InvestNow Market Wrap-Up: July 2025

Welcoming back Greg Fleming, Head of Global Diversified Funds at SALT Funds Management, as this month’s guest author of the InvestNow Market Wrap-Up.

“Hotter than July?”

The second half of 2025 got underway with a remarkable degree of unconcern, considering the continuing lack of clarity on many crucial global economic and market influences. In equity markets, which had recovered in the June quarter after the extremely volatile start to the year, the tone was not so much complacency, as a widespread willingness to give some major US developments the benefit of the doubt.

This “glass-half-full” mindset may be an understandable reaction to a barrage of disruptive announcements that has been the prime characteristic of what is proving to be a classic Chinese “Year of the Snake” – full of clashes, conflicts, and sudden plot-twists. In more concrete macroeconomic terms, many investment price drivers which developed nations have become accustomed to in the last thirty years are now losing stability and reliability. However, adapting to novel influences and threats takes time.

For instance, profit margins, which can typically be planned for and hedged well in advance of undertaking any commercial activity, are becoming less forecastable, as a range of imposts and costs come and go. Monetary policy is coming under increasing political influence in the US, and the developed world’s fiscal requirements are increasingly burdensome for growth, making tax reductions extremely fraught. All of these forces are slow-moving in terms of their ultimate economic and market impacts.

In July, investors were faced with something of a “phony war” situation where, while it is widely appreciated that the innovations in trade tariffs, tax cuts and industry policies launched by the Trump Administration will have a powerful effect, it is difficult to predict precisely when this will be evident. For tariffs, a 3-month lag after implementation to inflation impact is probable, but many actual tariff rates have just now been formalised, on the last day of July. So, only late this year might their impacts become indisputable, whether on corporate profits, consumer prices, or on consumer spending. Until then, markets are watching for any further signs of deterioration in the investment climate and in particular, in the labour market outlook and interest rate settings of the major developed economies.

In the US, second quarter earnings reports through the month showed companies generally beating consensus earnings and revenue growth estimates. This indicated the recent political turmoil and policy flip-flopping has thus far not impacted earnings greatly, though a number of firms in guidance warned of tariff impacts. The S&P 500 rallied 2.3% and the NASDAQ by 3.3%. Australasian equities were a degree less positive, with a 2.4% gain in the ASX 200 Index and a 1.8% gain in the NZX 50 for the month. Larger European share markets were generally softer with modest local currency gains, given the impact of the Trump tariffs on European exporter sales growth prospects, whilst the UK and Japanese market both rallied by 4%. As the NZ dollar unwound some of 2025’s advance against the US dollar and also slipped against the euro in July month, that boosted returns for unhedged investors in US and European equities.

“The Price You Pay” – Inflation and Central Banks

In mid-July, the US June CPI report came in better than expected, though early signs of the impact of tariffs are beginning to emerge. The Federal Reserve left interest rates unchanged, waiting for further clarity on the tariff impacts on consumer prices. The political pressure for Chair Jay Powell to cut rates is intense, but so far, the Fed has resisted – though two governors dissented in favour of easing, in the July policy setting meeting. September could see a showdown between the data hawks and the President-pleasers.

In Europe the June CPI came in at 2% y/y. After eight interest rate cuts, the European Central Bank left rates unchanged in July with ECB President Christine Lagarde saying they were well placed to wait and see the impact of tariffs on activity across the region. Japan was struck with fresh political uncertainty during the month as the ruling LDP lost its majority in the upper house elections. This has raised concerns about the political commitment to fiscal consolidation. Inflation remains well above target, and with the final tariff rate being set at a lower-than-expected 15%, mitigating some of the downside risk to the export-intensive economy, markets are starting to price in the possibility of another hike in interest rates this year from the Bank of Japan.

Against unanimous expectations from economists and a 25bp cut being almost fully priced (96%) by interest rate markets, the Reserve Bank of Australia left interest rate unchanged in July. The bank still articulated a bias to reduce interest rates with markets now expecting a cut at the August meeting. Likewise in New Zealand the RBNZ left the Official Cash Rate unchanged in July, though after 225bp of cuts, this was widely expected. Ongoing soft activity data has markets expecting further interest rate reductions, potentially in the August 20th meeting, though we are close to the bottom of the cycle.

“There’ll be time enough for countin’ when the dealin’s done!”

Several agreements were announced during the month of July, culminating in the release of the president’s further modifications of tariffs at the end of the month. This took the form of restatements as to where the (potentially) more stable tariff rates will sit for the main countries listed in the original Liberation Day placard, excepting for China, where negotiations still remain underway. New Zealand-originated goods have been slated with a 15% US tariff, Australia and the UK with 10%, while unfortunate Switzerland attracted a 39% rate – mainly due to the sheer size of the Swiss trade surplus with the US.

