Why the passive-active choice is not either-or

Article written by InvestNow – 3rd May 2022

Passive is the new black.

The index-based style has now taken hold in almost all market sectors, wowing investors with its low-cost look and promise of long-term competitive performance relative to its active peers.

Yet despite its apparent universal stage-appeal, passive investment is hardly a one-strategy-fits-all model; and active management has not gone out of fashion, regardless of what some critics say.

The index trend has undoubtedly gathered much momentum since the global financial crisis (GFC) as investors turned away from high-fee active managers in favour of cheap-and-cheerful passive products, many packaged in the modern must-have exchange-traded fund (ETF) design.

According to Financial Times journalist, Robin Wigglesworth, passive funds now own about half of the US share market.

Wigglesworth, who penned a popular book on the index-investing phenomenon titled ‘Trillions’, told US news outlet CNBC last year that: “I’ve tallied up the international and the U.S. and the global numbers on index funds and ETFs, and broadly speaking, there’s around [US$]17 trillion in index funds, formal index funds.”

Including institutional in-house managed portfolios, he estimates “that there’s probably around [US]$26 trillion in passive strategies, so that’s globally and in both stocks and bonds and a few other asset classes”.

Aside from the price, the success of indexing has been built on the premise that most active managers will underperform their benchmarks after fees over the long term.

And studies from the likes of research house, Morningstar, appear to back that claim.

For example, the Morningstar Active/Passive Barometer published this February found “that the likelihood and performance penalty for picking an underperforming manager tends to be greater than the probability and reward for finding a winner” in the actively managed US equities fund market.

However, the report says the active-passive trade-off “varies widely across categories” with actively managed fixed income and non US share funds showing more positive long-term returns compared to benchmarks.

The Morningstar data also shows active investors have generally weighted more money to better-performing funds.

“Over the past 10 years, the average dollar invested in active funds outperformed the average active fund in 17 of the 20 categories examined; this implies that investors have favored cheaper, higher quality funds,” the report says.

But the US-centric nature of the Morningstar study, and many other academic reviews of active-passive performance, tends to gloss over important factors that are specific to the NZ market.

Local knowledge matters

Investors here need to consider the active/passive argument in light of the actual funds available to local investors on platforms like InvestNow, as well as the NZ market structure and tax rules.

The Morningstar NZ database, for example, now includes about 800 products but about half of all money is invested in just 30 funds.

Given the huge weight of money in a limited number of funds, total active management return figures give limited insight into the actual experience of NZ investors.

