“The low fees mean the new Foundation Series Funds beat out all other funds in the same class. As a Kiwi I’ve been looking for this type of investment opportunity for a long time.”

– InvestNow customer

Like the Vanguard funds but hate paying high management fees or over 28% tax on your investments?

The new Foundation Series US 500 Fund and Total World Fund – both invested in Exchange-Traded Funds (ETFs) from index funds management pioneer, Vanguard – can help Kiwis achieve their investment goals more effectively by using some of the most cost-and tax-efficient vehicles in the market.

Your long-term returns can be higher with Foundation Series US 500 Fund and Total World Fund.*

Do the maths

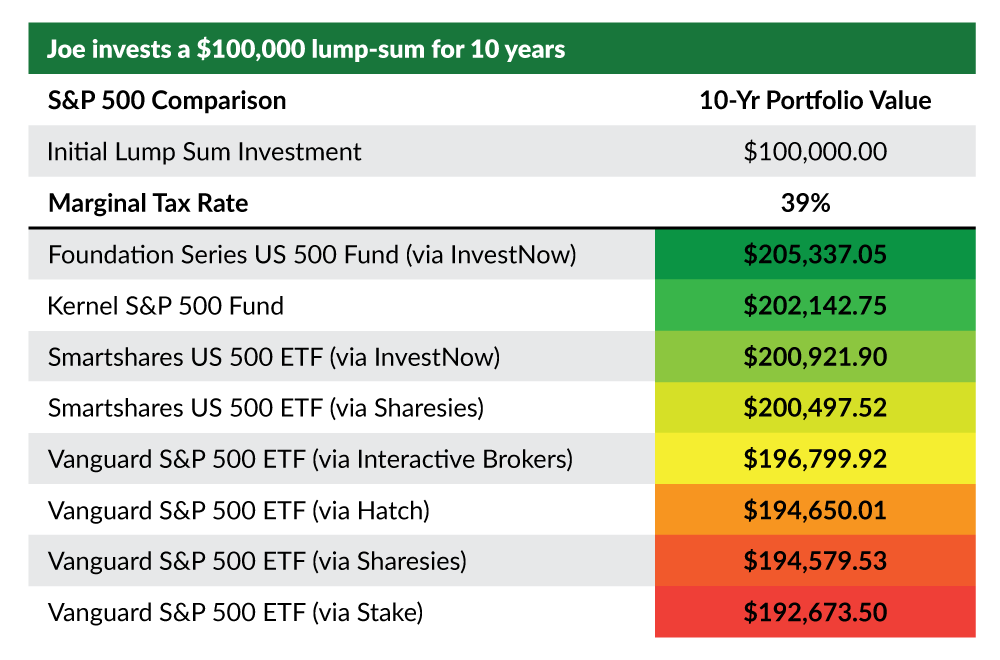

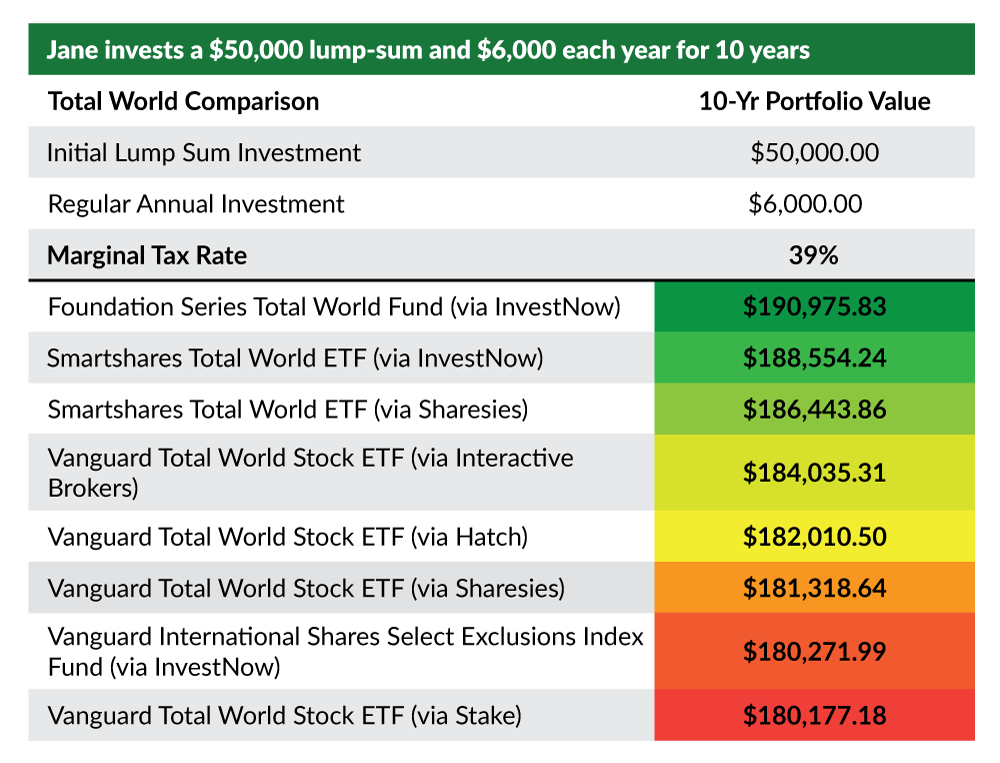

For illustrative purposes, let’s consider two examples of investors – Joe and Jane.

Joe is on a 39% marginal tax rate, a 28% Prescribed Investor Rate (PIR) and wants to invest $100,000 in the Foundation Series US 500 Fund. Jane is also on a 39% marginal tax rate, a 28% PIR and wants to invest $50,000 lump-sum and $6,000 in regular investments every year ($500 each month for 10-years) in the Foundation Series Total World Fund.

Assuming an annual gross return from the underlying ETF of 9% per annum, which includes 2% in annual dividends, we can calculate what Joe’s and Jane’s portfolios can look like in 10 years’ time. The tables compare the different index funds that are available to Kiwi investors on the InvestNow platform and other similar platforms.

Portfolio values are at the end of 10-year period net of all costs, including tax, foreign exchange fees, brokerage, spreads and any account or transaction fees.

By investing in the above Foundation Series Funds, both Joe and Jane could enjoy returns over the long term that are around 14%* greater in dollar terms compared to the worst performing equivalent option that invests in exactly the same underlying basket of shares.

We believe the combination of low management fees, one-off transaction fees and the PIE tax incentive make the new Vanguard-powered Foundation Series Funds a no-brainer for long-term investors, especially those investors on 39% or 33% marginal tax rates.