As a Swiss wit noted, not even if all his countrymen took up drinking Bourbon and riding Harleys, could the 9-million-person alpine nation ever hope to “balance” the total value of precious metals, precision tools, luxury goods and medicines which the US purchases in huge volumes from Switzerland. The Swiss President has now scooted to Washington to attempt to obtain a better deal, though hopes are not high.

This anecdote highlights the irrationality of the present global economic and market environment. Countries are having to adapt and pivot to “solve the unsolvable” or to address non-issues that have now become critical issues, due entirely to the headline-driven initiatives of the US administration. The use of US Emergency Economic Powers to impose the tariffs is itself controversial and subject to court challenge.

The World Trade Organisation, which was an effective and mostly consistent forum for lowering tariff and non-tariff trade barriers over time, thereby raising global prosperity for decades, has been sidelined in favour of an unpredictable deals-based approach from the US, wherein any number of extraneous factors (often political in kind) can affect the “most favoured nation” designations and market access restrictions and levies placed on companies supplying the US. The US importers or their customs agents who actually pay the tariffs over to the US Customs Service (in July, this amounted to a record USD 29 billion) must then work out ways in which to defray or to pass on these charges. Despite much rhetoric, tariffs are not a “fairness tax on foreign manufacturers” but an internal impost largely absorbed by the private sector inside country imposing them.

“Tax Free?” A degree of defiance in markets

In terms of the US fiscal situation, the One Big Beautiful Bill Act (OBBBA) passed through Congress, and the final iteration was more stimulatory than the initial version of the bill. However, much of the tax reductions and other pro-growth measures are not yet effective, and their lead time may limit the support these law changes can lend to asset class returns before the end of 2025. Nevertheless, the reduction of policy uncertainty saw developed market equities up 1.3% (in USD) in the month, marking an all-time high. To an extent, this reflects a tendency in markets to engage in defiance of risk, until the risk becomes immediate or until “something breaks” – often in the form of a corporate failure or geopolitical shock. Negative systemic problems have been in abeyance in 2025, allowing the path of least resistance for asset prices to be upward. However, it should be noted that leveraged and speculative trading is high at present.

Continued concerns about fiscal sustainability were a headwind for bond markets over the month with the global aggregate bond index losing 1.5% (in USD). The fully NZD-hedged global bond index lost -0.2% for the month, lowering its year-to-date gain to an anaemic 2.2%. The fact that so far, overall bond returns have remained below typical levels for a period of economic deceleration implies there may be latent opportunities building, especially given the overshadowing of fixed income by recent equity performance.

“Land of Confusion”

So, confusion is still high, and the inflationary effects largely remain to be seen, but the upshot for now is that business planning and consumer activity have been chilled, which is showing up in sentiment data. That sense of a hiatus is being reflected in asset prices to a degree, though it will likely only be when so-called “hard” – real economy, rather than sentiment survey – reports show the cooling that markets may come to reflect the weaker tone. US July payrolls numbers gave a hint of that, but there is likely more to come, making the environment for equity investors increasingly fraught with risk. Retail traders are reliably buying on market dips, while institutional investors are still more cautiously positioned, at present. Our own view is to remain cautious on highly-valued US equities trading on momentum; to build up defensive and NZ equity allocations incrementally, and to stick with listed Real Assets which have reliable cash flows. While there is considerable “Fear of Missing Out” in commentaries presently, that tends to be a characteristic of late-stage bull markets, rather than periods of opportunity for enduring capital growth. Wall Street estimates for 2026 currently imply 13% profits growth across the S&P 500 companies, which looks optimistic given the panoply of risks.

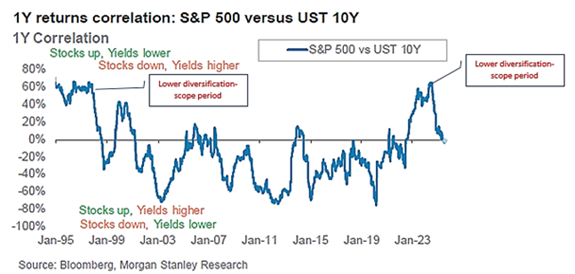

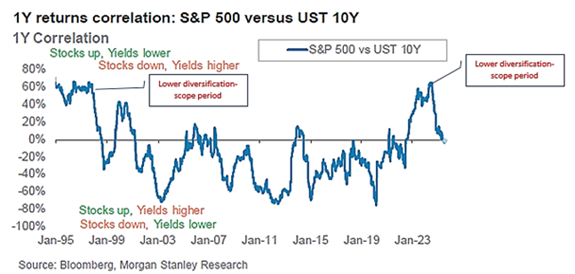

On the positive side, bond yields and equity returns have broken out of their two years’ of high correlation, making it easier to achieve better asset class diversification in multi-sector portfolios. Until recently, both bond and share prices were moving broadly in the same direction, but sample measures have recently revealed a return to zero correlation (on the 12-month measure.) While negative correlation is better for the best diversification benefits, the current situation is clearly an improvement for portfolio construction.

