InvestNow Market Wrap-Up: April 2025

Introducing Padraig Brown, Chief Investment Officer at Mercer (N.Z.) Limited (Mercer), this month’s guest author of the InvestNow Market Wrap-Up.

Introduction

The start of 2025 has been marked by considerable economic, geopolitical, and market instability in the United States. A combination of slowing economic indicators, escalating global tensions, and rising policy uncertainty has led to a reversal of the equity strength seen following Trump’s election win. This has resulted in heightened market volatility, declining US Treasury yields, and corrections in the US equity markets.

Markets experienced significant volatility in April following US President Trump’s tariff announcements. Initially, equity markets declined sharply, causing the VIX measure of implied market volatility to spike to its highest level since the pandemic. However, stocks rebounded after Trump announced a 90-day pause on the implementation of reciprocal tariffs and removed tariffs on various electronic products, leading to a slight easing of US-China trade tensions.

Economic overview

Reciprocal tariffs significantly increase the average tariff rate of goods imported into the US

President Trump announced reciprocal tariffs, significantly increasing the average tariff rate of goods imported into the US to over 20%. He introduced a universal 10% tariff on all US imports and a “reciprocal” tariff on approximately 60 nations with large trade imbalances with the US. However, the reciprocal tariffs were delayed for 90 days.

University of Michigan 1-year forward inflation expectations rose to 6.7%, the highest reading since 1981, due to US tariffs on imports. US Federal Reserve (the Fed) Governor, Jerome Powell, hinted that the new tariffs are “significantly larger than expected” and may have a persistent inflation impact. However, US breakeven inflation rates remain steady.

China is assessing the possibility of tariff negotiations with the US. Declining port traffic from China suggests potential supply shortages in the US.

US economic growth contracted by -0.3% quarter-on-quarter, down from growth of 2.4% in the final quarter of 2024. The decline was largely due to a surge in imports, likely from pre-emptive actions against import tariffs. Without this distortion, growth was not as bad as the headline suggested with consumption falling but remaining solid.

Market review

International shares (hedged) were marginally down -0.4% over the month. New Zealand shares were down -3.0% in April, underperforming international shares.

International sovereign bonds increased by 1.0% over the month as bond yields fell due to reduced tariff rhetoric and President Trump’s assurance that there are no plans to remove Jerome Powell as Fed Chair.

The New Zealand dollar (NZD) started the month weaker, dropping to 0.55 against the US dollar (USD), after the announcement of the US reciprocal tariffs. before rallying strongly ending the month at 0.59.

Oil dropped by -15.5% in April as OPEC announced a significant increase in output, coinciding with investors likely preparing for a drop in demand due to weakening global growth.

