InvestNow News – 11th December – Franklin Templeton – A RELIABLE FRAMEWORK HELPS MANAGE RISK

Article written by Andrew Bogle & Kevin O’Neil, Franklin Templeton – 9th November 2020

Brandywine Global: Our view on risk management within our multi-sector and credit-oriented strategies.

The term “risk management” is universally espoused in the investment community but not necessarily universally implemented. At Brandywine Global, the ultimate purpose of risk management is to minimize the permanent loss of client capital. Furthermore, risk management is especially important when managing across multiple sectors that contain numerous factors driving performance. But how, exactly, do we aim to accomplish that within our multi-sector and credit-oriented strategies? There are many approaches to risk management, varying in method, complexity, and output. However, all share the common goal of making the portfolio manager keenly aware of the potential sources of future volatility. Whether it be a value-at-risk analysis, a Monte Carlo simulation, or a key rate duration report, each of these elements has an important role in the investment process.

UNDERSTANDING THE LIMITATIONS OF RISK MANAGEMENT

With all this information available, what is a portfolio manager to do? We think the first step is to acknowledge and accept some of the weaknesses inherent in the majority of risk management tools. Most traditional methods use historical observances to forecast future outcomes. While this approach is sound in theory, a simple review of 2020 would suggest expecting the unexpected because “unprecedented times” may be only a pandemic away. Relationships break down due to secular shifts, and securities that once offered a counterbalance may now trade in the same trajectory. In a similar vein, we think it is important to know what is not captured as an input to some of these tools. How does a risk management system model a $7T Federal Reserve balance sheet? What about record federal deficits and seemingly bottomless monetary support? Ultimately, the data out is only as good as the data in, and if the tools being used to inform investment decisions are incomplete, the investment manager must account for and adapt to these known flaws.

RESPONDING PREDICTABLY TO FUTURE UNKNOWNS

Our viewpoint has always been that pure output from risk management analysis is much less important than its interpretation. We think one of the most critical steps to managing risks lies in constructing a process around managing the unknowns, that is assigning probabilities to forecasted outcomes, acknowledging incomplete information, and building a comprehensive framework of what future events may do to asset prices. This framework is at the foundation of sizing positions, assessing conviction levels, and providing true diversification across the portfolio. The process was recently put to the test surrounding the recent U.S. election. Understanding assets would perform differently under the multitude of political outcomes, portfolios were positioned accordingly based on the firm’s assessment of probabilities.

Ultimately, our goal is to use all tools at our disposal to make ourselves as informed as possible to arrive at educated probabilities of future outcomes. This process is questioned, challenged, and refined on a daily basis given adapting viewpoints from all members of the investment team. The result is a portfolio in which we feel confident to respond with predictability as future unknowns reveal themselves.

DIFFERENTIATING VOLATILITY FROM OUTCOMES

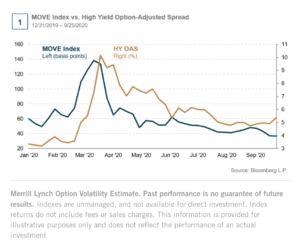

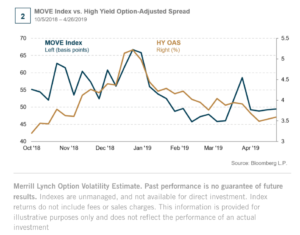

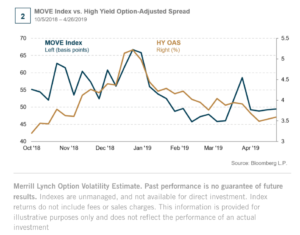

Lastly, risk management is only as good as the outcome. Managing ex-post or realized volatility is more important at Brandywine Global than managing to forecasted or ex-ante risk. In fact, in many cases, our view has been that ex-ante risk increases usually correlate to a possible opportunity rather than signaling an inherent problem. As evidenced in the two charts below, the most recent spikes in implied volatility measured by the MOVE Index were subsequently followed by significant spread compression in high yield corporate bonds.

In the end, it is not the complexity of the tools themselves or the sophistication of the risk management framework that ultimately matters. Realized drawdowns and Sharpe ratios are what define the effectiveness of risk management for an investment manager.

DEFINITIONS

Value at risk (VaR) is a statistic that measures and quantifies the level of financial risk within a firm, portfolio or position over a specific time frame. This metric is most commonly used by investment and commercial banks to determine the extent and occurrence ratio of potential losses in their institutional portfolios.

