InvestNow News – 10th December – Harbour Asset Management – Harbour Outlook: Push and pull factors dictate equity returns

Article written by Harbour Team, Harbour Asset Management – 8th December 2021

The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed income and equity markets.

- The MSCI All Country World (global shares) Index fell -2.5% in USD in November, taking the 3-month return to -2.0%. Returns in NZD were positive due to a weakening domestic currency, delivering 2.9% in November whilst the 3-month return was 2.0%.

- Global equity markets fell materially on the combination of Omicron COVID variant headlines, the challenges of northern hemisphere lockdowns and the likely upward trajectory of interest rates following strong inflation data.

- While the Reserve Bank of New Zealand (RBNZ) raised the official cash rate (OCR) by 0.25%, their accompanying commentary was more balanced, reducing the risk of aggressive monetary policy tightening.

- Globally bond yields fell on news of the Omicron variant; the New Zealand 10-year bond yield drew back to 2.48% from 2.63%, while the US 10-year bond yield fell from 1.55% to 1.44%. This contributed to positive performance across bond indices.

Key developments

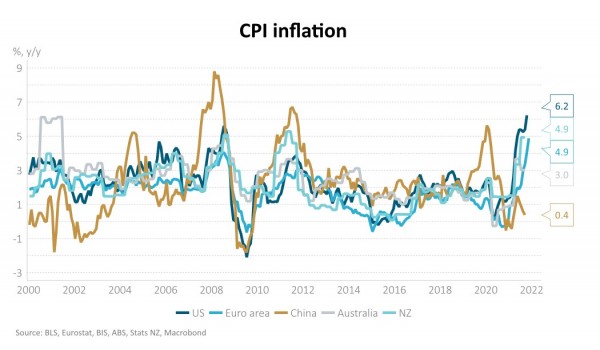

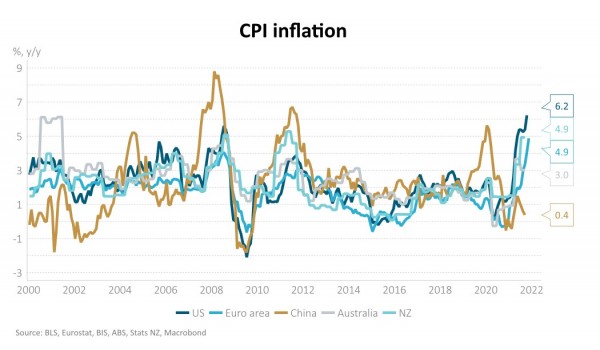

The emergence of the new COVID variant, Omicron, spooked global equity markets towards the end of November, whilst the challenges of northern hemisphere lockdowns and the likelihood of entering a rising interest rate environment due to persistently strong inflation data had already provided an artificial ceiling. Bond markets were volatile with long term bond yields falling on Omicron news. Central banks admitting that inflation might not be transitory contributed to return weakness as expectations of central banks ceasing bond buying (tapering, reducing liquidity in economies) were brought forward. The emergence of the new COVID strain tempered the yield curve rise, as investors considered the threat to economic growth from the new strain.

Locally, it was a similar theme to October with earnings results, AGMs and various company updates dominating the ticker tape. The New Zealand market continued to underperform, with the lift in the interest rate curves impacting the defensive/yield-orientated part of the market and generally lifting market volatility. Weak earnings results from Pushpay, Ryman Healthcare and Westpac also impacted market returns and an expectation of a slowing housing market hit the retirement sector more broadly. Capital raisings also applied downwards pressure, with Serko and Stride Property Group alongside various Australian companies tapping the market.

Commodity prices remained volatile with oil prices retracing sharply by US$14 to US$71/barrel, as the Omicron variant poses uncertainty for demand.

The RBNZ lifted rates again in November but was less hawkish than expected. The central bank delivered its second 0.25% rate hike (with market expectations split between 0.25% and 0.50%), taking the Official Cash Rate (OCR) to 0.75%. It also forecast an OCR peak of 2.6%, which was 0.4% below market pricing at the time. The tone of the communication was balanced with the Committee judging “that considered steps in the OCR were the most appropriate way to continue reducing monetary stimulus for now” – a signal, in our view, that 0.25% increments are more likely than 0.50% increments.

