InvestNow News – 12th February – Harbour Asset Management – Harbour Outlook: Choppy markets…but with earnings upside

Article written by Harbour Team, Harbour Asset Management – 9th February 2021

The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed interest, credit and equity markets.

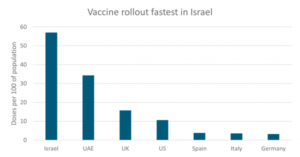

- The COVID-19 vaccine rollout gathered steam during January. Israel, who has given the initial jab to a third of its population, is showing positive early signs. The vaccine rollout has not been as smooth in all jurisdictions, with Europe and the US especially encountering teething issues.

- The US earnings season has shown broad-based strength. At the time of writing, 277 of companies in the S&P 500 had reported earnings, with 79% of companies reporting earnings in line or above consensus expectations.

- New Zealand economic data continued to beat conservative consensus expectations. Stronger inflation and employment data has seen the market no longer price in future interest rate cuts.

Key developments

January was a volatile month. The first half of the month was dominated by expectations of stronger economic activity with long bond yields increasing (New Zealand Government 10-year bond yields up from 0.99% to 1.12% over the month), and stock markets moving higher as investors rotated capital into more cyclical parts of the market. The second half saw stock markets fall as worsening COVID-19 waves hit near-term growth, US fiscal stimulus was slower than expected and US equity market liquidity was tested.

Against this backdrop, global equities (MSCI AC World index) fell -0.5% in USD over the month after being up as much as 3.6% in the middle of the month. New Zealand and Australian equities followed a similar trend but closed the month slightly up, both returning 0.3%. The better-than-expected economic data in New Zealand, combined with a more upbeat economic tone globally, has seen yields increase in New Zealand, leading to a -0.4% decline in the Bloomberg NZ Bond Composite 0+Year Index.

Approved and highly effective COVID-19 vaccines continue to allow markets to see a path to normalcy despite ongoing mobility restrictions and some uncertainty about the speed of vaccine deployment. Global economic activity has suffered because of greater mobility restrictions in many developed economies since November but an end is in sight. Despite some initial vaccine supply constraints in continental Europe, analysts are expecting most developed economies to reach herd immunity (or population immunity), defined as vaccination coverage of 63% (assuming a rate of spread, or R-nought of 2.7 for each infected person), by the end of Q2 or Q3 2021.

The New Zealand economic recovery continues to impress. The labour market has proved exceptionally resilient to the expiry of the wage subsidy scheme with the Q4 unemployment rate unexpectedly dropping to 4.9%, driven by employment gains. House prices increased a whopping 17% in 2020 vs. the Reserve Bank of New Zealand (RBNZ) revised expectations of a 10% gain. Consistent with the improved state of the economy and strength in the construction sector, core inflation increased in Q4 with the RBNZ measure printing at 1.8% y/y from 1.7% in Q3. This measure is broadly consistent with the Stats NZ core inflation measures (trimmed mean and weighted median) that sit at the mid-point of the RBNZ’s 1-3% target range. Credit growth outside of housing, however, remains low and the tourism industry continues to be vulnerable to ongoing border closure due to insufficient vaccine availability.

What to watch

All eyes are on Israel as the country, at the time of writing, had already supplied a third of its population with an initial COVID-19 vaccine jab. With the circulation of new variants raising doubts on the true efficacy of vaccines, the real data from Israel will be watched with interest by the rest of the world. This will help set market expectations on the timing of broader reopening of economies and trade. So far, the results look strong as the country has begun to observe a falling number of cases, a lower positive testing rate and a lower number of severe cases as their vaccine rollout takes flight. Further, the real observed efficacy rate of 92% reported in Israel for the Pfizer/BioNTech vaccine, while below the 95% shown in clinical trials, has surprised to the upside when considering the evolution of the virus.

Source: Bloomberg. Measures doses per 100 of population, noting the current approved vaccines require two doses. Data to 04/02/2021.

