How to be a better-than-average investor

Article written by InvestNow – 17 January 2024

“Buy low, sell high” is the standard advice for generating capital returns on investment assets, however, this advice doesn’t provide practical guidance on how to actually spot the ideal buying and selling opportunities.

In today’s fast-moving and increasingly volatile market, it’s a full-time job attempting to time the market, and even still it’s a mighty difficult task that even the experts get wrong from time to time…

Managing volatility the DCA way

Volatility is and will always be a feature of investment markets, especially with higher-risk assets like equities and cryptocurrencies. While the degree of market uncertainty varies over time, investors must make decisions based on their own circumstances and risk tolerance, regardless of background conditions.

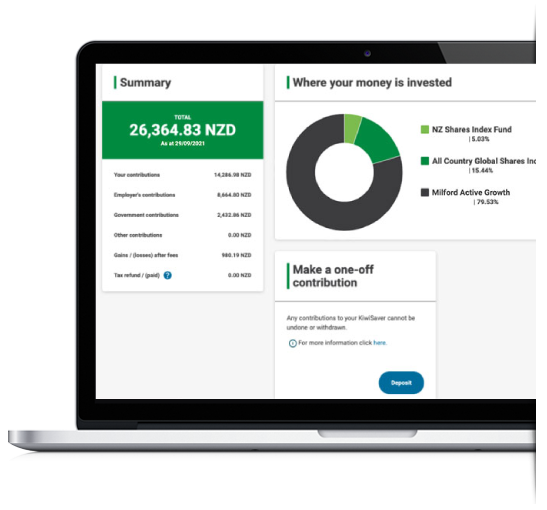

Dollar cost averaging (DCA) is an investment strategy where an investor regularly invests a fixed amount of money into a particular investment over time, regardless of the investment’s price fluctuations. This strategy aims to reduce the impact of short-term market volatility by spreading the investment purchases across different market conditions. Dollar cost averaging is commonly used by retail investors to invest in managed funds in New Zealand, offering several benefits.

- Mitigating market timing risk: Dollar cost averaging reduces the risk of making poor investment decisions based on short-term market fluctuations. It eliminates the need to time the market, which can be challenging for even seasoned investors.

- Potential for lower average purchase price: When markets are volatile and prices are low, the fixed investment amount buys more shares or units of the managed fund. Conversely, when prices are high, the fixed investment amount buys fewer shares. Over time, this strategy can result in a lower average purchase price per share, potentially enhancing long-term returns.

- Disciplined approach to investing: Dollar cost averaging encourages discipline by ensuring regular investments, regardless of market sentiment or investor emotions. It helps avoid making impulsive investment decisions based on market highs or lows.

- Averaging out market volatility: Dollar cost averaging helps smooth out the impact of market volatility over the lifetime of your investment. Rather than making a lump-sum investment, which could be significantly affected by the market’s immediate ups and downs.

The proof is in the pudding

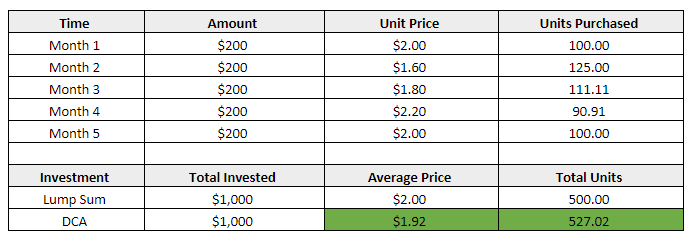

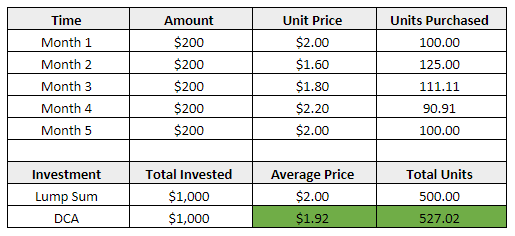

Ignoring buy-sell spreads, and assuming some variation in unit pricing over a 5-month period, if two investors both had $1000 to invest in the same asset, and one investor invested 100% of the $1000 in a single transaction in month 1, and the other investor invested 20% ($200) each month from month 1 to month 5, the outcome would be as follows:

Now, imagine the above scenario on a bigger scale, over a longer time period. The compounding effects of dollar cost averaging has the potential to have a big impact on the value of an investor’s portfolio.

