InvestNow Market Wrap-Up: January 2025

Introducing Mike Taylor, Founder/CIO at Pie Funds, this month’s guest author of the InvestNow Market Wrap-Up.

Beyond the Magnificent 7: Is 2025 the Year of Market Expansion?

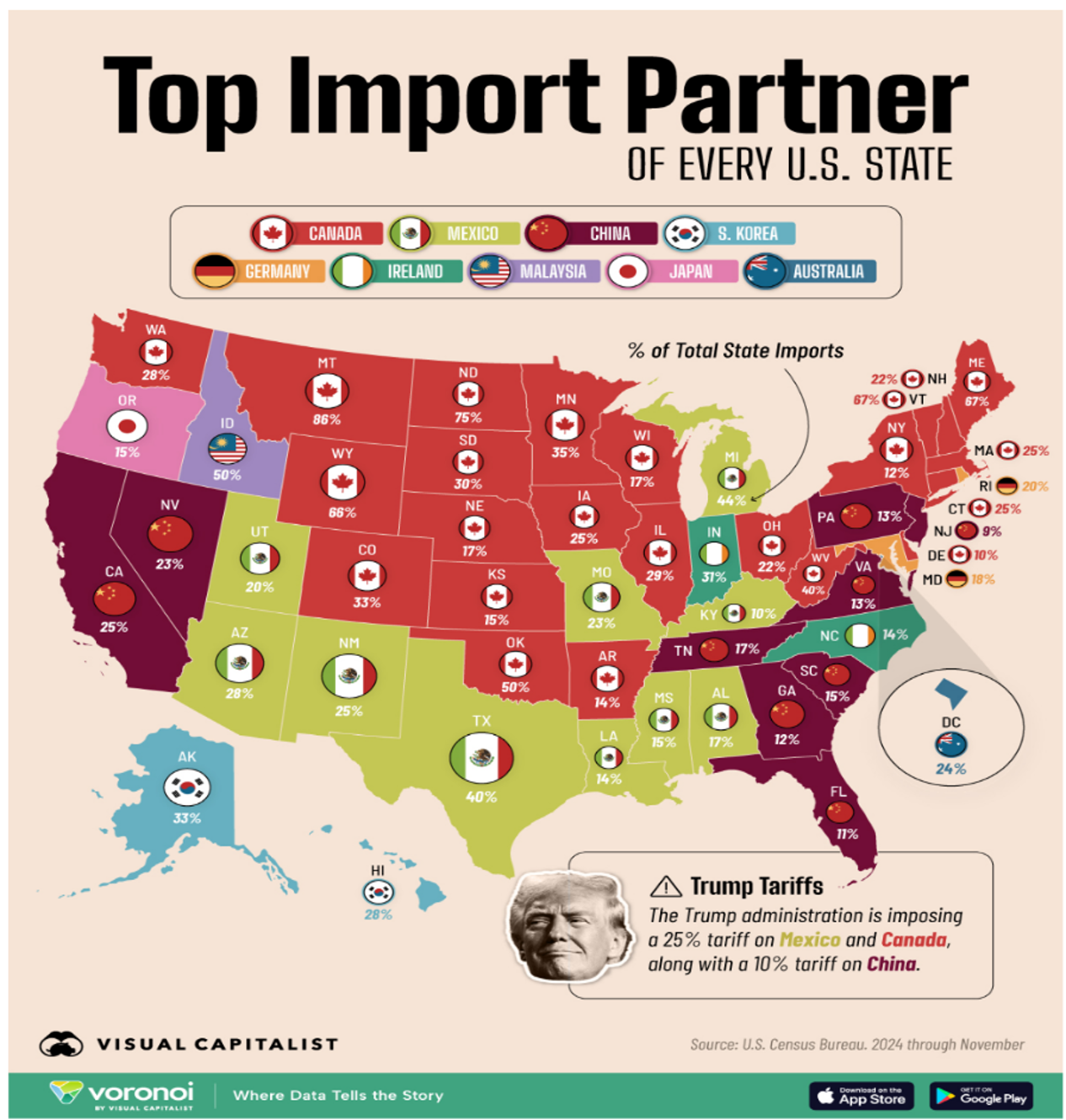

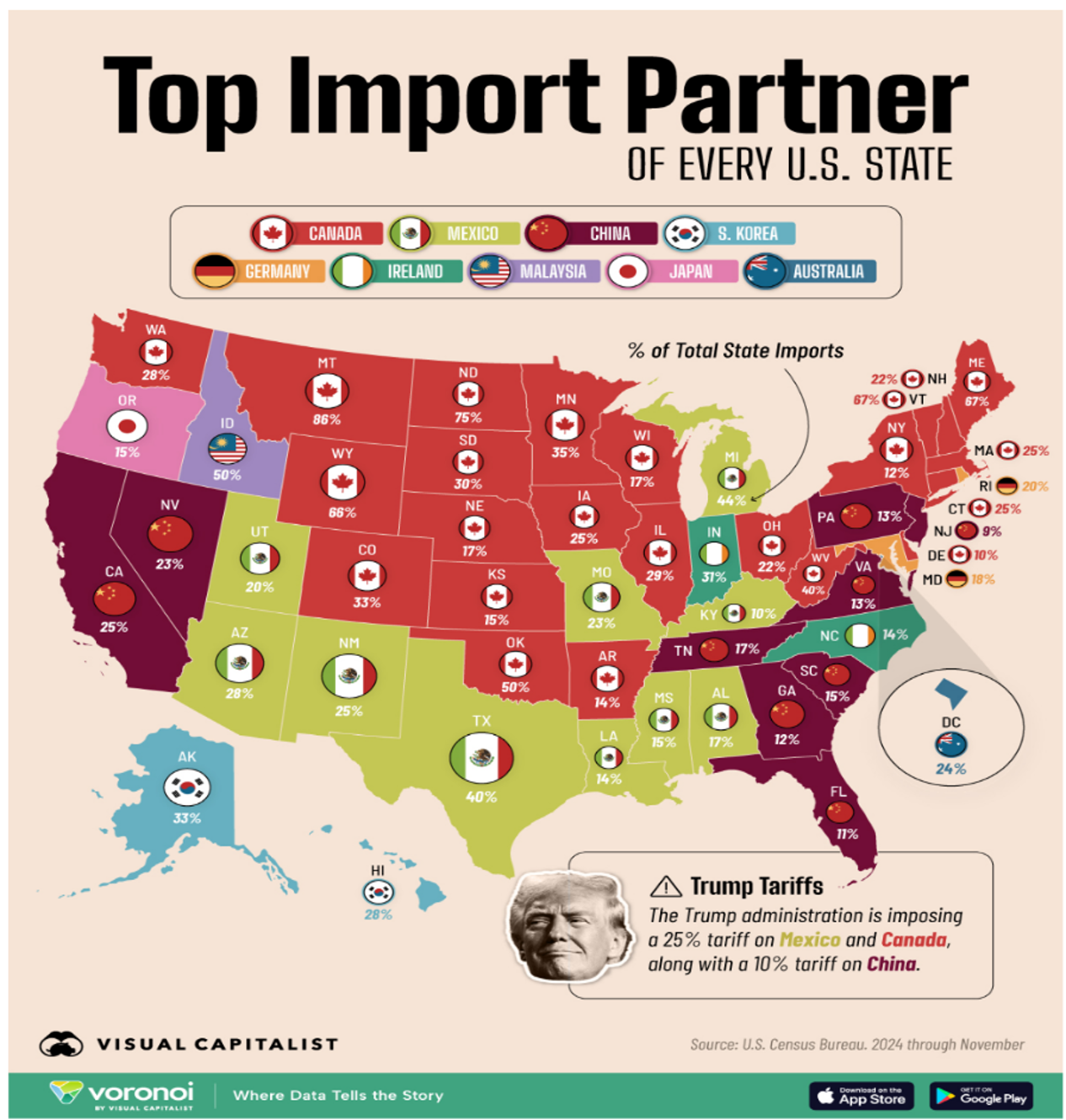

The fast and the furious! 2025 has kicked off at a whirlwind pace, with an influx of news and developments keeping investors on their toes. From trade wars to artificial intelligence breakthroughs, tariffs to geopolitical tensions, January has delivered much to digest. The most headline-grabbing of these events was no doubt President Donald Trump’s bold move to escalate the US trade war. Tariffs of 25% on Canada and Mexico, and 10% on China, reignited fears of inflationary pressures and increased costs for American consumers. The historic use of tariffs by