InvestNow News – 8th October – Devon – ESG – More Than a Buzz Word

Article written by Devon Funds Management – 5th September 2021

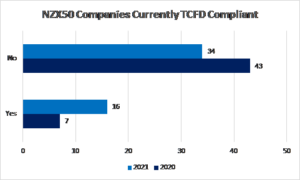

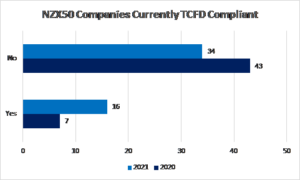

September 5th 2021: Over the past few years environmental, social and governance – commonly termed ESG – factors have risen to prominence within the local and global investing landscape. At Devon Funds we support many collaborations and initiatives so we can continue to be at the forefront of this positive change. We are signatories of the globally recognized Principles for Responsible Investment, a collaborator within Climate Action 100+, an active contributor within the New Zealand Governance Forum and a member of the Responsible Investment Association Australasia (RIAA). Recently RIAA recognized Devon Funds as a Top Three Responsible Investment Leader in its landmark 2021 NZ study, due to our responsible investing practices. Last year we launched the Climate Related Financial Disclosure survey of all companies within the S&P/NZX50. We did this for a number of reasons, but primarily because we believe improving disclosures in this area vastly improves the framework for making investment decisions. This year the survey focused on the 34 companies who currently don’t have disclosures in line with the Task Force on Climate-Related Financial Disclosures (TCFD) guidelines. Below we discuss why we desire better climate related disclosures, along with changes we’d like to see after analysing the survey results.

September 5th 2021: Over the past few years environmental, social and governance – commonly termed ESG – factors have risen to prominence within the local and global investing landscape. At Devon Funds we support many collaborations and initiatives so we can continue to be at the forefront of this positive change. We are signatories of the globally recognized Principles for Responsible Investment, a collaborator within Climate Action 100+, an active contributor within the New Zealand Governance Forum and a member of the Responsible Investment Association Australasia (RIAA). Recently RIAA recognized Devon Funds as a Top Three Responsible Investment Leader in its landmark 2021 NZ study, due to our responsible investing practices. Last year we launched the Climate Related Financial Disclosure survey of all companies within the S&P/NZX50. We did this for a number of reasons, but primarily because we believe improving disclosures in this area vastly improves the framework for making investment decisions. This year the survey focused on the 34 companies who currently don’t have disclosures in line with the Task Force on Climate-Related Financial Disclosures (TCFD) guidelines. Below we discuss why we desire better climate related disclosures, along with changes we’d like to see after analysing the survey results.

Climate change is a term willfully thrown around but widely misunderstood. It’s a long-term change to the temperature of the atmosphere which occurs naturally and has been accelerated by human activity following the industrial revolution. Since the start of the 19th century we have released large amounts of greenhouse gases (GHG) into the Earth’s atmosphere through the burning of petrochemicals and large-scale agriculture, among other activities. These GHG emissions result in more heat being trapped within the atmosphere, with the rising temperature then affecting the world we interact with. A warming atmosphere has two primary concerns. Firstly, it facilitates more extreme and unpredictable weather events. Secondly, it expedites the melting of glaciers and land-based ice deposits. This leads to rising sea levels, which in turn further exacerbates flooding and erosion being experienced during more extreme weather events. Examples of local climate change driven events are numerous and touch many of our lives. Furthermore, these events present a very real risk to many of our local companies.

Given the growing materiality of climate change and the increasing adoption of conscious investing principles, many companies have adopted voluntary ESG reporting. This frequently varies in its depth, quality and usefulness. However, in April this year New Zealand became the first country in the world to legislate mandatory climate related disclosures. This will come into effect during 2023, pending final parliamentary approval. It will apply to around 200 companies; all NZX equity and debt issuers, in addition to all banks, credit unions, insurers and registered investment schemes with $1 billion in relevant assets. These climate disclosures will be in-line with the global best practice set out within the TCFD guidelines. TCFD disclosures have four main pillars: Governance; Strategy; Risk Management; and Metrics and Targets. We were very pleased to see a further nine companies voluntarily publish their TCFD disclosures during 2021 and look forward to seeing the remaining companies adopt the guidelines over the remaining two years.

