Ashley Gardyne – Senior Portfolio Manager — International Shares | 21 March, 2019

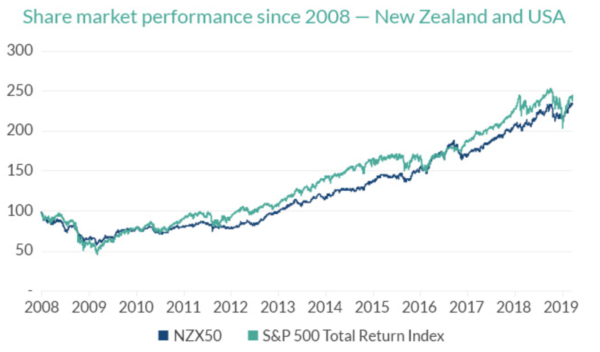

10 years ago global share markets hit rock bottom. In March 2009, the US share market had more than halved from its peak and the New Zealand market had fallen more than 40%. With the benefit of hindsight we now know the global financial crisis provided a phenomenal investment opportunity for brave investors and has been a boon for savvy KiwiSaver members (particularly those in a growth fund). But just how good has the last 10 years been in financial markets, how does this compare to previous decades, and what might the future hold?

I can still remember March 2009 vividly. The press was full of headlines about banks on the brink of collapse (I was working for one of them at the time), economic growth was stalling and job losses were starting to mount. That month the US S&P Index hit its lowest point during the financial crisis – 58% off its highs. For those that had the courage to be buying at that time, the US share market has gone on to deliver a return of over 400% since then. New Zealand’s NZX50 Index is up more than 280% over the same period. By comparison, property prices in Auckland are up 95% over the same period. So it has clearly been a great run for the share market.