Market outlook and positioning

While a recovery in global economic activity is well underway it is difficult to determine the timing and shape of the recovery given the trickiness of COVID-19. In our view investors will move their focus from the number of COVID-19 cases to the rate and efficacy of vaccinations. We must be aware of the potential for higher inflation as activity increases but, for now, higher inflation is not a major risk to market sentiment as central banks have stated they will tolerate higher than average inflation levels in the near term. Higher growth and inflation expectations have already led to steeper interest rate yield curves, with long-term bond yields trending higher while central banks anchoring short term rates. This is likely to be a tension that markets grapple with in 2021, especially if the strength in data surprises continues, as it has in New Zealand, evidenced most recently by strong broad based employment data.

Within fixed Interest portfolios, we have held a fairly consistent strategy in portfolios over the last 3 months. This has centred around a view that a recovering economy would mean the RBNZ would not cut the Official Cash Rate (OCR) from +0.25% and that long-term bond yields would rise. New Zealand bonds had been quite expensive relative to global bonds, so this reinforced our view. This view also suggested that inflation-indexed bonds were very cheap and could outperform. These views have played out, with New Zealand 10-year government stock yields up 0.9% from the low levels seen in September. We think the recovery will continue and become more apparent globally, with Australia, the United States and then the Eurozone following, in that order.

With bonds having already travelled this far, we are making some adjustments to where our positioning is emphasized. The sell-off in New Zealand bonds, while other markets have moved less, has reduced the extent of our overvaluation and so we have reduced this position. In inflation-indexed bonds, we are shifting emphasis towards 5- and 10-year maturities, which are more sensitive to near term inflation pressure than 15 and 20-year maturities. We are short duration in long-dated bonds and these have moved the most. We are now shifting our short position towards the 3-year sector, as the market still prices in only modest OCR hikes over the next 3 years. While a lot of water is still to go under the bridge, our judgement is that there is a reasonable likelihood that the RBNZ starts hiking the OCR in 2022. If we remind ourselves that estimates of a neutral OCR rate are a little over 2%, we could be facing quite sizable hikes over the next 2-3 years under the more bullish scenarios.

Within our equity growth portfolios, we remain aware that earnings upside potential may provide the real driver to stock market returns. Our research suggests that there is potential for earnings forecasts to be increased as companies unwind COVID-19 related caution on revenue growth and COVID-related costs in the near term, and benefit from business restructuring changes (e.g., via business processes, automation, robotics) forced upon them by COVID-19 over the medium term. The US stock market reporting season is already showing better-than-expected profit results driven by forced structural change – something we see as highly possible in New Zealand and Australia.

The portfolios are overweight versus their benchmarks in selected quality growth companies in the healthcare, information technology and consumer staples sectors, where the potential rate and sustainability of growth may not be fully reflected in share prices. The portfolios have selected investments in cyclical growth stocks in the financials and materials sectors that may benefit from the economic cyclical and structural change. Conversely, the portfolios are underweight the New Zealand consumer discretionary and energy sectors where disruption risk remains high, and the utilities, communications and real estate sectors where valuations are high relative to their potential growth.

Within the Active Growth Fund, we had a strong bias towards “stay at home” stocks during 2020 which served investors well and we recognise that this reflationary environment can potentially benefit some cyclical stocks that were left behind in 2020. As a result, the portfolio has added to more cyclical exposures with the ballast of the portfolio remaining in stocks that will benefit from long-term structural trends. Overall, the fund is modestly underweight share markets.

The Income Fund strategy has continued with its slightly underweight equities position and has hedged all of its interest rate risk, with the exception of holding inflation-indexed bonds. Equity exposure includes small weightings in Europe and China, where global recovery themes can play out. Conversely we are underweight in New Zealand, where rising interest rates may become more of a challenge to equity valuations. While liquidity is very supportive of asset prices at present, we are mindful of investors anticipating a change, even though that may be some time away. The modestly more cautious approach in the Income Fund’s strategy reflects our broader investment style, where we are mindful of maintaining capital stability for investors.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

InvestNow News – 12th February – Harbour Asset Management – Harbour Outlook: Choppy markets…but with earnings upside

Article written by Harbour Team, Harbour Asset Management – 9th February 2021

The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed interest, credit and equity markets.

