Retirement Readiness Index: Young confidence, investor advantage but poor planning remains

Article written by Mike Heath, InvestNow General Manager – 29th July 2025

The latest InvestNow Retirement Readiness Index (RRI) shows a stubborn lack of financial planning for New Zealanders’ twilight years.

The biannual Index, taken from separate surveys of InvestNow customers and a portion of the general public (conducted by TGM Research), shows the proportion of individuals that have a retirement plan that they are confident in.

It has again found that many Kiwis are not confident that they will be financially set up for retirement.

The headline Index is 48.7%, down slightly on 50.4% from six months ago. Once again, it shows that around half of all New Zealanders do not believe they have an effective plan to finance their retirement years.

The proportion of people who have a plan they are confident in is also similar to previous findings. The RRI for InvestNow customers is 69% (compared to 70% in November 2024), while for the general public it is 14% (19% previously).

Young investors more confident

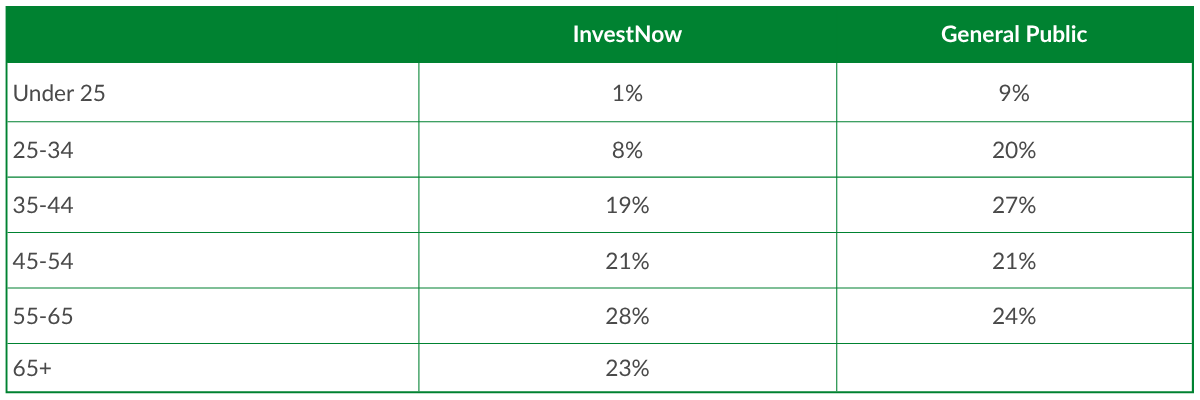

Perhaps unsurprisingly, the older someone is, the more likely they are to have a retirement plan. Of those with a plan, just 1% of InvestNow customers and 9% of the public are aged under 25.

Table 1: Do you have a retirement plan?

It’s interesting to note that, for the general public, planning peaks between the ages of 35-44, then goes backwards from there. It would suggest that some people abandon their plans, which is a curious thing to do.

InvestNow customer trends follow what we’d expect more closely, where those in their 50s and 60s are most likely to have a plan. They likely have more discretionary cash, with kids flown the nest and a mortgage paid off, and retirement is more relevant given it is much sooner.

But while younger people tend to be less prepared, those that do have plans are more confident in them – especially among InvestNow customers. 100% of the InvestNow customers under 25 that have a plan said they were either pretty confident in it, or really confident.

Two explanations come to mind as to why this could be:

- The young people surveyed have a good awareness and understanding of how to effectively save for retirement. The optimistic point of view is to say it’s a reflection of better financial skills and planning among the next generation. However, this is a relatively small sample size, so it probably isn’t representative of all young people.

- There’s an element of naivety at play. Younger investors don’t have as much time in the market, they likely haven’t experienced withdrawing a chunk of their savings to pay for a house, and they don’t fully appreciate the cost of financing a retirement.

Whatever the case, investor confidence is generally not a bad thing, especially when it’s backed up by a sound plan.

KiwiSaver confidence (or lack of)

Investor confidence is down, with both customers and the public saying they have less confidence in their KiwiSaver supporting a retirement lifestyle that’s at least as good as what they have currently.

Despite revamped KiwiSaver settings announced in Budget 2025 that will see increased default contributions rates, 74% of customers and 63% of the public still say they have little or no confidence in KiwiSaver alone delivering what they need for retirement. This is a big leap from six months ago, where 49% of both groups said the same.

Recent market volatility, with the threat of a trade war still on the table would’ve no doubt impacted investor sentiment. The silver lining to this though is it can often lead to more investors being engaged with their KiwiSaver and better understand the impacts global events can have on their portfolios.

In any case, it reinforces that many Kiwis need more than just KiwiSaver to finance a healthy retirement.

Resources

It’s interesting to note the difference between the two groups about the resources they turn to for retirement planning.

The most popular resource for InvestNow customers is articles (26%), followed by a financial adviser (23%). For the public, 32% use a financial adviser, while 30% consult friends or family.

There’s nothing quite like getting expert advice that’s tailored to your situation, investing goals and individual preferences.

Advisers can provide immense value, not only in times of volatility, but over a long period where they can work alongside you to review and update plans to keep you on track.

Self-managing is certainly possible, but having an expert alongside you gives you that much more chance of reaching the desired outcome. Your retirement is a big thing to have at stake too, so why wouldn’t you boost your odds of success?

Plan, plan, plan

It’s a little jarring to see how many of both groups (recognising those in the general public may or may not be investors elsewhere) aren’t following our time-proven Investment Principles.

The principles are a framework for making an investment plan that is right for you – it’s not advice, but a planning guide.

Of those without a plan, most (53% of customers and 34% of the public) said they wanted to make one ASAP.

Sometimes it’s just about having a starting point. Our Investment Principles are designed to be exactly that.

Disclaimer:

This information is provided by InvestNow Saving and Investment Service Limited (“InvestNow”). The information and any opinions in this publication are based on sources that InvestNow believes are reliable and accurate. InvestNow, its directors, officers and employees make no representations or warranties of any kind as to the accuracy or completeness of the information contained in this publication and disclaim liability for any loss, damage, cost or expense that may arise from any reliance on the information or any opinions, conclusions or recommendations contained in it, whether that loss or damage is caused by any fault or negligence on the part of InvestNow, or otherwise, except for any statutory liability which cannot be excluded. All opinions and market commentary reflect InvestNow’s judgment on the date of this publication and are subject to change without notice. This disclaimer extends to any entity that may distribute this publication. The information in this publication is not intended to be financial advice for the purposes of the Financial Markets Conduct Act 2013, as amended by the Financial Services Legislation Amendment Act 2019. In particular, in preparing this document, InvestNow did not take into account the investment objectives, financial situation and particular needs of any particular person. Professional investment advice from an appropriately qualified adviser is recommended before making any investment. All Investments involve risk.

Leave A Comment