KiwiSaver cuts worry investors, but they’re not leaving

Article written by Joanna Mathers, Editor, Informed Investor – September 2025

Informed Investor’s latest KiwiSaver survey (powered by InvestNow) reveals government changes to KiwiSaver are likely to alter the level of engagement for some investors, but most are committed to staying the course, as Joanna Mathers outlines.

The year’s budget contained a kicker for the 3,334,654 of us who invest in KiwiSaver. The government contribution, 50 cents per dollar up to a maximum of $521.43 per annum, was dropped to $260.72, or 25 cents per dollar. While those earning over $180,000 a year are no longer eligible for the government contribution altogether.

These changes will save the government $2.46 billion over four years; which is compelling. But an address to parliament by opposition leader Chris Hipkins posited that an 18-year-old starting on their KiwiSaver journey will be $66,000 worse off at retirement age. Equally compelling.

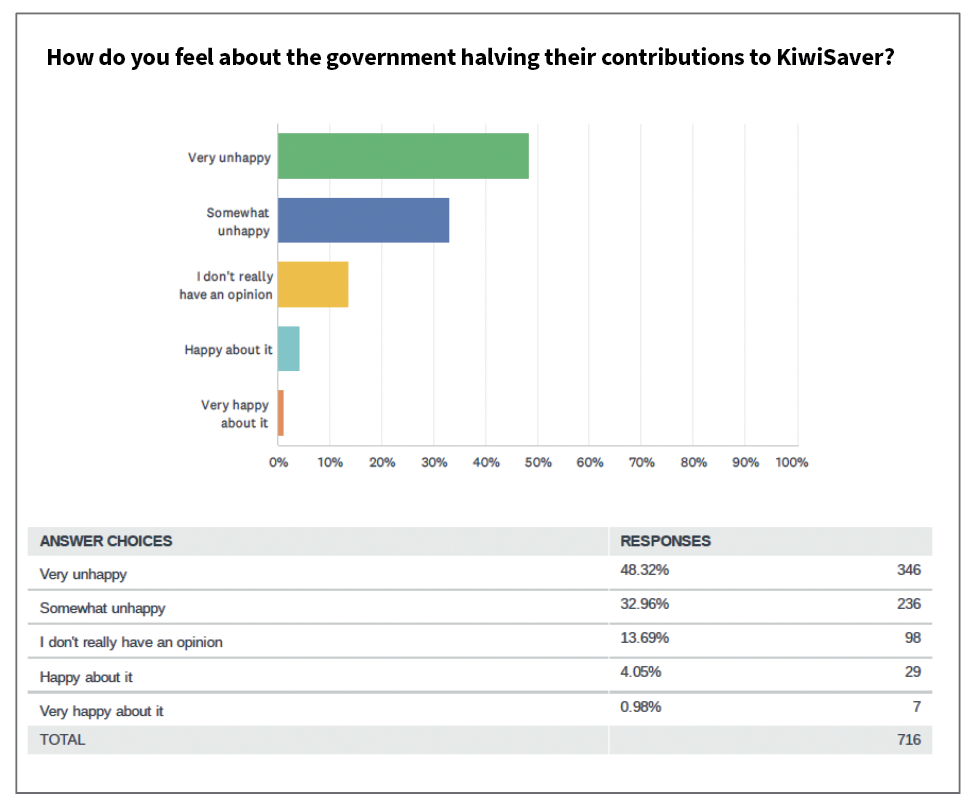

And according to our annual KiwiSaver survey, the move is unpopular.

Forty-eight per cent of the more than 700 respondents stated that they were “very unhappy” with the government contribution reduction, with 33% “somewhat unhappy”. Under 5% of respondents supported the change.

Another change, the increase of minimum contribution rate being lifted from 3 per cent to 3.5% – with a further increase to 4 per cent in 2028, which will be matched by employers, is likely to lead to a healthier balance at the time of retirement.

This change was more popular; over 50% of respondents claimed they were extremely satisfied with this change. (Only 17 per cent were dissatisfied or very dissatisfied).

‘I’ll keep contributing the minimum and would rather focus on investing outside my KiwiSaver. The reduced government contribution is disappointing, with little incentive or tax benefit to contribute more’ SURVEY RESPONDENT

But asked to elaborate on these changes, the following statement by a respondent encapsulated the broader sentiment.

“I think it’s a bit rich of the government to reduce their contribution and increase business and individual contribution in a cost-of-living crisis. I suspect the impact will be more contribution holidays which is bad for all Kiwis.”