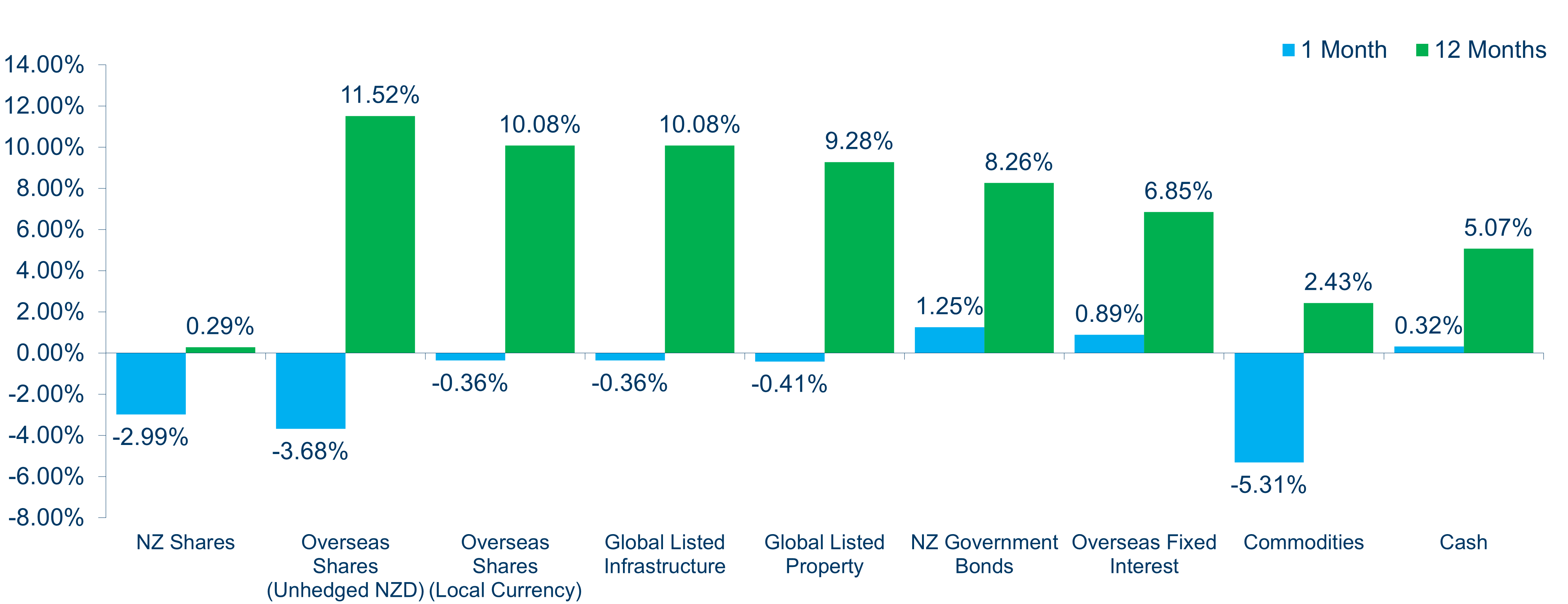

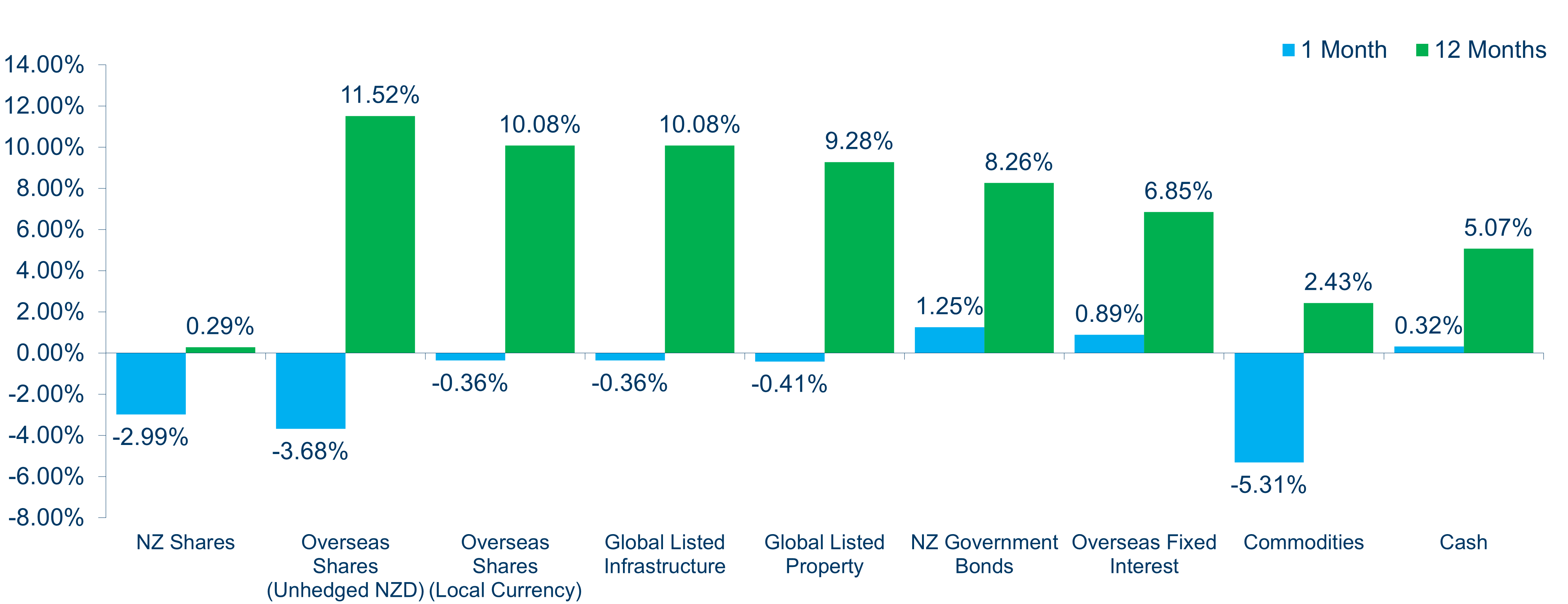

Chart 1: Market returns for periods ending 30 April 2025

Source: Mercer (N.Z.) Limited*

* Chart constituents: NZ Shares – S&P/NZX 50 Index with Imputation Credits; Overseas Shares (unhedged NZD) – MSCI World NZD; Overseas Shares – MSCI World; Global Listed Infrastructure – FTSE Global Core Infrastructure 50/50 Hedged (NZD); Global Listed Property – FTSE EPRA NAREIT Developed Index Hedged (NZD); NZ Government Bonds – S&P/NZX NZ Government Bond Index; Overseas Fixed Interest – Bloomberg Capital Global Aggregate-Hedged (NZD); Commodities – Bloomberg Commodity Index Hedged (NZD); Cash – S&P/NZX Bank Bills 90-Day Index.

Market insights

We believe that the recent tariffs and resulting uncertainty may push the US into a mild recession and cause a moderate slowdown elsewhere. The main impact on the US is likely to be the sudden fiscal tightening due to the sharp rise in import prices.

In Europe, a significant fiscal boost in Germany should support growth in the medium term, though US trade tensions may pose short-term challenges. After a positive start to the year, China’s economy may slow sharply because of tariffs, but the government might try to counteract this with looser fiscal policy.

Central banks around the world are likely to gradually cut interest rates in response to slowing growth. The Fed is expected to prioritise slowing growth rather than rising inflation, resulting in several rate cuts this year. The European Central Bank is likely to continue easing monetary policy in response to sluggish growth and inflation approaching their target. Meanwhile, the Bank of Japan is in a rate-hiking cycle, with further increases expected as inflation remains above target. However, near-term rate hikes may be postponed due to tariff uncertainty and a stronger yen.

We have an unfavourable view on growth assets as tariffs are likely to impact US economic growth in the short term and the impact on corporate earnings is likely underpriced by shares markets as companies are withdrawing forward earning guidance.

Inflation increases but weakening confidence suggests the RBNZ will likely cut interest rates further

New Zealand annual inflation lifted to 2.5% in Q1 2025, up from 2.2% in Q4, which was slightly higher than expected. A large contribution to this increase was from offshore factors (tradeable inflation). We expect the RBNZ to continue interest rate cuts in 2025. We retain our overweight to New Zealand government bonds. The global trade uncertainty and impact to global growth also supports this position.

While unemployment remains steady at 5.1% (Q1 2025), coming in a touch lower than expected but at levels we are likely to wage inflation ease.