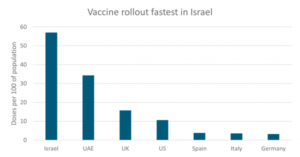

- The COVID-19 vaccine rollout gathered steam during January. Israel, who has given the initial jab to a third of its population, is showing positive early signs. The vaccine rollout has not been as smooth in all jurisdictions, with Europe and the US especially encountering teething issues.

- The US earnings season has shown broad-based strength. At the time of writing, 277 of companies in the S&P 500 had reported earnings, with 79% of companies reporting earnings in line or above consensus expectations.

- New Zealand economic data continued to beat conservative consensus expectations. Stronger inflation and employment data has seen the market no longer price in future interest rate cuts.

Key developments

January was a volatile month. The first half of the month was dominated by expectations of stronger economic activity with long bond yields increasing (New Zealand Government 10-year bond yields up from 0.99% to 1.12% over the month), and stock markets moving higher as investors rotated capital into more cyclical parts of the market. The second half saw stock markets fall as worsening COVID-19 waves hit near-term growth, US fiscal stimulus was slower than expected and US equity market liquidity was tested.

Against this backdrop, global equities (MSCI AC World index) fell -0.5% in USD over the month after being up as much as 3.6% in the middle of the month. New Zealand and Australian equities followed a similar trend but closed the month slightly up, both returning 0.3%. The better-than-expected economic data in New Zealand, combined with a more upbeat economic tone globally, has seen yields increase in New Zealand, leading to a -0.4% decline in the Bloomberg NZ Bond Composite 0+Year Index.

Approved and highly effective COVID-19 vaccines continue to allow markets to see a path to normalcy despite ongoing mobility restrictions and some uncertainty about the speed of vaccine deployment. Global economic activity has suffered because of greater mobility restrictions in many developed economies since November but an end is in sight. Despite some initial vaccine supply constraints in continental Europe, analysts are expecting most developed economies to reach herd immunity (or population immunity), defined as vaccination coverage of 63% (assuming a rate of spread, or R-nought of 2.7 for each infected person), by the end of Q2 or Q3 2021.

The New Zealand economic recovery continues to impress. The labour market has proved exceptionally resilient to the expiry of the wage subsidy scheme with the Q4 unemployment rate unexpectedly dropping to 4.9%, driven by employment gains. House prices increased a whopping 17% in 2020 vs. the Reserve Bank of New Zealand (RBNZ) revised expectations of a 10% gain. Consistent with the improved state of the economy and strength in the construction sector, core inflation increased in Q4 with the RBNZ measure printing at 1.8% y/y from 1.7% in Q3. This measure is broadly consistent with the Stats NZ core inflation measures (trimmed mean and weighted median) that sit at the mid-point of the RBNZ’s 1-3% target range. Credit growth outside of housing, however, remains low and the tourism industry continues to be vulnerable to ongoing border closure due to insufficient vaccine availability.

What to watch

All eyes are on Israel as the country, at the time of writing, had already supplied a third of its population with an initial COVID-19 vaccine jab. With the circulation of new variants raising doubts on the true efficacy of vaccines, the real data from Israel will be watched with interest by the rest of the world. This will help set market expectations on the timing of broader reopening of economies and trade. So far, the results look strong as the country has begun to observe a falling number of cases, a lower positive testing rate and a lower number of severe cases as their vaccine rollout takes flight. Further, the real observed efficacy rate of 92% reported in Israel for the Pfizer/BioNTech vaccine, while below the 95% shown in clinical trials, has surprised to the upside when considering the evolution of the virus.

Source: Bloomberg. Measures doses per 100 of population, noting the current approved vaccines require two doses. Data to 04/02/2021.