The RBNZ noted the need to continue to tighten monetary policy, eventually into restrictive territory, given inflation is well above target and employment is beyond maximum sustainable levels. It also recognised that COVID-19 is creating ongoing health uncertainties that may weigh on household and business investment. There was recognition that retail interest rates had already increased and with high household debt levels, along with a large share of fixed-rate mortgages re-pricing in coming months, there may be a higher sensitivity of consumer spending to interest rates rises.

Globally, the Omicron COVID-19 variant has created uncertainty about the economic recovery and the pace at which monetary policy support is removed. The new variant appears to be more transmissible, and its large number of mutations raises the possibility that vaccines will be less effective against it. Symptoms reported to date, however, have been milder than Delta and hospitalisations low. Regardless, it will take weeks before we can be certain.

Despite Omicron, above-potential growth should continue to add inflation pressure for most of the world. Prior to Omicron, the global economy was expected to grow at roughly double its potential rate this year and next. Labour markets continue to show signs of tightness. Early indications suggest a much stronger relationship between unemployment and wage growth than has been observed over the past decade.

What to watch

Do central bankers have an inflation problem? And is 2022 likely to be the year of monetary policy normalisation? The global inflation outlook continues to be driven by a combination of ongoing demand, supply chain disruption, higher energy prices and a lack of spare capacity. A portion of these factors are transitory, but a large amount is not and requires a monetary policy response. New Zealand started tightening earlier than most, but the rest of the world is not far behind. This carries risks for asset prices – if central banks are aggressive in winding down QE programmes and raising policy rates, real rates could move significantly higher. If central banks instead sit behind the curve, inflation may persist at higher levels and real assets, such as inflation-linked bonds, might outperform. Regardless, some volatility is likely in this process of policy normalisation.

Market outlook and positioning

Central bank tightening and COVID variants are contributing to increased uncertainty and volatility. There are known risks to equity market performance. COVID variants will slow economic re-opening, but they may not force sustained lockdowns as seen in the past. Central bank tapering is a known unknown and the pace of tapering will be a risk for equity markets. A hawkish move to accelerate removal of supportive monetary policy is potentially a risk for economic growth. Geopolitics may add to volatility over the northern hemisphere winter with energy markets remaining fragile.

However, supply chain disruptions showing signs of easing provides an emerging tailwind for equity market returns. Re-opening in New Zealand, global shipping getting ‘less worse’ and technology production catching back up takes some pressure away from earnings forecasts and may allow central banks to tighten monetary policy settings at a pace that does not destabilise growth. The re-opening of economies reduces shipping friction and costs, and producer price inflation levelling out, as supply catches up with demand, may allow profit margins to expand more than the market expects.

Within equity growth portfolios we remain focused on structural trends including demographics, digitisation and decarbonisation. We are maintaining a diversified ‘barbell’ (bias to certain sectors) approach to portfolio construction with defensive healthcare, given positive upside from demographics and technology, and some inflation protection at one end, and an overweight to cyclical materials and financials with pricing power, favouring stocks that benefit from structural trends like materials stocks and Macquarie Bank at the other end of the ‘barbell’.

Within fixed interest portfolios, we hold the view that the market pricing the OCR to reach 3% was excessive at this stage. While we think that inflation pressures will persist, there are also risks at play, which could easily cause the RBNZ to pause their hiking cycle over the next 12-18 months. With the market now pricing in a less aggressive path of rate hikes, we have reduced our positioning on this view. Globally, we expect that inflation will prove to be more persistent than central banks assumed, leading to reduction of policy support earlier than expected, pushing long-term bond yields higher. Whilst yields fell in November due to Omicron concerns and weak equity markets, we are expecting core inflation to continue to be robust. We expect the more persistent aspects to be driven by rents and pressure in labour markets and are likely to continue to position for rising long term bond yields.

