InvestNow News – 7th May – Harbour Asset Management – Inflation risks building

Article written by Hamish Pepper, Harbour Asset Management – 23rd April 2021

- Inflation is likely to surge through the Reserve Bank of New Zealand’s (RBNZ) 2% target in the coming months, reflecting mostly temporary factors that could easily reverse.

- But there is a risk that inflation becomes more persistent, something the market may be underestimating.

- We think medium-term inflation risks are skewed to the upside and have positioned portfolios accordingly.

New Zealand consumer price inflation increased modestly in Q1 to 1.5% y/y, in line with market expectations, but is likely to surge through the Reserve Bank of New Zealand’s (RBNZ) 2% target in the coming months. The increase will be driven mainly by common global factors that the RBNZ deem as transitory. These include:

- Base effects. For the calculation of annual inflation, Q2 2021 prices will be compared to a period where prices had declined due to COVID lockdowns.

- Goods supply disruption and higher freight costs. Goods prices have increased as COVID has disrupted global supply chains at a time where global demand has increased.

- Higher oil prices. Oil prices, measured in NZ$, have increased 70% over the past year and New Zealand petrol prices are about 9% higher. Petrol has a 3.6% weight in the consumer price index (CPI).

The risk, however, is that higher inflation becomes more persistent if:

- Core inflation measures and inflation expectations, that are already close to the RBNZ’s target, track higher with increases in headline inflation. The RBNZ’s preferred measure of core inflation (based on a sectoral factor model) has been steadily ticking higher in recent quarters to 1.9% y/y in Q1 and most other measures of core inflation sit close to 2% (see figure below). Inflation expectations also sit close to 2% and since the Global Financial Crisis, have tended to be formed by actual inflation outcomes. If inflation expectations increase in line with the rise in headline CPI inflation, inflation pressure may become more persistent as these expectations influence wage and price setting We suspect there may be a behavioural aspect here. Perhaps inflation begets inflation in a way not seen over the last decade.

- The strong desire by firms to pass on recent cost increases is acted upon. Recent cost increases relate not just to the goods supply disruption and capacity constraints mentioned above, but also the recent 5.8% increase in minimum wages from $18.90 to $20 per hour and ongoing upward pressure on Council rates. The ANZ business outlook survey shows that the largest portion of firms on record intend to increase prices (see figure below).

- Spare capacity within the economy is overestimated. The way in which the RBNZ, and most economists, assume inflation will return to lower levels beyond Q3 this year is via spare capacity within the economy acting as a disinflationary force. The RBNZ, for example, assumes the currently negative output gap will not close until the second half of next year.

Capacity constraints, however, are already pronounced in the construction sector where builders report capacity utilisation close to 100%. The price of constructing a new home and rents are rising strongly and represent 9% and 10% of the CPI, respectively. This may be temporary or a dynamic that begins to emerge in other sectors of the economy. The unemployment rate is just 4.9% and there is limited prospect for foreign workers to meet labour demand until borders fully reopen. New Zealand goods exports should benefit from high commodity prices and a global economy that is likely to grow at the fastest pace in almost 50 years. All of this sits in the context of monetary policy settings that remain highly stimulatory and ongoing government spending.

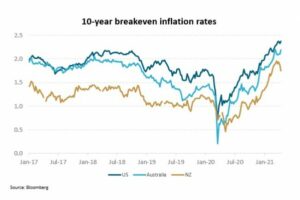

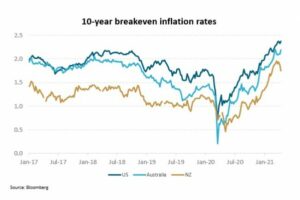

We think medium-term inflation risks are skewed to the upside and have positioned portfolios accordingly. The market appears to be ascribing a low probability to persistently high inflation in New Zealand with a 0.25% OCR increase not fully priced until early 2023 and New Zealand 10-year breakeven inflation rates below 1.7%, versus 2.2% in Australia and 2.3% in the US (see figure below). Within fixed income portfolios, we remain short-duration and continue to hold a large position in inflation-indexed New Zealand government bonds. Within equity portfolios, we continue to examine the opportunity to invest in cyclical growth sectors.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

InvestNow News – 7th May – Harbour Asset Management – Inflation risks building

Article written by Hamish Pepper, Harbour Asset Management – 23rd April 2021

- Inflation is likely to surge through the Reserve Bank of New Zealand’s (RBNZ) 2% target in the coming months, reflecting mostly temporary factors that could easily reverse.

