TAHITO on InvestNow

The TAHITO Te Tai o Rehua Fund is an Australasian equities fund on the InvestNow platform.

Learn more about TAHITO, their investment options available to InvestNow customers, plus access their latest news & updates.

TAHITO is one of 30+ specialist investment managers that have partnered with InvestNow.

How TAHITO describe themselves:

Manahua te Tapu o Tahito-mātauranga – Empowering ancestral knowledge

TAHITO is a Māori indigenous ethical and sustainable investment offering which is focused on rebuilding the connection between people and the environment. It is an indigenous contribution towards a new global story of diversity, equity and sustainability.

As awareness in climate change and sustainability intensifies, the world is increasingly looking toward indigenous cultures, values and sustainability practices for solutions. We believe TAHITO to be a world-first in using indigenous knowledge to provide these solutions within the context of financial services.

The first fund we have made available through TAHITO is the TAHITO Te Tai ō Rehua Fund (Te Tai o Rēhua is the indigenous name for the Tasman sea). The Fund provides actively managed exposure to a portfolio of primarily New Zealand and Australian companies that have been selected in accordance with the TAHITO investment philosophy. The Fund aims to generate a better return than the benchmark over the medium to long term.

Underpinning the TAHITO Te Tai ō Rehua Fund is the TAHITO Te Kōwhiringa Tapu (or Careful Selection) investment process for measuring companies. The process combines Māori ancestral knowledge with sophisticated environmental, social and governance (ESG) data capture technology and strong financial analysis. In applying this investment approach, we are endeavouring to select New Zealand and Australian companies that best display collective and relational ethics and behaviours derived from indigenous Māori culture and ancestry.

The TAHITO Te Tai ō Rehua Fund is managed by Clarity Funds Management, in partnership with TAHITO Limited as the investment adviser. Clarity Funds has over $650mn in client funds under management, while Investment Services Group (the parent company to both Clarity Funds and TAHITO Limited) has over $5bn in client funds under management.

TAHITO investment options

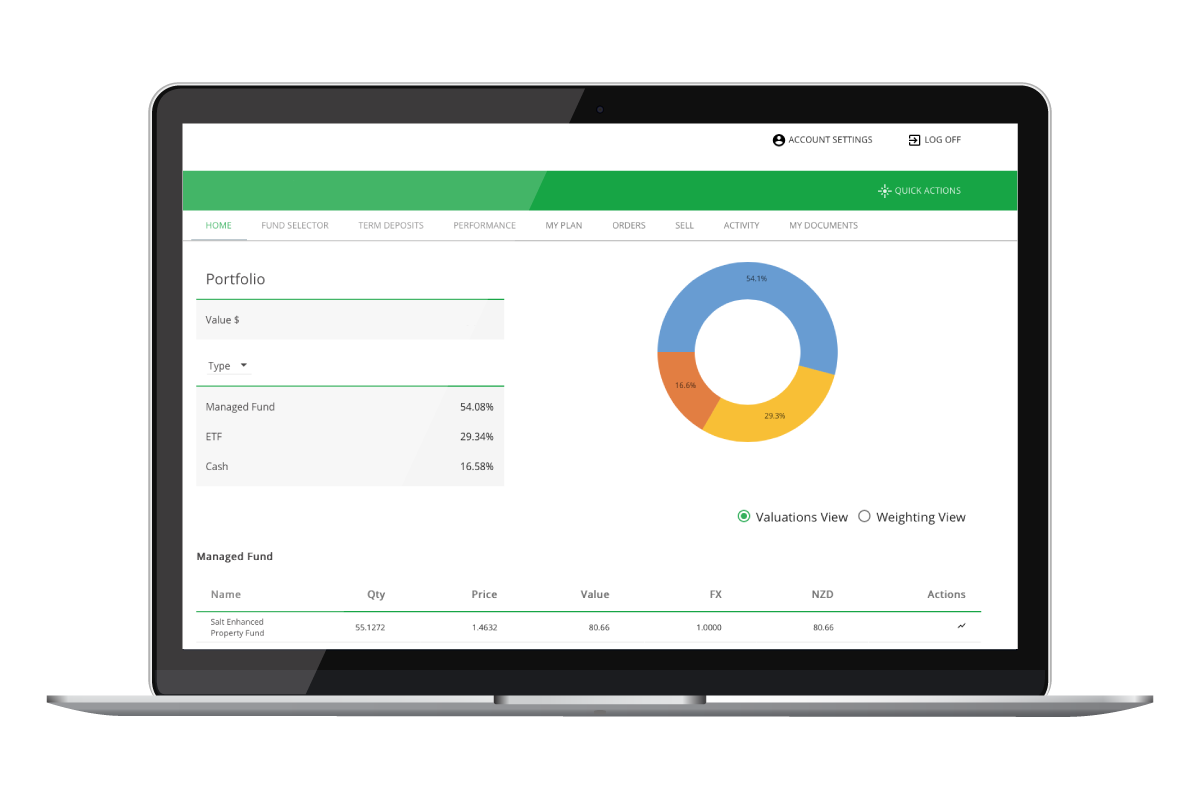

Below is the range of investment options from TAHITO that are available through the InvestNow platform. To see a full range of managed fund investment options available on InvestNow, please click here.

Using the table below:

To view more information about a fund and to view a Product Disclosure Statement, scroll to the right. To see a fund’s description on desktop, hover over the fund name. To see a fund’s description on mobile, click ‘read description’.

Important Information

- For a description of what each column heading means, please click here.

- The performance figures are for periods ending 31 March 2025.