The KiwiSaver survey is always useful as a snapshot of attitudes and behaviour relating to our national retirement savings scheme.

Focusing on investor behaviour, understanding, and engagement, the survey reveals that New Zealanders are very engaged with the scheme – and happy with their providers. And while changes made by government are a concern to some, there is still an overarching commitment to achieving a comfortable retirement.

Well-informed investors

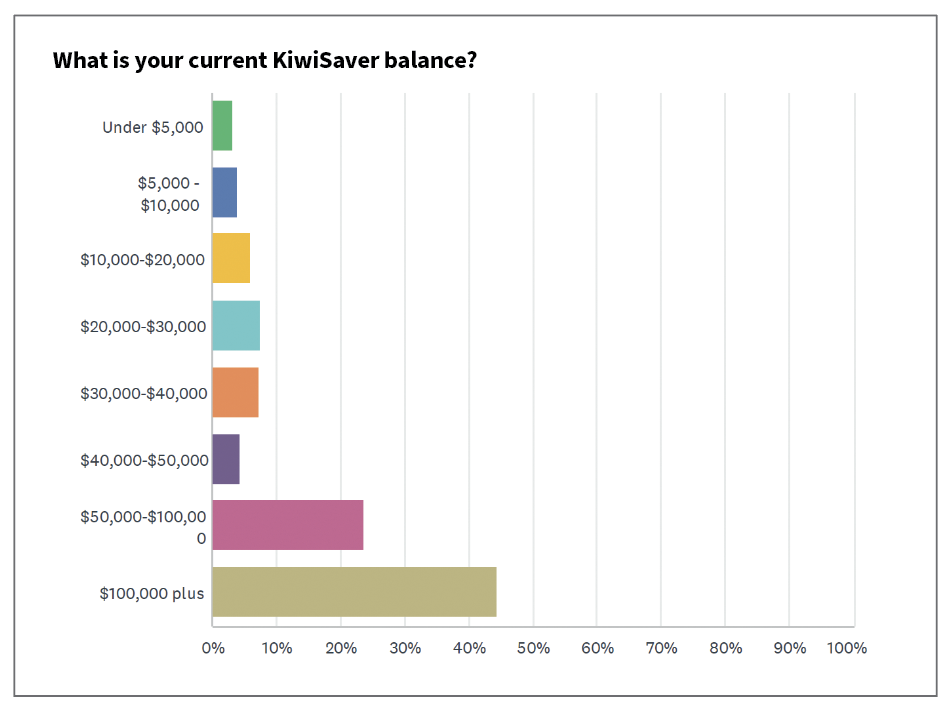

Respondents to our survey have a high level of knowledge around KiwiSaver … and a much higher balance than the majority of New Zealanders.

Ninety-five per cent of our respondents claimed they were “somewhat”, “very” or “extremely” confident about their level of KiwiSaver knowledge, which indicates a strong level of engagement in the fund.

Even more striking is the amount these people have in their funds: 44 % of respondents stated they had over $100,000 in their fund, with 25 per cent having between $50,000 and $100,000.

According to retirement commission data, the average balance across all age groups was $37,000 – our survey respondents are older and more engaged with investing than most Kiwis.

