Global shares – Tax explained: Tips and tricks for building a tax-efficient global shares portfolio

Article written by InvestNow – Updated 5th April 2023

Modern platforms, offering instant access to global markets along with a steady stream of new financial products targeting international assets, have kicked the world wide open for Kiwi investors.

And a growing number of New Zealanders are taking advantage of this new-found freedom to load up on the global investment opportunities unfolding before them.

Of course, NZ investors have long been overweight offshore assets compared to many global peers as the recent Morningstar Global Investor Portfolio Study revealed. Morningstar found NZ had one of the lowest ‘home-country bias’ scores of more than 20 major economies included in the survey – confirming the Kiwi appetite for international investing.

Offshore markets undoubtedly provide New Zealanders with the kind of portfolio diversification they can’t get at home – and it’s encouraging to see this message has taken hold.

However, investing in global shares also comes with additional tax complexities that can have a significant impact on portfolio returns if not carefully managed.

Many Kiwi investors might be surprised to learn that the Inland Revenue Department will treat the same bundle of underlying shares in markedly different ways for tax purposes, depending on the ownership structures.

Headline expenses such as management fees get most of the spotlight when assessing the cost-effectiveness of a solution. But less-visible features, such as the impact of tax, can turn a seemingly cheap but poorly structured solution into an expensive mistake.

Whatever their individual circumstances, most investors can usually benefit from incorporating some key principles and building blocks of tax-efficiency into investing in global shares – as outlined below.

Foreign Investment Funds (FIF) tax rules explained

Firstly, it’s helpful to understand how foreign investments are generally taxed in New Zealand. Investors who have holdings in direct shares or funds which are domiciled overseas, such as Australian Unit Trusts (AUTs) or offshore Exchange-Traded Funds (ETFs), are subject to the Foreign Investment Funds (FIF) tax rules.

Under the FIF rules, any relevant income for the year is taxed at the investor’s marginal rate, which can be as high as 39%.

The starting place with the FIF tax rules is to determine whether an investor falls under the ‘de minimis’ exemption that applies if the total cost of a person’s portfolio of FIF investments is less than $50,000. If so, then taxable FIF income is limited to any dividends that the FIF investments pays out during the tax year.

If the cost of an investor’s portfolio of FIF investments exceeds $50,000, then each year investors will need to choose between two methods to calculate their taxable FIF income, being the:

- Fair Dividend Rate (FDR): Taxable FIF Income = Market Value of FIFs x 5%; or

- Comparative Value (CV): Taxable FIF Income = (Opening Market Value of FIFs + Costs of new FIFs) – (Closing Market Value of FIFs + Proceeds from FIFs)

Typically, investors will choose the FDR method in positive return years, while choosing the CV method in negative years. Importantly, investors need to use the same method for calculating the tax on their whole FIF portfolio. Owning FIF investments also comes with hefty administration duties including filing a tax return.

Tax-Efficiency Principle #1: The benefits of tax-advantaged investment funds

Well-structured PIE global share funds provide a common way for investors to optimise their after-tax returns.

While directly held FIF investments are taxed at an investor’s marginal rate (topping out at 39%), PIE funds are taxed at an investor’s Prescribed Investor Rate (PIR), which is capped at 28%.

PIE funds create immediate tax savings for investors in the years where they are paying tax in accordance with the FDR methodology. Investors on 39% tax rates get an extra 0.55% per year boost to returns by using PIE funds, while their counterparts on 33% tax rates get an additional 0.25% per annum.

Any tax in PIE funds is calculated and paid for by managers on behalf of the underlying investors, freeing them up from any reporting obligations.

Tax-Efficiency Principle #2: Minimise tax leakage

Another area that investors can focus on is investing into efficiently structured PIE global share funds that have minimal tax leakage.

PIE funds investing directly in global shares provide the most efficient tax structure. Investors in international equities via PIE funds can get an offset for the non-resident withholding tax deducted on any underlying company dividends.

In contrast, Kiwis who obtain their global share exposure via AUTs can suffer from significant leakage, as NZ investors can’t claim any offset for the underlying non-resident withholding tax.