Of course, if instead, the fund price rose continuously each month in the scenario above, then the lump-sum investment would outperform the DCA method. Equally, however, if the fund price fell continuously, then the lump-sum investment would underperform comparatively.

To sum it all up

Given volatility continues to be the norm in financial markets, DCA remains an effective way to manage risk over time and influence good, disciplined investment habits such as avoiding emotion-based reactions to market volatility.

It’s worth noting that while dollar cost averaging can be an effective strategy, it doesn’t guarantee profits or protect against losses. It’s essential to conduct thorough research on the managed funds you’re considering, and review their historical performance, fees, and the expertise of the fund managers. Consulting with a financial advisor can also provide personalised guidance tailored to your financial goals and risk tolerance.

How to be a better-than-average investor

Article written by InvestNow – 17 July 2023

“Buy low, sell high” is the standard advice for generating capital returns on investment assets, however, this advice doesn’t provide practical guidance on how to actually spot the ideal buying and selling opportunities.

In today’s fast-moving and increasingly volatile market, it’s a full-time job attempting to time the market, and even still it’s a mighty difficult task that even the experts get wrong from time to time…

Managing volatility the DCA way

Volatility is and will always be a feature of investment markets, especially with higher-risk assets like equities and cryptocurrencies. While the degree of market uncertainty varies over time, investors must make decisions based on their own circumstances and risk tolerance, regardless of background conditions.

Dollar cost averaging (DCA) is an investment strategy where an investor regularly invests a fixed amount of money into a particular investment over time, regardless of the investment’s price fluctuations. This strategy aims to reduce the impact of short-term market volatility by spreading the investment purchases across different market conditions. Dollar cost averaging is commonly used by retail investors to invest in managed funds in New Zealand, offering several benefits.

- Mitigating market timing risk: Dollar cost averaging reduces the risk of making poor investment decisions based on short-term market fluctuations. It eliminates the need to time the market, which can be challenging for even seasoned investors.

- Potential for lower average purchase price: When markets are volatile and prices are low, the fixed investment amount buys more shares or units of the managed fund. Conversely, when prices are high, the fixed investment amount buys fewer shares. Over time, this strategy can result in a lower average purchase price per share, potentially enhancing long-term returns.

- Disciplined approach to investing: Dollar cost averaging encourages discipline by ensuring regular investments, regardless of market sentiment or investor emotions. It helps avoid making impulsive investment decisions based on market highs or lows.

- Averaging out market volatility: Dollar cost averaging helps smooth out the impact of market volatility over the lifetime of your investment. Rather than making a lump-sum investment, which could be significantly affected by the market’s immediate ups and downs.

The proof is in the pudding

Ignoring buy-sell spreads, and assuming some variation in unit pricing over a 5-month period, if two investors both had $1000 to invest in the same asset, and one investor invested 100% of the $1000 in a single transaction in month 1, and the other investor invested 20% ($200) each month from month 1 to month 5, the outcome would be as follows:

Now, imagine the above scenario on a bigger scale, over a longer time period. The compounding effects of dollar cost averaging has the potential to have a big impact on the value of an investor’s portfolio.

Of course, if instead, the fund price rose continuously each month in the scenario above, then the lump-sum investment would outperform the DCA method. Equally, however, if the fund price fell continuously, then the lump-sum investment would underperform comparatively.

To sum it all up

Given volatility continues to be the norm in financial markets, DCA remains an effective way to manage risk over time and influence good, disciplined investment habits such as avoiding emotion-based reactions to market volatility.

It’s worth noting that while dollar cost averaging can be an effective strategy, it doesn’t guarantee profits or protect against losses. It’s essential to conduct thorough research on the managed funds you’re considering, and review their historical performance, fees, and the expertise of the fund managers. Consulting with a financial advisor can also provide personalised guidance tailored to your financial goals and risk tolerance.