Trump, echoing the protectionist policies of the 1930s, is being met with mixed reactions. While some argue it’s a negotiating tactic, the risk of stoking inflation and slowing US growth is undeniable. The question remains – how far will this escalation go, and how much damage will it inflict?

Trump’s tariffs come at a time of mounting geopolitical tensions, and the consequences could ripple across the globe. The trade war threatens not only US relations with its allies but also risks higher costs for essentials like food, housing, and gasoline. The US’s three largest sources of imports – Canada, Mexico, and China – are now directly impacted, raising questions about the long-term consequences for the economy. Ultimately, the increased costs to consumers may push Trump to reconsider his stance, given the impact on his base. The electoral landscape, with inflation a key concern, will likely add pressure to the White House’s position.

Source: Visual Capitalist

In the tech sphere, China’s unveiling of DeepSeek, an AI alternative to ChatGPT, has propelled the US-China tech rivalry into a new gear. Offered at a fraction of the price of its American counterpart, DeepSeek highlights the impressive strides China is making in technology. With Chinese tech companies like BYD and GWM making waves in the automotive and tech sectors, this AI race between the US and China is set to intensify. While some may view this as a threat to American dominance, the broader impact on the global economy could be positive. This technological revolution will enhance productivity and efficiency, driving economic growth. As a result, AI stocks are likely to benefit, as this secular trend continues to play out over the long term.