- But there is a risk that inflation becomes more persistent, something the market may be underestimating.

- We think medium-term inflation risks are skewed to the upside and have positioned portfolios accordingly.

New Zealand consumer price inflation increased modestly in Q1 to 1.5% y/y, in line with market expectations, but is likely to surge through the Reserve Bank of New Zealand’s (RBNZ) 2% target in the coming months. The increase will be driven mainly by common global factors that the RBNZ deem as transitory. These include:

- Base effects. For the calculation of annual inflation, Q2 2021 prices will be compared to a period where prices had declined due to COVID lockdowns.

- Goods supply disruption and higher freight costs. Goods prices have increased as COVID has disrupted global supply chains at a time where global demand has increased.

- Higher oil prices. Oil prices, measured in NZ$, have increased 70% over the past year and New Zealand petrol prices are about 9% higher. Petrol has a 3.6% weight in the consumer price index (CPI).

The risk, however, is that higher inflation becomes more persistent if:

- Core inflation measures and inflation expectations, that are already close to the RBNZ’s target, track higher with increases in headline inflation. The RBNZ’s preferred measure of core inflation (based on a sectoral factor model) has been steadily ticking higher in recent quarters to 1.9% y/y in Q1 and most other measures of core inflation sit close to 2% (see figure below). Inflation expectations also sit close to 2% and since the Global Financial Crisis, have tended to be formed by actual inflation outcomes. If inflation expectations increase in line with the rise in headline CPI inflation, inflation pressure may become more persistent as these expectations influence wage and price setting We suspect there may be a behavioural aspect here. Perhaps inflation begets inflation in a way not seen over the last decade.

- The strong desire by firms to pass on recent cost increases is acted upon. Recent cost increases relate not just to the goods supply disruption and capacity constraints mentioned above, but also the recent 5.8% increase in minimum wages from $18.90 to $20 per hour and ongoing upward pressure on Council rates. The ANZ business outlook survey shows that the largest portion of firms on record intend to increase prices (see figure below).

- Spare capacity within the economy is overestimated. The way in which the RBNZ, and most economists, assume inflation will return to lower levels beyond Q3 this year is via spare capacity within the economy acting as a disinflationary force. The RBNZ, for example, assumes the currently negative output gap will not close until the second half of next year.

Capacity constraints, however, are already pronounced in the construction sector where builders report capacity utilisation close to 100%. The price of constructing a new home and rents are rising strongly and represent 9% and 10% of the CPI, respectively. This may be temporary or a dynamic that begins to emerge in other sectors of the economy. The unemployment rate is just 4.9% and there is limited prospect for foreign workers to meet labour demand until borders fully reopen. New Zealand goods exports should benefit from high commodity prices and a global economy that is likely to grow at the fastest pace in almost 50 years. All of this sits in the context of monetary policy settings that remain highly stimulatory and ongoing government spending.

We think medium-term inflation risks are skewed to the upside and have positioned portfolios accordingly. The market appears to be ascribing a low probability to persistently high inflation in New Zealand with a 0.25% OCR increase not fully priced until early 2023 and New Zealand 10-year breakeven inflation rates below 1.7%, versus 2.2% in Australia and 2.3% in the US (see figure below). Within fixed income portfolios, we remain short-duration and continue to hold a large position in inflation-indexed New Zealand government bonds. Within equity portfolios, we continue to examine the opportunity to invest in cyclical growth sectors.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.