InvestNow News – 10th July – Harbour Asset Management – ‘Blame it on Rio’

Article written by Craig Stent, Harbour Asset Management – 9th July

Key Points

- Rio to leave, another Think Big Project bites the dust

- Rio Tinto has announced the closure of the New Zealand Aluminium Smelter (NZAS) from August 2021.

- Short term, the biggest impact on earnings will be felt by Contact Energy and Meridian Energy with stranded generation in the lower half of the South Island.

- Is it time to move forward and focus on transmission investment and de-carbonisation?

In a surprise for the New Zealand equity market today, Rio Tinto announced the closure of the New Zealand Aluminium Smelter (NZAS) from August 2021. NZAS consumes about 13% of New Zealand’s electricity through offtake arrangements with Meridian Energy which are, in turn, hedged in contracts with other electricity suppliers. This closure will have a material impact on electricity demand in the short to medium term and may result in lower electricity prices over time. In addition, the direct impacts will be substantial on the Southland economy and employment.

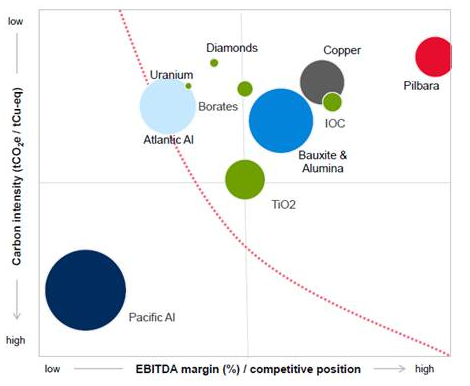

The context of Rio deciding to leave is probably best summed up in the broad analysis of the profitability of their overall Pacific Aluminium group (within which NZAS sits), where earnings before interest, taxes, depreciation, and amortization (EBITDA) margins remain low and overall carbon intensity is high. The below graph shows Rio’s emissions intensity by division.

Rio divisional carbon emission intensity

Source: Rio Tinto and JP Morgan

In the medium term, the opportunity to accelerate de-carbonisation in New Zealand now presents itself as a significant development. For instance, plans to consider replacement cycles in coal-fired milk powder drying plants, particularly in the South Island, could be accelerated, and potentially lower electricity prices might accelerate the uptake of electric vehicles over the next decade.

Electricity companies will be reviewing capital expenditure plans, with many development projects likely to be shelved for a period, and some thermal plant closures are likely to be accelerated. More specifically, the balancing of excess electricity supply might come over time from closing higher cost generation plants, such as Contact’s Taranaki Combine Cycle plant, and Genesis’ Huntly Rankine units.

Short term, the biggest impact on earnings will be felt by Contact Energy and Meridian Energy, who are directly impacted with stranded electricity generation in the lower half of the South Island. However, most analysts expect the whole electricity sector will suffer to some extent (reflecting hedging contracts and potential for lower electricity prices).

From an operational perspective, the key limiting factor will be the trapping of generation in the lower South Island. Investment will be required by Transpower in three specific projects. Firstly, transmission upgrades are needed in the lower South Island to allow the trapped electricity from hydro generation at Manapouri and Clutha to reach Benmore, the southern high voltage direct current (HVDC) interisland link terminal. This work is underway and likely to be completed in about two years, with one summer of work completed. Secondly, increasing the capacity by installing a fourth undersea cable across the Cook Strait connecting the South Island and North Island. And thirdly, there are several central North Island upgrades around Palmerston North and the southern end of Lake Taupo. It is estimated that the major work could be completed in two further summers, but it may take between five to eight years in total, and at a cost of between $400-500m. This project of work has already begun, however there will be an intervening period where the water and generation will remain trapped. We suspect that the Government could consider prioritising investment in unlocking the bottleneck, given the potential for both lower electricity prices and further de-carbonisation projects.

Equity market impact

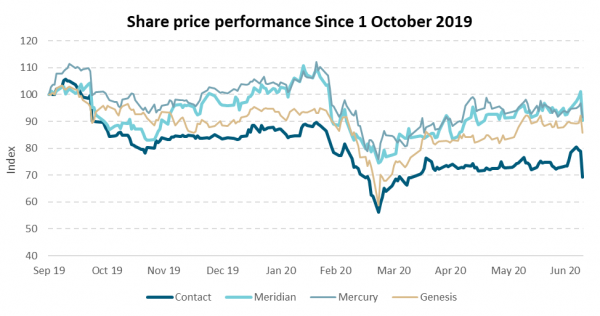

Prior to this announcement, the five listed electricity companies accounted for 13.7% of the New Zealand listed market index. Many equity market commentators had been leaning their views towards a scenario where NZAS stayed, or at least further delayed their decision. As a result, the share prices of the electricity sector listed companies had performed strongly in recent months.

Source: Harbour. Share price movements indexed from 100. Price performance to 9 July 2010.

In the immediate aftermath of Rio’s announcement, we saw a sharp negative share price reaction across the sector. Contact Energy (-12%), Meridian (-10%) and Genesis (-7%) led the falls.

These periods of disruption provide opportunities for active investors to add value for clients. Our equity portfolios have remained significantly underweight in the sector reflecting the combination of more attractive growth opportunities in other sectors, and the risk relating to the Rio decision.

We will be assessing the outlook for earnings and dividends for the electricity sector, while also reflecting on a likely lower profile for capital expenditure. The prospect of a rebalancing of assets, and the closure of supply in higher-cost plants will also need to be considered. The balance of these influences may mean that lower earnings may not impact as heavily on the outlook for dividends.

