InvestNow News – 27th August – Harbour Asset Management – Real Estate Investment Trusts – Quality over quantity?

Article written by Shane Solly, Harbour Asset Management – 24th August 2021

- Real Estate Investment Trusts (REITs) have delivered an attractive return relative to their lower volatility over the longer term

- The quality of New Zealand property returns has improved over the last 10 years with a higher weighting to industrial assets

- New Zealand REIT dividend distributions are now more sustainable, with most dividends now based on conservative available funds from operations definition rather than accounting definitions

Listed real estate/property securities and trusts, also known as REITs, have delivered an attractive return relative to their lower volatility over the longer term. COVID-19 mobility restrictions initially challenged expectations of long run consistent returns from the asset class. More than a year into the COVID-19 pandemic, investors now how have a better understanding of what COVID-19 means for real estate returns and valuations. However, there is still some wariness about return reliability from real estate securities.

In our view, investors may be overstating the riskiness of prospective REIT returns. While there is some ongoing contention about how office and retail mall space may be used in the future, there are several key trends that may continue to support listed real estate returns. Government growth (both federal and local) is supporting demand for office space in government precincts. High amenity, sustainable office space is supporting demand from commercial users trying to attract employees back into the office. Demographics is driving demand for social infrastructure including healthcare assets. And the rise of logistics as a key business enabler is powering demand for well-located modern industrial property.

A good return relative to risk

Even in a period of elevated volatility, New Zealand REITs have continued to deliver a high total return per unit of volatility – in our opinion investors are being rewarded for higher-than-normal movements in stock prices.

Over the year to August 2021, during a once in a 100-year pandemic challenge to property assets that facilitate physical interaction, the New Zealand property securities index delivered a 17.7% total return (gross before fees and taxes). New Zealand property security returns were certainly more volatile (more ups and downs in stock prices) than normal during the 12-month period to August 2021, with an observed volatility of 23.6% versus a 10-year average volatility of just 12.1% per annum. But volatility increased for most growth asset classes over the last year. For instance, the broad S&P/NZX50 returned a 11% total return (gross before fees and taxes) over the same period, with an observed volatility of 18.6%, resulting in a return-to-volatility ratio of around 0.6. Even with its almost doubling in volatility versus long run averages, New Zealand REITs delivered a return-to-volatility ratio of 0.75 over the last 12 months.

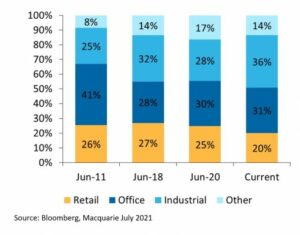

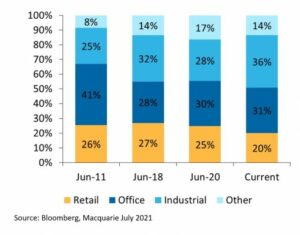

Investors may be underestimating the improvement in the quality of New Zealand property returns over the last 10 years. In 2011, office and retail mall assets made up two-thirds of the New Zealand property securities index, as shown in figure 1. Now they make up only one-half of the New Zealand property securities index.

Industrial real estate has increased from 25% to 36% of the index over the same 10-year period. This change in asset allocation mix for New Zealand property securities is important because returns from industrial assets tend to have lower volatility than office and retail, improving the overall income certainty and return quality of the asset class.

Figure 1: NZ property securities asset allocation; Higher industrial improves certainty

Dividends are more securely covered by cash earnings

New Zealand REIT dividend distributions are now more conservative. The definition of profits from which dividends are paid has generally moved from an accounting-based definition to a more conservative “funds from operations” (FFO) or “available funds from operations” (AFFO) definition that adjusts for maintenance, capital expenditure and tenant incentives. This adjustment means REITs are no longer paying capital out as dividends, or, worse still, borrowing to pay capital as dividends.

The change means REITs are not overpaying and can sustain dividends through the cycle, and may consistently grow dividends over time, be it off a lower absolute dividend income yield base.