Within the Active Growth Fund, we balance the exposure to structural trends achieved through our Harbour equity growth strategies with exposure to quality defensives such as real estate and listed infrastructure. While economic expansion remains positive, we expect equities to deliver better returns than bonds, and the increased volatility reinforces the need to be active and aware of valuations. The Active Growth Fund has an overweight position to equity markets overall. The portfolio is tilted towards quality growth stocks which we believe can grow earnings faster than inflation.

Within the Income Fund, our strategy reflects the themes of ongoing inflation risks and the reduction of liquidity we expect to see in the financial system as central banks move steadily towards tighter monetary policy. This has led us to be cautious about longer-dated fixed interest securities and highly geared borrowers. We are slightly underweight equities, having shifted away from global equities towards New Zealand, where tighter monetary policy is already factored in. Recognition that firms with pricing power can sustain earnings suggests that a more defensive equity position is not warranted.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

InvestNow News – 10th December – Harbour Asset Management – Harbour Outlook: Push and pull factors dictate equity returns

Article written by Harbour Team, Harbour Asset Management – 8th December 2021

The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed income and equity markets.

- The MSCI All Country World (global shares) Index fell -2.5% in USD in November, taking the 3-month return to -2.0%. Returns in NZD were positive due to a weakening domestic currency, delivering 2.9% in November whilst the 3-month return was 2.0%.

- Global equity markets fell materially on the combination of Omicron COVID variant headlines, the challenges of northern hemisphere lockdowns and the likely upward trajectory of interest rates following strong inflation data.

- While the Reserve Bank of New Zealand (RBNZ) raised the official cash rate (OCR) by 0.25%, their accompanying commentary was more balanced, reducing the risk of aggressive monetary policy tightening.

- Globally bond yields fell on news of the Omicron variant; the New Zealand 10-year bond yield drew back to 2.48% from 2.63%, while the US 10-year bond yield fell from 1.55% to 1.44%. This contributed to positive performance across bond indices.

Key developments

The emergence of the new COVID variant, Omicron, spooked global equity markets towards the end of November, whilst the challenges of northern hemisphere lockdowns and the likelihood of entering a rising interest rate environment due to persistently strong inflation data had already provided an artificial ceiling. Bond markets were volatile with long term bond yields falling on Omicron news. Central banks admitting that inflation might not be transitory contributed to return weakness as expectations of central banks ceasing bond buying (tapering, reducing liquidity in economies) were brought forward. The emergence of the new COVID strain tempered the yield curve rise, as investors considered the threat to economic growth from the new strain.

Locally, it was a similar theme to October with earnings results, AGMs and various company updates dominating the ticker tape. The New Zealand market continued to underperform, with the lift in the interest rate curves impacting the defensive/yield-orientated part of the market and generally lifting market volatility. Weak earnings results from Pushpay, Ryman Healthcare and Westpac also impacted market returns and an expectation of a slowing housing market hit the retirement sector more broadly. Capital raisings also applied downwards pressure, with Serko and Stride Property Group alongside various Australian companies tapping the market.

Commodity prices remained volatile with oil prices retracing sharply by US$14 to US$71/barrel, as the Omicron variant poses uncertainty for demand.

The RBNZ lifted rates again in November but was less hawkish than expected. The central bank delivered its second 0.25% rate hike (with market expectations split between 0.25% and 0.50%), taking the Official Cash Rate (OCR) to 0.75%. It also forecast an OCR peak of 2.6%, which was 0.4% below market pricing at the time. The tone of the communication was balanced with the Committee judging “that considered steps in the OCR were the most appropriate way to continue reducing monetary stimulus for now” – a signal, in our view, that 0.25% increments are more likely than 0.50% increments.

The RBNZ noted the need to continue to tighten monetary policy, eventually into restrictive territory, given inflation is well above target and employment is beyond maximum sustainable levels. It also recognised that COVID-19 is creating ongoing health uncertainties that may weigh on household and business investment. There was recognition that retail interest rates had already increased and with high household debt levels, along with a large share of fixed-rate mortgages re-pricing in coming months, there may be a higher sensitivity of consumer spending to interest rates rises.

Globally, the Omicron COVID-19 variant has created uncertainty about the economic recovery and the pace at which monetary policy support is removed. The new variant appears to be more transmissible, and its large number of mutations raises the possibility that vaccines will be less effective against it. Symptoms reported to date, however, have been milder than Delta and hospitalisations low. Regardless, it will take weeks before we can be certain.

