Commentator – Chris Di Leva, Multi Asset Specialist

Summary

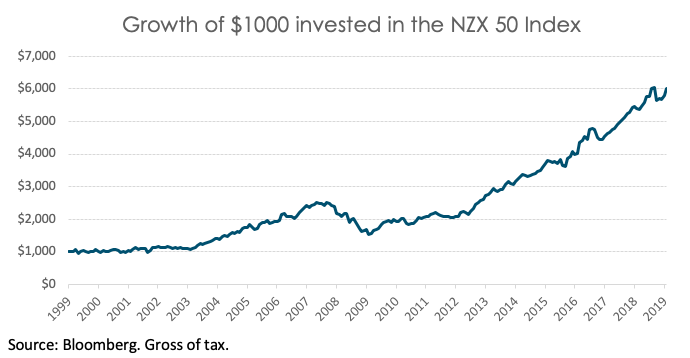

A noticeable feature of markets in the ten years since the GFC has been the unusually low amount of market volatility. Buoyed by stimulus from central banks, which kept interest rates at artificially low levels, this created a positive environment for all asset classes. Indeed, the rising tide lifted all boats with both passive and active strategies enjoying strong returns over this period. However, market movements in recent months could be a signal that this prolonged period of low volatility is coming to an end. We should not view this as a paradigm shift towards a high volatility period, rather a return to a more “normal” period of volatility by historical standards. Of course, history also tells us that investors have been well rewarded for this volatility when taking a long-term view.

Q1: What’s driving the recent market volatility?

It is often said that bull markets rarely die of old age, and that was certainly true of the most recent bout of volatility within investment markets as tightening global liquidity conditions, trade anxieties and signs of slowing global growth combining to rattle investors.

It is worth bearing in mind that volatility goes both ways, for example the 20% fall we saw in the US market, has nearly been offset by a strong rally post-Christmas. The bounce-back was primarily due to dovish statements from the US Federal Reserve (the Fed) which is now expected to pause its interest rate hiking cycle. A better than expected kick-off to the US earnings season further whetted investors’ appetite for risk assets. The New Zealand market has also recovered from the comparatively smaller (-9%) falls that it saw in the quarter.

Q2: How long do you think it will continue? Why?

The market now expects US Federal Reserve to pause its interest rate hiking cycle until the cross currents of slowing global growth, market volatility and “tightened” financial conditions pass. This combined with positive murmurings surrounding US–China trade talks and a better-than- expected US earnings season has resulted in a period of relative calm so far this year.

Despite this, we believe equity markets will likely continue to exhibit a higher level of volatility than the abnormally low levels that we have seen in the past three years. There are several risks we are monitoring including US-China trade negotiations and signs of a global earnings slowdown.

Q3: Is volatility – especially if it is sustained – better for active management strategies rather than passive? Why

Price movement creates opportunities for active managers to capitalise on, so volatility is not a bad thing for active managers, but we do not think that is the sole driver of why investors may want to be active. We also see disruptive technologies having a larger impact on corporate earnings in the next 10 to 15 years than that of any central bank or government. Consequently, we believe performance gaps between the winners and losers will be atypically large and being on the right side of disruption will yield good outcomes for investors.

We believe this will provide challenges for passive managers, who are forced to own the entire index, which includes the disruptors like Amazon, but once also housed the disrupted like Borders, Toys ‘R’ Us and Sears, once the leaders in their industries.

Q4: How does your investment process define and manage volatility?

As active managers we make choices about where to allocate the funds our clients have entrusted with us to manage on their behalf. This means that we can tilt portfolios away from areas of the market where we do not believe investors are going to be well compensated for the risks they take.

For example, within our equity portfolios, we have higher allocations to quality growth companies in the consumer staples, information technology and financial sectors, where the potential rate of growth over time may not be reflected in share prices. Conversely the equity portfolios have lower allocations to NZ consumer discretionary and energy sectors where disruption risk remains high, and the utilities, real estate and telecommunications sectors where valuations are high relative to their potential growth.

Within multi asset funds like the Harbour Income Fund, the Portfolio Manager for the fund can vary the level and type of growth assets within that fund, based on the relative prospects of that market in order to preserve capital. This gives the fund more flexibility to deal with volatile quarters like the December quarter where it held up relatively well, down just 0.5% in a period where many funds in the market suffered larger losses.

This does not constitute advice to any person. www.harbourasset.co.nz/disclaimer