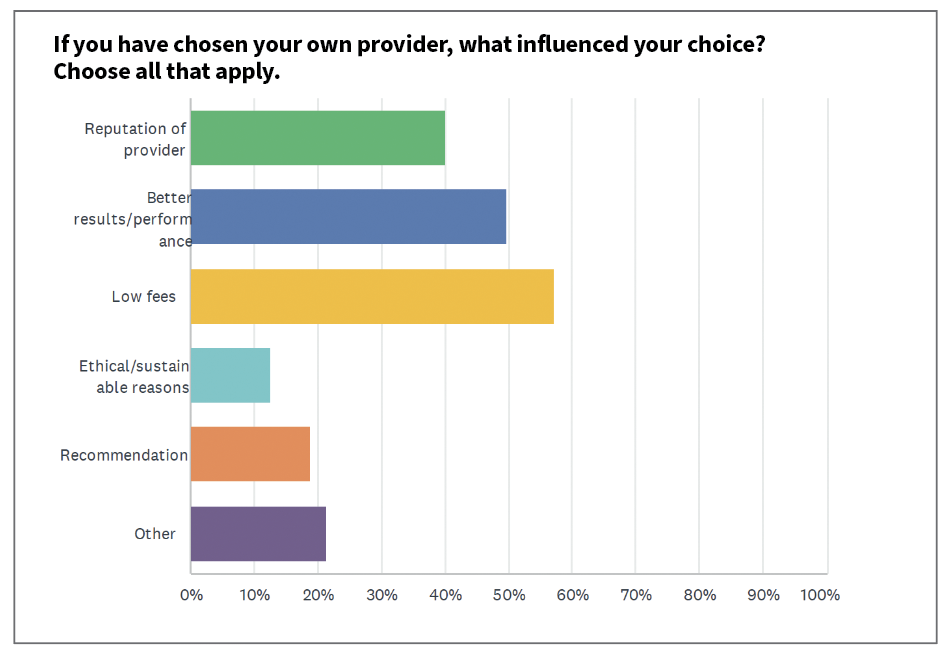

A vast majority of those who took part in the survey chose their own providers (94%) and when asked what the factors influenced their choice of provider, three stood out – reputation of provider (40%), better results/performance (49.7%) and low fees (57%).

Ethical and sustainable factors were low on the list – just 12% of respondents listed this as a key factor for their choice of provider. Nevertheless, when asked later how important ethical considerations were for them, 61% claimed they were “somewhat”, “very”, or “extremely” important.

Contribution rates

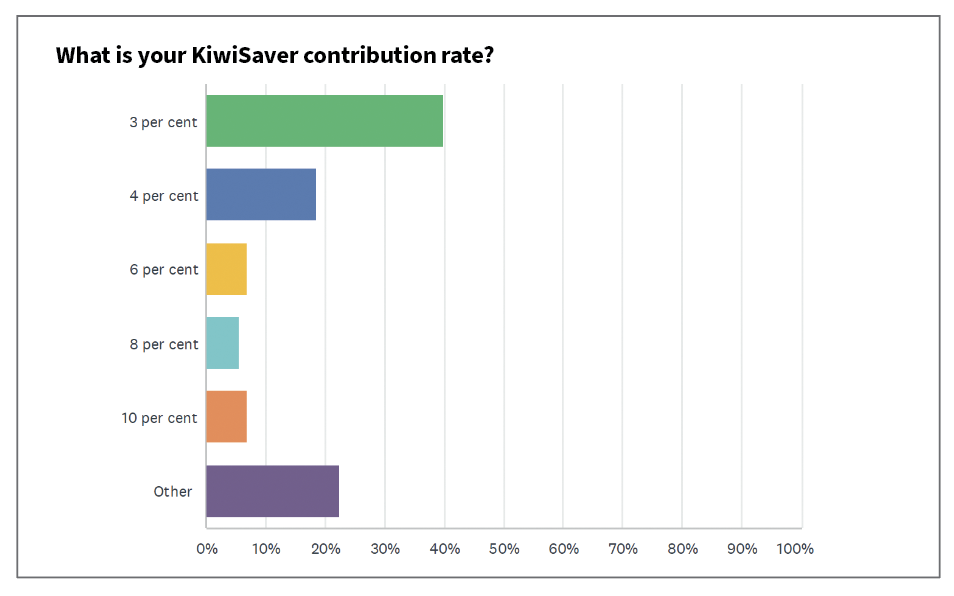

Contribution rates, set to go up in April next year, are interesting to consider. In Australia, employer contribution rates sit at 12% , compared to our measly 3 (soon to be 3.5) %. Even the 4% rate (coming into effect in 2028) is pallid by comparison.

In the survey, however, only 40% of respondents contributed at a rate 3%. Around 40% contributed more than this, with 22% choosing their own rates.

These are likely to be self-employed people – who can contribute at whatever rate they choose. And these people are the most likely to be affected by the halving of government contributions.

Self-employed respondents to this survey have stated that this reduction will most likely change their KiwiSaver investment behaviour.

“I am self-employed and used to put in just enough to get the full government contribution. In my opinion this is no longer worth it,” stated one respondent. “I have stopped my KiwiSaver contributions.”