It is also worth noting that Bonds are broadly not over-valued at present, although corporate spreads are historically slender, but that considerable mark-to-market gains in Fixed income could be unleashed if a currently-unexpected, sharper economic deterioration in the US does in fact eventuate. Active bond selection remains crucial, as both credit and duration risk must be considered, in anticipation of a shift in macro conditions from benevolent towards challenging, if not outright contractionary.

“Here Comes the Rain Again?”

If US policy interest rate reductions are re-started in the Fourth Quarter and advanced due mainly to a sliding employment market, that suggests substantial equity risks are underpriced. Similarly, the US Equity Risk Premium – the estimate of the return investors should expect from shares above risk-free bond returns – remains in negative zone, meaning that equity investors are comfortable to pay (rather than be paid) to take on risk, in the hope of continued capital gains. Historically, that doesn’t suggest widespread opportunity ahead in international share markets dominated by mega-capitalisation US multinationals operating in technology, despite the still somewhat nebulous promise of future returns from Artificial Intelligence as a transformer of industries. That narrative is too well-known and even somewhat hyped, so value probably lies elsewhere.

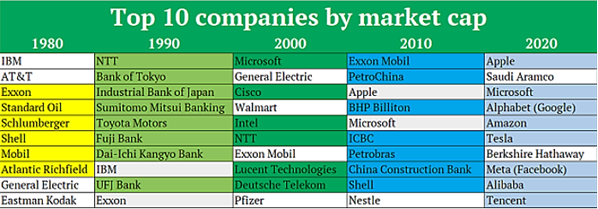

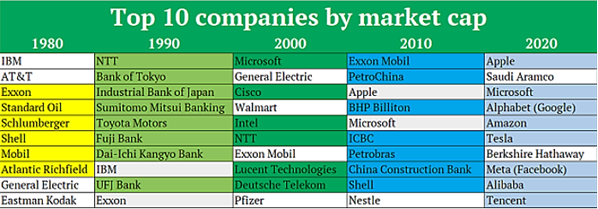

As we learned in the decades from 1980-2000, it wasn’t the period’s dominant and popular investment themes (Oil & Japan then, Social Media & Microchips now) that had the power of endurance in the longer run. We suspect the changed political environment will impact on investment returns, that reversals can develop swiftly when the tide shifts, and that future winners may be found outside today’s biggest names. This catalyst might not hit before year-end, but 2026 should show indications of a shift back toward tangible assets, and to countries benefitting from stable and responsible regulations and policy plans.

If you want to see which SALT investments are available on InvestNow, plus read any other opinion or commentary pieces from Greg and the team at SALT, please visit their page on our website.

InvestNow Market Wrap-Up: July 2025

Welcoming back Greg Fleming, Head of Global Diversified Funds at SALT Funds Management, as this month’s guest author of the InvestNow Market Wrap-Up.

“Hotter than July?”

The second half of 2025 got underway with a remarkable degree of unconcern, considering the continuing lack of clarity on many crucial global economic and market influences. In equity markets, which had recovered in the June quarter after the extremely volatile start to the year, the tone was not so much complacency, as a widespread willingness to give some major US developments the benefit of the doubt.

This “glass-half-full” mindset may be an understandable reaction to a barrage of disruptive announcements that has been the prime characteristic of what is proving to be a classic Chinese “Year of the Snake” – full of clashes, conflicts, and sudden plot-twists. In more concrete macroeconomic terms, many investment price drivers which developed nations have become accustomed to in the last thirty years are now losing stability and reliability. However, adapting to novel influences and threats takes time.

For instance, profit margins, which can typically be planned for and hedged well in advance of undertaking any commercial activity, are becoming less forecastable, as a range of imposts and costs come and go. Monetary policy is coming under increasing political influence in the US, and the developed world’s fiscal requirements are increasingly burdensome for growth, making tax reductions extremely fraught. All of these forces are slow-moving in terms of their ultimate economic and market impacts.

