Investing Success: Why Men and Women Invest More Alike Than You Think

Article written by Jason Choy, InvestNow Senior Portfolio Manager – 28th March 2025

When it comes to investing, do men and women really approach it differently?

An InvestNow survey of 700 customers has revealed some key insights in the way men and women invest – and challenges some common stereotypes.

While conventional wisdom often highlights gender differences, our data tells a different story: male and female investors share far more similarities than differences.

That said, a few key distinctions emerged – particularly in research habits, ethical investing preferences, and confidence levels.

It’s important to preface that none of the following constitutes financial advice. This is our attempt to highlight similarities and differences between genders, and provide resources to assist women and men based on survey findings.

These are our top takeaways:

1. Men and women invest surprisingly similarly

From the diversity of investments in their portfolio, to the aggressiveness of their investing styles, and how often they invest and review their portfolios – male and female investors on InvestNow demonstrated strikingly similar investing habits.

While there were some differences, many were at the margins, which may be surprising.

Why such consistency? Because good investing is universal. InvestNow champions fundamental Investing Principles, such as prioritising investing early, regular contributions, and risk-aligned diversification – which resonates equally across genders.

Since these core principles guide investors toward aligning with long-term goals (such as saving for retirement), which are often shared across genders, it makes sense that men and women adopt similar investing strategies.

The key takeaway is that investing excellence is gender neutral – success depends on discipline, not demographics.

2. Women research using a greater variety of resources

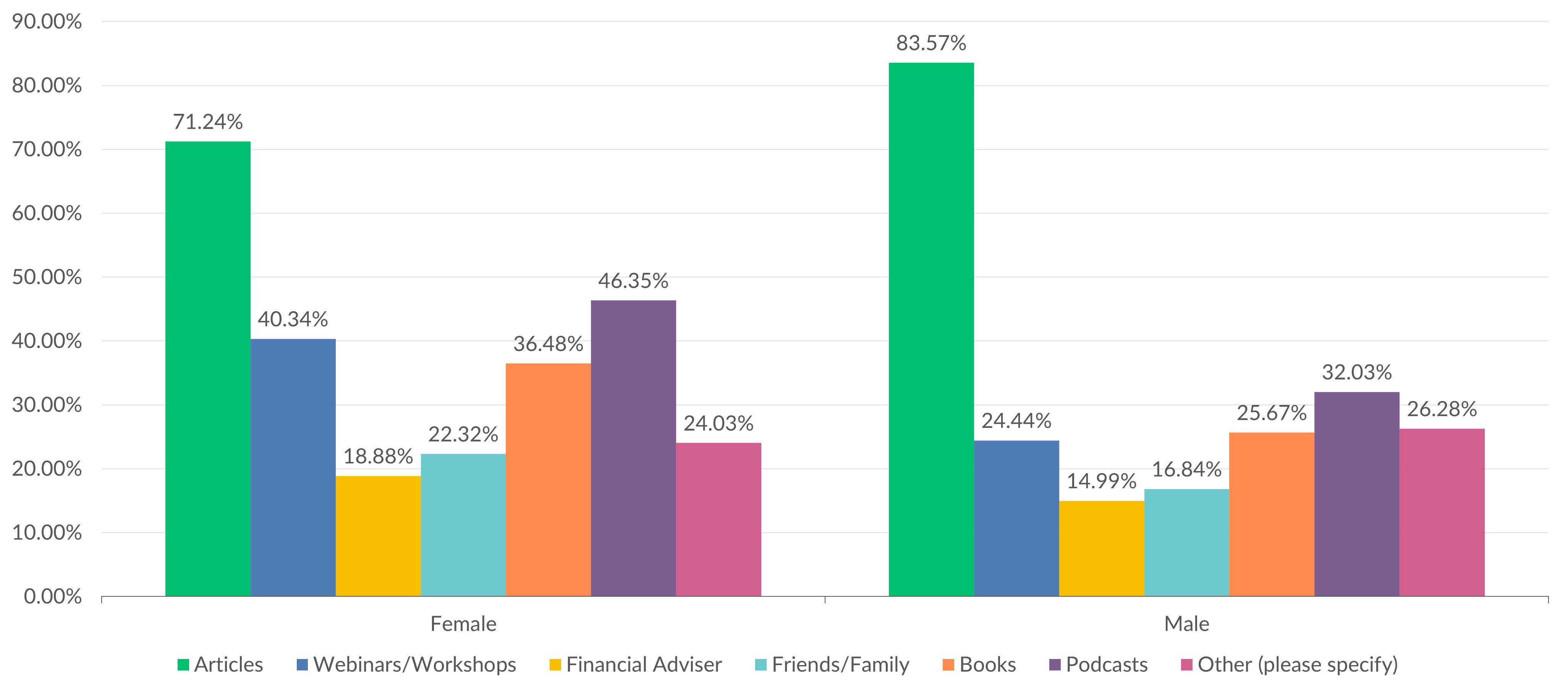

While articles are the most common research tool for women and men, with 71% and 84% using them respectively, women are more likely to review multiple sources when undertaking their investment research.