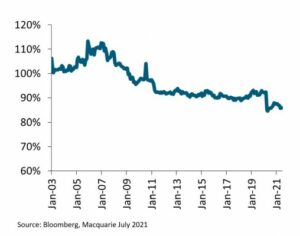

As shown by figure 2, New Zealand property securities are now paying out an average of 85% of this more conservative definition of profits, meaning they sustain dividends through the cycle. This is a far cry from the sector’s 113% pay-out of the less conservative accounting definition of profitability in 2005.

Figure 2: NZ Property securities earnings pay-out ratio: Lower pay-out provides upside as economy improves

And relative to bonds, REITs look attractive

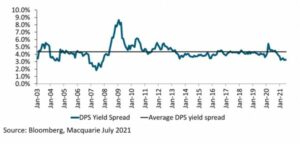

As shown in figure 3, investors in New Zealand property securities are being rewarded with a 3%-plus income yield above 10-Year New Zealand Government bonds. While this income yield enhancement for New Zealand property securities over bonds is slightly below the 18-year average (since 2003) of 4.3%, the change in part reflects the conservative dividend definition. If New Zealand property securities were paying out 100% of accounting earnings, the yield spread premium over bonds would be above 4%. In our view, the more conservative dividend pay-out is valuable to investors seeking consistent, lower volatility, compounding growth investments.

Figure 3. NZ Property dividend yield spread above NZ 10-year government bond yields

While yield enhancement offered by New Zealand property securities over 10-year New Zealand Government bonds may be slightly lower than the long run average, asset allocation changes and more conservative earnings definitions and earnings pay-out ratios have, in our opinion, improved the certainty of income and quality of New Zealand property security returns.

In our view, quality beats quantity.

REIT returns may remain more volatile than normal as COVID-19 waves alter how physical real estate is used and as governments and central banks react to changing economic conditions. REITs remain an evolving asset class with disruption amplifying return dispersion. Maintaining an active and diversified approach to managing REIT investments may be key to the asset class delivering on its long term consistent, lower volatility compounding growth characteristics which have made them a useful part of diversified portfolios.

As Henry Royce of Rolls Royce said, “The quality will remain long after the price is forgotten”.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

InvestNow News – 27th August – Harbour Asset Management – Real Estate Investment Trusts – Quality over quantity?

Article written by Shane Solly, Harbour Asset Management – 24th August 2021

- Real Estate Investment Trusts (REITs) have delivered an attractive return relative to their lower volatility over the longer term

- The quality of New Zealand property returns has improved over the last 10 years with a higher weighting to industrial assets

- New Zealand REIT dividend distributions are now more sustainable, with most dividends now based on conservative available funds from operations definition rather than accounting definitions

Listed real estate/property securities and trusts, also known as REITs, have delivered an attractive return relative to their lower volatility over the longer term. COVID-19 mobility restrictions initially challenged expectations of long run consistent returns from the asset class. More than a year into the COVID-19 pandemic, investors now how have a better understanding of what COVID-19 means for real estate returns and valuations. However, there is still some wariness about return reliability from real estate securities.

In our view, investors may be overstating the riskiness of prospective REIT returns. While there is some ongoing contention about how office and retail mall space may be used in the future, there are several key trends that may continue to support listed real estate returns. Government growth (both federal and local) is supporting demand for office space in government precincts. High amenity, sustainable office space is supporting demand from commercial users trying to attract employees back into the office. Demographics is driving demand for social infrastructure including healthcare assets. And the rise of logistics as a key business enabler is powering demand for well-located modern industrial property.

A good return relative to risk

Even in a period of elevated volatility, New Zealand REITs have continued to deliver a high total return per unit of volatility – in our opinion investors are being rewarded for higher-than-normal movements in stock prices.