Risk Tolerance

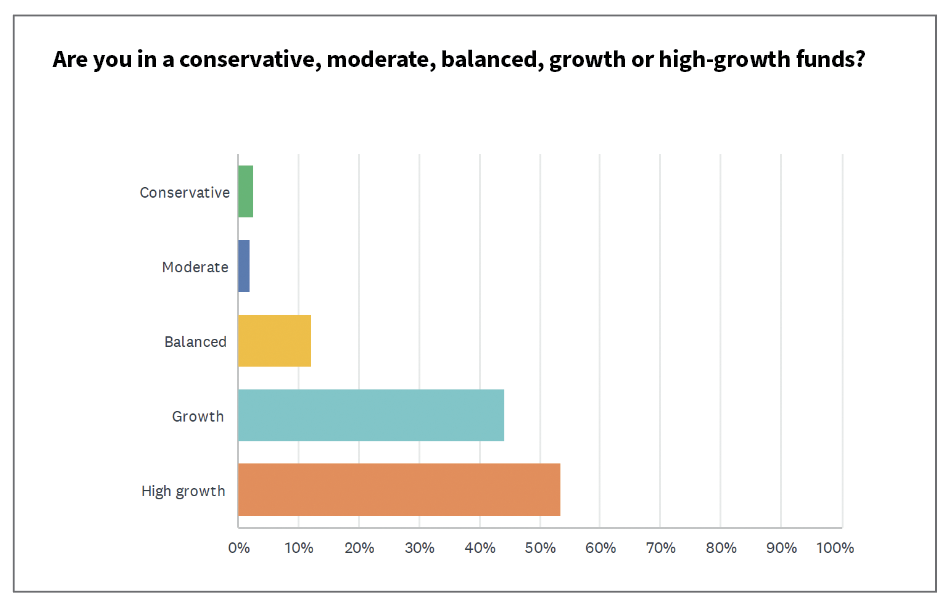

The results also reveal that our audience is not afraid of market volatility. With 53% on high-growth and 44% choosing growth funds, this reflects a Kiwi’s appetite for risk, as Mike Heath, general manager of InvestNow, shares.

“This result makes sense to me. Kiwis like growth assets and global equities.”

According to the Financial Markets Authority (FMA), the proportion of KiwiSaver members invested in high volatility funds quadrupled from around 10% in 2021 to more than 40% in 2024, with the proportion in low-to-medium volatility funds decreasing from 30% to 10% in the same period.

Heath explains that there could be a few reasons for this move to higher risk funds.

“[There is an] ever-increasing interest in index funds/exchange traded funds/ passive investing, the most popular of which are the growth ones – S&P 500, Total World, Nasdaq,” he says.

“Part of the recent change in default KiwiSaver providers also included a shift up the risk curve – away from conservative to balanced. Perhaps what we are seeing is that people are gaining a better understanding of risk and volatility, and for those with a long runway to retirement, they are now willing to accept the risk.”

First home deposit

The ability to use KiwiSaver as a deposit on a first home makes it a compelling choice for younger investors. But only 30% of our respondents stated they had used KiwiSaver for this purpose.

(According to the most recent FMA data, $1.2 billion was withdrawn by almost 35,700 people for a first home purchase in the last financial year – which was 34% higher than 2023, but 14% down from the peak in 2022.)

So, the low rate of withdrawals for a first home is likely to be determined by the age of our respondents, with 60% of respondents aged over 45.

If we are to consider the 2025 KiwiSaver Demographic Survey undertaken by consulting actuary firm Melville Jessup Weaver, the 18-25 age bracket has the most KiwiSaver members; closely followed by the 31-45 age range. So our survey skews older; and the results reflect this.

The respondents also exhibited a high level of financial security – with only 1% having taken money out of their KiwiSaver due to financial hardship.

However, 40% have stopped contributing at some stage – the reasons are varied: financial reasons (8%), travel (6%), and change in circumstances (4%) being the most common.

‘For many people there is no incentive to be in KiwiSaver at all, compared with a regular managed fund’ SURVEY RESPONDENT