Source: NZX50 constituent management teams, Devon Funds Management analysis

Our investment research process has two core objectives. Primarily we aim to forecast the cash flows which a business is likely to generate and to also understand the risk surrounding them. Doing this generates an intrinsic value estimate of the business, which we then compare to the stock’s price to determine the attractiveness of the current valuation. TCFD disclosures are particularly valuable when evaluating the risk element of these future cashflows. Examples of the usefulness of these disclosures include our ability to monitor the efforts of Freightways and A2 Milk to reduce the scope 1, 2 and 3 emissions along their supply chain. The first order consequence is that much of Freightways’s emissions are subject to the Emissions Trading Scheme and in turn are exposed to an escalation in carbon unit prices. However, a secondary risk to both companies is that of consumer abandonment, if they are seen to be too dirty or failing to do well on their sustainability goals.

A different example of the ways in which TCFD disclosures can also be applied is with Auckland Airport. Regrettably, areas of their runway are quite exposed to rising sea levels. This would be highlighted in the company’s TCFD scenario analysis and reported accordingly. Moreover, this leads to other conversations about mitigation strategies including the possibility of new runways. Together, this analysis helps build out an investor’s picture of the risks surrounding future cash flows, including possible future capital expenditure and costs. While TCFD disclosures will help New Zealand towards our 2050 net zero emissions target, they have also become an important resource within the investment process.

Reflecting upon the survey results we noticed a clear dichotomy. Of the 34 companies surveyed who aren’t currently TCFD compliant, over half expect climate change to have a material impact on their operations between now and 2026. Yet only 25% of the same management teams surveyed responded that climate-related key performance indicators (KPIs) are a factor within their remuneration. As climate change becomes a material factor affecting their operations, it intuitively should be a variable against which the performance of management teams is measured. Suitable KPIs will be varied and wide ranging and apply to company specific operations. Not all organizations have the same capacity to move New Zealand towards a greener future (e.g low emitting tech companies), but everyone can do better. Since incentives are an important driver of human behavior, we think it is imperative that more management personnel have their compensation tied to climate related performance. This stands as a call to action for the boards of our local companies who set our business leaders’ remuneration policies.

Source: NZX50 constituent management teams, Devon Funds Management analysis

The recent legislation requiring TCFD compliant disclosures for our public companies is a huge step for New Zealand and sets a desirable precedent for many other countries. The next step we would like to see is smarter compensation policies. This will naturally lead to management decisions which incorporate more than merely their bottom line. We will see new product lines offered, greener assets built, and more favorable services provided, all of which will help move New Zealand and the world towards a greener future. All of the different investment strategies at Devon Funds are managed with responsible investment at the front of mind, although the recently launched Sustainability Fund provides a targeted means of partaking in this positive change.

InvestNow News – 8th October – Devon – ESG – More Than a Buzz Word

Article written by Devon Funds Management – 5th September 2021

September 5th 2021: Over the past few years environmental, social and governance – commonly termed ESG – factors have risen to prominence within the local and global investing landscape. At Devon Funds we support many collaborations and initiatives so we can continue to be at the forefront of this positive change. We are signatories of the globally recognized Principles for Responsible Investment, a collaborator within Climate Action 100+, an active contributor within the New Zealand Governance Forum and a member of the Responsible Investment Association Australasia (RIAA). Recently RIAA recognized Devon Funds as a Top Three Responsible Investment Leader in its landmark 2021 NZ study, due to our responsible investing practices. Last year we launched the Climate Related Financial Disclosure survey of all companies within the S&P/NZX50. We did this for a number of reasons, but primarily because we believe improving disclosures in this area vastly improves the framework for making investment decisions. This year the survey focused on the 34 companies who currently don’t have disclosures in line with the Task Force on Climate-Related Financial Disclosures (TCFD) guidelines. Below we discuss why we desire better climate related disclosures, along with changes we’d like to see after analysing the survey results.

September 5th 2021: Over the past few years environmental, social and governance – commonly termed ESG – factors have risen to prominence within the local and global investing landscape. At Devon Funds we support many collaborations and initiatives so we can continue to be at the forefront of this positive change. We are signatories of the globally recognized Principles for Responsible Investment, a collaborator within Climate Action 100+, an active contributor within the New Zealand Governance Forum and a member of the Responsible Investment Association Australasia (RIAA). Recently RIAA recognized Devon Funds as a Top Three Responsible Investment Leader in its landmark 2021 NZ study, due to our responsible investing practices. Last year we launched the Climate Related Financial Disclosure survey of all companies within the S&P/NZX50. We did this for a number of reasons, but primarily because we believe improving disclosures in this area vastly improves the framework for making investment decisions. This year the survey focused on the 34 companies who currently don’t have disclosures in line with the Task Force on Climate-Related Financial Disclosures (TCFD) guidelines. Below we discuss why we desire better climate related disclosures, along with changes we’d like to see after analysing the survey results.

