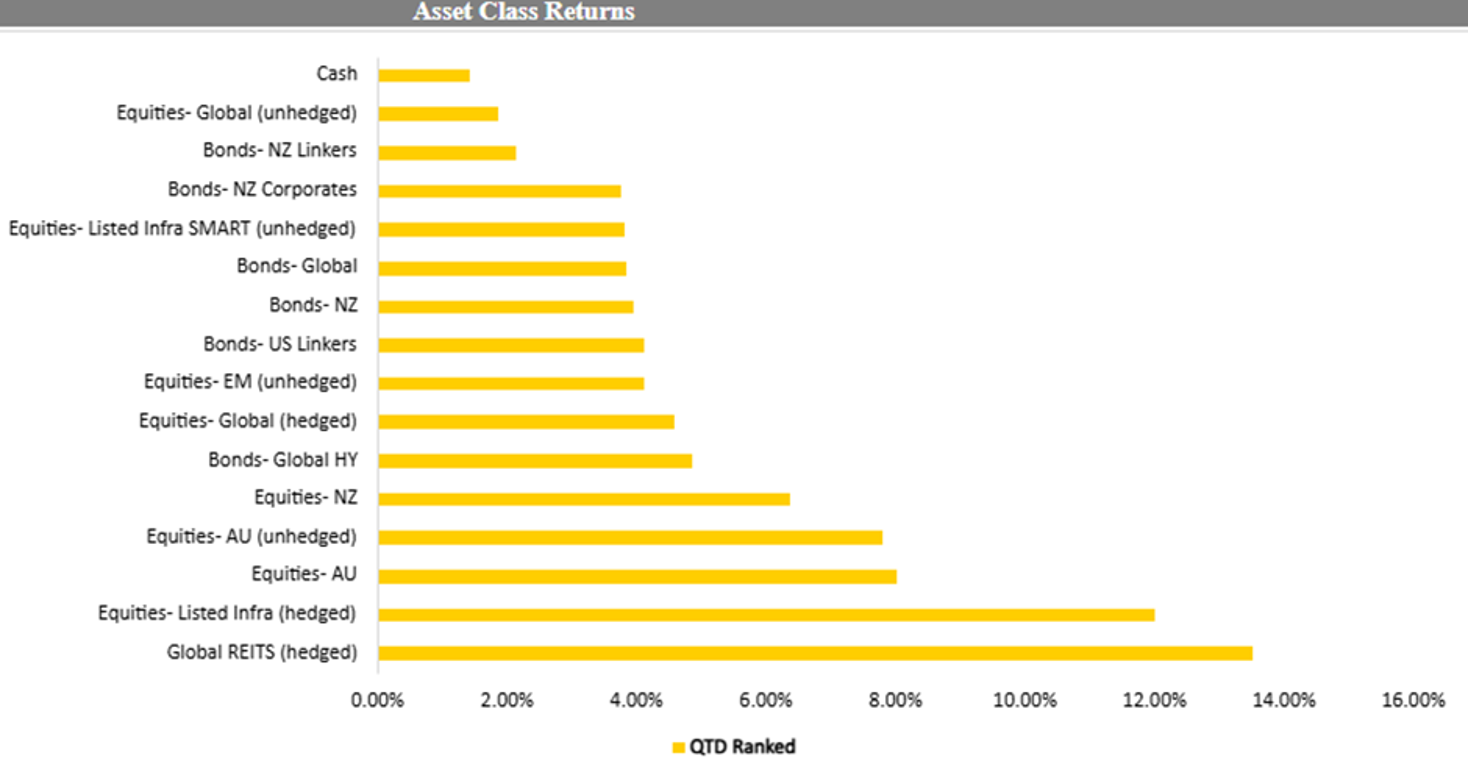

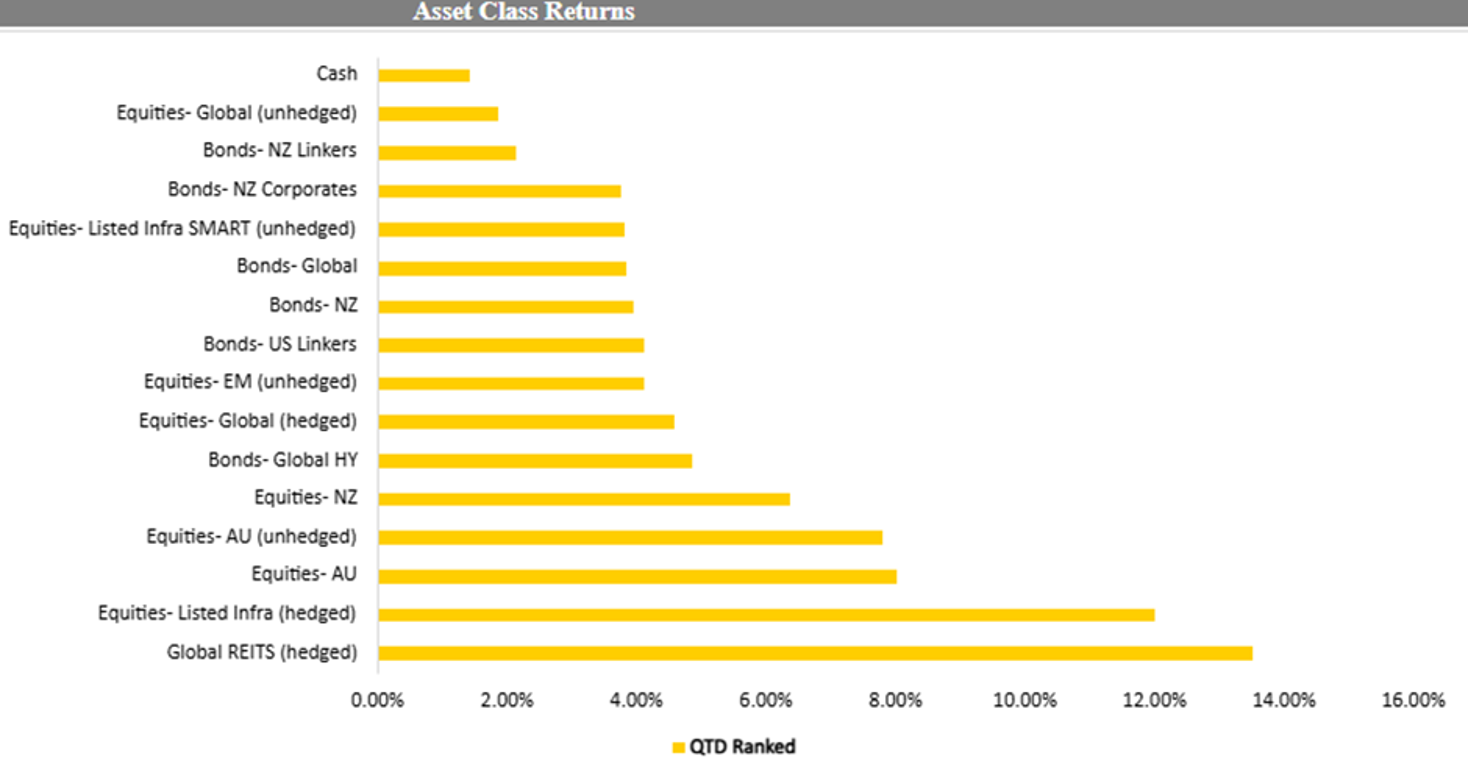

We live in interesting times! Despite an almost ten per cent drop in the S&P 500 Index (the broad US stock market index) in early August, most major asset classes ended the quarter in positive territory with new all-time high records along the way.

Around the world

A combination of weaker US economic data and an unexpected interest rate hike by the Bank of Japan saw investors re-evaluating risk. This resulted in a sell-off in equities causing equity market indices to fall. At the time, the balance of opinion swung from expectations of a US economic soft landing to that of real fear of a recession in US economic growth. Markets are now priced for a soft landing with economic data supporting the soft landing thesis.

At the start of the quarter, inflation was very much the focus for global markets and most central banks maintained restrictive monetary policy in efforts to combat inflation. For now, inflation is declining, growth in wages in the US is moderating and labour market pressures are cooling. Importantly, 14 months on from its last interest rate hike, the Federal Reserve has begun easing monetary policy with a 0.50% interest rate cut in September.

US Corporate profit reporting season showed that the sector was resilient and earnings growth consensus estimates shows that this should continue. US Treasury yields, and indeed interest rates globally, fell sharply during the third quarter resulting in positive returns for bonds.