In July, investors were faced with something of a “phony war” situation where, while it is widely appreciated that the innovations in trade tariffs, tax cuts and industry policies launched by the Trump Administration will have a powerful effect, it is difficult to predict precisely when this will be evident. For tariffs, a 3-month lag after implementation to inflation impact is probable, but many actual tariff rates have just now been formalised, on the last day of July. So, only late this year might their impacts become indisputable, whether on corporate profits, consumer prices, or on consumer spending. Until then, markets are watching for any further signs of deterioration in the investment climate and in particular, in the labour market outlook and interest rate settings of the major developed economies.

In the US, second quarter earnings reports through the month showed companies generally beating consensus earnings and revenue growth estimates. This indicated the recent political turmoil and policy flip-flopping has thus far not impacted earnings greatly, though a number of firms in guidance warned of tariff impacts. The S&P 500 rallied 2.3% and the NASDAQ by 3.3%. Australasian equities were a degree less positive, with a 2.4% gain in the ASX 200 Index and a 1.8% gain in the NZX 50 for the month. Larger European share markets were generally softer with modest local currency gains, given the impact of the Trump tariffs on European exporter sales growth prospects, whilst the UK and Japanese market both rallied by 4%. As the NZ dollar unwound some of 2025’s advance against the US dollar and also slipped against the euro in July month, that boosted returns for unhedged investors in US and European equities.

“The Price You Pay” – Inflation and Central Banks

In mid-July, the US June CPI report came in better than expected, though early signs of the impact of tariffs are beginning to emerge. The Federal Reserve left interest rates unchanged, waiting for further clarity on the tariff impacts on consumer prices. The political pressure for Chair Jay Powell to cut rates is intense, but so far, the Fed has resisted – though two governors dissented in favour of easing, in the July policy setting meeting. September could see a showdown between the data hawks and the President-pleasers.

In Europe the June CPI came in at 2% y/y. After eight interest rate cuts, the European Central Bank left rates unchanged in July with ECB President Christine Lagarde saying they were well placed to wait and see the impact of tariffs on activity across the region. Japan was struck with fresh political uncertainty during the month as the ruling LDP lost its majority in the upper house elections. This has raised concerns about the political commitment to fiscal consolidation. Inflation remains well above target, and with the final tariff rate being set at a lower-than-expected 15%, mitigating some of the downside risk to the export-intensive economy, markets are starting to price in the possibility of another hike in interest rates this year from the Bank of Japan.

Against unanimous expectations from economists and a 25bp cut being almost fully priced (96%) by interest rate markets, the Reserve Bank of Australia left interest rate unchanged in July. The bank still articulated a bias to reduce interest rates with markets now expecting a cut at the August meeting. Likewise in New Zealand the RBNZ left the Official Cash Rate unchanged in July, though after 225bp of cuts, this was widely expected. Ongoing soft activity data has markets expecting further interest rate reductions, potentially in the August 20th meeting, though we are close to the bottom of the cycle.

“There’ll be time enough for countin’ when the dealin’s done!”

Several agreements were announced during the month of July, culminating in the release of the president’s further modifications of tariffs at the end of the month. This took the form of restatements as to where the (potentially) more stable tariff rates will sit for the main countries listed in the original Liberation Day placard, excepting for China, where negotiations still remain underway. New Zealand-originated goods have been slated with a 15% US tariff, Australia and the UK with 10%, while unfortunate Switzerland attracted a 39% rate – mainly due to the sheer size of the Swiss trade surplus with the US.

As a Swiss wit noted, not even if all his countrymen took up drinking Bourbon and riding Harleys, could the 9-million-person alpine nation ever hope to “balance” the total value of precious metals, precision tools, luxury goods and medicines which the US purchases in huge volumes from Switzerland. The Swiss President has now scooted to Washington to attempt to obtain a better deal, though hopes are not high.

This anecdote highlights the irrationality of the present global economic and market environment. Countries are having to adapt and pivot to “solve the unsolvable” or to address non-issues that have now become critical issues, due entirely to the headline-driven initiatives of the US administration. The use of US Emergency Economic Powers to impose the tariffs is itself controversial and subject to court challenge.

The World Trade Organisation, which was an effective and mostly consistent forum for lowering tariff and non-tariff trade barriers over time, thereby raising global prosperity for decades, has been sidelined in favour of an unpredictable deals-based approach from the US, wherein any number of extraneous factors (often political in kind) can affect the “most favoured nation” designations and market access restrictions and levies placed on companies supplying the US. The US importers or their customs agents who actually pay the tariffs over to the US Customs Service (in July, this amounted to a record USD 29 billion) must then work out ways in which to defray or to pass on these charges. Despite much rhetoric, tariffs are not a “fairness tax on foreign manufacturers” but an internal impost largely absorbed by the private sector inside country imposing them.