Climate change is a term willfully thrown around but widely misunderstood. It’s a long-term change to the temperature of the atmosphere which occurs naturally and has been accelerated by human activity following the industrial revolution. Since the start of the 19th century we have released large amounts of greenhouse gases (GHG) into the Earth’s atmosphere through the burning of petrochemicals and large-scale agriculture, among other activities. These GHG emissions result in more heat being trapped within the atmosphere, with the rising temperature then affecting the world we interact with. A warming atmosphere has two primary concerns. Firstly, it facilitates more extreme and unpredictable weather events. Secondly, it expedites the melting of glaciers and land-based ice deposits. This leads to rising sea levels, which in turn further exacerbates flooding and erosion being experienced during more extreme weather events. Examples of local climate change driven events are numerous and touch many of our lives. Furthermore, these events present a very real risk to many of our local companies.

Given the growing materiality of climate change and the increasing adoption of conscious investing principles, many companies have adopted voluntary ESG reporting. This frequently varies in its depth, quality and usefulness. However, in April this year New Zealand became the first country in the world to legislate mandatory climate related disclosures. This will come into effect during 2023, pending final parliamentary approval. It will apply to around 200 companies; all NZX equity and debt issuers, in addition to all banks, credit unions, insurers and registered investment schemes with $1 billion in relevant assets. These climate disclosures will be in-line with the global best practice set out within the TCFD guidelines. TCFD disclosures have four main pillars: Governance; Strategy; Risk Management; and Metrics and Targets. We were very pleased to see a further nine companies voluntarily publish their TCFD disclosures during 2021 and look forward to seeing the remaining companies adopt the guidelines over the remaining two years.

Source: NZX50 constituent management teams, Devon Funds Management analysis

Our investment research process has two core objectives. Primarily we aim to forecast the cash flows which a business is likely to generate and to also understand the risk surrounding them. Doing this generates an intrinsic value estimate of the business, which we then compare to the stock’s price to determine the attractiveness of the current valuation. TCFD disclosures are particularly valuable when evaluating the risk element of these future cashflows. Examples of the usefulness of these disclosures include our ability to monitor the efforts of Freightways and A2 Milk to reduce the scope 1, 2 and 3 emissions along their supply chain. The first order consequence is that much of Freightways’s emissions are subject to the Emissions Trading Scheme and in turn are exposed to an escalation in carbon unit prices. However, a secondary risk to both companies is that of consumer abandonment, if they are seen to be too dirty or failing to do well on their sustainability goals.

A different example of the ways in which TCFD disclosures can also be applied is with Auckland Airport. Regrettably, areas of their runway are quite exposed to rising sea levels. This would be highlighted in the company’s TCFD scenario analysis and reported accordingly. Moreover, this leads to other conversations about mitigation strategies including the possibility of new runways. Together, this analysis helps build out an investor’s picture of the risks surrounding future cash flows, including possible future capital expenditure and costs. While TCFD disclosures will help New Zealand towards our 2050 net zero emissions target, they have also become an important resource within the investment process.

Reflecting upon the survey results we noticed a clear dichotomy. Of the 34 companies surveyed who aren’t currently TCFD compliant, over half expect climate change to have a material impact on their operations between now and 2026. Yet only 25% of the same management teams surveyed responded that climate-related key performance indicators (KPIs) are a factor within their remuneration. As climate change becomes a material factor affecting their operations, it intuitively should be a variable against which the performance of management teams is measured. Suitable KPIs will be varied and wide ranging and apply to company specific operations. Not all organizations have the same capacity to move New Zealand towards a greener future (e.g low emitting tech companies), but everyone can do better. Since incentives are an important driver of human behavior, we think it is imperative that more management personnel have their compensation tied to climate related performance. This stands as a call to action for the boards of our local companies who set our business leaders’ remuneration policies.

Source: NZX50 constituent management teams, Devon Funds Management analysis

The recent legislation requiring TCFD compliant disclosures for our public companies is a huge step for New Zealand and sets a desirable precedent for many other countries. The next step we would like to see is smarter compensation policies. This will naturally lead to management decisions which incorporate more than merely their bottom line. We will see new product lines offered, greener assets built, and more favorable services provided, all of which will help move New Zealand and the world towards a greener future. All of the different investment strategies at Devon Funds are managed with responsible investment at the front of mind, although the recently launched Sustainability Fund provides a targeted means of partaking in this positive change.