InvestNow Market Wrap-Up: November 2024

Introducing Dave Tyrer, COO at Squirrel, this month’s guest author of the InvestNow Market Wrap-Up.

According to the Oxford Dictionary, “brain rot” is the official 2024 word of the year—but if you ask me, I think it might just be “volatility”.

Most markets and asset classes have seen larger-than-usual movements (both positive and negative) in November—with the US elections certainly being a major disruptive force.

Here’s what’s been happening.

Cash

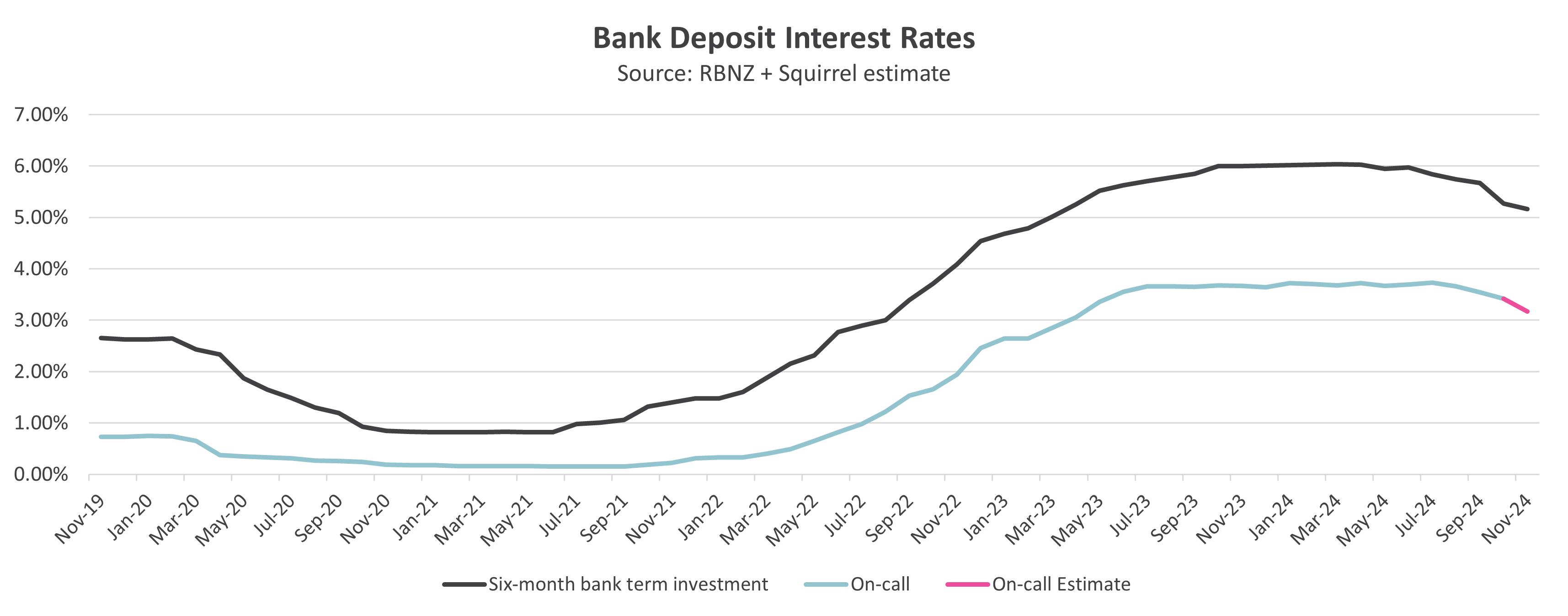

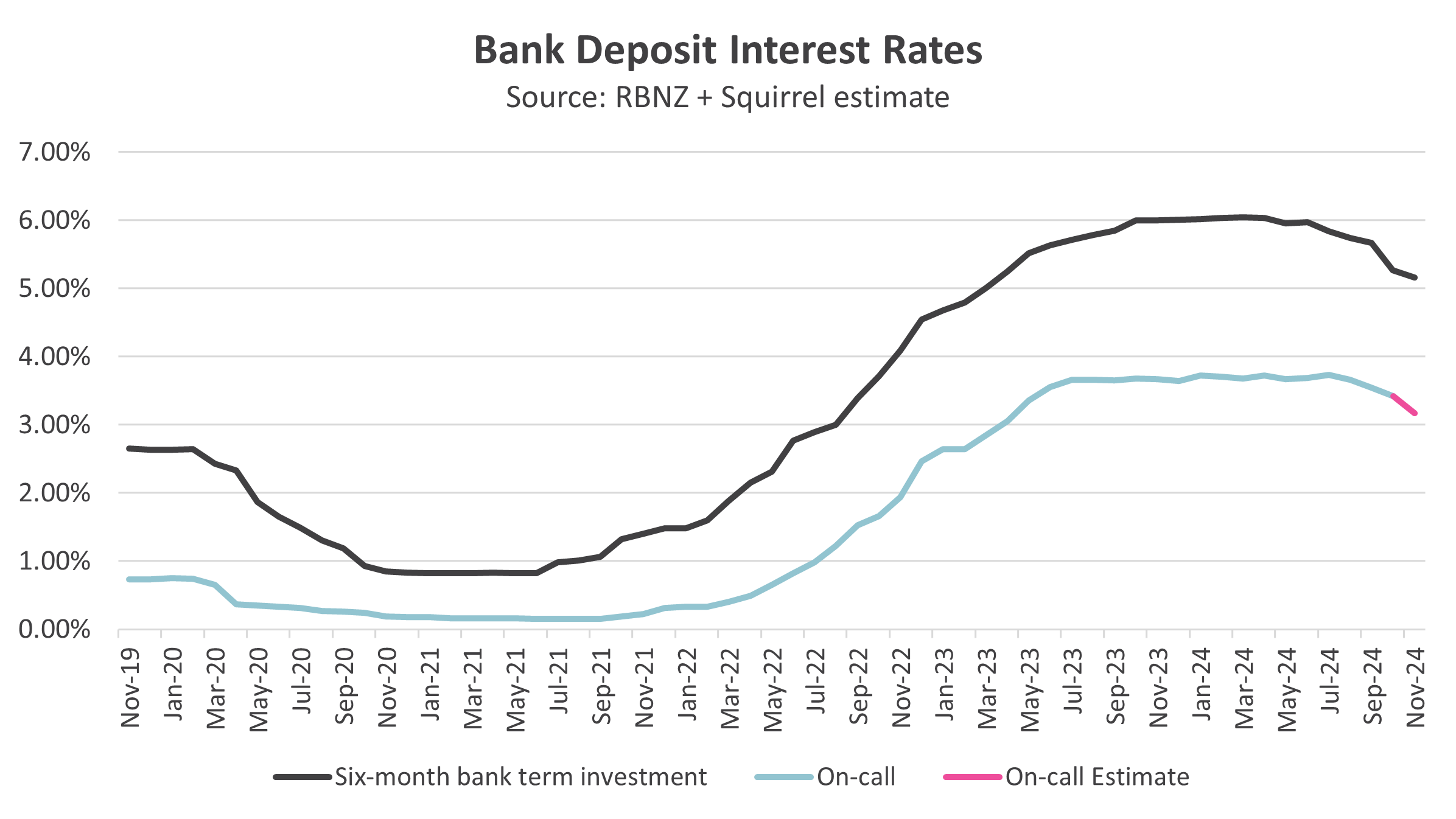

NZ’s Official Cash Rate dropped 0.50% on 27 November, from 4.75% to 4.25%.

The Reserve Bank’s accompanying commentary suggests we’re in for another 0.50% reduction in February, before easing back to 0.25% cuts over the remainder of 2025.

Banks have responded to the news by dropping Term Investment and On-Call/Savings rates across the board. Longer-term rates for most banks are now below 5.00%—which, historically, has been a tipping point for investors, prompting them to look for alternative options.

A major development over the last couple of years has been the emergence of several fintech providers offering on-call and savings accounts, with funds (usually) held with a bank(s) in the background. The majority of fintechs are paying around 4.00% p.a. post the November OCR cut, compared to the average bank rate which has slipped to around 3.00% p.a. Squirrel’s offering is set at 4.00% p.a.

Locally ‘enhanced cash’ funds are offering good value, with returns over 5.00% p.a. for a small increase in risk and volatility.

Fixed interest

In New Zealand, both the Government and Corporates were active with new bond issuance over November.

Approximately $2b of new Government bonds were issued, and we also saw Kiwibank come to market with a new five-year issue towards the end of the month.

Fixed interest managed funds have had a tailwind of falling interest rates over the back half of the year, although that appears to be slowing, with medium to longer-term interest rates stabilising (although continuing to be volatile).

Reductions in shorter-term interest rates supported Fixed Interest managed fund performance in the month. Squirrel’s Monthly Income Fund delivered an annualised return of 7.20% for November, and its three-year track record stands at 6.87% p.a.

US interest rates have been on a rollercoaster this year. As prediction markets started to favour a Trump win, US Treasuries began to rise, peaking in mid-November at 4.45% before falling back to 4.18% by month-end. It’s worth noting that the 10yr US treasury bonds were yielding 3.62% as at mid-September 2024.