We continue to expect growth to remain weak as higher interest rates and cost-of-living pressures are likely to keep consumption suppressed. Geopolitical concerns are likely to make businesses cautious about investing.

International shares

International shares (hedged) ended April marginally lower, down by –0.4%. Early in the month, the US reciprocal tariff announcement caused concern, but news of a 90-day delay in implementation eased investor concerns.

International shares (unhedged) fell more, down by -3.7%. While the New Zealand dollar rose against the US dollar in April, it was mixed against other countries’ currencies.

Both consumer staples and utilities were the strongest performing sectors, up 2% over the month, while energy fell by -12.4% in April on the back of falling energy prices. Global small-cap shares (unhedged) and emerging market shares underperformed the broader indices in April.

Fixed interest

International sovereign bonds were higher, up 1.2% over the month as bond yields fell due to reduced tariff rhetoric and President Trump’s assurance that there are no plans to remove Jerome Powell as Fed Chair.

Falling business confidence in the US suggests the impact of tariffs is beginning to impact confidence. The resulting uncertainty will likely push the US into a mild recession and cause a more moderate slowdown elsewhere. This will likely continue to put downward pressure on bond yields.

New Zealand sovereign bonds were up 1.25% as the New Zealand 10-year bond yields fell 15 bps over the month.

Looking ahead

Looking ahead, the financial landscape appears poised for continued volatility as considerable uncertainty remains around the ultimate form of tariffs imposed by the Trump Administration and the impacts that they will have. While a 90-day pause has been announced on tariffs announced on ‘Liberation Day’, subsequent communications around the level of tariffs, stages of negotiations with other jurisdictions and carve outs that may or may not apply have boosted this uncertainty.

From a monetary policy standpoint, the Fed has maintained its neutral position noting that given the uncertainty in the economic outlook, it believes it is well placed to cut rates if required. With a vocal President Trump publicly announcing his desire for cuts to the Federal Funds Rate and his dissatisfaction with Fed Chair Jerome Powell, markets reacted to the possibility of a new Chair to be appointed to the Fed. The effect has been that to maintain an appearance of political neutrality, the Fed is likely waiting for a clear mandate (in the form of increasing unemployment and/or soft economic data) before announcing cuts.