Despite Omicron, above-potential growth should continue to add inflation pressure for most of the world. Prior to Omicron, the global economy was expected to grow at roughly double its potential rate this year and next. Labour markets continue to show signs of tightness. Early indications suggest a much stronger relationship between unemployment and wage growth than has been observed over the past decade.

What to watch

Do central bankers have an inflation problem? And is 2022 likely to be the year of monetary policy normalisation? The global inflation outlook continues to be driven by a combination of ongoing demand, supply chain disruption, higher energy prices and a lack of spare capacity. A portion of these factors are transitory, but a large amount is not and requires a monetary policy response. New Zealand started tightening earlier than most, but the rest of the world is not far behind. This carries risks for asset prices – if central banks are aggressive in winding down QE programmes and raising policy rates, real rates could move significantly higher. If central banks instead sit behind the curve, inflation may persist at higher levels and real assets, such as inflation-linked bonds, might outperform. Regardless, some volatility is likely in this process of policy normalisation.

Market outlook and positioning

Central bank tightening and COVID variants are contributing to increased uncertainty and volatility. There are known risks to equity market performance. COVID variants will slow economic re-opening, but they may not force sustained lockdowns as seen in the past. Central bank tapering is a known unknown and the pace of tapering will be a risk for equity markets. A hawkish move to accelerate removal of supportive monetary policy is potentially a risk for economic growth. Geopolitics may add to volatility over the northern hemisphere winter with energy markets remaining fragile.

However, supply chain disruptions showing signs of easing provides an emerging tailwind for equity market returns. Re-opening in New Zealand, global shipping getting ‘less worse’ and technology production catching back up takes some pressure away from earnings forecasts and may allow central banks to tighten monetary policy settings at a pace that does not destabilise growth. The re-opening of economies reduces shipping friction and costs, and producer price inflation levelling out, as supply catches up with demand, may allow profit margins to expand more than the market expects.

Within equity growth portfolios we remain focused on structural trends including demographics, digitisation and decarbonisation. We are maintaining a diversified ‘barbell’ (bias to certain sectors) approach to portfolio construction with defensive healthcare, given positive upside from demographics and technology, and some inflation protection at one end, and an overweight to cyclical materials and financials with pricing power, favouring stocks that benefit from structural trends like materials stocks and Macquarie Bank at the other end of the ‘barbell’.

Within fixed interest portfolios, we hold the view that the market pricing the OCR to reach 3% was excessive at this stage. While we think that inflation pressures will persist, there are also risks at play, which could easily cause the RBNZ to pause their hiking cycle over the next 12-18 months. With the market now pricing in a less aggressive path of rate hikes, we have reduced our positioning on this view. Globally, we expect that inflation will prove to be more persistent than central banks assumed, leading to reduction of policy support earlier than expected, pushing long-term bond yields higher. Whilst yields fell in November due to Omicron concerns and weak equity markets, we are expecting core inflation to continue to be robust. We expect the more persistent aspects to be driven by rents and pressure in labour markets and are likely to continue to position for rising long term bond yields.

Within the Active Growth Fund, we balance the exposure to structural trends achieved through our Harbour equity growth strategies with exposure to quality defensives such as real estate and listed infrastructure. While economic expansion remains positive, we expect equities to deliver better returns than bonds, and the increased volatility reinforces the need to be active and aware of valuations. The Active Growth Fund has an overweight position to equity markets overall. The portfolio is tilted towards quality growth stocks which we believe can grow earnings faster than inflation.

Within the Income Fund, our strategy reflects the themes of ongoing inflation risks and the reduction of liquidity we expect to see in the financial system as central banks move steadily towards tighter monetary policy. This has led us to be cautious about longer-dated fixed interest securities and highly geared borrowers. We are slightly underweight equities, having shifted away from global equities towards New Zealand, where tighter monetary policy is already factored in. Recognition that firms with pricing power can sustain earnings suggests that a more defensive equity position is not warranted.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

Leave A Comment