InvestNow Market Wrap-Up: August 2025

Welcoming back Greg Smith, Investment Specialist, at Generate, as this month’s guest author of the InvestNow Market Wrap-Up.

Up in the clouds

Global equities rose strongly in August, led by the US markets. The S&P 500 gained 1.9% and the Nasdaq 1.6%, both reaching record highs (and pushing further into blue sky territory in September). Optimism was driven by a robust US earnings season, upbeat guidance, and ongoing enthusiasm for AI. Apple gained 12%, reporting 10% revenue growth to US$94 billion, its strongest since late 2021. Investor excitement was further buoyed when the Trump administration announced semiconductor companies would face zero tariffs if they invested onshore. Amazon’s earnings impressed but its outlook disappointed, with concerns about heavy AI spending. Microsoft and Meta also disclosed tens of billions in AI investment.

With the Trump administration putting increasing pressure on the Fed for more rate cuts, economic data played into this narrative, with tariff impacts yet to show up in inflation data but starting to take its toll on other economic metrics. However, investors continued to subscribe to the “soft landing” scenario for the world’s largest economy – the Russell 2000 small cap index rose 7% during August, the fourth consecutive winning month, and the best since November 2024.

Tariff negotiations dominated headlines. The US finalized a 15% tariff deal with Europe, securing US$750 billion in US energy purchases and US$600 billion in EU investments. Deals also closed with South Korea (with ~US$450 billion investment into the US) and other Asian partners. China remains unresolved, with deadlines extended another 90 days. New Zealand was assigned a 15% tariff, compared to Australia’s 10%, reflecting closer political and defence ties and tax differences.

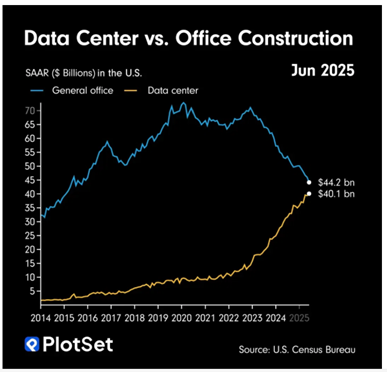

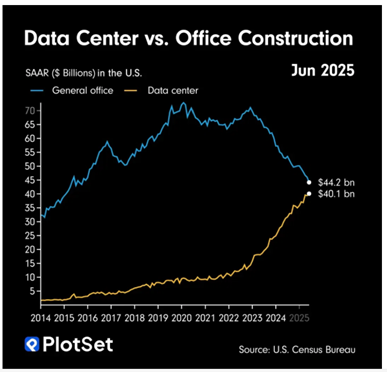

Technology was front and centre again. The US secured a “revenue share” deal with Nvidia and AMD on AI chip sales to China, with chipmakers rewarded for investing domestically and penalised with 100% tariffs if not. The government also took a 10% stake (~US$10 billion) in Intel, which has lagged in the AI race. Nvidia reported data centre sales up 56% year on year to US$41.1 billion, though slightly below forecasts. The largest company in the world (its market cap is over US$4 trillion) actually had a relatively quiet month share price wise, but is up over 30% this year after almost tripling in 2024.

Broadcom (which makes chips for Google, Meta and Tik Tok’s parent ByteDance) reported that AI quarterly revenues hit US$6 billion, and are growing at over 60% annually. Broadcom also announced a US$10 billion contract believed to be with OpenAI. Broadcom is held in the Generate KiwiSaver Thematic Fund and Thematic Managed Fund. The shares have gained 44% year to date (through to September 5). Cloudflare, a web infrastructure and security name that also delivered a strong results during this earnings season, and is also held in both the Generate KiwiSaver Thematic Fund and Thematic Managed Fund. The shares have doubled year to date (through to September 5).

The back end of the earnings season delivered another major positive surprise. Last week Oracle stunned markets with AI-related revenues up 1500% in the quarter, driving a 35% jump in the share price in one session. It now forecasts US$18 billion in FY26 cloud revenue, rising to US$144 billion in five years.

