InvestNow News – 25th June – Platinum Asset Management – Milk: A Nourishing Option for Investors

Article written by James Foreman, Platinum Asset Management – 21st June 2021

The milk, yoghurt, cheese and dairy industry might be viewed as well-established, perhaps even dull, but it actually has rather a lot going on. On a per capita basis, Australians consume about 97 litres (L) of milk per year, along with 14 kilograms (kgs) of cheese and 9 kgs of yoghurt.[1] We drink more milk than the European Union average (65 L) and Americans (64 L)[2] – partly because of our coffee culture and low supermarket milk prices.

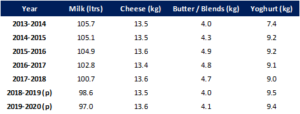

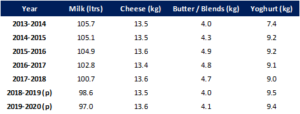

The trend in Australia and across Western societies is declining milk consumption but growing cheese and yogurt consumption (see Fig. 1). Declining milk consumption is partly due to consumers switching to plant-based alternatives. You may have heard of Swedish brand Oatly, which recently listed in the US (and catchily brands itself as ‘milk for humans’). Perhaps you’ve tried almond, soy or another plant-based dairy alternative? Last year, plant-based milk-alternative products represented approximately 9% of the global dairy milk category (excluding soy drinks in China).[3]

Fig. 1: Australia: Per Capita Consumption of Major Dairy Products (litres / kg)

Source: Dairy Australia

While plant-based milk-alternatives are getting considerable media attention, the traditional dairy industry continues to hold attraction, especially in Asian markets where dairy consumption is low and rising.

In China, annual dairy consumption per capita was just 21 kgs in 2020 (comprising around 14 L of milk, 0.3 kgs of cheese and 6.8 kgs of yoghurt), and is expected to grow by 5% p.a. in volume terms to 2025 (see Fig. 2).[4] Milk consumption in China has been consistently promoted as a health drink for all ages and was a significant tool in tackling under-nourishment in the 1980s and 1990s. As recently as March 2020, in response to COVID, Chinese government bodies have reminded citizens of guidelines to consume 300 millilitres (ml) of liquid milk per day or 110 kgs per year. While reaching Western levels may never be realised, a pattern of increased per capita consumption in higher tier cities indicates that rising wealth and urbanisation in China is supportive of structural growth.

Fig. 2: China Dairy Market Size Estimate

Source: Euromonitor, CMS (HK) estimates

As well as consumption volumes increasing, Chinese consumers are trading up within the liquid milk category. Leading dairy processors China Mengniu and Inner Mongolia Yili, have a range of products spanning from affordable to premium prices and are benefiting from the perception of milk in China as a premium ‘branded’ and even giftable product. While it might seem odd to revere branded liquid milk, the combination of its perceived ‘health properties’ and Chinese focus on quality and safety as a result of the 2008 milk tainting scandal, go some way to explaining the mindset and opportunity for leading dairy companies to capitalise on. Another notable feature is that milk consumption is occurring throughout different age groups, as health and wellness becomes an increasing consideration, including amongst the elderly.

In Vietnam, dairy consumption is at similar levels to China (see Fig. 3),[5] which is somewhat surprising given per capita incomes are about one-third of China’s levels,[6] and the average price of dairy is only slightly lower.[7]

Fig. 3: China vs. Vietnam: Dairy Consumption and GDP Per Capita

Source: Euromonitor, IMF

Interestingly, the consumption pattern in Vietnam is different. Estimates suggest 80% of milk consumption is by children. Explanations for this include Vietnam’s younger population demographics, its less developed status, and the different stages of effect from central government nutrition policy and promotion of the dairy category. In China, public health programs began in the 1970s to address child malnutrition and development rates (e.g. height potential) and this issue has been widely solved.[8] In Vietnam, a similar program began much later in 1995. Since then, the development rate amongst 5-year-old children has improved markedly,[9] but remains well below rates in other Asian economies today. With government policy and industry marketing still promoting milk firstly for the development of children, this is reflected in consumer perceptions and consumption patterns.