Over the year to August 2021, during a once in a 100-year pandemic challenge to property assets that facilitate physical interaction, the New Zealand property securities index delivered a 17.7% total return (gross before fees and taxes). New Zealand property security returns were certainly more volatile (more ups and downs in stock prices) than normal during the 12-month period to August 2021, with an observed volatility of 23.6% versus a 10-year average volatility of just 12.1% per annum. But volatility increased for most growth asset classes over the last year. For instance, the broad S&P/NZX50 returned a 11% total return (gross before fees and taxes) over the same period, with an observed volatility of 18.6%, resulting in a return-to-volatility ratio of around 0.6. Even with its almost doubling in volatility versus long run averages, New Zealand REITs delivered a return-to-volatility ratio of 0.75 over the last 12 months.

Investors may be underestimating the improvement in the quality of New Zealand property returns over the last 10 years. In 2011, office and retail mall assets made up two-thirds of the New Zealand property securities index, as shown in figure 1. Now they make up only one-half of the New Zealand property securities index.

Industrial real estate has increased from 25% to 36% of the index over the same 10-year period. This change in asset allocation mix for New Zealand property securities is important because returns from industrial assets tend to have lower volatility than office and retail, improving the overall income certainty and return quality of the asset class.

Figure 1: NZ property securities asset allocation; Higher industrial improves certainty

Dividends are more securely covered by cash earnings

New Zealand REIT dividend distributions are now more conservative. The definition of profits from which dividends are paid has generally moved from an accounting-based definition to a more conservative “funds from operations” (FFO) or “available funds from operations” (AFFO) definition that adjusts for maintenance, capital expenditure and tenant incentives. This adjustment means REITs are no longer paying capital out as dividends, or, worse still, borrowing to pay capital as dividends.

The change means REITs are not overpaying and can sustain dividends through the cycle, and may consistently grow dividends over time, be it off a lower absolute dividend income yield base.

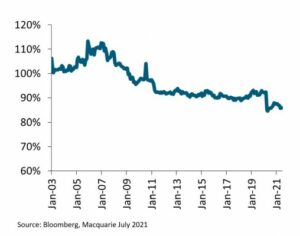

As shown by figure 2, New Zealand property securities are now paying out an average of 85% of this more conservative definition of profits, meaning they sustain dividends through the cycle. This is a far cry from the sector’s 113% pay-out of the less conservative accounting definition of profitability in 2005.

Figure 2: NZ Property securities earnings pay-out ratio: Lower pay-out provides upside as economy improves

And relative to bonds, REITs look attractive

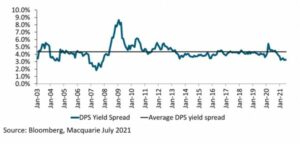

As shown in figure 3, investors in New Zealand property securities are being rewarded with a 3%-plus income yield above 10-Year New Zealand Government bonds. While this income yield enhancement for New Zealand property securities over bonds is slightly below the 18-year average (since 2003) of 4.3%, the change in part reflects the conservative dividend definition. If New Zealand property securities were paying out 100% of accounting earnings, the yield spread premium over bonds would be above 4%. In our view, the more conservative dividend pay-out is valuable to investors seeking consistent, lower volatility, compounding growth investments.

Figure 3. NZ Property dividend yield spread above NZ 10-year government bond yields

While yield enhancement offered by New Zealand property securities over 10-year New Zealand Government bonds may be slightly lower than the long run average, asset allocation changes and more conservative earnings definitions and earnings pay-out ratios have, in our opinion, improved the certainty of income and quality of New Zealand property security returns.

In our view, quality beats quantity.

REIT returns may remain more volatile than normal as COVID-19 waves alter how physical real estate is used and as governments and central banks react to changing economic conditions. REITs remain an evolving asset class with disruption amplifying return dispersion. Maintaining an active and diversified approach to managing REIT investments may be key to the asset class delivering on its long term consistent, lower volatility compounding growth characteristics which have made them a useful part of diversified portfolios.

As Henry Royce of Rolls Royce said, “The quality will remain long after the price is forgotten”.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.