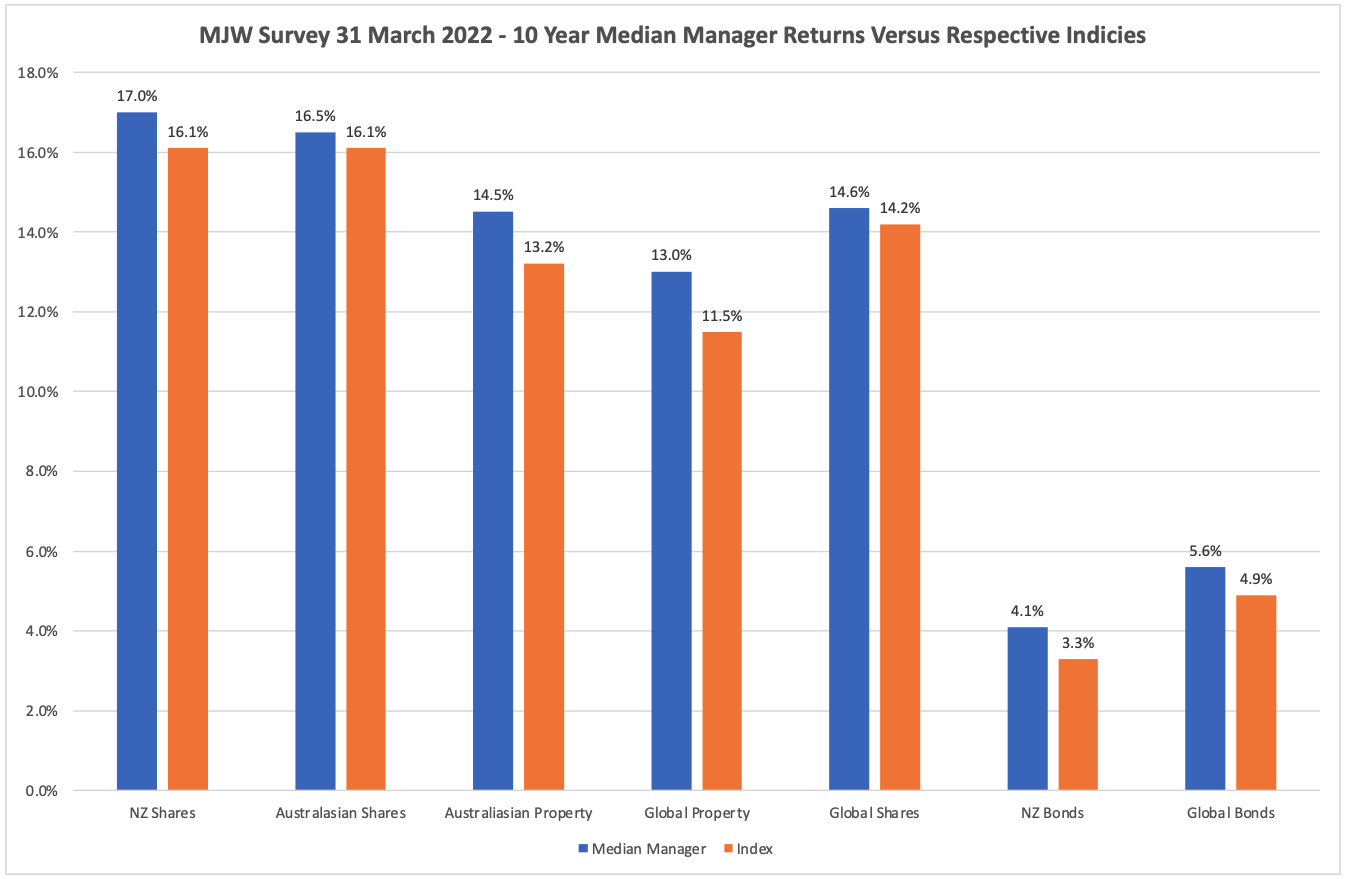

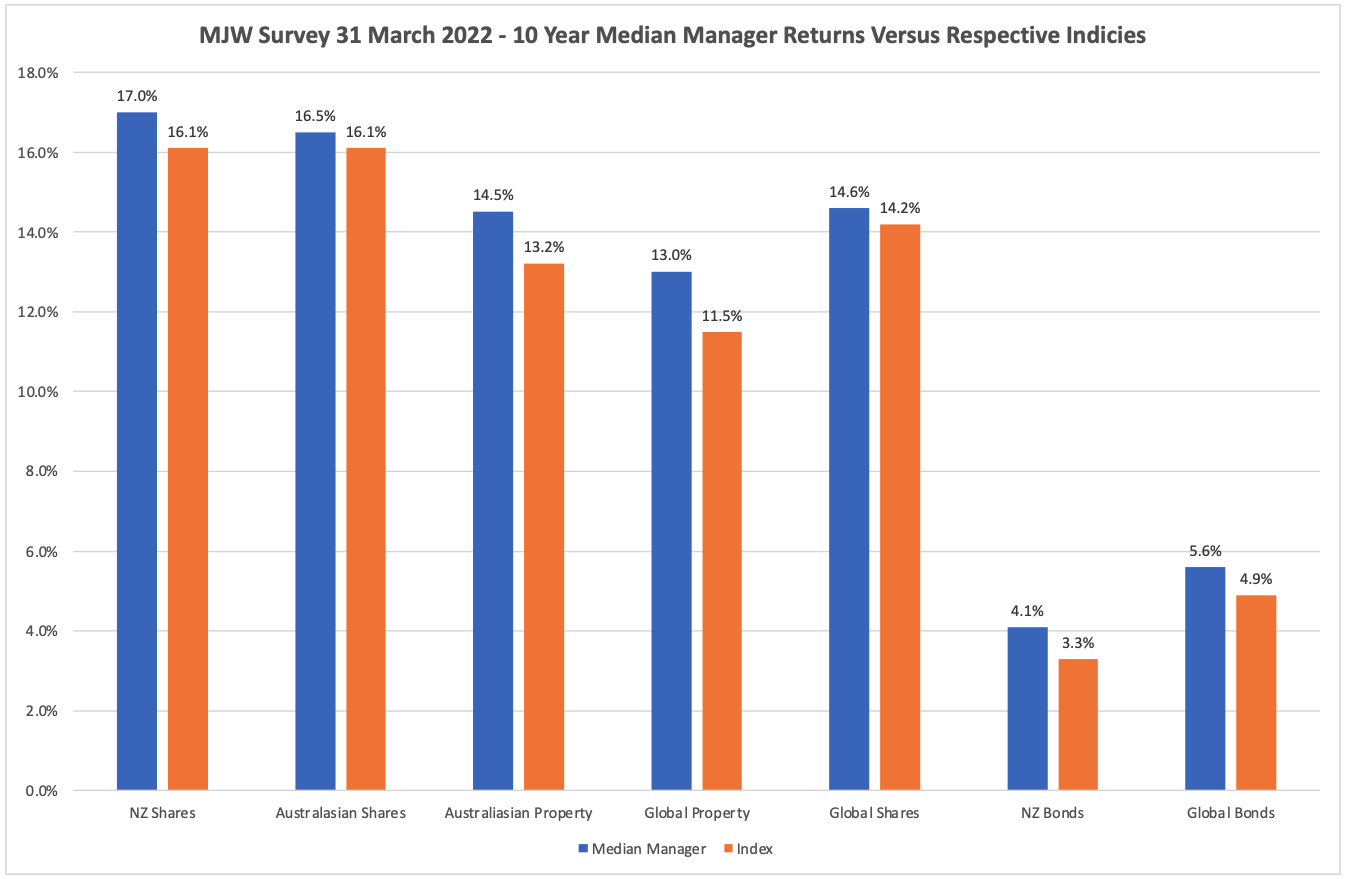

The long-running quarterly investment survey published by Auckland asset consultancy, Melville Jessup Weaver (MJW), provides a more realistic picture of long-term active returns.

According to the latest MJW study, the average NZ active share manager returned an annual 15.5% over the 10 years to the end of March this year before fees – compared to 14.4% for the relevant NZX50 benchmark.

Compounded annual returns of 1% above the index year-on-year for a decade or more suggest NZ active share managers are doing something right.

The New Zealand share market itself also has some peculiar characteristics that might actually play into the hands of active managers. For example, a few years ago the New Zealand Herald found professional fund managers represented just 15% of the local share market: the predominantly retail investors (a trend enhanced in recent years) and large, often index-based, offshore-based funds are not incentivised to outperform market benchmarks.

Similarly, Kiwi investors have a limited palette of managed fund options when investing offshore. While InvestNow offers a growing range of individual international funds structured for local investors, the most common way New Zealanders access actively managed global shares and fixed interest tends to be via multi-manager solutions.

Good multi-manager funds focus on selecting quality underlying global investment specialists without aiming for the ‘average’.

As the chart below shows, according to the MJW Survey the average active manager in NZ has outperformed their respective indices before fees and tax in every category during the 10 years to the end of March this year.

In the KiwiSaver universe, too, actively managed schemes have been among the best long-term performers in most categories.

The top three KiwiSaver growth funds over the last 10 years captured in the MJW survey – Milford, ANZ and Kiwi Wealth – all follow an active management philosophy.

Catching a tax break

Active investors also have a bit of a leg-up in NZ due to local legal quirks that allow deductibility of fees and essentially tax-free capital gains. Investors in both Australasian and global share funds – albeit under different rules – stand to gain a tax-efficient boost from any active manager outperformance.