Market outlook and positioning

While a recovery in global economic activity is well underway it is difficult to determine the timing and shape of the recovery given the trickiness of COVID-19. In our view investors will move their focus from the number of COVID-19 cases to the rate and efficacy of vaccinations. We must be aware of the potential for higher inflation as activity increases but, for now, higher inflation is not a major risk to market sentiment as central banks have stated they will tolerate higher than average inflation levels in the near term. Higher growth and inflation expectations have already led to steeper interest rate yield curves, with long-term bond yields trending higher while central banks anchoring short term rates. This is likely to be a tension that markets grapple with in 2021, especially if the strength in data surprises continues, as it has in New Zealand, evidenced most recently by strong broad based employment data.

Within fixed Interest portfolios, we have held a fairly consistent strategy in portfolios over the last 3 months. This has centred around a view that a recovering economy would mean the RBNZ would not cut the Official Cash Rate (OCR) from +0.25% and that long-term bond yields would rise. New Zealand bonds had been quite expensive relative to global bonds, so this reinforced our view. This view also suggested that inflation-indexed bonds were very cheap and could outperform. These views have played out, with New Zealand 10-year government stock yields up 0.9% from the low levels seen in September. We think the recovery will continue and become more apparent globally, with Australia, the United States and then the Eurozone following, in that order.

With bonds having already travelled this far, we are making some adjustments to where our positioning is emphasized. The sell-off in New Zealand bonds, while other markets have moved less, has reduced the extent of our overvaluation and so we have reduced this position. In inflation-indexed bonds, we are shifting emphasis towards 5- and 10-year maturities, which are more sensitive to near term inflation pressure than 15 and 20-year maturities. We are short duration in long-dated bonds and these have moved the most. We are now shifting our short position towards the 3-year sector, as the market still prices in only modest OCR hikes over the next 3 years. While a lot of water is still to go under the bridge, our judgement is that there is a reasonable likelihood that the RBNZ starts hiking the OCR in 2022. If we remind ourselves that estimates of a neutral OCR rate are a little over 2%, we could be facing quite sizable hikes over the next 2-3 years under the more bullish scenarios.

Within our equity growth portfolios, we remain aware that earnings upside potential may provide the real driver to stock market returns. Our research suggests that there is potential for earnings forecasts to be increased as companies unwind COVID-19 related caution on revenue growth and COVID-related costs in the near term, and benefit from business restructuring changes (e.g., via business processes, automation, robotics) forced upon them by COVID-19 over the medium term. The US stock market reporting season is already showing better-than-expected profit results driven by forced structural change – something we see as highly possible in New Zealand and Australia.

The portfolios are overweight versus their benchmarks in selected quality growth companies in the healthcare, information technology and consumer staples sectors, where the potential rate and sustainability of growth may not be fully reflected in share prices. The portfolios have selected investments in cyclical growth stocks in the financials and materials sectors that may benefit from the economic cyclical and structural change. Conversely, the portfolios are underweight the New Zealand consumer discretionary and energy sectors where disruption risk remains high, and the utilities, communications and real estate sectors where valuations are high relative to their potential growth.

Within the Active Growth Fund, we had a strong bias towards “stay at home” stocks during 2020 which served investors well and we recognise that this reflationary environment can potentially benefit some cyclical stocks that were left behind in 2020. As a result, the portfolio has added to more cyclical exposures with the ballast of the portfolio remaining in stocks that will benefit from long-term structural trends. Overall, the fund is modestly underweight share markets.

The Income Fund strategy has continued with its slightly underweight equities position and has hedged all of its interest rate risk, with the exception of holding inflation-indexed bonds. Equity exposure includes small weightings in Europe and China, where global recovery themes can play out. Conversely we are underweight in New Zealand, where rising interest rates may become more of a challenge to equity valuations. While liquidity is very supportive of asset prices at present, we are mindful of investors anticipating a change, even though that may be some time away. The modestly more cautious approach in the Income Fund’s strategy reflects our broader investment style, where we are mindful of maintaining capital stability for investors.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.