As Vietnam’s economy continues to grow, consumers’ purchasing power will improve. Consumption habits that have been formed over the past decade will have become ingrained. Vietnam’s dairy industry should capitalise on this trend, either by serving milk products targeted to adult health needs, or as is already occurring, up-trading adult consumers to yoghurt and cheese.

The demographic trends and emerging wealth across Asia provides some interesting and attractive investment opportunities, with the dairy industry perhaps one of the overlooked beneficiaries.

[1] Source: https://www.dairyaustralia.com.au/industry-statistics/dairy-consumption-in-australia.

[2] Source: Euromonitor

[3] Source: Euromonitor, Oatly prospectus.

[4] Source: Euromonitor.

[5] Source: Euromonitor.

[6] Source: International Monetary Fund.

[7] Source: Euromonitor.

[8] Source:https://bmcpublichealth.biomedcentral.com/articles/10.1186/s12889-019-6699-z#:~:text=capita%20and%20IMR-,Stunting,to%202015%20(Table%203)

[9] Source: https://data.unicef.org/resources/dataset/malnutrition-data. Accessed: 30 November 2020.

DISCLAIMER: This article has been prepared by Platinum Investment Management Limited ABN 25 063 565 006, AFSL 221935, trading as Platinum Asset Management (“Platinum”).

While the information in this article has been prepared in good faith and with reasonable care, no representation or warranty, express or implied, is made as to the accuracy, adequacy or reliability of any statements, estimates, opinions or other information contained in the articles, and to the extent permitted by law, no liability is accepted by any company of the Platinum Group® or their directors, officers or employees for any loss or damage as a result of any reliance on this information.

Commentary reflects Platinum’s views and beliefs at the time of preparation, which are subject to change without notice. Commentary may also contain forward-looking statements. These forward-looking statements have been made based upon Platinum’s expectations and beliefs. No assurance is given that future developments will be in accordance with Platinum’s expectations. Actual outcomes could differ materially from those expected by Platinum.

The information presented in this article is general information only and not intended to be financial product advice. It has not been prepared taking into account any particular investor’s or class of investors’ investment objectives, financial situation or needs, and should not be used as the basis for making investment, financial or other decisions. You should obtain professional advice prior to making any investment decision.

InvestNow News – 25th June – Platinum Asset Management – Milk: A Nourishing Option for Investors

Article written by James Foreman, Platinum Asset Management – 21st June 2021

The milk, yoghurt, cheese and dairy industry might be viewed as well-established, perhaps even dull, but it actually has rather a lot going on. On a per capita basis, Australians consume about 97 litres (L) of milk per year, along with 14 kilograms (kgs) of cheese and 9 kgs of yoghurt.[1] We drink more milk than the European Union average (65 L) and Americans (64 L)[2] – partly because of our coffee culture and low supermarket milk prices.

The trend in Australia and across Western societies is declining milk consumption but growing cheese and yogurt consumption (see Fig. 1). Declining milk consumption is partly due to consumers switching to plant-based alternatives. You may have heard of Swedish brand Oatly, which recently listed in the US (and catchily brands itself as ‘milk for humans’). Perhaps you’ve tried almond, soy or another plant-based dairy alternative? Last year, plant-based milk-alternative products represented approximately 9% of the global dairy milk category (excluding soy drinks in China).[3]

Fig. 1: Australia: Per Capita Consumption of Major Dairy Products (litres / kg)

Source: Dairy Australia

While plant-based milk-alternatives are getting considerable media attention, the traditional dairy industry continues to hold attraction, especially in Asian markets where dairy consumption is low and rising.

In China, annual dairy consumption per capita was just 21 kgs in 2020 (comprising around 14 L of milk, 0.3 kgs of cheese and 6.8 kgs of yoghurt), and is expected to grow by 5% p.a. in volume terms to 2025 (see Fig. 2).[4] Milk consumption in China has been consistently promoted as a health drink for all ages and was a significant tool in tackling under-nourishment in the 1980s and 1990s. As recently as March 2020, in response to COVID, Chinese government bodies have reminded citizens of guidelines to consume 300 millilitres (ml) of liquid milk per day or 110 kgs per year. While reaching Western levels may never be realised, a pattern of increased per capita consumption in higher tier cities indicates that rising wealth and urbanisation in China is supportive of structural growth.