Source: Voronai

Oracle is another company approaching the US$1 trillion market cap level. There are already 8 companies worth over a trillion dollars, and their combined value is north of US$20 trillion. This has also taken its share of the S&P500 to more than 35%. This also means that these US tech titans make up around 1/6th of the total value of stock markets globally. Big Tech has also got a boost from the notion that break up calls will be avoided. Google’s parent Alphabet has surged after a US District court ruled that the company doesn’t need to sell its chrome browser, instead it has to just share data with competitors.

Beyond tech, results were generally solid, with 80% of S&P 500 beating expectations. Still, tariffs hurt some companies. The clothing retailer Gap expects a 200bps margin hit, while heavy machinery giant Caterpillar forecasts a US$1.5–1.8 billion tariff impact in 2025.

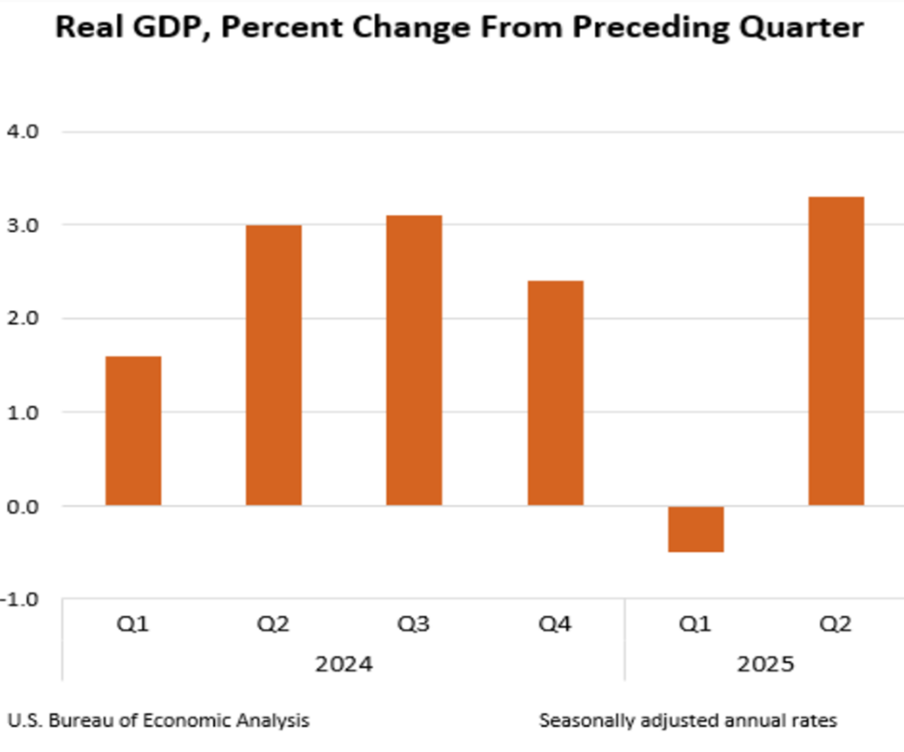

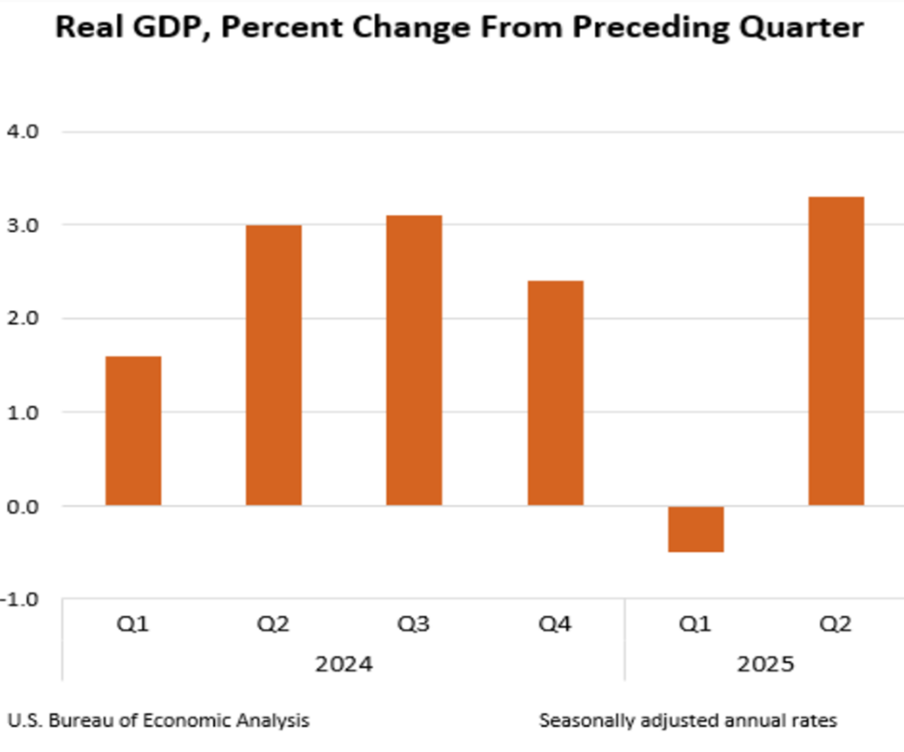

The US economy is handling tariffs more resiliently, at least for now it seems. Second-quarter GDP growth came in above expectations at an annualised rate of 3.3%, rebounding from a 0.5% contraction in the first quarter and revised up from an initial 3% estimate. Firmer consumer spending and investment were the drivers. Imports tumbled 30% in the quarter after companies stockpiled ahead of “Liberation Day.”

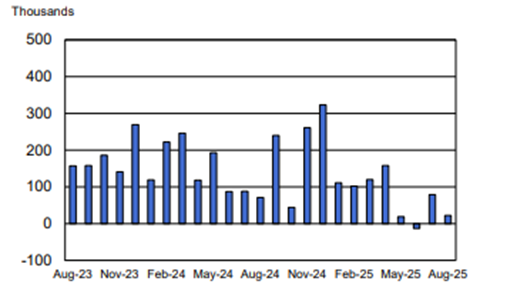

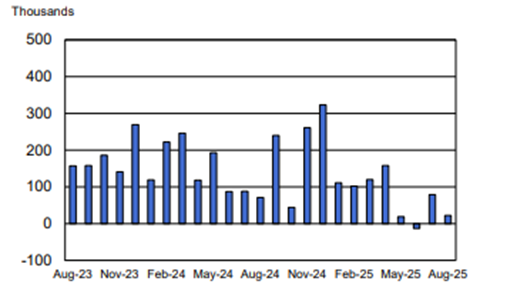

But recent signs point to slowing momentum. Consumer confidence and durable goods orders weakened, and jobs data disappointed. The economy added just 22,000 jobs in August (vs. 75,000 forecast), with downward revisions showing June job losses of 13,000. The unemployment rate rose to 4.3%, with broader unemployment at 8.1%, the highest since 2021. In total, job gains across May–August 2025 equal August 2024 alone. Last week also showed that 911,000 fewer jobs were created in the year to March than previously reported.

US job creation

Source: US Bureau of Labor Statistics

Donald Trump recently fired the head of the agency that compiles and reports the jobs numbers, claiming they were inaccurate and biased (against his administration). The US President may now have to own the trend that is playing out. Ongoing uncertainty around the fallout from tariffs looks to be weighing on hiring in the US economy.

This will all put even more pressure on the Fed to cut rates, with a quarter point rate cut this week now priced in by investors (and a 12% chance of a 50bps reduction). This is likely why US equity markets haven’t reacted too severely to weak jobs data.

There has been some suggestions that the negative month for job additions is pretty rare and was a precursor to the recessions in 2001 and 2007. The historical caveat is that several downturns were avoided when the central bank embarked on a substantial monetary easing campaign.

