InvestNow Market Wrap-Up: October 2025

Welcoming Mark Donnell, Director at Lighthouse Funds, as this month’s guest author of the InvestNow Market Wrap-Up.

Climbing The Wall of Worry

Through October it seemed like nearly every financial news site ran at least one story asking whether US equity markets are in a bubble – more specifically an AI bubble – and whether that might mean markets are too frothy and might be at risk of a big movement that takes the foam off the top. How might we think about that?

Firstly, we need to accept that the future is always uncertain. None of us know with certainty what direction markets will take in the next month, let alone year. That uncertainty is the heart of investment risk – riskier investments are the ones where your investment has a range of possible outcomes spanning from good to bad and you’re not certain what eventual future outcome you’re going to end up with. So we have to accept that a market fall is always a possibility, but that it’s not the only possible outcome and it’s by no means a certainty.

Secondly, we need to recognise that financial markets are always worried about something. Sometimes it might be inflation, other times economic growth, or geopolitics, or perhaps possible over-investment and so on. Successful investing requires patience, discipline, and not allowing yourself to be caught up in the latest scare.

But, yes, there are times when markets fall and because those falls are emotionally and financially hard naturally it’s appealing to think we could sidestep them. So where do we think things might be at today?

Of Bulls and Bears

A bull market is Wall Street lingo for a strong and consistent rally. Technically it’s when an index rises more than 20% from the end of the last bear market. A bear market is the opposite – it’s when an index falls more than 20% from the end of the last bull market. So basically it’s about long-term trends where the market rises or falls by at least 20%.