Chinese Government Bond interest rates have continued to fall and had moved to be at their weakest in recorded history in early December. This has been driven by the market betting the Chinese Government stimulus will not be enough to stave off a slowing economy.

Property investment

As New Zealand’s largest independent mortgage broker, Squirrel has a good feel for what’s happening in the residential property market.

Relative to the last 18 months, there’s been a noticeable uptick in investor buying activity of late—particularly in the last quarter—and we’re also seeing a number of investors look to rebalance their portfolio.

Property prices are still flat, although vendors are now finding it easier to attract buyers than it has been over the last 18 months.

Commercial property has seen some improvement over recent months in the New Zealand market after performing poorly in the 12months prior. Offshore, there is wide variance across countries and market segments. Office space has been in the doldrums for some time and no real recovery in site.

Equities

In November 2024, the New Zealand Stock Exchange (NZX) demonstrated robust performance, with the S&P/NZX 50 index gaining 3.32% for the month and is up over 11% since 30 June this year.

Likewise, the Australian Securities Exchange (ASX) performed well in November 2024. The S&P/ASX 200 Index surged 3.38% in November, marking its second-best monthly performance of the year. On November 28th, the index reached a new all-time high of 8,477.1 points—subsequently surpassed in early December—helping to fuel speculation of an early start to the traditional ‘Santa Rally’.

Results were mixed across the global share markets last month.

The S&P 500 index had an exceptional performance in November 2024, marking its best month of the year. The index gained 5.73% during the month, closing at a record high of 6,032.3856. This strong performance brought the year-to-date return for the S&P 500 to 26.47%

It was a more varied picture in Europe. The UK FTSE 100 rose in November to print a 2.1% gain, benefiting from a weaker pound. Meanwhile, the CAC 40 in France fell 1.56%, reflecting concerns about the government’s ability to pass a fiscally responsible budget. In contrast to many western markets, the CAC 40 is now down YTD.

Asian markets also faced challenges, with the Hang Seng index in Hong Kong falling 4.39% in November, although it remains up 15.7% YTD. This decline was partly attributed to ongoing economic concerns in China and geopolitical tensions. The Japanese Nikkei 225 was broadly flat for November, although is up almost 15% YTD.

Overall, global markets continued to be influenced by factors such as central bank policies, geopolitical events, and sector-specific developments. The technology sector, particularly in the US, remained a key driver of market performance.

Cryptocurrency

It’s been quite the month for Bitcoin and other cryptocurrencies. Based on the support of the incoming Trump administration, the volume of money headed towards various crypto plays surged over the month.

Bitcoin, in particular, experienced remarkable growth—up from USD$69,300 at the start of the month to near USD$100,000 by month-end (before briefly breaking that milestone in early December).

Strong ETF inflows were also noted in November.

Currency markets

The Kiwi dollar weakened further against the USD during November, now sitting just above its 12-month low. With a slight uptick at the end of the month, it finished at just over $0.59 against the USD.

The USD found strong support over the course of the month against major currencies and looks set to continue its run into December.

The other big talking point this month was Russia, where the Ruble fell to near its lowest-ever ever against the USD following the introduction of further US trade sanctions. You know things are wobbly when the Russian President starts saying “there’s nothing to see here”.

The implications for Russia–Ukraine war aren’t yet clear at the time of writing.

If you want to see which Squirrel investments are available on InvestNow, plus read any other opinion or commentary pieces from Dave and the team at Squirrel, please visit their page on our website.

InvestNow Market Wrap-Up: November 2024

Introducing Dave Tyrer, COO at Squirrel, this month’s guest author of the InvestNow Market Wrap-Up.

According to the Oxford Dictionary, “brain rot” is the official 2024 word of the year—but if you ask me, I think it might just be “volatility”.

Most markets and asset classes have seen larger-than-usual movements (both positive and negative) in November—with the US elections certainly being a major disruptive force.

Here’s what’s been happening.

Cash

NZ’s Official Cash Rate dropped 0.50% on 27 November, from 4.75% to 4.25%.

The Reserve Bank’s accompanying commentary suggests we’re in for another 0.50% reduction in February, before easing back to 0.25% cuts over the remainder of 2025.

Banks have responded to the news by dropping Term Investment and On-Call/Savings rates across the board. Longer-term rates for most banks are now below 5.00%—which, historically, has been a tipping point for investors, prompting them to look for alternative options.

A major development over the last couple of years has been the emergence of several fintech providers offering on-call and savings accounts, with funds (usually) held with a bank(s) in the background. The majority of fintechs are paying around 4.00% p.a. post the November OCR cut, compared to the average bank rate which has slipped to around 3.00% p.a. Squirrel’s offering is set at 4.00% p.a.