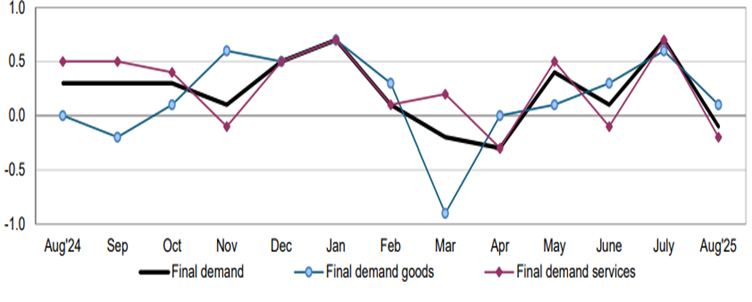

Chair Jerome Powell was quite dovish when he spoke at the central bank symposium at Jackson Hole last month, so the bell might have been rung for the Fed. Recent inflation prints have maintained the case for a rate cut. US factory gate prices fell 0.1% in August. While headline consumer prices rose 0.4% last month, annual inflation at 2.9% was in line with forecasts. Core consumer inflation of 0.3% for the month (and 3.1% annually) was also in line with forecasts.

US Producer prices

Source: US Bureau of Labor Statistics

Looking ahead, the market is pricing three more Fed rate cuts this year. This could change though, and other economic data will be important in the months ahead. The US$ is also something to watch (notably gold which typically is inversely correlated with it continues to push to record highs), as is the inter-related and evolving story around attempts to interfere in the Fed’s independence.

Donald Trump has moved to fire Governor Lisa Cook on the allegations that she made false statements on a mortgage application. This is unprecedented. Trump has been very vocal and public in his pressure on Jerome Powell to lower rates, and is now looking to secure his desired outcome by getting a majority on the Fed. The move takes the challenge to Fed independence into uncharted territory, and will likely go to the Supreme Court. The Trump administration is also reviewing options for exerting more influence over the Federal Reserve’s 12 regional banks. There are some clear motivators for Trump to get interest rates lowered. The U.S. government’s gross national debt last month surpassed US$37 trillion for the first time.

Looking at other countries outside of the U.S., Europe is another on a rate cutting journey, and amid ongoing questions about the impact of ever-changing trade developments. China will clearly be a big focus in the months ahead, especially as the timeline rolls down on the tariff pause. Recent economic data has underscored slowing momentum in the Chinese economy, so the possible prospect of further stimulus out of Beijing remains. Japan meanwhile is also facing political upheaval, amid ongoing concern over whether it is ahead of the curve on addressing inflation.

Down under, the Australian market (+2.6% in the month) hit a record high last month and despite what was one of the more volatile earnings seasons on record. Supermarket giant Coles and Qantas (posted a near record full year profit of A$2.4 billion) were amongst the positive standouts while building products name James Hardie and healthcare giant CSL were big laggards. The Reserve Bank of Australia (RBA) cut the cash rate to 3.6%, but the prospect for another cut later this month has receded. Monthly inflation figures came in higher than expected, up 2.8% in July year on year. Quarterly GDP figures were also stronger than expected, with the Aussie economy growing at 1.8% year on year – the fastest rate since September 2023. Some Aussie banks may be trimming staff, but house price growth expectations are at the highest in 15 years.