Fig. 2: China Dairy Market Size Estimate

Source: Euromonitor, CMS (HK) estimates

As well as consumption volumes increasing, Chinese consumers are trading up within the liquid milk category. Leading dairy processors China Mengniu and Inner Mongolia Yili, have a range of products spanning from affordable to premium prices and are benefiting from the perception of milk in China as a premium ‘branded’ and even giftable product. While it might seem odd to revere branded liquid milk, the combination of its perceived ‘health properties’ and Chinese focus on quality and safety as a result of the 2008 milk tainting scandal, go some way to explaining the mindset and opportunity for leading dairy companies to capitalise on. Another notable feature is that milk consumption is occurring throughout different age groups, as health and wellness becomes an increasing consideration, including amongst the elderly.

In Vietnam, dairy consumption is at similar levels to China (see Fig. 3),[5] which is somewhat surprising given per capita incomes are about one-third of China’s levels,[6] and the average price of dairy is only slightly lower.[7]

Fig. 3: China vs. Vietnam: Dairy Consumption and GDP Per Capita

Source: Euromonitor, IMF

Interestingly, the consumption pattern in Vietnam is different. Estimates suggest 80% of milk consumption is by children. Explanations for this include Vietnam’s younger population demographics, its less developed status, and the different stages of effect from central government nutrition policy and promotion of the dairy category. In China, public health programs began in the 1970s to address child malnutrition and development rates (e.g. height potential) and this issue has been widely solved.[8] In Vietnam, a similar program began much later in 1995. Since then, the development rate amongst 5-year-old children has improved markedly,[9] but remains well below rates in other Asian economies today. With government policy and industry marketing still promoting milk firstly for the development of children, this is reflected in consumer perceptions and consumption patterns.

As Vietnam’s economy continues to grow, consumers’ purchasing power will improve. Consumption habits that have been formed over the past decade will have become ingrained. Vietnam’s dairy industry should capitalise on this trend, either by serving milk products targeted to adult health needs, or as is already occurring, up-trading adult consumers to yoghurt and cheese.

The demographic trends and emerging wealth across Asia provides some interesting and attractive investment opportunities, with the dairy industry perhaps one of the overlooked beneficiaries.

[1] Source: https://www.dairyaustralia.com.au/industry-statistics/dairy-consumption-in-australia.

[2] Source: Euromonitor

[3] Source: Euromonitor, Oatly prospectus.

[4] Source: Euromonitor.

[5] Source: Euromonitor.

[6] Source: International Monetary Fund.

[7] Source: Euromonitor.

[8] Source:https://bmcpublichealth.biomedcentral.com/articles/10.1186/s12889-019-6699-z#:~:text=capita%20and%20IMR-,Stunting,to%202015%20(Table%203)

[9] Source: https://data.unicef.org/resources/dataset/malnutrition-data. Accessed: 30 November 2020.

DISCLAIMER: This article has been prepared by Platinum Investment Management Limited ABN 25 063 565 006, AFSL 221935, trading as Platinum Asset Management (“Platinum”).

While the information in this article has been prepared in good faith and with reasonable care, no representation or warranty, express or implied, is made as to the accuracy, adequacy or reliability of any statements, estimates, opinions or other information contained in the articles, and to the extent permitted by law, no liability is accepted by any company of the Platinum Group® or their directors, officers or employees for any loss or damage as a result of any reliance on this information.

Commentary reflects Platinum’s views and beliefs at the time of preparation, which are subject to change without notice. Commentary may also contain forward-looking statements. These forward-looking statements have been made based upon Platinum’s expectations and beliefs. No assurance is given that future developments will be in accordance with Platinum’s expectations. Actual outcomes could differ materially from those expected by Platinum.

The information presented in this article is general information only and not intended to be financial product advice. It has not been prepared taking into account any particular investor’s or class of investors’ investment objectives, financial situation or needs, and should not be used as the basis for making investment, financial or other decisions. You should obtain professional advice prior to making any investment decision.