In Europe and the United Kingdom, economic prospects are brightening after a period of slow and near recession conditions. Moderating inflation in Europe also allowed the European Central Bank to cut rates. The outlier here is Germany, where its industrial sector is struggling due to its reliance on China and its auto sector which has fallen behind in the shift to electric vehicles. In the United Kingdom, the third quarter of this year saw its economy showing signs of life. Growth in the UK has been stagnant since the end of COVID-19 lockdowns. Consumer and business confidence is on the rise, and declining inflation allowed the Bank of England to also cut interest rates.

In Japan economic performance remains patchy. Although business confidence is rising, growth remains weak, and household spending is constrained. The Bank of Japan has an interesting history for the past 30 years of raising interest rates and tightening monetary policy in anticipation of inflation. The Japanese yen has historically been very cheap and one of the driving factors was the prevalence of a carry trade in the currency. A carry trade is where an investor borrows money in a currency where there is a low-interest rate environment, and then proceeds to invest that money in another currency with a higher interest rate environment. What makes the trade successful is a depreciating or stable currency. The surprise interest rate hike by the Bank of Japan led to rising Japanese interest rates, resulting in repricing of the carry trade and its subsequent unwinding during July and August, as the yen appreciated versus the US dollar.

China’s economic performance over the quarter has failed to fire and its property market problems remained unsolved, negatively impacting consumer confidence and credit growth.

New Zealand

Gross domestic product (GDP) growth has been almost nil since September 2022 and the Reserve Bank of New Zealand (RBNZ) has finally let its foot off the brakes and began its interest rate cutting cycle. Monetary policy, however, is still restrictive while inflation is hovering just above the RBNZ inflation target. In its monetary policy statement, the central bank acknowledged that downside risks to the economy remain, and that it is monitoring conditions and are prepared to act more aggressively if deemed necessary.

In what is good news for importers but bad news for the export industry, the NZ dollar rallied just over 4% to close the quarter out at $0.6345 versus the US dollar.

AMP Portfolio changes

During the last 3 months, we introduced allocations to Global Listed Infrastructure for our diversified funds, to further diversify and strengthen our portfolio. Infrastructure investments have defensive characteristics including; their low correlation with other asset classes and their ability to offer inflation protection. Moreover, our Global Climate Fund made its first private market investment into renewable power opportunities. These investments are now also part of our diversified funds as direct infrastructure investments.

Outlook

As mentioned, US markets are priced for a soft landing, however, this can change in an instant if new data is released that points to negative growth expectations. Where central banks across the globe have now started easing monetary policy, interest rate sensitive assets such as bonds and real estate, could benefit from this.

We continue to monitor the geopolitical situation in the Middle East and the Ukraine, and if it escalates it could have a negative impact on asset prices. The imminent US Election now seems like a close race, and it is not clear how markets might react with either outcome. Tariffs, corporate taxes, fiscal deficits and the independence of the Federal Reserve are all hotly contested issues, so until policies become clearer, and the result is known, it is hard to determine how a Trump or a Harris outcome might impact markets.

Lastly, China has announced sizeable policy stimulus measures across the board. Monetary policy is now more expansive – the equity market and property sectors are benefitting from interest rate cuts and increased liquidity. Broad financing programmes have been announced to assist SMEs as well. This had a sizeable effect on China’s equity market which, at the time of writing, has rallied 27% since mid-September.

We continue to support the case for keeping a long-term view and maintaining good diversification across investment portfolios. These fundamentals are core to our investment philosophy, and it is always important to look through the ‘noise’ that we read about daily. The current environment is not different to others we have seen in the past. History is a great teacher for all investors and savers.

If you want to see which AMP investments are available on InvestNow, plus read any other opinion or commentary pieces from Aaron and the team at AMP, please visit their page on our website.

InvestNow Market Wrap-Up: September 2024

Introducing Aaron Klee, General Manager, Investment Management & Services at AMP, this month’s guest author of the InvestNow Market Wrap-Up.

We live in interesting times! Despite an almost ten per cent drop in the S&P 500 Index (the broad US stock market index) in early August, most major asset classes ended the quarter in positive territory with new all-time high records along the way.

Around the world

A combination of weaker US economic data and an unexpected interest rate hike by the Bank of Japan saw investors re-evaluating risk. This resulted in a sell-off in equities causing equity market indices to fall. At the time, the balance of opinion swung from expectations of a US economic soft landing to that of real fear of a recession in US economic growth. Markets are now priced for a soft landing with economic data supporting the soft landing thesis.