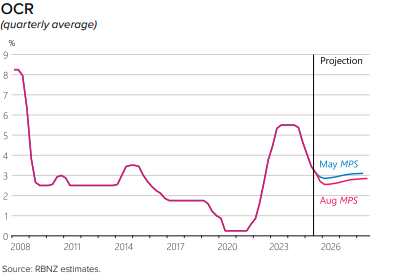

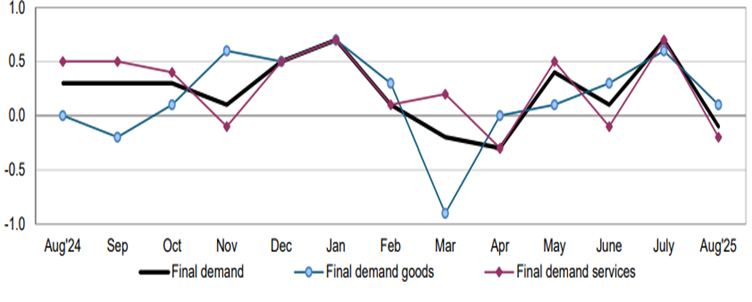

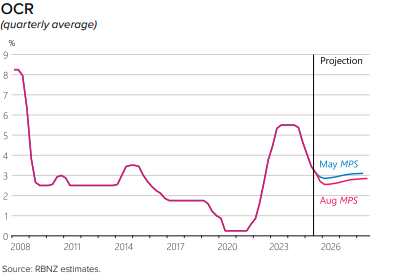

The kiwi market had a positive month in August with a 0.8% rise, the fourth straight monthly gain. The RBNZ cut rates by 0.25% (two members voted for 0.5%) to a three-year low of 3% and flagged further reductions. The reporting season was something of a mixed bag, but mostly outcomes were better than feared (EBOS was a notable exception). There were interesting divestment announcements from Spark NZ (which is selling 75% of its data centre business to Australia’s Pacific Equity Partners) and Fonterra (which is selling its Consumer and associated businesses to France’s Lactalis, the world’s largest dairy company, for $3.85 billion). The farmer vote on the latter, and a $3.2 billion tax free capital return is one of NZ’s largest ever corporate transactions, is due in the coming months.

Vulcan Steel was the first cyclical company to recount signs of “green shoots”, while A2 Milk was one of the highlights from the reporting season, with revenues jumping 13.5% to $1.9 billion. Earnings rose 17% to $274.3 million. Growth in China/Asia drove the momentum, and A2 is intending to pay a $300m special dividend. Chinese birth rates are expected to decline, but A2 has been taking market share. A2 Milk is held in the Generate KiwiSaver Australasian Fund and Australasian Managed Fund. The shares have gained 62% year to date (through to September 5).

The dairy sector (along with tourism) has been a bright spot (dairy auctions are worth watching after some negative ones in recent times) for the kiwi economy which has been struggling in many places. Retail sales data last month was not as bad as expected, but the services sector is still in the doldrums (NZ is an outlier here in the OECD) and last week’s business and manufacturing data on the second quarter was less than convincing. Our construction sector remains weak. This potentially sets up for a weak second quarter GDP print this week. A weak jobs market (unemployment is running at 5.2% nationally and 6.1% in Auckland at the last quarter) already sets up for the RBNZ to cut rates a few more times before the year is out.

If you want to see which Generate investments are available on InvestNow, plus read any other opinion or commentary pieces from Greg and the team at Generate, please visit their page on our website.

InvestNow Market Wrap-Up: August 2025

Welcoming back Greg Smith, Investment Specialist, at Generate, as this month’s guest author of the InvestNow Market Wrap-Up.

Up in the clouds

Global equities rose strongly in August, led by the US markets. The S&P 500 gained 1.9% and the Nasdaq 1.6%, both reaching record highs (and pushing further into blue sky territory in September). Optimism was driven by a robust US earnings season, upbeat guidance, and ongoing enthusiasm for AI. Apple gained 12%, reporting 10% revenue growth to US$94 billion, its strongest since late 2021. Investor excitement was further buoyed when the Trump administration announced semiconductor companies would face zero tariffs if they invested onshore. Amazon’s earnings impressed but its outlook disappointed, with concerns about heavy AI spending. Microsoft and Meta also disclosed tens of billions in AI investment.

With the Trump administration putting increasing pressure on the Fed for more rate cuts, economic data played into this narrative, with tariff impacts yet to show up in inflation data but starting to take its toll on other economic metrics. However, investors continued to subscribe to the “soft landing” scenario for the world’s largest economy – the Russell 2000 small cap index rose 7% during August, the fourth consecutive winning month, and the best since November 2024.

Tariff negotiations dominated headlines. The US finalized a 15% tariff deal with Europe, securing US$750 billion in US energy purchases and US$600 billion in EU investments. Deals also closed with South Korea (with ~US$450 billion investment into the US) and other Asian partners. China remains unresolved, with deadlines extended another 90 days. New Zealand was assigned a 15% tariff, compared to Australia’s 10%, reflecting closer political and defence ties and tax differences.

Technology was front and centre again. The US secured a “revenue share” deal with Nvidia and AMD on AI chip sales to China, with chipmakers rewarded for investing domestically and penalised with 100% tariffs if not. The government also took a 10% stake (~US$10 billion) in Intel, which has lagged in the AI race. Nvidia reported data centre sales up 56% year on year to US$41.1 billion, though slightly below forecasts. The largest company in the world (its market cap is over US$4 trillion) actually had a relatively quiet month share price wise, but is up over 30% this year after almost tripling in 2024.

