How Kiwis are taking full advantage of the InvestNow KiwiSaver Scheme – building portfolios specific to their preferences and plans

Article written by InvestNow – 28th February 2022

The InvestNow KiwiSaver Scheme has just clicked past its first birthday, so we thought it would be interesting to share with you how the members of the InvestNow KiwiSaver Scheme are taking advantage of the flexibility and choice that we offer – building portfolios that best meet their investment preferences and objectives.

A quick recap – how does the InvestNow KiwiSaver Scheme work?

As popular as KiwiSaver is, many industry commentators and journalists have been pointing to its obvious design flaw – being the limited ability for one person to invest in multiple KiwiSaver offerings.

Stuff’s Janine Starks said in an article “KiwiSaver forces you to invest with one manager for decades of your life. Even if you switch managers, the whole lot goes to a single firm. There’s no polite way of putting this – it’s incredibly bad practice.”

The InvestNow KiwiSaver Scheme solves this by providing InvestNow KiwiSaver Scheme members with the choice and flexibility to mix and match between 36 funds from 14 different investment managers.

Offering investment options from managers such as Milford, Fisher Funds, Smartshares and Harbour Asset Management, means that members of the InvestNow KiwiSaver Scheme can build and maintain their personalised KiwiSaver portfolio – negating the design flaw in a typical KiwiSaver scheme.

People may have brands that they prefer or know of managers that have expertise in specific investment options. With the InvestNow KiwiSaver Scheme, this becomes easy, reflecting that people can select any fund or combination of funds, they want to invest in.

What funds are available within the InvestNow KiwiSaver Scheme?

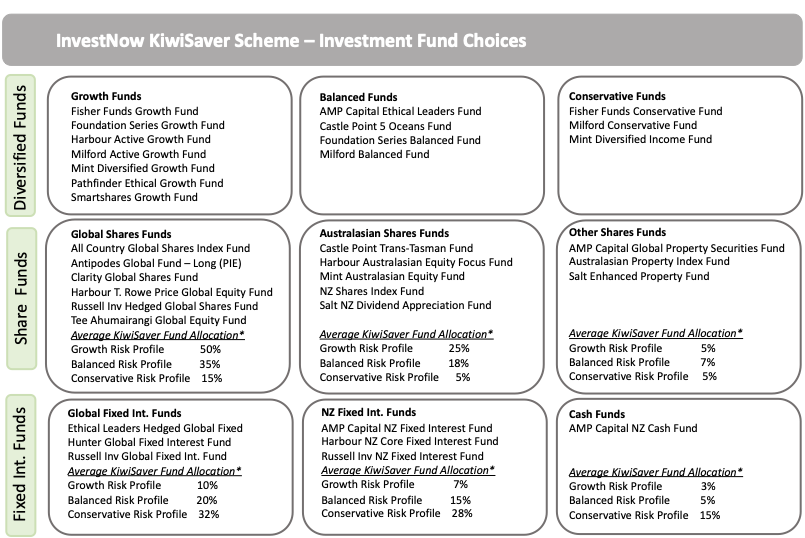

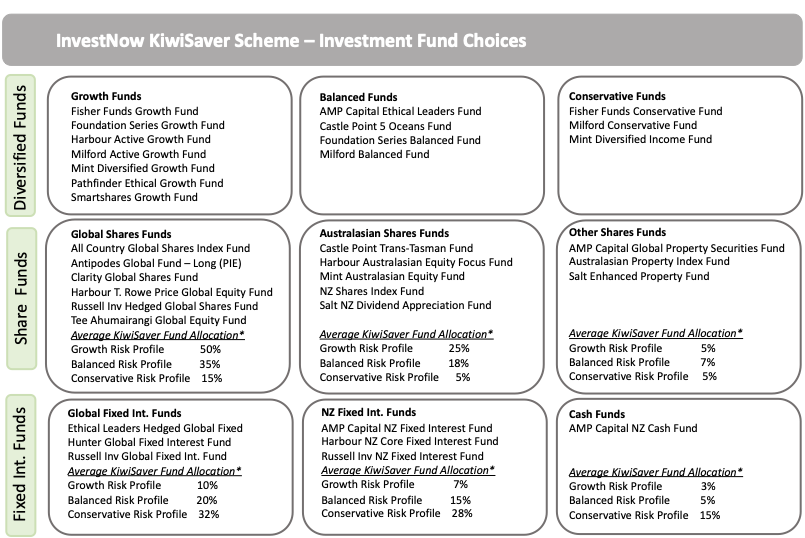

The InvestNow KiwiSaver Scheme is made up of easy-to-select diversified funds, as well as specialist funds covering each investment sector. We offer indexed/passive, active, and socially responsible investment funds to suit different investors’ preferences.