For example, capital gains are tax-free within a New Zealand shares portfolio investment entity (PIE). Manager outperformance, then, simply increases the tax-free component of the return – the capital gain.

Equally, under the Fair Dividend Rate (FDR) regime for offshore equities, any additional return above 5% that a global shares manager ekes out is a tax-free bonus because the tax is a constant regardless of the return.

Furthermore, investment management fees are tax-deductible, creating meaningful return uplift, especially for those on the higher prescribed investor rate (PIR) of 28%. In practical terms, this means that where an investor on the top PIR rate of 28% receives 1% of outperformance, while paying 1% in management fees, is actually 0.28% better off on a net of tax basis. This reflects the tax deduction the investor gets on their management fees, whereas the added value is tax free.

Clearly, active investing retains many attractive features for NZ investors. In fact, until relatively recently it was difficult for local investors to access well-structured passive products – particularly for offshore assets. InvestNow has even helped improve the passive fund range in NZ with tax-efficient index strategies in the Foundation Series products, which complement the other active and passive funds we offer.

Kiwis are certainly catching on to the global passive investment trend: many of the most popular funds on InvestNow, for instance, are index-trackers.

But both active and passive management may have a place in Kiwi portfolios; the decision should not be a black-and-white issue.

Why the passive-active choice is not either-or

Article written by InvestNow – 3rd May 2022

Passive is the new black.

The index-based style has now taken hold in almost all market sectors, wowing investors with its low-cost look and promise of long-term competitive performance relative to its active peers.

Yet despite its apparent universal stage-appeal, passive investment is hardly a one-strategy-fits-all model; and active management has not gone out of fashion, regardless of what some critics say.

The index trend has undoubtedly gathered much momentum since the global financial crisis (GFC) as investors turned away from high-fee active managers in favour of cheap-and-cheerful passive products, many packaged in the modern must-have exchange-traded fund (ETF) design.

According to Financial Times journalist, Robin Wigglesworth, passive funds now own about half of the US share market.