A Monte Carlo simulation is a problem solving technique used to approximate the probability of certain outcomes by running multiple trial runs using computational algorithms that rely on repeated random sampling to obtain numerical results; typically one runs simulations many times over in order to obtain the distribution of an unknown probabilistic entity.

Duration measures the sensitivity of price (the value of principal) of a fixed-income investment to a change in interest rates. The higher the duration number, the more sensitive a fixed-income investment will be to interest rate changes.

A global pandemic is the worldwide spread of a new disease. The World Health Organization declared COVID-19 to be a pandemic when it became clear that the illness was severe and that it was spreading quickly over a wide area.

The Federal Reserve Board (“Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments.

The Merrill Lynch Option Volatility Estimate (MOVE) Index is a yield-curve-weighted index of the normalized implied volatility on 1-month Treasury options for the 2, 5, 10, and 30 year maturities.

High yield (HY) bonds, also called junk bonds, are bonds with below investment-grade ratings (BB, B, CCC for example) and are considered low credit quality and have a higher risk of default.

An Option-Adjusted Spread (OAS) is a measure of risk that shows credit spreads with adjustments made to neutralize the impact of embedded options. A credit spread is the difference in yield between two different types of fixed income securities with similar maturities.

A drawdown is a peak-to-trough decline during a specific period for an investment, trading account, or fund.

Sharpe ratio is a risk-adjusted measure of investment return. The higher the Sharpe ratio, the better the fund’s historical risk-adjusted performance.

WHAT ARE THE RISKS?

Past performance is no guarantee of future results. Please note that an investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.

Equity securities are subject to price fluctuation and possible loss of principal. Fixed-income securities involve interest rate, credit, inflation and reinvestment risks; and possible loss of principal. As interest rates rise, the value of fixed income securities falls. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Commodities and currencies contain heightened risk that include market, political, regulatory, and natural conditions and may not be suitable for all investors.

U.S. Treasuries are direct debt obligations issued and backed by the “full faith and credit” of the U.S. government. The U.S. government guarantees the principal and interest payments on U.S. Treasuries when the securities are held to maturity. Unlike U.S. Treasuries, debt securities issued by the federal agencies and instrumentalities and related investments may or may not be backed by the full faith and credit of the U.S. government. Even when the U.S. government guarantees principal and interest payments on securities, this guarantee does not apply to losses resulting from declines in the market value of these securities.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

You need Adobe Acrobat Reader to view and print PDF documents. Download a free version from Adobe’s website.

Franklin Templeton Distributors, Inc.

InvestNow News – 11th December – Franklin Templeton – A RELIABLE FRAMEWORK HELPS MANAGE RISK

Article written by Andrew Bogle & Kevin O’Neil, Franklin Templeton – 9th November 2020

Brandywine Global: Our view on risk management within our multi-sector and credit-oriented strategies.

The term “risk management” is universally espoused in the investment community but not necessarily universally implemented. At Brandywine Global, the ultimate purpose of risk management is to minimize the permanent loss of client capital. Furthermore, risk management is especially important when managing across multiple sectors that contain numerous factors driving performance. But how, exactly, do we aim to accomplish that within our multi-sector and credit-oriented strategies? There are many approaches to risk management, varying in method, complexity, and output. However, all share the common goal of making the portfolio manager keenly aware of the potential sources of future volatility. Whether it be a value-at-risk analysis, a Monte Carlo simulation, or a key rate duration report, each of these elements has an important role in the investment process.

UNDERSTANDING THE LIMITATIONS OF RISK MANAGEMENT

With all this information available, what is a portfolio manager to do? We think the first step is to acknowledge and accept some of the weaknesses inherent in the majority of risk management tools. Most traditional methods use historical observances to forecast future outcomes. While this approach is sound in theory, a simple review of 2020 would suggest expecting the unexpected because “unprecedented times” may be only a pandemic away. Relationships break down due to secular shifts, and securities that once offered a counterbalance may now trade in the same trajectory. In a similar vein, we think it is important to know what is not captured as an input to some of these tools. How does a risk management system model a $7T Federal Reserve balance sheet? What about record federal deficits and seemingly bottomless monetary support? Ultimately, the data out is only as good as the data in, and if the tools being used to inform investment decisions are incomplete, the investment manager must account for and adapt to these known flaws.