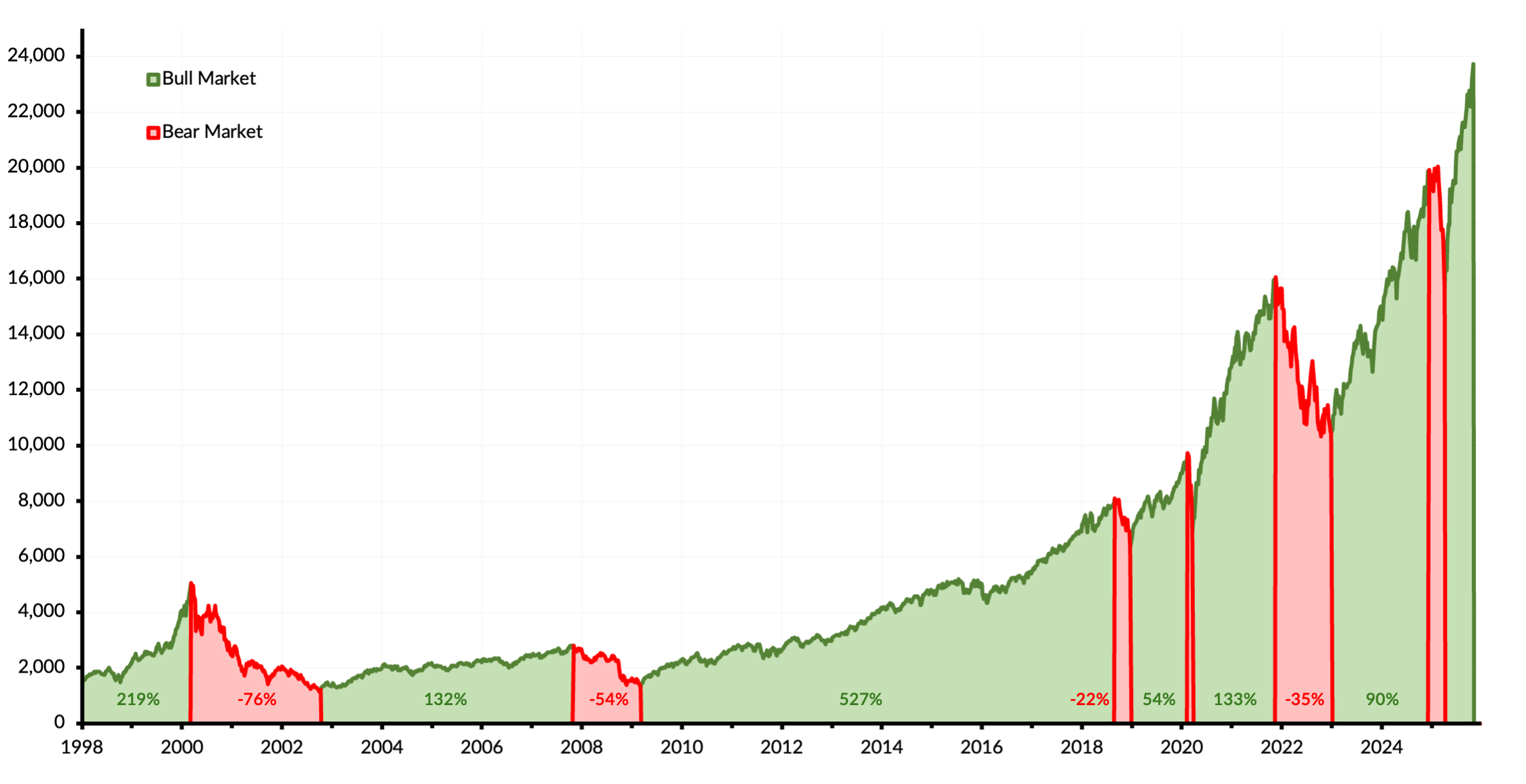

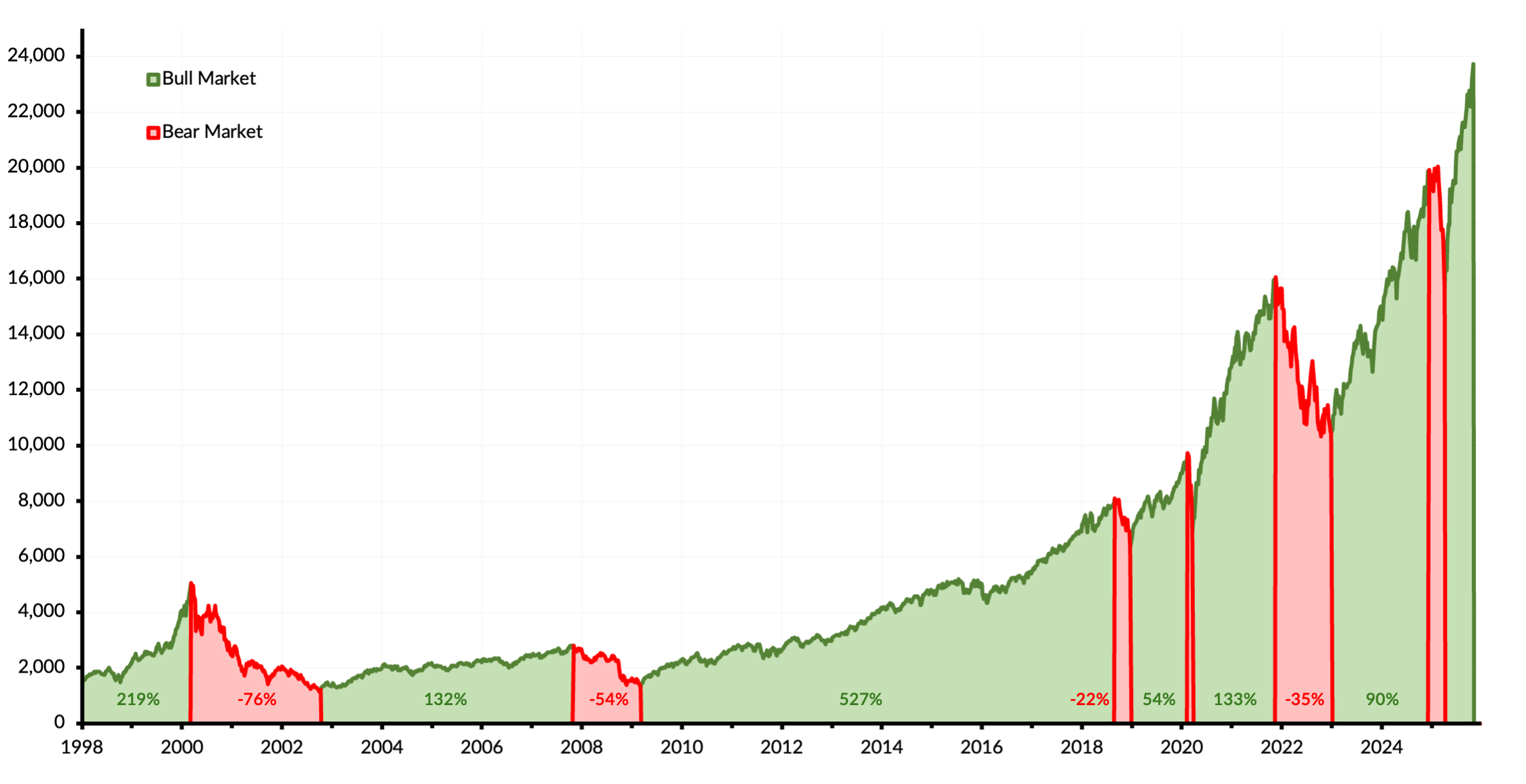

We prefer to measure those rises and falls using the Nasdaq index, because it’s “twitchier” and so its movements are clearer and easier to observe. Here’s a chart of the Nasdaq showing its bull and bear markets since 1998.