- Past performance is not a guarantee of future returns. Returns are after fees, before tax and denominated in NZD. Performance figures over 1 year are annualised.

- Performance data is sourced from Morningstar or from the underlying fund manager.

- For any funds offered within the InvestNow KiwiSaver Scheme, the fund performance figures outlined are for the underlying funds that it invests into.

- Please note, the PDS fee is the manager’s estimated total annual fund charge as stated in the Product Disclosure Statement (PDS) for this fund. The Quarterly Fund Update (QFU) Fee is the latest actual total annual fund charge reported by the fund for its most recent financial year, as stated in the fund’s most recent Quarterly Fund Update. Both figures include any applicable GST as well as any performance-based fees if applicable.

- Transaction-based charges may also apply when you buy or sell a fund, which could include buy/sell spreads (as outlined in the buy/sell spread column), entry/exit fees (denoted by * in the buy/sell spread column), or swing pricing adjustments (denoted by ** in the buy/sell spread column). Please see the PDS for full details on the charges that can apply.

- Managed funds in New Zealand must have a standard risk indicator. The risk indicator is designed to help investors understand the uncertainties both for loss and growth that may affect their investment. You can compare funds using the risk indicator – 1 is lower risk and potentially lower returns, while 7 is higher risk and potentially higher returns.

Latest news & updates from TAHITO

Te Hauwha Tuarua | 1st Quarter Report

Te Hauwha Tuarua | 1st Quarter Report

While this report covers the first quarter of 2025 and last month (March), major market events have occurred in the first couple of weeks of April. We have begun our report with some information on these developments, given their significance for investors.

Te Hauwha Tuarua | 4th Quarter Report

Te Hauwha Tuarua | 4th Quarter Report

February 2025

Te Tai o Rehua Fund underperformed the benchmark for the month of December returning -2.1%, -0.4% behind the benchmark.

Te Hauwha Tuarua | 3rd Quarter Report

Te Hauwha Tuarua | 3rd Quarter Report

October 2024

Te Tai o Rehua Fund showed a subdued performance for the month of September returning 0.4%, which was -1.6% behind the benchmark of 2.0%.

The TAHITO Te Tai o Rehua Fund has been recognised as a ‘Sustainable Plus’ product under RIAA’s new initiative

The TAHITO Te Tai o Rehua Fund has been recognised as a ‘Sustainable Plus’ product under RIAA’s new initiative

8 August 2024

Kua whiwhi a TAHITO te Pōkaitahi Toitū Kahuriangi o RIAA mo Te TAHITO Tai o Rehua Tahua. We are pleased to announce that the TAHITO Te Tai o Rehua Fund has been recognised as a ‘Sustainable Plus’ product under the Responsible Investment Association Australasia (RIAA) new sustainability classifications initiative.

Te Hauwha Tuarua | 2nd Quarter Report

Te Hauwha Tuarua | 2nd Quarter Report

In the June quarter, the RBNZ maintained the Official Cash Rate at 5.5%, a level it has held for the past year.

TAHITO welcomes international philanthropic investor

TAHITO welcomes international philanthropic investor

23 April 2024

We welcome GEM and their client The Christensen Fund to our TAHITO whānau.

Te Hauwha Tuarua | 1st Quarter Report

Te Hauwha Tuarua | 1st Quarter Report

In the March 2024 quarter, the NZ share market was influenced by the potential peak in rising costs as well as easing labour market pressures, which offered some optimism for NZ businesses.

Te Hauwha Tuarua | 4th Quarter Report

Te Hauwha Tuarua | 4th Quarter Report

Aotearoa financial markets were strong in December with the NZX 50 up 4% fuelled by declining interest rates, which also drove good returns for bonds.

Te Hauwha Tuarua | 3rd Quarter Report

Te Hauwha Tuarua | 3rd Quarter Report

Our Te Tai o Rehua Fund produced a negative return for third quarter, down -3.8% which was 0.6% below the benchmark. Performance for

the quarter was largely influenced by performance in September, in which the Fund was down -4.2%.

Te Hauwha Tuarua | 2nd Quarter Report

Te Hauwha Tuarua | 2nd Quarter Report

Our Te Tai o Rehua Fund showed further positive performance for the month of June, returning 1.9% which was 0.2% above benchmark. The Fund has delivered a strong performance for the quarter from 1 April to 30 June, returning 4.2% which was 2.1% above benchmark.

TAHITO wins “Best Ethical Retail Investment Fund Provider” in the Mindful Money awards

Kei te tino whakaiti a TAHITO ki te whakaingoatia hei te toa i roto i te wahanga ‘Best Ethical Retail Investment Provider’ o nga tohu Mindful Money. TAHITO is very humbled to be named the winner in the ‘Best Ethical Retail Investment Provider’ Category of the Mindful Money awards.

TAHITO named finalist in the Mindful Money awards

E harikoa ana a TAHITO ki te whakaingoatia hei whiringa toa i te wahanga ‘Kaiwhakarato Haumi Taonga Matatika Pai’ mo nga tohu Mindful Money.

Ka rere a TAHITO ki Kānata – TAHITO travels to Canada

TAHITO is a unique company that manages client wealth using an…

TAHITO appointment of new Chair.

We are pleased to announce that June McCabe has joined as Chair of the Board of TAHITO Limited…

He Pōkaitahi Haepapa Haumi – Responsible Investment Certification

The TAHITO Te Tai o Rehua Fund has received Responsible Investment Certification status from the Responsible Investment Association Australasia (RIAA)…