Locally ‘enhanced cash’ funds are offering good value, with returns over 5.00% p.a. for a small increase in risk and volatility.

Fixed interest

In New Zealand, both the Government and Corporates were active with new bond issuance over November.

Approximately $2b of new Government bonds were issued, and we also saw Kiwibank come to market with a new five-year issue towards the end of the month.

Fixed interest managed funds have had a tailwind of falling interest rates over the back half of the year, although that appears to be slowing, with medium to longer-term interest rates stabilising (although continuing to be volatile).

Reductions in shorter-term interest rates supported Fixed Interest managed fund performance in the month. Squirrel’s Monthly Income Fund delivered an annualised return of 7.20% for November, and its three-year track record stands at 6.87% p.a.

US interest rates have been on a rollercoaster this year. As prediction markets started to favour a Trump win, US Treasuries began to rise, peaking in mid-November at 4.45% before falling back to 4.18% by month-end. It’s worth noting that the 10yr US treasury bonds were yielding 3.62% as at mid-September 2024.

Chinese Government Bond interest rates have continued to fall and had moved to be at their weakest in recorded history in early December. This has been driven by the market betting the Chinese Government stimulus will not be enough to stave off a slowing economy.

Property investment

As New Zealand’s largest independent mortgage broker, Squirrel has a good feel for what’s happening in the residential property market.

Relative to the last 18 months, there’s been a noticeable uptick in investor buying activity of late—particularly in the last quarter—and we’re also seeing a number of investors look to rebalance their portfolio.

Property prices are still flat, although vendors are now finding it easier to attract buyers than it has been over the last 18 months.

Commercial property has seen some improvement over recent months in the New Zealand market after performing poorly in the 12months prior. Offshore, there is wide variance across countries and market segments. Office space has been in the doldrums for some time and no real recovery in site.

Equities

In November 2024, the New Zealand Stock Exchange (NZX) demonstrated robust performance, with the S&P/NZX 50 index gaining 3.32% for the month and is up over 11% since 30 June this year.

Likewise, the Australian Securities Exchange (ASX) performed well in November 2024. The S&P/ASX 200 Index surged 3.38% in November, marking its second-best monthly performance of the year. On November 28th, the index reached a new all-time high of 8,477.1 points—subsequently surpassed in early December—helping to fuel speculation of an early start to the traditional ‘Santa Rally’.

Results were mixed across the global share markets last month.

The S&P 500 index had an exceptional performance in November 2024, marking its best month of the year. The index gained 5.73% during the month, closing at a record high of 6,032.3856. This strong performance brought the year-to-date return for the S&P 500 to 26.47%.

It was a more varied picture in Europe. The UK FTSE 100 rose in November to print a 2.1% gain, benefiting from a weaker pound. Meanwhile, the CAC 40 in France fell 1.56%, reflecting concerns about the government’s ability to pass a fiscally responsible budget. In contrast to many western markets, the CAC 40 is now down YTD.

Asian markets also faced challenges, with the Hang Seng index in Hong Kong falling 4.39% in November, although it remains up 15.7% YTD. This decline was partly attributed to ongoing economic concerns in China and geopolitical tensions. The Japanese Nikkei 225 was broadly flat for November, although is up almost 15% YTD.

Overall, global markets continued to be influenced by factors such as central bank policies, geopolitical events, and sector-specific developments. The technology sector, particularly in the US, remained a key driver of market performance.

Cryptocurrency

It’s been quite the month for Bitcoin and other cryptocurrencies. Based on the support of the incoming Trump administration, the volume of money headed towards various crypto plays surged over the month.

Bitcoin, in particular, experienced remarkable growth—up from USD$69,300 at the start of the month to near USD$100,000 by month-end (before briefly breaking that milestone in early December).

Strong ETF inflows were also noted in November.

Currency markets

The Kiwi dollar weakened further against the USD during November, now sitting just above its 12-month low. With a slight uptick at the end of the month, it finished at just over $0.59 against the USD.

The USD found strong support over the course of the month against major currencies and looks set to continue its run into December.

The other big talking point this month was Russia, where the Ruble fell to near its lowest-ever ever against the USD following the introduction of further US trade sanctions. You know things are wobbly when the Russian President starts saying “there’s nothing to see here”.

The implications for Russia–Ukraine war aren’t yet clear at the time of writing.

If you want to see which Squirrel investments are available on InvestNow, plus read any other opinion or commentary pieces from Dave and the team at Squirrel, please visit their page on our website.