Source: Lighthouse Funds

On these measures we’re currently in a bull market that began in April, following a brief bear market driven by President Trump’s tariff initiatives.

But bull markets don’t travel in a straight line. Within any bull market there will be regular falls that are violent enough to hurt emotionally but that stop before reaching that 20% trigger for a new bear market. We talk about pullbacks (a fall of 5-10% from the index’s previous high) and corrections (a fall of 10-20% from that previous high). These are very common – on average there’s at least one pullback every year, and at least one correction every two years.

We find a useful analogy is to think of bull markets as like an incoming tide at the beach. Each wave that comes in pushes a little higher up the beach, although between the waves you’ll see the waterline fall back. But successive waves tend to crest higher and the long-term trend is that the waterline is rising.

Bear markets are the same but in reverse. Within a bull market there will be regular rises (sometimes termed “a dead cat bounce”) but the long-term trend is downwards.

The turning points between these bull and bear periods are normally marked by some material change in the real-world economy that triggers a rapid mood swing and significant changes in the expectations of future corporate profits. But here’s a good rule of thumb – share markets are forward looking and they’re typically pricing stocks based on what they think will happen 9-12 months in the future. So share markets often peak and trough months before the real-world economy does.

So, What About the Global Economy Today?

At the moment the global economy is a bit like a Rorschach inkblot test – everyone sees something different in the same data. There are enough bad indicators (stagnating labour markets, persistently sticky inflation, global trade dislocations etc) to fuel a narrative that we might be due some sort of downturn. But there are also enough good indicators (GDP growth remains positive, corporate profits remain strong, AI-fuelled infrastructure investments, interest rate cuts etc) to also fuel an optimistic narrative.

Our take is that the old economy – basically the industries that are reliant on physical goods and manual labour – is slowing. China’s momentum has faltered, with export growth slowing and a housing sector that’s still looking for a bottom. Western economies are resilient but low-growth, with unemployment edging slowly upwards. Laid over that are poor demographic trends in all developed economies, with more retirees (who spend less and incur more social and healthcare costs) and fewer young replacement workers entering the workforce (who spend more and pay taxes). The overall situation isn’t dire, but it does look like a global slowdown.

Meanwhile the new economy – industries driven by technology, digital innovation and knowledge – is growing quickly. Right now the bright spot in the global economy is the AI investment boom and we suspect that without this investment binge the global economy would be at risk of tipping into recession. Nvidia, a company that is just 30 years old and employs only 36,000 people, probably holds the keys to the global economy right now.

Which is perhaps why there are so many questions at the moment about whether these AI investments are a bubble. Is the scale of investment such that capex is going to outstrip demand? If it is a bubble and were to burst then could the rest of the global economy stay up without that cushion? It’s easy to draw a rhetorical line from today’s AI investments to the early-2000s dotcom bubble and the damage that caused to share markets.

We suspect that today’s AI investments are different from the dotcom bubble in several important ways. The AI capex boom is coming from big stable companies who have the balance sheet strength to support their spending, rather than from startups who only have cash and hope. The eye-watering sums being invested need to be set against the market capitalisations of these companies like Alphabet (Google), Microsoft and Meta (Facebook). Yes, they are investing billions, but their capex spend is smaller relative to the size of those companies that we saw in the dotcom era. And it’s profitable growth – their revenues are rising faster than their operating costs, unlike the dotcom era firms who were burning cash and couldn’t survive without ongoing share market support.

It is legitimate though to ask whether the AI-driven profits that might be made in the future will prove large enough to justify the level of investment being made today. But that’s not a concern for 2025, or probably even 2026. It will be several years from now before we can know if it was justified or wasted investment.

Nonetheless …

In the last week the CEOs of both Goldman Sachs and Morgan Stanley have warned of the potential for a share market drop. Goldman Sachs CEO David Solomon said “It’s likely there will be a 10% to 20% drawdown in equity markets sometime in the next 12 to 24 months”. Morgan Stanley CEO Ted Pick said “There could be 10% to 15% drawdowns”.* There are broader indications that Wall Street would like to see the AI spending tap turned down.

But look at what we wrote earlier about bull and bear markets. A 10%, or 15%, or 20% drawdown in the index is actually pretty common and doesn’t mean we’ve entered a long-term bear market. An investor who’s held global shares for the last 5 years has been through at least three such drawdowns. They are unsettling but they’re not unusual. History suggests that David Solomon’s prediction of a 10% to 20% drawdown sometime in the next 12 to 24 months is basically always the case and not unique to this moment.

