Important message: For the top 25% of income-producing Trusts in New Zealand, that account for almost all tax levied for the sector, the recent increase in Trustee Tax to 39% will result, on average, in a $22,000 higher tax bill per year – a figure which rises to $88,000 for the top 5% of income-producing Trusts.

InvestNow Trust Accounts

Are you prepared to pay up to 40% more Trustee Tax?

From 1 April 2024, Trusts that earn more than $10,000 in income, will pay 39% p.a. (previously 33% p.a.) in Trustee Tax… But investing in portfolio investment entity (PIE) managed funds will allow the income a trust receives from it’s investment to be taxed at a maximum of just 28% p.a.

An InvestNow Trust Account gives trusts the ability to invest in the full range of PIE managed funds available on our platform. Read more about the trustee tax change and how PIE funds could lead to significant tax savings in our recent article “PIE time: how trusts can side-step a 40% higher tax bill as new high rates kick in.”

Trust investments via PIE Managed Funds vs Direct Investments

There are a range of significant differences between these investment mechanisms, most of which apply to individuals as well as Trusts.

The table below outlines some of these key differences…

PIE Managed Funds |

Direct Investments |

|

| Types of assets Trusts can be invested in | Shares, Bonds, Property, Cash, Term Deposits | Shares, Bonds, Property, Cash, Term Deposits |

| Maximum Applicable Tax Rate on investment gains | 28% p.a. | 39% p.a. |

| Investment Management | Professional Fund Manager: Dedicated to research, selection and monitoring of investments on your Trust’s behalf | Self-Managed: Trust is self-reliant on time and expertise required for making and managing investments |

| Primary Costs of Investing | Fund Fees: Such as Management Fees and Buy/Sell Spreads/Fees |

Brokerage and Commission: Costs associated with paying intermediaries to invest |

| Diversification | Each investment provides exposure to a Diversified Pool of Assets |

Each investment provides exposure to a Single Asset Only |

| Liquidity | Daily Liquidity InvestNow’s PIE Managed Funds offer the ability to invest into or redeem out of a fund each business day. Cash is typically realised within 2 -3 business days. |

Asset-Dependent Some direct investments have no daily liquidity without additional charges (e.g. term deposits and property), while others are more liquid (e.g. listed shares and on-call accounts) |

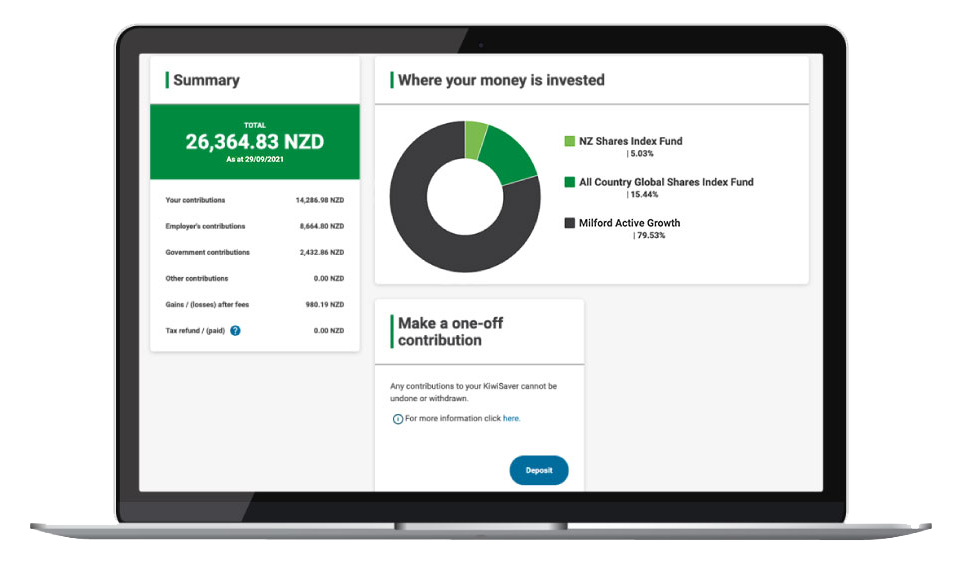

Your managed fund investment options

150+ Diversified & Single Sector funds to choose from

Click here to view and filter the full range of funds by various fund characteristics, including fee, performance, and product disclosure information.

Meet the fund managers

Learn more about the fund managers that manage your investments

Click here to see the range of fund managers we work with. From there you’ll be able to access information about each individual fund manager, including their investment approach, investment options, and their relevant editorial content.

Explore your trust investment options with InvestNow…

Register your interest

If you’d like more information about InvestNow Trust accounts, please complete the form below and we will be in touch.

Why choose an InvestNow Trust Account?

Full reporting control

Through your InvestNow Trust Account you’ll have the ability to generate all of the reports you need for your trust, whenever you need them. All members can have access to view the portfolio and produce investor reports.

Account access

Multiple people can be linked, as members, to an InvestNow Trust Account. Each member has specific rights – authoriser or view only. Rules can be set up to determine how many members are required to approve transactions.

Custody and safekeeping

Your investments are held in a bare trust managed by independent custodian Adminis. This ensures complete separation of client assets from InvestNow as a business. The custodial account is also structured to ensure that all assets, including the bank accounts, are separated from the custodian’s business.