You are free to keep things simple by investing in one manager’s fund or diversify between as many managers and funds that you like.

The funds that are available within the InvestNow KiwiSaver Scheme are:

*These are the average exposures that KiwiSaver funds with this risk profile have to the different sectors.

Which funds are most popular currently?

More than half of InvestNow KiwiSaver Scheme members have invested in easy-to-select diversified growth funds, with the most popular of these being the Milford Active Growth Fund and Foundation Series Growth Fund.

While Milford will be a well-known brand to many Kiwi investors, the Foundation Series Funds may be a little less familiar.

The Foundation Series Growth Fund provides investors with access to a low-cost tax-efficient diversified fund, similar to the Simplicity Growth Fund.

A key difference is that the Foundation Series Growth Fund’s global shares are managed tax efficiently (while Simplicity’s aren’t), while not having the same focus that Simplicity has on ethical considerations. These differences are explained in this useful article from MoneyKingNZ.

The Foundation Series Funds appeal to those looking for a low-cost, tax-efficient broad market KiwiSaver portfolio. A lot of the people who have invested in the Foundation Series Growth and Balanced Funds have switched to the InvestNow KiwiSaver Scheme from Simplicity.

Other popular growth funds include the Mint Diversified Growth Fund, which turned in a similar strong return for the year to 31 December 2021 as the Milford Active Growth Fund, while the Pathfinder Ethical Growth Fund appears to appeal to a segment of our customers wanting to invest in funds that have a strong ethical and socially responsible approach to investing.

While InvestNow KiwiSaver Scheme members can elect to invest in just one manager’s fund, interestingly 80% of people using growth funds have opted for diversifying between two or more managers’ growth funds. For example, a quarter of those invested in the Foundation Series Growth Fund – which is based around having passive exposures to shares – also invest in the Milford Active Growth Fund, suggesting many InvestNow KiwiSaver Scheme members want to mix index/passive and active investing styles.

Almost half of InvestNow KiwiSaver Scheme investors have invested in at least three funds, while nearly 20% have chosen at least five funds. We think that this is indicative that people understand the benefits of diversification, which is one of the truly free lunches within the investment management industry.

Some of the specialist global share funds within the InvestNow KiwiSaver Scheme are proving popular, especially with investors who are combining these with diversified growth funds to get a more aggressive overall investment exposure. Funds people are using to do this with include the All Country Global Share Index Fund, which is actually the most popular fund within the InvestNow KiwiSaver Scheme currently, and the Harbour T. Rowe Price Global Equity Fund, which is also popular amongst InvestNow KiwiSaver Scheme members wanting to increase the risk profile of their portfolio by getting a greater exposure to global shares.

The key thing that the InvestNow KiwiSaver Scheme brings you is flexibility and choice. This includes the option of investing in a single fund, through to creating any combination of the funds we have available within the InvestNow KiwiSaver Scheme.

While lots of InvestNow KiwiSaver Scheme members have kept things fairly straightforward by investing in one or two diversified growth funds, we have been interested to see that people are embracing diversifying their KiwiSaver portfolio between managers. This in itself is a good thing, as it ensures that investors get a smoother return over time – avoiding the highs and lows associated with having a single manager for your KiwiSaver portfolio. We think that this is a more astute approach than trying to pick the winning manager, as different market cycles will favour different investment philosophies and styles.

How Kiwis are taking full advantage of the InvestNow KiwiSaver Scheme – building portfolios specific to their preferences and plans

Article written by InvestNow – 28th February 2022

The InvestNow KiwiSaver Scheme has just clicked past its first birthday, so we thought it would be interesting to share with you how the members of the InvestNow KiwiSaver Scheme are taking advantage of the flexibility and choice that we offer – building portfolios that best meet their investment preferences and objectives.

A quick recap – how does the InvestNow KiwiSaver Scheme work?

As popular as KiwiSaver is, many industry commentators and journalists have been pointing to its obvious design flaw – being the limited ability for one person to invest in multiple KiwiSaver offerings.