Meanwhile equity investing’s long-term game is undefeated. A broad portfolio of global stocks should make a long-run average return in the low teen percentages, despite the occasional drawdowns. Our Lighthouse Global Equity Fund has averaged 21% pa net return over the last 10 years, despite experiencing several drawdowns of 20% or so. That is the nature of equity investing.

So, What Might We Do?

Our recommendation is to stop waiting for clarity in the markets – because there will always be uncertainty. The path to long-term wealth accumulation is riddled with uncertainty that will make you feel uncomfortable about being in the market, and with events that will lead to dips in the value of your portfolio.

It is discipline and consistency that enable successful investors to reach their financial goals. We believe that frequently chopping and changing your investment strategy based on what you think – or fear – might happen in the future is likely to lead to inferior returns. Peter Lynch, one of the greatest investors of all time, said “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” There’s nothing wrong with wanting a smooth ride per se, but we’re cautious about picking an investment strategy that has a lower long-term return in order to get it. Over the full market cycle investing to achieve short-term comfort costs a fortune.

So we recommend looking for an investment strategy that matches your convictions and your personal style, manage risk when wrong, and then try to stay the course. Accept that with equity investing much of your return will come in lumpy unpredictable bursts that are mixed in with the occasional stressful moments.

If you want to learn more about the Lighthouse Funds available on InvestNow, please visit their page on our website.

InvestNow Market Wrap-Up: October 2025

Welcoming Mark Donnell, Investment Manager at Lighthouse Funds, as this month’s guest author of the InvestNow Market Wrap-Up.

Climbing The Wall of Worry

Through October it seemed like nearly every financial news site ran at least one story asking whether US equity markets are in a bubble – more specifically an AI bubble – and whether that might mean markets are too frothy and might be at risk of a big movement that takes the foam off the top. How might we think about that?

Firstly, we need to accept that the future is always uncertain. None of us know with certainty what direction markets will take in the next month, let alone year. That uncertainty is the heart of investment risk – riskier investments are the ones where your investment has a range of possible outcomes spanning from good to bad and you’re not certain what eventual future outcome you’re going to end up with. So we have to accept that a market fall is always a possibility, but that it’s not the only possible outcome and it’s by no means a certainty.

Secondly, we need to recognise that financial markets are always worried about something. Sometimes it might be inflation, other times economic growth, or geopolitics, or perhaps possible over-investment and so on. Successful investing requires patience, discipline, and not allowing yourself to be caught up in the latest scare.

But, yes, there are times when markets fall and because those falls are emotionally and financially hard naturally it’s appealing to think we could sidestep them. So where do we think things might be at today?

Of Bulls and Bears

A bull market is Wall Street lingo for a strong and consistent rally. Technically it’s when an index rises more than 20% from the end of the last bear market. A bear market is the opposite – it’s when an index falls more than 20% from the end of the last bull market. So basically it’s about long-term trends where the market rises or falls by at least 20%.

We prefer to measure those rises and falls using the Nasdaq index, because it’s “twitchier” and so its movements are clearer and easier to observe. Here’s a chart of the Nasdaq showing its bull and bear markets since 1998.

Source: Lighthouse Funds

On these measures we’re currently in a bull market that began in April, following a brief bear market driven by President Trump’s tariff initiatives.

But bull markets don’t travel in a straight line. Within any bull market there will be regular falls that are violent enough to hurt emotionally but that stop before reaching that 20% trigger for a new bear market. We talk about pullbacks (a fall of 5-10% from the index’s previous high) and corrections (a fall of 10-20% from that previous high). These are very common – on average there’s at least one pullback every year, and at least one correction every two years.

We find a useful analogy is to think of bull markets as like an incoming tide at the beach. Each wave that comes in pushes a little higher up the beach, although between the waves you’ll see the waterline fall back. But successive waves tend to crest higher and the long-term trend is that the waterline is rising.

Bear markets are the same but in reverse. Within a bull market there will be regular rises (sometimes termed “a dead cat bounce”) but the long-term trend is downwards.

The turning points between these bull and bear periods are normally marked by some material change in the real-world economy that triggers a rapid mood swing and significant changes in the expectations of future corporate profits. But here’s a good rule of thumb – share markets are forward looking and they’re typically pricing stocks based on what they think will happen 9-12 months in the future. So share markets often peak and trough months before the real-world economy does.

So, What About the Global Economy Today?