The quantum of this leakage is the underlying dividend yield from the global shares (which has hovered around 2% in recent years for many global equity index funds from the likes of Vanguard) multiplied by 15%, which is the standard rate of non-resident withholding tax deducted around the world. Using this 2% dividend yield proxy results in a tax slippage cost to the end-investor of approximately 0.30% per annum.

For the end-investor, incurring an extra 0.30% in tax slippage has a more material impact than a fee of the same magnitude as fees are typically tax deductible, whereas tax slippage is purely a drag on investment returns.

Total All-In Costs: The key metric for tax-efficient investing

So how can retail investors incorporate these principles to build an efficient global shares portfolio? The key is to look beyond just the headline costs such as management fees, and also consider the likes of transaction costs and tax costs, to arrive at a total all-in cost figure.

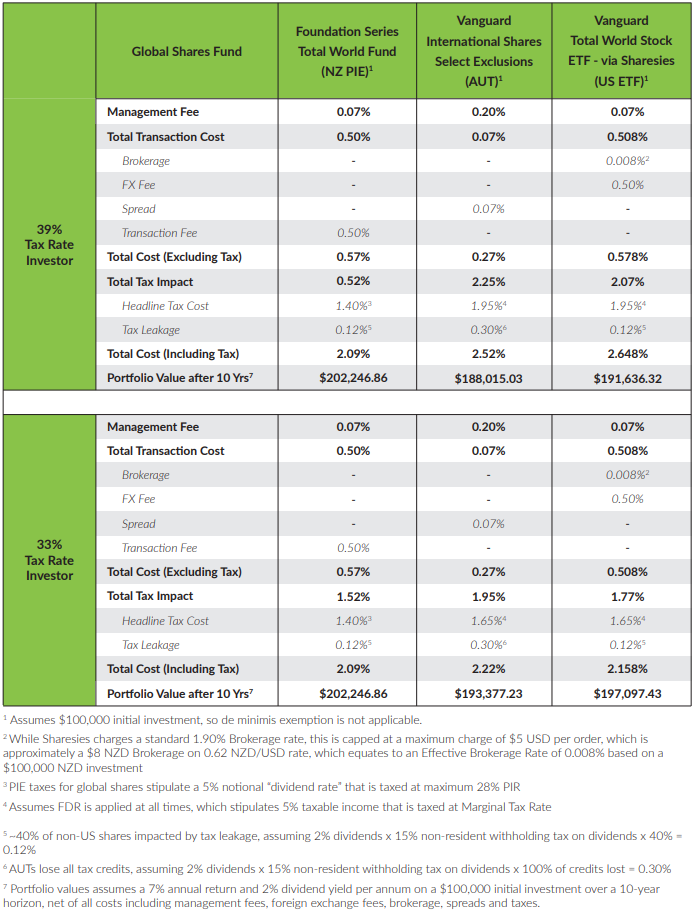

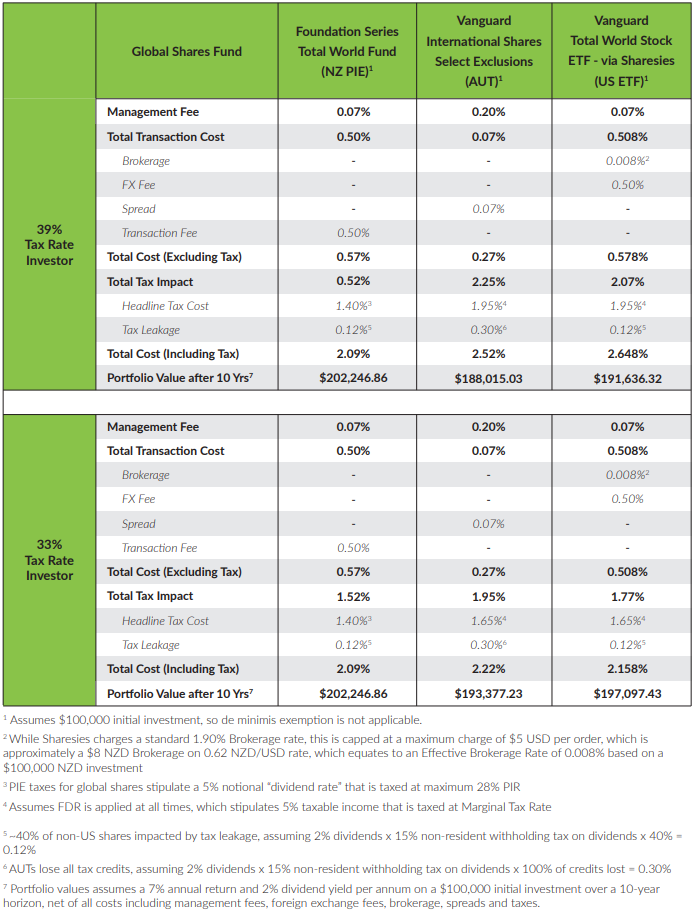

Consider the example below which compares investing $100,000 for a 10-year period into three different global shares fund that all use Vanguard as the underlying manager.

When it comes total all-in costs on an after-tax basis, the Foundation Series Total World Fund (which wraps up the same underlying Vanguard Total World Stock ETF within a tax-efficient PIE vehicle) offers the lowest total cost to investors when both tax and fees are taken into account.

The benefits of tax-efficient structuring and the compounding of total cost savings is particularly evident over the long-term. As shown in the example above, the Foundation Series Fund ends the 10-year period $10,000 higher than the other two vehicles for those on 39% marginal rate: for taxpayers on a 33% rate the differential is a still-healthy $5,000.

The 10-year performance disparity between the two funds follows a combination of tax-efficient portfolio construction (particularly versus the direct Vanguard ETF option), as well as the compounding benefits of lower annual management fees (especially compared to the Vanguard AUT option). While investors in the Foundation Series Total World Fund incur an initial entry fee, the lower annual management fees enable assets to compound more effectively over time.

Remember, investors only get to access returns after fees and tax, which determines whether they meet their ultimate objectives. In the same way that spending power is determined by our salary net of taxes – the value proposition of a fund should be based on its ability to drive after-tax outcomes for end-investors.

Key Takeaways:

In summary, when choosing a fund or product to meet your investment objectives look beyond the headline fee figure and dig deeper into the details such as the impact of tax: getting the details right (or wrong) can materially impact all-in costs and accordingly your overall investment returns.