Highlighting the uncertain market environment, corporate earnings releases have been marked by company executives refraining from providing forward guidance as the business environment over the near term can change with a social media post.

In New Zealand, a second 25 bps cut to the OCR is expected this quarter, bringing the OCR to 3.25% by mid-year. Christian Hawkesby was appointed Governor of RBNZ for a six-month term (following the departure of his predecessor Adrian Orr) while the RBNZ board undertakes a recruitment process to nominate a Governor who will serve for five years.

If you want to see which Mercer investments are available on InvestNow, please visit their page on our website.

InvestNow Market Wrap-Up: April 2025

Introducing Padraig Brown, Chief Investment Officer at Mercer (N.Z.) Limited (Mercer), this month’s guest author of the InvestNow Market Wrap-Up.

Introduction

The start of 2025 has been marked by considerable economic, geopolitical, and market instability in the United States. A combination of slowing economic indicators, escalating global tensions, and rising policy uncertainty has led to a reversal of the equity strength seen following Trump’s election win. This has resulted in heightened market volatility, declining US Treasury yields, and corrections in the US equity markets.

Markets experienced significant volatility in April following US President Trump’s tariff announcements. Initially, equity markets declined sharply, causing the VIX measure of implied market volatility to spike to its highest level since the pandemic. However, stocks rebounded after Trump announced a 90-day pause on the implementation of reciprocal tariffs and removed tariffs on various electronic products, leading to a slight easing of US-China trade tensions.

Economic overview

Reciprocal tariffs significantly increase the average tariff rate of goods imported into the US

President Trump announced reciprocal tariffs, significantly increasing the average tariff rate of goods imported into the US to over 20%. He introduced a universal 10% tariff on all US imports and a “reciprocal” tariff on approximately 60 nations with large trade imbalances with the US. However, the reciprocal tariffs were delayed for 90 days.

University of Michigan 1-year forward inflation expectations rose to 6.7%, the highest reading since 1981, due to US tariffs on imports. US Federal Reserve (the Fed) Governor, Jerome Powell, hinted that the new tariffs are “significantly larger than expected” and may have a persistent inflation impact. However, US breakeven inflation rates remain steady.

China is assessing the possibility of tariff negotiations with the US. Declining port traffic from China suggests potential supply shortages in the US.

US economic growth contracted by -0.3% quarter-on-quarter, down from growth of 2.4% in the final quarter of 2024. The decline was largely due to a surge in imports, likely from pre-emptive actions against import tariffs. Without this distortion, growth was not as bad as the headline suggested with consumption falling but remaining solid.

Market review

International shares (hedged) were marginally down -0.4% over the month. New Zealand shares were down -3.0% in April, underperforming international shares.

International sovereign bonds increased by 1.0% over the month as bond yields fell due to reduced tariff rhetoric and President Trump’s assurance that there are no plans to remove Jerome Powell as Fed Chair.

The New Zealand dollar (NZD) started the month weaker, dropping to 0.55 against the US dollar (USD), after the announcement of the US reciprocal tariffs. before rallying strongly ending the month at 0.59.

Oil dropped by -15.5% in April as OPEC announced a significant increase in output, coinciding with investors likely preparing for a drop in demand due to weakening global growth.

Chart 1: Market returns for periods ending 30 April 2025

Source: Mercer (N.Z.) Limited*

* Chart constituents: NZ Shares – S&P/NZX 50 Index with Imputation Credits; Overseas Shares (unhedged NZD) – MSCI World NZD; Overseas Shares – MSCI World; Global Listed Infrastructure – FTSE Global Core Infrastructure 50/50 Hedged (NZD); Global Listed Property – FTSE EPRA NAREIT Developed Index Hedged (NZD); NZ Government Bonds – S&P/NZX NZ Government Bond Index; Overseas Fixed Interest – Bloomberg Capital Global Aggregate-Hedged (NZD); Commodities – Bloomberg Commodity Index Hedged (NZD); Cash – S&P/NZX Bank Bills 90-Day Index.

Market insights

We believe that the recent tariffs and resulting uncertainty may push the US into a mild recession and cause a moderate slowdown elsewhere. The main impact on the US is likely to be the sudden fiscal tightening due to the sharp rise in import prices.

In Europe, a significant fiscal boost in Germany should support growth in the medium term, though US trade tensions may pose short-term challenges. After a positive start to the year, China’s economy may slow sharply because of tariffs, but the government might try to counteract this with looser fiscal policy.