Money King NZ’s article “What’s the best S&P 500 index fund in 2022?” provides a similar analysis, including a spreadsheet where you can do your own calculations and comparisons.

The examples we have provided are for illustrative purposes only. We note that in other scenarios, for example where a customer is on a lower marginal tax rate, has initially invested less than $50,000 or wishes to make regular investments/withdrawals or invest for a shorter period, the Foundation Series US 500 Fund and Total World Fund may not be the most ideal investment products. Investors should always take into consideration their own personal circumstances when making investment decisions and should seek personalised advice from qualified advisers.

The recently launched InvestNow Foundation Series US 500 Fund and Total World Fund feature in MoneyHub’s most recent guide re investing in Vanguard, where the conclusion was “…Foundation Series Funds in many cases provide long-term investors with the highest after-fees-and-tax returns out of all Vanguard options in New Zealand.”

Click here to read MoneyHub’s Investing in Vanguard Funds from New Zealand.

Please Note:

InvestNow does not provide personalised investment advice. We are one component of a person’s financial landscape and actively promote that our customers seek personalised advice from qualified advisers external to InvestNow.

* Compared to the worst performing option that invests in the same underlying basket of shares. This assumption is based on an initial lump-sum investment of $100,000 for Joe and $50,000 for Jane with a regular investment of $6,000 ($500 invested monthly for 10-years) with a PIR of 28% and marginal tax rate of 39%. The ‘return’ calculation above does not take into account the original investment of $100,000 for Joe and $110,000 for Jane ($50,000 + $6,000 yearly for 10-years) and is modelled at the end of 10-year period net of all costs, including tax, foreign exchange, brokerage, spread, and any account or transaction fees. The modelling assumes an annual gross return of 9% per annum, which includes 2% in annual dividends.

The Foundation Series US 500 Fund and Foundation Series Total World Fund are both subject to a transaction fee charge of 0.50% on all Buy Orders and 0.50% on all Sell Orders.

Neither FundRock NZ Limited nor any other party guarantees the return assumptions used in the table above.