For many investors global share exposure via a NZ PIE fund that has direct holdings offers the most tax-efficient option and the greatest amount of certainty of achieving their goals – along with the least amount of associated cost. PIEs have the added benefit of removing the need to file tax returns or engage the services of expensive accountants.

However, tax is always a complex topic for investing and each individual may have their own unique circumstances that will affect their choices and outcomes.

Nevertheless, the following questions can be a useful starting point for the rapidly growing number of Kiwis who are considering which global investment option would be best for their individual situation:

- Who is the underlying investment manager of the fund, and how likely will this manager deliver on the type of investment I am after?

- What are the total costs (fees, plus taxes, plus transaction costs) of this option – how does this total all-in cost compare with other options?

- Are there are any other costs in terms of time or expertise that would be required to discharge the tax burden associated with this investment option?

At InvestNow, we have a wide range of global share options to meet a variety of tax situations. Click here to see our range of funds and optimise your after-tax investment portfolio today.

Disclaimer: InvestNow is not a financial advisor and therefore we do not offer or provide personalised advice or recommendations. All investing involves risk. We encourage you to read the Product Disclosure Statement (PDS) of any prospective funds and consider seeking financial advice from a licenced provider, before making any investment decisions in any of the products offered on the InvestNow platform. Furthermore, any material relating to tax has been prepared for informational purposes only and is not formal tax advice, nor has it considered your individual tax circumstances.

Global shares – Tax explained: Tips and tricks for building a tax-efficient global shares portfolio

Article written by InvestNow – Updated 5th April 2023

Modern platforms, offering instant access to global markets along with a steady stream of new financial products targeting international assets, have kicked the world wide open for Kiwi investors.

And a growing number of New Zealanders are taking advantage of this new-found freedom to load up on the global investment opportunities unfolding before them.

Of course, NZ investors have long been overweight offshore assets compared to many global peers as the recent Morningstar Global Investor Portfolio Study revealed. Morningstar found NZ had one of the lowest ‘home-country bias’ scores of more than 20 major economies included in the survey – confirming the Kiwi appetite for international investing.