RESPONDING PREDICTABLY TO FUTURE UNKNOWNS

Our viewpoint has always been that pure output from risk management analysis is much less important than its interpretation. We think one of the most critical steps to managing risks lies in constructing a process around managing the unknowns, that is assigning probabilities to forecasted outcomes, acknowledging incomplete information, and building a comprehensive framework of what future events may do to asset prices. This framework is at the foundation of sizing positions, assessing conviction levels, and providing true diversification across the portfolio. The process was recently put to the test surrounding the recent U.S. election. Understanding assets would perform differently under the multitude of political outcomes, portfolios were positioned accordingly based on the firm’s assessment of probabilities.

Ultimately, our goal is to use all tools at our disposal to make ourselves as informed as possible to arrive at educated probabilities of future outcomes. This process is questioned, challenged, and refined on a daily basis given adapting viewpoints from all members of the investment team. The result is a portfolio in which we feel confident to respond with predictability as future unknowns reveal themselves.

DIFFERENTIATING VOLATILITY FROM OUTCOMES

Lastly, risk management is only as good as the outcome. Managing ex-post or realized volatility is more important at Brandywine Global than managing to forecasted or ex-ante risk. In fact, in many cases, our view has been that ex-ante risk increases usually correlate to a possible opportunity rather than signaling an inherent problem. As evidenced in the two charts below, the most recent spikes in implied volatility measured by the MOVE Index were subsequently followed by significant spread compression in high yield corporate bonds.

In the end, it is not the complexity of the tools themselves or the sophistication of the risk management framework that ultimately matters. Realized drawdowns and Sharpe ratios are what define the effectiveness of risk management for an investment manager.

DEFINITIONS

Value at risk (VaR) is a statistic that measures and quantifies the level of financial risk within a firm, portfolio or position over a specific time frame. This metric is most commonly used by investment and commercial banks to determine the extent and occurrence ratio of potential losses in their institutional portfolios.

A Monte Carlo simulation is a problem solving technique used to approximate the probability of certain outcomes by running multiple trial runs using computational algorithms that rely on repeated random sampling to obtain numerical results; typically one runs simulations many times over in order to obtain the distribution of an unknown probabilistic entity.

Duration measures the sensitivity of price (the value of principal) of a fixed-income investment to a change in interest rates. The higher the duration number, the more sensitive a fixed-income investment will be to interest rate changes.

A global pandemic is the worldwide spread of a new disease. The World Health Organization declared COVID-19 to be a pandemic when it became clear that the illness was severe and that it was spreading quickly over a wide area.

The Federal Reserve Board (“Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments.

The Merrill Lynch Option Volatility Estimate (MOVE) Index is a yield-curve-weighted index of the normalized implied volatility on 1-month Treasury options for the 2, 5, 10, and 30 year maturities.

High yield (HY) bonds, also called junk bonds, are bonds with below investment-grade ratings (BB, B, CCC for example) and are considered low credit quality and have a higher risk of default.

An Option-Adjusted Spread (OAS) is a measure of risk that shows credit spreads with adjustments made to neutralize the impact of embedded options. A credit spread is the difference in yield between two different types of fixed income securities with similar maturities.

A drawdown is a peak-to-trough decline during a specific period for an investment, trading account, or fund.

Sharpe ratio is a risk-adjusted measure of investment return. The higher the Sharpe ratio, the better the fund’s historical risk-adjusted performance.

WHAT ARE THE RISKS?

Past performance is no guarantee of future results. Please note that an investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.

Equity securities are subject to price fluctuation and possible loss of principal. Fixed-income securities involve interest rate, credit, inflation and reinvestment risks; and possible loss of principal. As interest rates rise, the value of fixed income securities falls. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Commodities and currencies contain heightened risk that include market, political, regulatory, and natural conditions and may not be suitable for all investors.

U.S. Treasuries are direct debt obligations issued and backed by the “full faith and credit” of the U.S. government. The U.S. government guarantees the principal and interest payments on U.S. Treasuries when the securities are held to maturity. Unlike U.S. Treasuries, debt securities issued by the federal agencies and instrumentalities and related investments may or may not be backed by the full faith and credit of the U.S. government. Even when the U.S. government guarantees principal and interest payments on securities, this guarantee does not apply to losses resulting from declines in the market value of these securities.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

You need Adobe Acrobat Reader to view and print PDF documents. Download a free version from Adobe’s website.

Franklin Templeton Distributors, Inc.