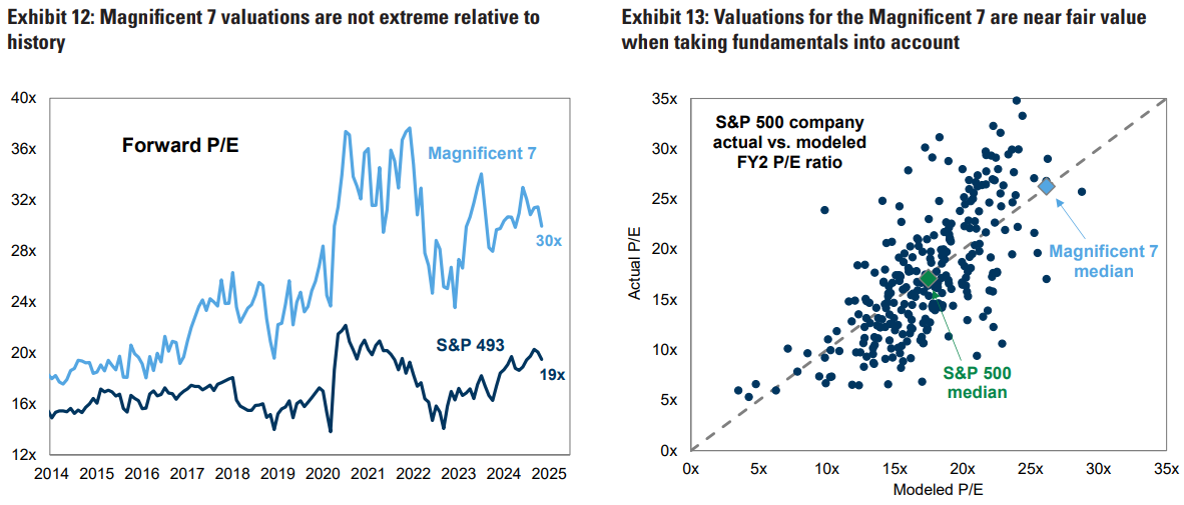

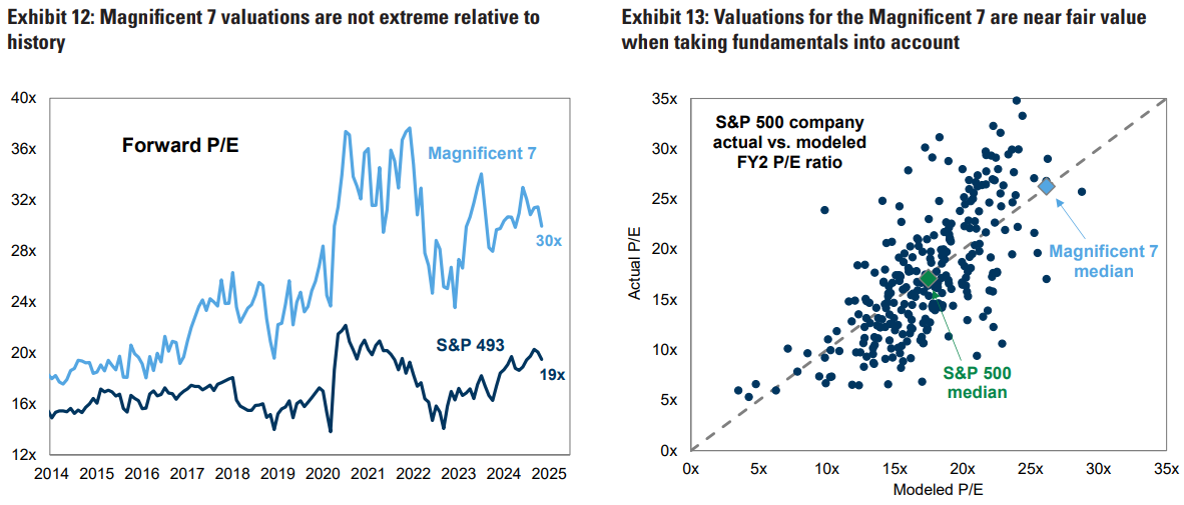

We’ve seen discrepancies in market pricing over the past couple of years, and some of those distortions have become less evident in recent weeks. One of the notable trends we’re keeping an eye on is the overcrowding in US big tech stocks, with names like Apple, Microsoft, and Amazon becoming increasingly expensive. According to Bank of America’s Michael Hartnett, US exceptionalism has reached a point of “exceptional” pricing. We anticipate that big tech may underperform or perform in-line with the market in 2025. Smaller-cap names and more traditional industries are also being closely watched to see if there’s a rotation out of big tech and back into older economy sectors.

In Europe and the UK, markets had a somewhat mixed start to 2025. While global equity markets were influenced by the U.S. President’s policies and the emergence of China’s AI platform DeepSeek discussed above, Europe had its own set of challenges, including the upcoming German election, a newly formed government in France, and rising bond yields in the UK. Despite these uncertainties, European markets remained relatively resilient.

Markets saw positive momentum across the Tasman, with Australian equities benefiting from a strong global risk-on rally. The Small Ordinaries index rose 4.6%, pushing the market to new highs. Despite a relatively quiet corporate news flow ahead of the February reporting season, sentiment remained optimistic, with many sectors showing resilience. Gold stocks outperformed, benefiting from rising prices, while resources as a whole saw strong performance driven by expectations of softer inflation and potential rate cuts. As reporting season approaches, markets remain poised to adjust to any volatility, with opportunities expected from potential mispricing and shifting market dynamics.