Broadcom (which makes chips for Google, Meta and Tik Tok’s parent ByteDance) reported that AI quarterly revenues hit US$6 billion, and are growing at over 60% annually. Broadcom also announced a US$10 billion contract believed to be with OpenAI. Broadcom is held in the Generate KiwiSaver Thematic Fund and Thematic Managed Fund. The shares have gained 44% year to date (through to September 5). Cloudflare, a web infrastructure and security name that also delivered a strong results during this earnings season, and is also held in both the Generate KiwiSaver Thematic Fund and Thematic Managed Fund. The shares have doubled year to date (through to September 5).

The back end of the earnings season delivered another major positive surprise. Last week Oracle stunned markets with AI-related revenues up 1500% in the quarter, driving a 35% jump in the share price in one session. It now forecasts US$18 billion in FY26 cloud revenue, rising to US$144 billion in five years.

Source: Voronai

Oracle is another company approaching the US$1 trillion market cap level. There are already 8 companies worth over a trillion dollars, and their combined value is north of US$20 trillion. This has also taken its share of the S&P500 to more than 35%. This also means that these US tech titans make up around 1/6th of the total value of stock markets globally. Big Tech has also got a boost from the notion that break up calls will be avoided. Google’s parent Alphabet has surged after a US District court ruled that the company doesn’t need to sell its chrome browser, instead it has to just share data with competitors.

Beyond tech, results were generally solid, with 80% of S&P 500 beating expectations. Still, tariffs hurt some companies. The clothing retailer Gap expects a 200bps margin hit, while heavy machinery giant Caterpillar forecasts a US$1.5–1.8 billion tariff impact in 2025.

The US economy is handling tariffs more resiliently, at least for now it seems. Second-quarter GDP growth came in above expectations at an annualised rate of 3.3%, rebounding from a 0.5% contraction in the first quarter and revised up from an initial 3% estimate. Firmer consumer spending and investment were the drivers. Imports tumbled 30% in the quarter after companies stockpiled ahead of “Liberation Day.”

But recent signs point to slowing momentum. Consumer confidence and durable goods orders weakened, and jobs data disappointed. The economy added just 22,000 jobs in August (vs. 75,000 forecast), with downward revisions showing June job losses of 13,000. The unemployment rate rose to 4.3%, with broader unemployment at 8.1%, the highest since 2021. In total, job gains across May–August 2025 equal August 2024 alone. Last week also showed that 911,000 fewer jobs were created in the year to March than previously reported.

US job creation

Source: US Bureau of Labor Statistics

Donald Trump recently fired the head of the agency that compiles and reports the jobs numbers, claiming they were inaccurate and biased (against his administration). The US President may now have to own the trend that is playing out. Ongoing uncertainty around the fallout from tariffs looks to be weighing on hiring in the US economy.

This will all put even more pressure on the Fed to cut rates, with a quarter point rate cut this week now priced in by investors (and a 12% chance of a 50bps reduction). This is likely why US equity markets haven’t reacted too severely to weak jobs data.

There has been some suggestions that the negative month for job additions is pretty rare and was a precursor to the recessions in 2001 and 2007. The historical caveat is that several downturns were avoided when the central bank embarked on a substantial monetary easing campaign.

Chair Jerome Powell was quite dovish when he spoke at the central bank symposium at Jackson Hole last month, so the bell might have been rung for the Fed. Recent inflation prints have maintained the case for a rate cut. US factory gate prices fell 0.1% in August. While headline consumer prices rose 0.4% last month, annual inflation at 2.9% was in line with forecasts. Core consumer inflation of 0.3% for the month (and 3.1% annually) was also in line with forecasts.

US Producer prices

Source: US Bureau of Labor Statistics

Looking ahead, the market is pricing three more Fed rate cuts this year. This could change though, and other economic data will be important in the months ahead. The US$ is also something to watch (notably gold which typically is inversely correlated with it continues to push to record highs), as is the inter-related and evolving story around attempts to interfere in the Fed’s independence.