This included more of every other type of resource we asked about – podcasts, webinars, workshops, a financial adviser, books and friends and family.

Resources Used for Investment Research

Utilising a range of resources is important in forming any investment strategy, and these results suggest women are better at this than men.

If you’re keen to expand your financial knowledge base, here are some resources that you may find valuable.

- MoneyHub: Trusted resource for over half a million New Zealanders covering all things money, including a range of articles and video guides on investing.

- The Happy Saver: Provides personal finance content, including a blog and podcast, that is aimed at helping Kiwis manage their money and build financial security.

- The Curve: A community of more than 70,000 women focused on financial empowerment through podcasts, blogs and all sorts of other resources.

- Girls that Invest: Similar to The Curve, with a focus on younger women (although not exclusively). Girls That Invest is run by Simran Kaur, an EY Entrepreneur of the Year finalist, Forbes 30 Under 30 Honouree, author, Tedx speaker…the list goes on.

- Women’s Wealth Podcast Series: Milford Financial Advisor Joanna Day talks to a variety of guests about the basics of investing. There are only five episodes, all around 15 minutes, making it a really snackable, accessible introduction for relatively new investors.

3. Women prefer ethical investments

ESG stands for Environmental, Social and Governance – a framework used to evaluate a company’s sustainability and ethical impact.

42% of women said they consider the ESG profile of their investments, compared to 27% of men. Only 16% of women said they don’t consider ESG at all, compared to 32% of men for whom it isn’t a factor.

This is one of the clearest gender differences from our survey. And this is because there’s no right or wrong answer here – it is largely a personal choice.

Both ethical investments and more vanilla investments can equally help investors achieve their financial goals. It’s all about defining what that goal is – based on what’s important to you – and tailoring an investment strategy to achieve it.

If responsible investing is something you value, one tool that can help is Mindful Money. You can use it to check the sustainability profile of your KiwiSaver or investment fund, and make a decision accordingly.

4. Women’s confidence catches up to men once they start proactively investing

Around the world, in many different ways, we hear about how men are more financially confident than women.

For example, the confidence gap is commonly spoken about in employment situations. A recent Financial Services Council (FSC) report also highlighted how women tend to feel less confident in investing, despite actually having higher financial literacy than men.

Our survey revealed female InvestNow investors have a similar level of confidence to men, with 71% of women saying they are at least somewhat confident in investing, compared to 74% of men.

This contrasts with the broader surveys like the FSC’s, where 60% of women reported little investing experience. The key lesson here is that investing confidence grows with action.

So how can you take action and build investing confidence?

- Start with KiwiSaver – whether they know it or not, most New Zealanders are already investors through KiwiSaver. Being proactive and reviewing whether your KiwiSaver investments are best suited to meet your goals is an excellent starting point to building your financial capability.

- Branch Out Gradually – Consider building an investment portfolio outside of KiwiSaver. This largely follows the same investing principles but comes with the added benefit of accessing your investments before the age of 65.

- Stay Consistent – By starting small and making regular contributions, your investment portfolio and investing confidence will naturally grow over time.

The path to financial growth isn’t about gender – it’s about building smart habits.

Our goal is to empower investors by showing how investing success is largely within reach by following core investing principles – and it all starts with a simple decision to invest now.

Interested in finding out more? InvestNow’s 10 Investing Principles are designed to help investors form individual strategies with solid foundations in best practices.

Disclaimer:

This information is provided by InvestNow Saving and Investment Service Limited (“InvestNow”). The information and any opinions in this publication are based on sources that InvestNow believes are reliable and accurate. InvestNow, its directors, officers and employees make no representations or warranties of any kind as to the accuracy or completeness of the information contained in this publication and disclaim liability for any loss, damage, cost or expense that may arise from any reliance on the information or any opinions, conclusions or recommendations contained in it, whether that loss or damage is caused by any fault or negligence on the part of InvestNow, or otherwise, except for any statutory liability which cannot be excluded. All opinions and market commentary reflect InvestNow’s judgment on the date of this publication and are subject to change without notice. This disclaimer extends to any entity that may distribute this publication. The information in this publication is not intended to be financial advice for the purposes of the Financial Markets Conduct Act 2013, as amended by the Financial Services Legislation Amendment Act 2019. In particular, in preparing this document, InvestNow did not take into account the investment objectives, financial situation and particular needs of any particular person. Professional investment advice from an appropriately qualified adviser is recommended before making any investment. All Investments involve risk.

Leave A Comment