Wigglesworth, who penned a popular book on the index-investing phenomenon titled ‘Trillions’, told US news outlet CNBC last year that: “I’ve tallied up the international and the U.S. and the global numbers on index funds and ETFs, and broadly speaking, there’s around [US$]17 trillion in index funds, formal index funds.”

Including institutional in-house managed portfolios, he estimates “that there’s probably around [US]$26 trillion in passive strategies, so that’s globally and in both stocks and bonds and a few other asset classes”.

Aside from the price, the success of indexing has been built on the premise that most active managers will underperform their benchmarks after fees over the long term.

And studies from the likes of research house, Morningstar, appear to back that claim.

For example, the Morningstar Active/Passive Barometer published this February found “that the likelihood and performance penalty for picking an underperforming manager tends to be greater than the probability and reward for finding a winner” in the actively managed US equities fund market.

However, the report says the active-passive trade-off “varies widely across categories” with actively managed fixed income and non US share funds showing more positive long-term returns compared to benchmarks.

The Morningstar data also shows active investors have generally weighted more money to better-performing funds.

“Over the past 10 years, the average dollar invested in active funds outperformed the average active fund in 17 of the 20 categories examined; this implies that investors have favored cheaper, higher quality funds,” the report says.

But the US-centric nature of the Morningstar study, and many other academic reviews of active-passive performance, tends to gloss over important factors that are specific to the NZ market.

Local knowledge matters

Investors here need to consider the active/passive argument in light of the actual funds available to local investors on platforms like InvestNow, as well as the NZ market structure and tax rules.

The Morningstar NZ database, for example, now includes about 800 products but about half of all money is invested in just 30 funds.

Given the huge weight of money in a limited number of funds, total active management return figures give limited insight into the actual experience of NZ investors.

The long-running quarterly investment survey published by Auckland asset consultancy, Melville Jessup Weaver (MJW), provides a more realistic picture of long-term active returns.

According to the latest MJW study, the average NZ active share manager returned an annual 15.5% over the 10 years to the end of March this year before fees – compared to 14.4% for the relevant NZX50 benchmark.

Compounded annual returns of 1% above the index year-on-year for a decade or more suggest NZ active share managers are doing something right.

The New Zealand share market itself also has some peculiar characteristics that might actually play into the hands of active managers. For example, a few years ago the New Zealand Herald found professional fund managers represented just 15% of the local share market: the predominantly retail investors (a trend enhanced in recent years) and large, often index-based, offshore-based funds are not incentivised to outperform market benchmarks.

Similarly, Kiwi investors have a limited palette of managed fund options when investing offshore. While InvestNow offers a growing range of individual international funds structured for local investors, the most common way New Zealanders access actively managed global shares and fixed interest tends to be via multi-manager solutions.

Good multi-manager funds focus on selecting quality underlying global investment specialists without aiming for the ‘average’.

As the chart below shows, according to the MJW Survey the average active manager in NZ has outperformed their respective indices before fees and tax in every category during the 10 years to the end of March this year.

In the KiwiSaver universe, too, actively managed schemes have been among the best long-term performers in most categories.

The top three KiwiSaver growth funds over the last 10 years captured in the MJW survey – Milford, ANZ and Kiwi Wealth – all follow an active management philosophy.

Catching a tax break

Active investors also have a bit of a leg-up in NZ due to local legal quirks that allow deductibility of fees and essentially tax-free capital gains. Investors in both Australasian and global share funds – albeit under different rules – stand to gain a tax-efficient boost from any active manager outperformance.

For example, capital gains are tax-free within a New Zealand shares portfolio investment entity (PIE). Manager outperformance, then, simply increases the tax-free component of the return – the capital gain.

Equally, under the Fair Dividend Rate (FDR) regime for offshore equities, any additional return above 5% that a global shares manager ekes out is a tax-free bonus because the tax is a constant regardless of the return.

Furthermore, investment management fees are tax-deductible, creating meaningful return uplift, especially for those on the higher prescribed investor rate (PIR) of 28%. In practical terms, this means that where an investor on the top PIR rate of 28% receives 1% of outperformance, while paying 1% in management fees, is actually 0.28% better off on a net of tax basis. This reflects the tax deduction the investor gets on their management fees, whereas the added value is tax free.

Clearly, active investing retains many attractive features for NZ investors. In fact, until relatively recently it was difficult for local investors to access well-structured passive products – particularly for offshore assets. InvestNow has even helped improve the passive fund range in NZ with tax-efficient index strategies in the Foundation Series products, which complement the other active and passive funds we offer.

Kiwis are certainly catching on to the global passive investment trend: many of the most popular funds on InvestNow, for instance, are index-trackers.

But both active and passive management may have a place in Kiwi portfolios; the decision should not be a black-and-white issue.

Leave A Comment