“Tax Free?” A degree of defiance in markets

In terms of the US fiscal situation, the One Big Beautiful Bill Act (OBBBA) passed through Congress, and the final iteration was more stimulatory than the initial version of the bill. However, much of the tax reductions and other pro-growth measures are not yet effective, and their lead time may limit the support these law changes can lend to asset class returns before the end of 2025. Nevertheless, the reduction of policy uncertainty saw developed market equities up 1.3% (in USD) in the month, marking an all-time high. To an extent, this reflects a tendency in markets to engage in defiance of risk, until the risk becomes immediate or until “something breaks” – often in the form of a corporate failure or geopolitical shock. Negative systemic problems have been in abeyance in 2025, allowing the path of least resistance for asset prices to be upward. However, it should be noted that leveraged and speculative trading is high at present.

Continued concerns about fiscal sustainability were a headwind for bond markets over the month with the global aggregate bond index losing 1.5% (in USD). The fully NZD-hedged global bond index lost -0.2% for the month, lowering its year-to-date gain to an anaemic 2.2%. The fact that so far, overall bond returns have remained below typical levels for a period of economic deceleration implies there may be latent opportunities building, especially given the overshadowing of fixed income by recent equity performance.

“Land of Confusion”

So, confusion is still high, and the inflationary effects largely remain to be seen, but the upshot for now is that business planning and consumer activity have been chilled, which is showing up in sentiment data. That sense of a hiatus is being reflected in asset prices to a degree, though it will likely only be when so-called “hard” – real economy, rather than sentiment survey – reports show the cooling that markets may come to reflect the weaker tone. US July payrolls numbers gave a hint of that, but there is likely more to come, making the environment for equity investors increasingly fraught with risk. Retail traders are reliably buying on market dips, while institutional investors are still more cautiously positioned, at present. Our own view is to remain cautious on highly-valued US equities trading on momentum; to build up defensive and NZ equity allocations incrementally, and to stick with listed Real Assets which have reliable cash flows. While there is considerable “Fear of Missing Out” in commentaries presently, that tends to be a characteristic of late-stage bull markets, rather than periods of opportunity for enduring capital growth. Wall Street estimates for 2026 currently imply 13% profits growth across the S&P 500 companies, which looks optimistic given the panoply of risks.

On the positive side, bond yields and equity returns have broken out of their two years’ of high correlation, making it easier to achieve better asset class diversification in multi-sector portfolios. Until recently, both bond and share prices were moving broadly in the same direction, but sample measures have recently revealed a return to zero correlation (on the 12-month measure.) While negative correlation is better for the best diversification benefits, the current situation is clearly an improvement for portfolio construction.

It is also worth noting that Bonds are broadly not over-valued at present, although corporate spreads are historically slender, but that considerable mark-to-market gains in Fixed income could be unleashed if a currently-unexpected, sharper economic deterioration in the US does in fact eventuate. Active bond selection remains crucial, as both credit and duration risk must be considered, in anticipation of a shift in macro conditions from benevolent towards challenging, if not outright contractionary.

“Here Comes the Rain Again?”

If US policy interest rate reductions are re-started in the Fourth Quarter and advanced due mainly to a sliding employment market, that suggests substantial equity risks are underpriced. Similarly, the US Equity Risk Premium – the estimate of the return investors should expect from shares above risk-free bond returns – remains in negative zone, meaning that equity investors are comfortable to pay (rather than be paid) to take on risk, in the hope of continued capital gains. Historically, that doesn’t suggest widespread opportunity ahead in international share markets dominated by mega-capitalisation US multinationals operating in technology, despite the still somewhat nebulous promise of future returns from Artificial Intelligence as a transformer of industries. That narrative is too well-known and even somewhat hyped, so value probably lies elsewhere.

As we learned in the decades from 1980-2000, it wasn’t the period’s dominant and popular investment themes (Oil & Japan then, Social Media & Microchips now) that had the power of endurance in the longer run. We suspect the changed political environment will impact on investment returns, that reversals can develop swiftly when the tide shifts, and that future winners may be found outside today’s biggest names. This catalyst might not hit before year-end, but 2026 should show indications of a shift back toward tangible assets, and to countries benefitting from stable and responsible regulations and policy plans.

If you want to see which SALT investments are available on InvestNow, plus read any other opinion or commentary pieces from Greg and the team at SALT, please visit their page on our website.

Leave A Comment