Offshore markets undoubtedly provide New Zealanders with the kind of portfolio diversification they can’t get at home – and it’s encouraging to see this message has taken hold.

However, investing in global shares also comes with additional tax complexities that can have a significant impact on portfolio returns if not carefully managed.

Many Kiwi investors might be surprised to learn that the Inland Revenue Department will treat the same bundle of underlying shares in markedly different ways for tax purposes, depending on the ownership structures.

Headline expenses such as management fees get most of the spotlight when assessing the cost-effectiveness of a solution. But less-visible features, such as the impact of tax, can turn a seemingly cheap but poorly structured solution into an expensive mistake.

Whatever their individual circumstances, most investors can usually benefit from incorporating some key principles and building blocks of tax-efficiency into investing in global shares – as outlined below.

Foreign Investment Funds (FIF) tax rules explained

Firstly, it’s helpful to understand how foreign investments are generally taxed in New Zealand. Investors who have holdings in direct shares or funds which are domiciled overseas, such as Australian Unit Trusts (AUTs) or offshore Exchange-Traded Funds (ETFs), are subject to the Foreign Investment Funds (FIF) tax rules.

Under the FIF rules, any relevant income for the year is taxed at the investor’s marginal rate, which can be as high as 39%.

The starting place with the FIF tax rules is to determine whether an investor falls under the ‘de minimis’ exemption that applies if the total cost of a person’s portfolio of FIF investments is less than $50,000. If so, then taxable FIF income is limited to any dividends that the FIF investments pays out during the tax year.

If the cost of an investor’s portfolio of FIF investments exceeds $50,000, then each year investors will need to choose between two methods to calculate their taxable FIF income, being the:

- Fair Dividend Rate (FDR): Taxable FIF Income = Market Value of FIFs x 5%; or

- Comparative Value (CV): Taxable FIF Income = (Opening Market Value of FIFs + Costs of new FIFs) – (Closing Market Value of FIFs + Proceeds from FIFs)

Typically, investors will choose the FDR method in positive return years, while choosing the CV method in negative years. Importantly, investors need to use the same method for calculating the tax on their whole FIF portfolio. Owning FIF investments also comes with hefty administration duties including filing a tax return.

Tax-Efficiency Principle #1: The benefits of tax-advantaged investment funds

Well-structured PIE global share funds provide a common way for investors to optimise their after-tax returns.

While directly held FIF investments are taxed at an investor’s marginal rate (topping out at 39%), PIE funds are taxed at an investor’s Prescribed Investor Rate (PIR), which is capped at 28%.

PIE funds create immediate tax savings for investors in the years where they are paying tax in accordance with the FDR methodology. Investors on 39% tax rates get an extra 0.55% per year boost to returns by using PIE funds, while their counterparts on 33% tax rates get an additional 0.25% per annum.

Any tax in PIE funds is calculated and paid for by managers on behalf of the underlying investors, freeing them up from any reporting obligations.

Tax-Efficiency Principle #2: Minimise tax leakage

Another area that investors can focus on is investing into efficiently structured PIE global share funds that have minimal tax leakage.

PIE funds investing directly in global shares provide the most efficient tax structure. Investors in international equities via PIE funds can get an offset for the non-resident withholding tax deducted on any underlying company dividends.

In contrast, Kiwis who obtain their global share exposure via AUTs can suffer from significant leakage, as NZ investors can’t claim any offset for the underlying non-resident withholding tax.

The quantum of this leakage is the underlying dividend yield from the global shares (which has hovered around 2% in recent years for many global equity index funds from the likes of Vanguard) multiplied by 15%, which is the standard rate of non-resident withholding tax deducted around the world. Using this 2% dividend yield proxy results in a tax slippage cost to the end-investor of approximately 0.30% per annum.

For the end-investor, incurring an extra 0.30% in tax slippage has a more material impact than a fee of the same magnitude as fees are typically tax deductible, whereas tax slippage is purely a drag on investment returns.