From a policy perspective, it is probably time to move forward and focus on transmission of trapped electricity generation, de-carbonisation, and the business innovation that lower electricity prices might sustain.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

InvestNow News – 10th July – Harbour Asset Management – ‘Blame it on Rio’

Article written by Craig Stent, Harbour Asset Management – 9th July

Key Points

- Rio to leave, another Think Big Project bites the dust

- Rio Tinto has announced the closure of the New Zealand Aluminium Smelter (NZAS) from August 2021.

- Short term, the biggest impact on earnings will be felt by Contact Energy and Meridian Energy with stranded generation in the lower half of the South Island.

- Is it time to move forward and focus on transmission investment and de-carbonisation?

In a surprise for the New Zealand equity market today, Rio Tinto announced the closure of the New Zealand Aluminium Smelter (NZAS) from August 2021. NZAS consumes about 13% of New Zealand’s electricity through offtake arrangements with Meridian Energy which are, in turn, hedged in contracts with other electricity suppliers. This closure will have a material impact on electricity demand in the short to medium term and may result in lower electricity prices over time. In addition, the direct impacts will be substantial on the Southland economy and employment.

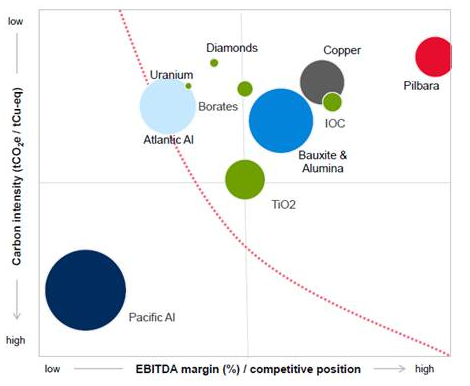

The context of Rio deciding to leave is probably best summed up in the broad analysis of the profitability of their overall Pacific Aluminium group (within which NZAS sits), where earnings before interest, taxes, depreciation, and amortization (EBITDA) margins remain low and overall carbon intensity is high. The below graph shows Rio’s emissions intensity by division.

Rio divisional carbon emission intensity

Source: Rio Tinto and JP Morgan

In the medium term, the opportunity to accelerate de-carbonisation in New Zealand now presents itself as a significant development. For instance, plans to consider replacement cycles in coal-fired milk powder drying plants, particularly in the South Island, could be accelerated, and potentially lower electricity prices might accelerate the uptake of electric vehicles over the next decade.

Electricity companies will be reviewing capital expenditure plans, with many development projects likely to be shelved for a period, and some thermal plant closures are likely to be accelerated. More specifically, the balancing of excess electricity supply might come over time from closing higher cost generation plants, such as Contact’s Taranaki Combine Cycle plant, and Genesis’ Huntly Rankine units.

Short term, the biggest impact on earnings will be felt by Contact Energy and Meridian Energy, who are directly impacted with stranded electricity generation in the lower half of the South Island. However, most analysts expect the whole electricity sector will suffer to some extent (reflecting hedging contracts and potential for lower electricity prices).

From an operational perspective, the key limiting factor will be the trapping of generation in the lower South Island. Investment will be required by Transpower in three specific projects. Firstly, transmission upgrades are needed in the lower South Island to allow the trapped electricity from hydro generation at Manapouri and Clutha to reach Benmore, the southern high voltage direct current (HVDC) interisland link terminal. This work is underway and likely to be completed in about two years, with one summer of work completed. Secondly, increasing the capacity by installing a fourth undersea cable across the Cook Strait connecting the South Island and North Island. And thirdly, there are several central North Island upgrades around Palmerston North and the southern end of Lake Taupo. It is estimated that the major work could be completed in two further summers, but it may take between five to eight years in total, and at a cost of between $400-500m. This project of work has already begun, however there will be an intervening period where the water and generation will remain trapped. We suspect that the Government could consider prioritising investment in unlocking the bottleneck, given the potential for both lower electricity prices and further de-carbonisation projects.

Equity market impact

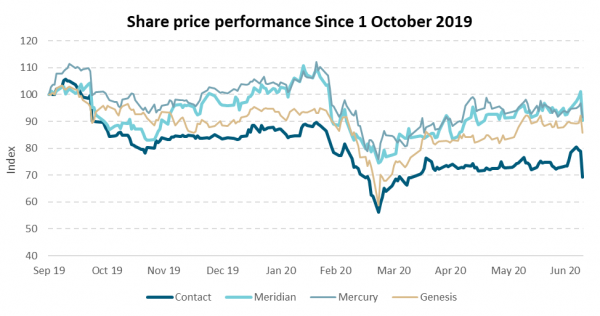

Prior to this announcement, the five listed electricity companies accounted for 13.7% of the New Zealand listed market index. Many equity market commentators had been leaning their views towards a scenario where NZAS stayed, or at least further delayed their decision. As a result, the share prices of the electricity sector listed companies had performed strongly in recent months.

Source: Harbour. Share price movements indexed from 100. Price performance to 9 July 2010.

In the immediate aftermath of Rio’s announcement, we saw a sharp negative share price reaction across the sector. Contact Energy (-12%), Meridian (-10%) and Genesis (-7%) led the falls.

These periods of disruption provide opportunities for active investors to add value for clients. Our equity portfolios have remained significantly underweight in the sector reflecting the combination of more attractive growth opportunities in other sectors, and the risk relating to the Rio decision.

We will be assessing the outlook for earnings and dividends for the electricity sector, while also reflecting on a likely lower profile for capital expenditure. The prospect of a rebalancing of assets, and the closure of supply in higher-cost plants will also need to be considered. The balance of these influences may mean that lower earnings may not impact as heavily on the outlook for dividends.

From a policy perspective, it is probably time to move forward and focus on transmission of trapped electricity generation, de-carbonisation, and the business innovation that lower electricity prices might sustain.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.