Stuff’s Janine Starks said in an article “KiwiSaver forces you to invest with one manager for decades of your life. Even if you switch managers, the whole lot goes to a single firm. There’s no polite way of putting this – it’s incredibly bad practice.”

The InvestNow KiwiSaver Scheme solves this by providing InvestNow KiwiSaver Scheme members with the choice and flexibility to mix and match between 36 funds from 14 different investment managers.

Offering investment options from managers such as Milford, Fisher Funds, Smartshares and Harbour Asset Management, means that members of the InvestNow KiwiSaver Scheme can build and maintain their personalised KiwiSaver portfolio – negating the design flaw in a typical KiwiSaver scheme.

People may have brands that they prefer or know of managers that have expertise in specific investment options. With the InvestNow KiwiSaver Scheme, this becomes easy, reflecting that people can select any fund or combination of funds, they want to invest in.

What funds are available within the InvestNow KiwiSaver Scheme?

The InvestNow KiwiSaver Scheme is made up of easy-to-select diversified funds, as well as specialist funds covering each investment sector. We offer indexed/passive, active, and socially responsible investment funds to suit different investors’ preferences.

You are free to keep things simple by investing in one manager’s fund or diversify between as many managers and funds that you like.

The funds that are available within the InvestNow KiwiSaver Scheme are:

*These are the average exposures that KiwiSaver funds with this risk profile have to the different sectors.

Which funds are most popular currently?

More than half of InvestNow KiwiSaver Scheme members have invested in easy-to-select diversified growth funds, with the most popular of these being the Milford Active Growth Fund and Foundation Series Growth Fund.

While Milford will be a well-known brand to many Kiwi investors, the Foundation Series Funds may be a little less familiar.

The Foundation Series Growth Fund provides investors with access to a low-cost tax-efficient diversified fund, similar to the Simplicity Growth Fund.

A key difference is that the Foundation Series Growth Fund’s global shares are managed tax efficiently (while Simplicity’s aren’t), while not having the same focus that Simplicity has on ethical considerations. These differences are explained in this useful article from MoneyKingNZ.

The Foundation Series Funds appeal to those looking for a low-cost, tax-efficient broad market KiwiSaver portfolio. A lot of the people who have invested in the Foundation Series Growth and Balanced Funds have switched to the InvestNow KiwiSaver Scheme from Simplicity.

Other popular growth funds include the Mint Diversified Growth Fund, which turned in a similar strong return for the year to 31 December 2021 as the Milford Active Growth Fund, while the Pathfinder Ethical Growth Fund appears to appeal to a segment of our customers wanting to invest in funds that have a strong ethical and socially responsible approach to investing.

While InvestNow KiwiSaver Scheme members can elect to invest in just one manager’s fund, interestingly 80% of people using growth funds have opted for diversifying between two or more managers’ growth funds. For example, a quarter of those invested in the Foundation Series Growth Fund – which is based around having passive exposures to shares – also invest in the Milford Active Growth Fund, suggesting many InvestNow KiwiSaver Scheme members want to mix index/passive and active investing styles.

Almost half of InvestNow KiwiSaver Scheme investors have invested in at least three funds, while nearly 20% have chosen at least five funds. We think that this is indicative that people understand the benefits of diversification, which is one of the truly free lunches within the investment management industry.

Some of the specialist global share funds within the InvestNow KiwiSaver Scheme are proving popular, especially with investors who are combining these with diversified growth funds to get a more aggressive overall investment exposure. Funds people are using to do this with include the All Country Global Share Index Fund, which is actually the most popular fund within the InvestNow KiwiSaver Scheme currently, and the Harbour T. Rowe Price Global Equity Fund, which is also popular amongst InvestNow KiwiSaver Scheme members wanting to increase the risk profile of their portfolio by getting a greater exposure to global shares.

The key thing that the InvestNow KiwiSaver Scheme brings you is flexibility and choice. This includes the option of investing in a single fund, through to creating any combination of the funds we have available within the InvestNow KiwiSaver Scheme.

While lots of InvestNow KiwiSaver Scheme members have kept things fairly straightforward by investing in one or two diversified growth funds, we have been interested to see that people are embracing diversifying their KiwiSaver portfolio between managers. This in itself is a good thing, as it ensures that investors get a smoother return over time – avoiding the highs and lows associated with having a single manager for your KiwiSaver portfolio. We think that this is a more astute approach than trying to pick the winning manager, as different market cycles will favour different investment philosophies and styles.

Leave A Comment