Total All-In Costs: The key metric for tax-efficient investing

So how can retail investors incorporate these principles to build an efficient global shares portfolio? The key is to look beyond just the headline costs such as management fees, and also consider the likes of transaction costs and tax costs, to arrive at a total all-in cost figure.

Consider the example below which compares investing $100,000 for a 10-year period into three different global shares fund that all use Vanguard as the underlying manager.

When it comes total all-in costs on an after-tax basis, the Foundation Series Total World Fund (which wraps up the same underlying Vanguard Total World Stock ETF within a tax-efficient PIE vehicle) offers the lowest total cost to investors when both tax and fees are taken into account.

The benefits of tax-efficient structuring and the compounding of total cost savings is particularly evident over the long-term. As shown in the example above, the Foundation Series Fund ends the 10-year period $10,000 higher than the other two vehicles for those on 39% marginal rate: for taxpayers on a 33% rate the differential is a still-healthy $5,000.

The 10-year performance disparity between the two funds follows a combination of tax-efficient portfolio construction (particularly versus the direct Vanguard ETF option), as well as the compounding benefits of lower annual management fees (especially compared to the Vanguard AUT option). While investors in the Foundation Series Total World Fund incur an initial entry fee, the lower annual management fees enable assets to compound more effectively over time.

Remember, investors only get to access returns after fees and tax, which determines whether they meet their ultimate objectives. In the same way that spending power is determined by our salary net of taxes – the value proposition of a fund should be based on its ability to drive after-tax outcomes for end-investors.

Key Takeaways:

In summary, when choosing a fund or product to meet your investment objectives look beyond the headline fee figure and dig deeper into the details such as the impact of tax: getting the details right (or wrong) can materially impact all-in costs and accordingly your overall investment returns.

For many investors global share exposure via a NZ PIE fund that has direct holdings offers the most tax-efficient option and the greatest amount of certainty of achieving their goals – along with the least amount of associated cost. PIEs have the added benefit of removing the need to file tax returns or engage the services of expensive accountants.

However, tax is always a complex topic for investing and each individual may have their own unique circumstances that will affect their choices and outcomes.

Nevertheless, the following questions can be a useful starting point for the rapidly growing number of Kiwis who are considering which global investment option would be best for their individual situation:

- Who is the underlying investment manager of the fund, and how likely will this manager deliver on the type of investment I am after?

- What are the total costs (fees, plus taxes, plus transaction costs) of this option – how does this total all-in cost compare with other options?

- Are there are any other costs in terms of time or expertise that would be required to discharge the tax burden associated with this investment option?

At InvestNow, we have a wide range of global share options to meet a variety of tax situations. Click here to see our range of funds and optimise your after-tax investment portfolio today.

Disclaimer: InvestNow is not a financial advisor and therefore we do not offer or provide personalised advice or recommendations. All investing involves risk. We encourage you to read the Product Disclosure Statement (PDS) of any prospective funds and consider seeking financial advice from a licenced provider, before making any investment decisions in any of the products offered on the InvestNow platform. Furthermore, any material relating to tax has been prepared for informational purposes only and is not formal tax advice, nor has it considered your individual tax circumstances.

What has home country bias got to do with investing here? We all know that our market is small and many investment opportunities are not available on the local market . I can’t see why this matter is relevant to the focus of this article.

Endless circle…login to account, don’t want to login to invest, so tap on articles, go to global shares again….login to invest. .etc…..wasting my time

David, apologies … there appears to be an issue with this article when you try and read it on mobile (it appears to be working ok on desktop). We will resolve ASAP.

Regards Mike Heath, GM InvestNow

Hi David, this has been resolved. Apologies once again.

Regards, Mike Heath GM InvestNow

In the comparison table near the end, I think you should add a column for Smartshares TWF. Having your Foundation Series fund as the only PIE fund in the table, when a well established alternative exists, makes the article seem a bit like an ad.

Thanks for the feedback Paul. We are going to enhance this sort of comparison content for funds like these, which will include expanding on the scenarios/options to make them more useful.

Regards Mike Heath, GM InvestNow.

It would be nice to see another comparision for 49k invested to see how the ‘de minimis’ exemption comes into play.

Thanks Steve. I’ll include this request in our planned enhancements to such comparisons we make.