Central banks around the world are likely to gradually cut interest rates in response to slowing growth. The Fed is expected to prioritise slowing growth rather than rising inflation, resulting in several rate cuts this year. The European Central Bank is likely to continue easing monetary policy in response to sluggish growth and inflation approaching their target. Meanwhile, the Bank of Japan is in a rate-hiking cycle, with further increases expected as inflation remains above target. However, near-term rate hikes may be postponed due to tariff uncertainty and a stronger yen.

We have an unfavourable view on growth assets as tariffs are likely to impact US economic growth in the short term and the impact on corporate earnings is likely underpriced by shares markets as companies are withdrawing forward earning guidance.

Inflation increases but weakening confidence suggests the RBNZ will likely cut interest rates further

New Zealand annual inflation lifted to 2.5% in Q1 2025, up from 2.2% in Q4, which was slightly higher than expected. A large contribution to this increase was from offshore factors (tradeable inflation). We expect the RBNZ to continue interest rate cuts in 2025. We retain our overweight to New Zealand government bonds. The global trade uncertainty and impact to global growth also supports this position.

While unemployment remains steady at 5.1% (Q1 2025), coming in a touch lower than expected but at levels we are likely to wage inflation ease.

We continue to expect growth to remain weak as higher interest rates and cost-of-living pressures are likely to keep consumption suppressed. Geopolitical concerns are likely to make businesses cautious about investing.

International shares

International shares (hedged) ended April marginally lower, down by –0.4%. Early in the month, the US reciprocal tariff announcement caused concern, but news of a 90-day delay in implementation eased investor concerns.

International shares (unhedged) fell more, down by -3.7%. While the New Zealand dollar rose against the US dollar in April, it was mixed against other countries’ currencies.

Both consumer staples and utilities were the strongest performing sectors, up 2% over the month, while energy fell by -12.4% in April on the back of falling energy prices. Global small-cap shares (unhedged) and emerging market shares underperformed the broader indices in April.

Fixed interest

International sovereign bonds were higher, up 1.2% over the month as bond yields fell due to reduced tariff rhetoric and President Trump’s assurance that there are no plans to remove Jerome Powell as Fed Chair.

Falling business confidence in the US suggests the impact of tariffs is beginning to impact confidence. The resulting uncertainty will likely push the US into a mild recession and cause a more moderate slowdown elsewhere. This will likely continue to put downward pressure on bond yields.

New Zealand sovereign bonds were up 1.25% as the New Zealand 10-year bond yields fell 15 bps over the month.

Looking ahead

Looking ahead, the financial landscape appears poised for continued volatility as considerable uncertainty remains around the ultimate form of tariffs imposed by the Trump Administration and the impacts that they will have. While a 90-day pause has been announced on tariffs announced on ‘Liberation Day’, subsequent communications around the level of tariffs, stages of negotiations with other jurisdictions and carve outs that may or may not apply have boosted this uncertainty.

From a monetary policy standpoint, the Fed has maintained its neutral position noting that given the uncertainty in the economic outlook, it believes it is well placed to cut rates if required. With a vocal President Trump publicly announcing his desire for cuts to the Federal Funds Rate and his dissatisfaction with Fed Chair Jerome Powell, markets reacted to the possibility of a new Chair to be appointed to the Fed. The effect has been that to maintain an appearance of political neutrality, the Fed is likely waiting for a clear mandate (in the form of increasing unemployment and/or soft economic data) before announcing cuts.

Highlighting the uncertain market environment, corporate earnings releases have been marked by company executives refraining from providing forward guidance as the business environment over the near term can change with a social media post.

In New Zealand, a second 25 bps cut to the OCR is expected this quarter, bringing the OCR to 3.25% by mid-year. Christian Hawkesby was appointed Governor of RBNZ for a six-month term (following the departure of his predecessor Adrian Orr) while the RBNZ board undertakes a recruitment process to nominate a Governor who will serve for five years.

If you want to see which Mercer investments are available on InvestNow, please visit their page on our website.

Disclaimer: The information contained in this article is intended for general guidance only and does not take account of the investment objectives, financial situation and/or particular needs of any person. Before making any investment decision, you should take financial advice as to whether your intended action is appropriate in light of your particular investment needs, objectives and financial circumstances. Past performance is no guarantee or indicator of future performance.

Copyright 2025 Mercer (N.Z.) Limited. All rights reserved.

Leave A Comment