At the moment the global economy is a bit like a Rorschach inkblot test – everyone sees something different in the same data. There are enough bad indicators (stagnating labour markets, persistently sticky inflation, global trade dislocations etc) to fuel a narrative that we might be due some sort of downturn. But there are also enough good indicators (GDP growth remains positive, corporate profits remain strong, AI-fuelled infrastructure investments, interest rate cuts etc) to also fuel an optimistic narrative.

Our take is that the old economy – basically the industries that are reliant on physical goods and manual labour – is slowing. China’s momentum has faltered, with export growth slowing and a housing sector that’s still looking for a bottom. Western economies are resilient but low-growth, with unemployment edging slowly upwards. Laid over that are poor demographic trends in all developed economies, with more retirees (who spend less and incur more social and healthcare costs) and fewer young replacement workers entering the workforce (who spend more and pay taxes). The overall situation isn’t dire, but it does look like a global slowdown.

Meanwhile the new economy – industries driven by technology, digital innovation and knowledge – is growing quickly. Right now the bright spot in the global economy is the AI investment boom and we suspect that without this investment binge the global economy would be at risk of tipping into recession. Nvidia, a company that is just 30 years old and employs only 36,000 people, probably holds the keys to the global economy right now.

Which is perhaps why there are so many questions at the moment about whether these AI investments are a bubble. Is the scale of investment such that capex is going to outstrip demand? If it is a bubble and were to burst then could the rest of the global economy stay up without that cushion? It’s easy to draw a rhetorical line from today’s AI investments to the early-2000s dotcom bubble and the damage that caused to share markets.

We suspect that today’s AI investments are different from the dotcom bubble in several important ways. The AI capex boom is coming from big stable companies who have the balance sheet strength to support their spending, rather than from startups who only have cash and hope. The eye-watering sums being invested need to be set against the market capitalisations of these companies like Alphabet (Google), Microsoft and Meta (Facebook). Yes, they are investing billions, but their capex spend is smaller relative to the size of those companies that we saw in the dotcom era. And it’s profitable growth – their revenues are rising faster than their operating costs, unlike the dotcom era firms who were burning cash and couldn’t survive without ongoing share market support.

It is legitimate though to ask whether the AI-driven profits that might be made in the future will prove large enough to justify the level of investment being made today. But that’s not a concern for 2025, or probably even 2026. It will be several years from now before we can know if it was justified or wasted investment.

Nonetheless …

In the last week the CEOs of both Goldman Sachs and Morgan Stanley have warned of the potential for a share market drop. Goldman Sachs CEO David Solomon said “It’s likely there will be a 10% to 20% drawdown in equity markets sometime in the next 12 to 24 months”. Morgan Stanley CEO Ted Pick said “There could be 10% to 15% drawdowns”.* There are broader indications that Wall Street would like to see the AI spending tap turned down.

But look at what we wrote earlier about bull and bear markets. A 10%, or 15%, or 20% drawdown in the index is actually pretty common and doesn’t mean we’ve entered a long-term bear market. An investor who’s held global shares for the last 5 years has been through at least three such drawdowns. They are unsettling but they’re not unusual. History suggests that David Solomon’s prediction of a 10% to 20% drawdown sometime in the next 12 to 24 months is basically always the case and not unique to this moment.

Meanwhile equity investing’s long-term game is undefeated. A broad portfolio of global stocks should make a long-run average return in the low teen percentages, despite the occasional drawdowns. Our Lighthouse Global Equity Fund has averaged 21% pa net return over the last 10 years, despite experiencing several drawdowns of 20% or so. That is the nature of equity investing.

So, What Might We Do?

Our recommendation is to stop waiting for clarity in the markets – because there will always be uncertainty. The path to long-term wealth accumulation is riddled with uncertainty that will make you feel uncomfortable about being in the market, and with events that will lead to dips in the value of your portfolio.

It is discipline and consistency that enable successful investors to reach their financial goals. We believe that frequently chopping and changing your investment strategy based on what you think – or fear – might happen in the future is likely to lead to inferior returns. Peter Lynch, one of the greatest investors of all time, said “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” There’s nothing wrong with wanting a smooth ride per se, but we’re cautious about picking an investment strategy that has a lower long-term return in order to get it. Over the full market cycle investing to achieve short-term comfort costs a fortune.

So we recommend looking for an investment strategy that matches your convictions and your personal style, manage risk when wrong, and then try to stay the course. Accept that with equity investing much of your return will come in lumpy unpredictable bursts that are mixed in with the occasional stressful moments.

If you want to learn more about the Lighthouse Funds available on InvestNow, please visit their page on our website.

Leave A Comment