Regards, Mike Heath. GM InvestNow

It would appear that the overall impact reduces as one’s Marginal Tax rate reduces. For a Family Trust as the investor distributing income to a number of beneficiaries all on a 17.5% tax rate the relative advantage almost disappears.

Hi Geoff, yes investors on higher marginal tax rates will stand to gain the most in terms of tax savings relative to a PIE fund’s maximum 28% PIR rate. Notwithstanding this though, investors on a marginal rate of 17.5% would not necessarily be worse off within a well-structured PIE fund either, as they would also likely be on the 17.5% PIR rate as well – if that is the case then they wouldn’t be charged at any higher of a rate within a PIE and if anything could also perhaps be eligible to be charged at a lower rate at the 10.5% PIR rate if they earned $14,000 or less in non-PIE income in any of the last two years!

Furthermore, the importance of tax efficient portfolio construction still stands regardless of PIR rates, as investors on any PIR rate can still benefit from a well-structured PIE that minimises / eliminates any tax leakage. As evidenced in the article, an inefficiently structured fund such as a NZ investor investing into a fund that achieves their global shares exposure through an Australian Unit Trust (AUT) can suffer ~0.30% in tax leakage (which essentially equates to an additional 0.30% fee each year), whereas an NZ investor that is exposed to the same underlying global shares assets but through a PIE that holds the shares directly can eliminate this tax leakage completely – meaning the end-investor gets benefit from more of the fund’s performance rather than have this be lost to some overseas tax office!

Regards, Jason Choy

InvestNow Chief Investment & Product Officer

It looks like the 10.5% can only be claimed by testamentary trusts (not the average family trust) – per IRD guidance in IR860 at top of page 55 “Trustees – PIRs available for trustees to elect”. Are all InvestNow PIE funds multi-rate PIEs? That is, PIEs that pay tax on investment income based on the tax rates of their investors, rather than at a flat rate of 28%. How do the underlying Vanguard funds tax InvestNow to ensure the benefit of a trust’s 17.5% PIR pass all the way through to the taxation by the underlying fund of InvestNow? That is, avoiding leakage at the underlying fund level.

Hi Matt

I am confused. Our P. I.R is 17.5%. As with many people the the value of their Pie investments have decreased. My accountant has just informed me that my loss cannot be claimed as a tax deduction as all Pie Investments are taxed at 25%. What am I missing?

Hi

Firstly apologies for my tardiness in responding to this comment. PIE funds are taxed at your PIR rate ie not at a flat 25%. Here is an earlier article on PIE funds and PIE tax – hope that helps answer some of your questions.

Regards, Mike Heath

GM InvestNow

Aren’t PIE funds forced to use the FDR method? i.e. pay tax on an assumed 5% return even when the actual return is less than 5%, or negative? This seems like a major drawback that is not mentioned in this article.

Hi Brian. Firstly, apologies for being so tardy in responding to your question (a technical issue resulted in us not being alerted to comments having been posted by customers on our website).

Yes that is correct that PIE funds that invest into international shares are taxed based on a deemed return of 5% each year (FDR method), irrespective of whether the underlying investments returned more than 5% or less than 5% in any one year.

However, based off the historic performance of major global market indices, a rough average is that one-third of the time global markets have returned less than 5% a year. This means that two-thirds of the time the FDR method minimises your tax obligations for the year.

Contrast this with investing directly into the same international shares but not through a PIE structure. While an investor could elect to use the CV tax method in underperforming years (roughly one-third of the time) to minimise their tax obligations, the majority of the time (roughly two-thirds) the investor will be electing the same FDR method (capping gains at 5%) as the PIE fund.

The difference though is that the PIE fund will cap the applicable tax rate at 28% (maximum PIR), while a direct investor choosing the same FDR method will be taxed at a maximum rate of 39%. The up to 0.55% of tax savings on offer each and every year with the PIE fund (5% x 28% = 1.40% p.a. tax bill) versus going direct (5% x 39% = 1.95% p.a. tax bill) in many cases is a worthy trade-off versus the chance of investing directly and seeing the underlying investments consistently do well each year, resulting in a higher tax bill than necessary in most years.

Regards, Jason Choy, Senior Portfolio Manager InvestNow