At the start of the quarter, inflation was very much the focus for global markets and most central banks maintained restrictive monetary policy in efforts to combat inflation. For now, inflation is declining, growth in wages in the US is moderating and labour market pressures are cooling. Importantly, 14 months on from its last interest rate hike, the Federal Reserve has begun easing monetary policy with a 0.50% interest rate cut in September.

US Corporate profit reporting season showed that the sector was resilient and earnings growth consensus estimates shows that this should continue. US Treasury yields, and indeed interest rates globally, fell sharply during the third quarter resulting in positive returns for bonds.

In Europe and the United Kingdom, economic prospects are brightening after a period of slow and near recession conditions. Moderating inflation in Europe also allowed the European Central Bank to cut rates. The outlier here is Germany, where its industrial sector is struggling due to its reliance on China and its auto sector which has fallen behind in the shift to electric vehicles. In the United Kingdom, the third quarter of this year saw its economy showing signs of life. Growth in the UK has been stagnant since the end of COVID-19 lockdowns. Consumer and business confidence is on the rise, and declining inflation allowed the Bank of England to also cut interest rates.

In Japan economic performance remains patchy. Although business confidence is rising, growth remains weak, and household spending is constrained. The Bank of Japan has an interesting history for the past 30 years of raising interest rates and tightening monetary policy in anticipation of inflation. The Japanese yen has historically been very cheap and one of the driving factors was the prevalence of a carry trade in the currency. A carry trade is where an investor borrows money in a currency where there is a low-interest rate environment, and then proceeds to invest that money in another currency with a higher interest rate environment. What makes the trade successful is a depreciating or stable currency. The surprise interest rate hike by the Bank of Japan led to rising Japanese interest rates, resulting in repricing of the carry trade and its subsequent unwinding during July and August, as the yen appreciated versus the US dollar.

China’s economic performance over the quarter has failed to fire and its property market problems remained unsolved, negatively impacting consumer confidence and credit growth.

New Zealand

Gross domestic product (GDP) growth has been almost nil since September 2022 and the Reserve Bank of New Zealand (RBNZ) has finally let its foot off the brakes and began its interest rate cutting cycle. Monetary policy, however, is still restrictive while inflation is hovering just above the RBNZ inflation target. In its monetary policy statement, the central bank acknowledged that downside risks to the economy remain, and that it is monitoring conditions and are prepared to act more aggressively if deemed necessary.

In what is good news for importers but bad news for the export industry, the NZ dollar rallied just over 4% to close the quarter out at $0.6345 versus the US dollar.

AMP Portfolio changes

During the last 3 months, we introduced allocations to Global Listed Infrastructure for our diversified funds, to further diversify and strengthen our portfolio. Infrastructure investments have defensive characteristics including; their low correlation with other asset classes and their ability to offer inflation protection. Moreover, our Global Climate Fund made its first private market investment into renewable power opportunities. These investments are now also part of our diversified funds as direct infrastructure investments.

Outlook

As mentioned, US markets are priced for a soft landing, however, this can change in an instant if new data is released that points to negative growth expectations. Where central banks across the globe have now started easing monetary policy, interest rate sensitive assets such as bonds and real estate, could benefit from this.

We continue to monitor the geopolitical situation in the Middle East and the Ukraine, and if it escalates it could have a negative impact on asset prices. The imminent US Election now seems like a close race, and it is not clear how markets might react with either outcome. Tariffs, corporate taxes, fiscal deficits and the independence of the Federal Reserve are all hotly contested issues, so until policies become clearer, and the result is known, it is hard to determine how a Trump or a Harris outcome might impact markets.

Lastly, China has announced sizeable policy stimulus measures across the board. Monetary policy is now more expansive – the equity market and property sectors are benefitting from interest rate cuts and increased liquidity. Broad financing programmes have been announced to assist SMEs as well. This had a sizeable effect on China’s equity market which, at the time of writing, has rallied 27% since mid-September.

We continue to support the case for keeping a long-term view and maintaining good diversification across investment portfolios. These fundamentals are core to our investment philosophy, and it is always important to look through the ‘noise’ that we read about daily. The current environment is not different to others we have seen in the past. History is a great teacher for all investors and savers.

If you want to see which AMP investments are available on InvestNow, plus read any other opinion or commentary pieces from Aaron and the team at AMP, please visit their page on our website.