Donald Trump has moved to fire Governor Lisa Cook on the allegations that she made false statements on a mortgage application. This is unprecedented. Trump has been very vocal and public in his pressure on Jerome Powell to lower rates, and is now looking to secure his desired outcome by getting a majority on the Fed. The move takes the challenge to Fed independence into uncharted territory, and will likely go to the Supreme Court. The Trump administration is also reviewing options for exerting more influence over the Federal Reserve’s 12 regional banks. There are some clear motivators for Trump to get interest rates lowered. The U.S. government’s gross national debt last month surpassed US$37 trillion for the first time.

Looking at other countries outside of the U.S., Europe is another on a rate cutting journey, and amid ongoing questions about the impact of ever-changing trade developments. China will clearly be a big focus in the months ahead, especially as the timeline rolls down on the tariff pause. Recent economic data has underscored slowing momentum in the Chinese economy, so the possible prospect of further stimulus out of Beijing remains. Japan meanwhile is also facing political upheaval, amid ongoing concern over whether it is ahead of the curve on addressing inflation.

Down under, the Australian market (+2.6% in the month) hit a record high last month and despite what was one of the more volatile earnings seasons on record. Supermarket giant Coles and Qantas (posted a near record full year profit of A$2.4 billion) were amongst the positive standouts while building products name James Hardie and healthcare giant CSL were big laggards. The Reserve Bank of Australia (RBA) cut the cash rate to 3.6%, but the prospect for another cut later this month has receded. Monthly inflation figures came in higher than expected, up 2.8% in July year on year. Quarterly GDP figures were also stronger than expected, with the Aussie economy growing at 1.8% year on year – the fastest rate since September 2023. Some Aussie banks may be trimming staff, but house price growth expectations are at the highest in 15 years.

The kiwi market had a positive month in August with a 0.8% rise, the fourth straight monthly gain. The RBNZ cut rates by 0.25% (two members voted for 0.5%) to a three-year low of 3% and flagged further reductions. The reporting season was something of a mixed bag, but mostly outcomes were better than feared (EBOS was a notable exception). There were interesting divestment announcements from Spark NZ (which is selling 75% of its data centre business to Australia’s Pacific Equity Partners) and Fonterra (which is selling its Consumer and associated businesses to France’s Lactalis, the world’s largest dairy company, for $3.85 billion). The farmer vote on the latter, and a $3.2 billion tax free capital return is one of NZ’s largest ever corporate transactions, is due in the coming months.

Vulcan Steel was the first cyclical company to recount signs of “green shoots”, while A2 Milk was one of the highlights from the reporting season, with revenues jumping 13.5% to $1.9 billion. Earnings rose 17% to $274.3 million. Growth in China/Asia drove the momentum, and A2 is intending to pay a $300m special dividend. Chinese birth rates are expected to decline, but A2 has been taking market share. A2 Milk is held in the Generate KiwiSaver Australasian Fund and Australasian Managed Fund. The shares have gained 62% year to date (through to September 5).

The dairy sector (along with tourism) has been a bright spot (dairy auctions are worth watching after some negative ones in recent times) for the kiwi economy which has been struggling in many places. Retail sales data last month was not as bad as expected, but the services sector is still in the doldrums (NZ is an outlier here in the OECD) and last week’s business and manufacturing data on the second quarter was less than convincing. Our construction sector remains weak. This potentially sets up for a weak second quarter GDP print this week. A weak jobs market (unemployment is running at 5.2% nationally and 6.1% in Auckland at the last quarter) already sets up for the RBNZ to cut rates a few more times before the year is out.

If you want to see which Generate investments are available on InvestNow, plus read any other opinion or commentary pieces from Greg and the team at Generate, please visit their page on our website.

This article is intended for general information only and should not be considered financial advice. The views expressed are those of the author. All investments carry risk, and past performance is not indicative of future results. The issuer is Generate Investment Management Limited. To view Generate’s Product Disclosure Statements see generatekiwisaver.co.nz/disclosures.

Leave A Comment