Other assets

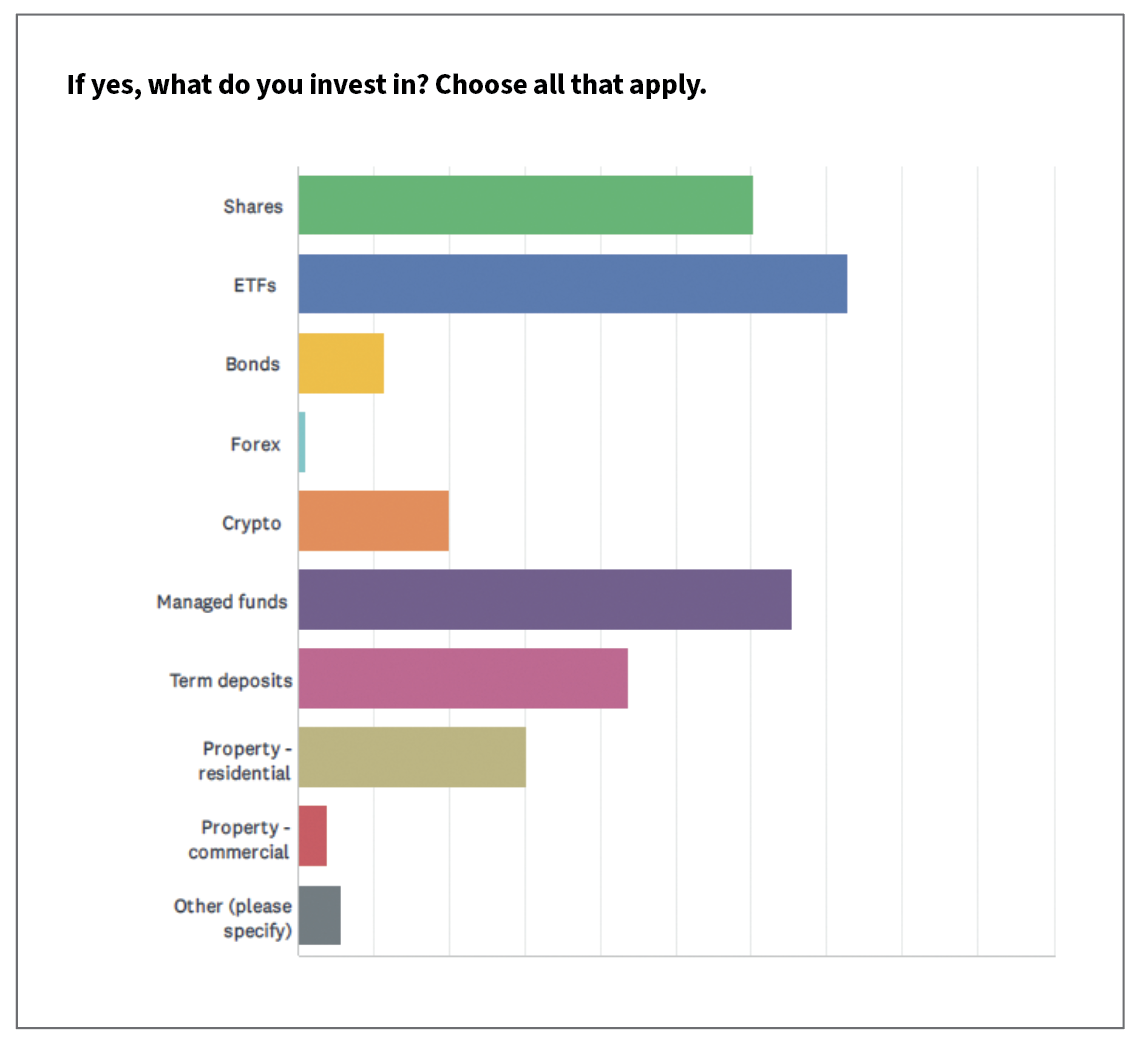

A vast majority of our respondents, in fact 97.5%, invest their money in other assets. Exchange traded funds (ETFs) are the number one choice, with 72% investing in these. Six per cent invested in managed funds; 60% in shares; and 43% had their money in managed funds.

Crypto investment is becoming increasingly mainstream – nearly 20% of respondents invest in this. And residential property is also a popular investment option; 30% of respondents owned rental properties.

Five per cent of our respondents invested in other assets – these included everything from trees, gold and silver, whiskey, carbon credits and art. It’s another indication of the level of understanding and engagement our readers have around investment – and their willingness to look for unconventional ways to create wealth.

Disclaimer:

This information is provided by InvestNow Saving and Investment Service Limited (“InvestNow”). The information and any opinions in this publication are based on sources that InvestNow believes are reliable and accurate. InvestNow, its directors, officers and employees make no representations or warranties of any kind as to the accuracy or completeness of the information contained in this publication and disclaim liability for any loss, damage, cost or expense that may arise from any reliance on the information or any opinions, conclusions or recommendations contained in it, whether that loss or damage is caused by any fault or negligence on the part of InvestNow, or otherwise, except for any statutory liability which cannot be excluded. All opinions and market commentary reflect InvestNow’s judgment on the date of this publication and are subject to change without notice. This disclaimer extends to any entity that may distribute this publication. The information in this publication is not intended to be financial advice for the purposes of the Financial Markets Conduct Act 2013, as amended by the Financial Services Legislation Amendment Act 2019. In particular, in preparing this document, InvestNow did not take into account the investment objectives, financial situation and particular needs of any particular person. Professional investment advice from an appropriately qualified adviser is recommended before making any investment. All Investments involve risk.

Leave A Comment