Despite all the turbulence, January saw a generally positive start to 2025. As the year progresses, much will depend on the actions of central banks, corporate earnings, and the ongoing dynamics of inflation and economic growth. The pressure of uncertainty will continue, and volatility is likely to remain a feature of the investment landscape for some time yet. Global events will move at breakneck speed and there’ll be shifts in sentiment as markets navigate these twists and turns – it promises to be anything but boring!

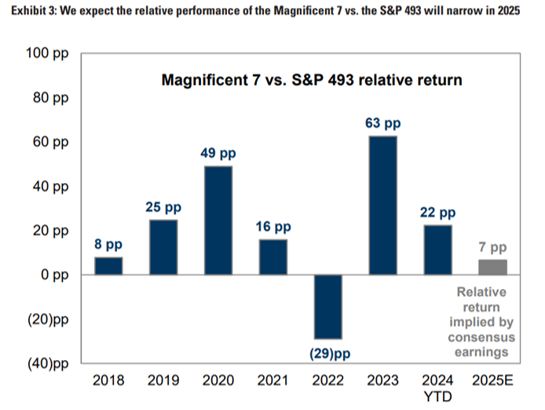

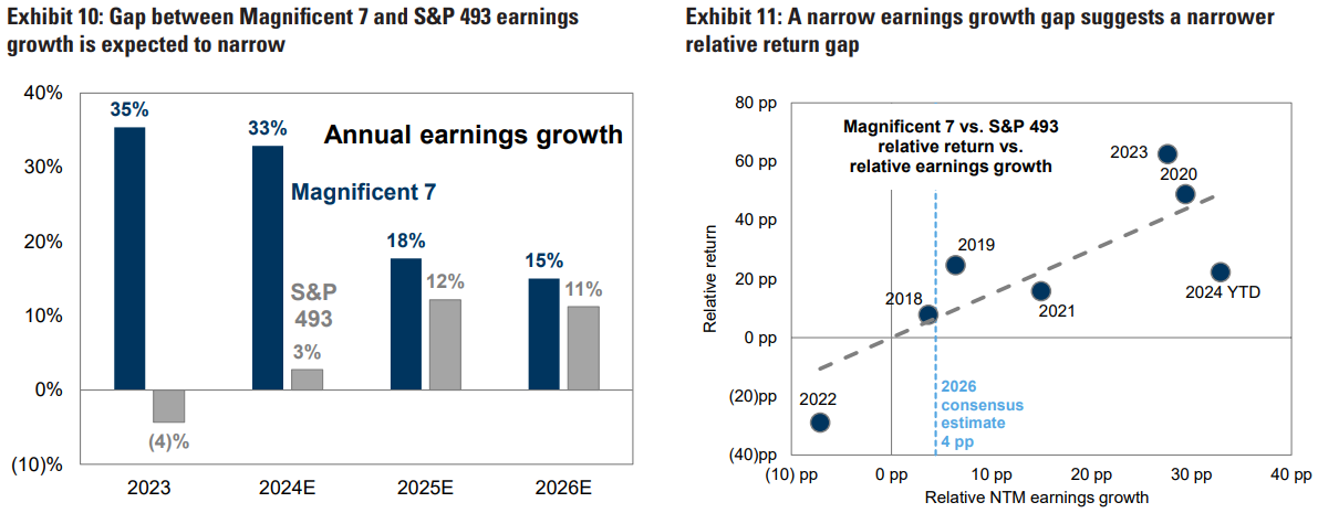

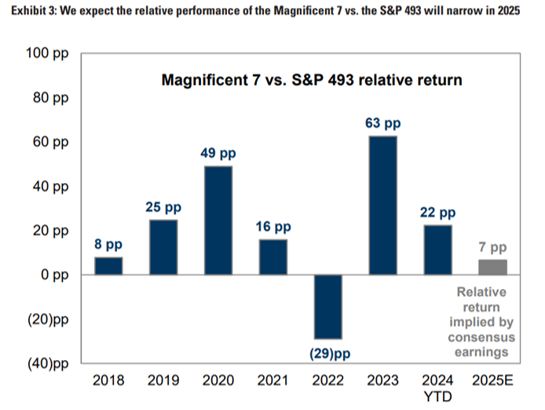

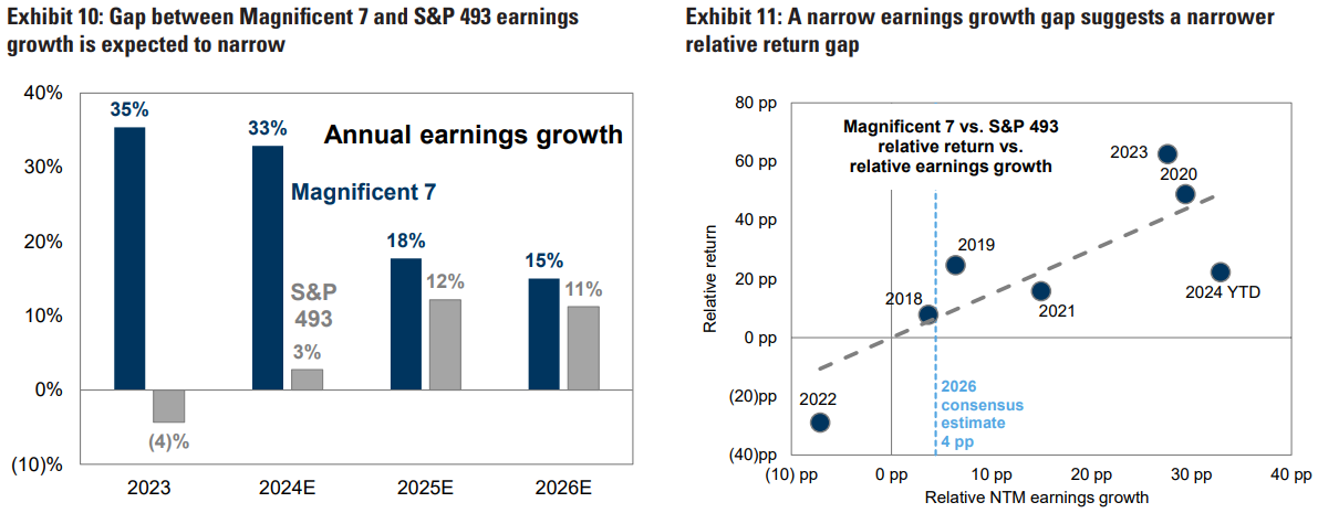

After two years dominated by the “Magnificent 7” (M7), 2025 is shaping up to be a broader market story. We expect the rally to extend beyond these tech giants, with the rest of the market either keeping pace or even outperforming the M7. This would mark a stark shift from 2024, where the M7 delivered an average return of 60.5%, leaving the remaining S&P 493 far behind at just +13%.

Source: Goldman Sachs

More broadly, global equity markets have never been more concentrated. While diversification may have felt unnecessary in recent years, history suggests that relying too heavily on a handful of stocks can be risky. From the Nifty Fifty era to the late-1990s tech bubble, top-heavy markets have often faced sharp reversals – even in less index-driven environments.

The rise of passive investing has undoubtedly amplified the M7’s gains, but for contrarian investors, opportunities still exist beyond this elite group. As capital rotates into undervalued sectors, those willing to look beyond the obvious winners may uncover the next breakout stock – or even the next member of the Magnificent 7.

If you want to see which Pie Funds investments are available on InvestNow, plus read any other opinion or commentary pieces from Mike and the team at Pie Funds, please visit their page on our website.

InvestNow Market Wrap-Up: January 2025

Introducing Mike Taylor, Founder/CIO at Pie Funds, this month’s guest author of the InvestNow Market Wrap-Up.

Beyond the Magnificent 7: Is 2025 the Year of Market Expansion?

The fast and the furious! 2025 has kicked off at a whirlwind pace, with an influx of news and developments keeping investors on their toes. From trade wars to artificial intelligence breakthroughs, tariffs to geopolitical tensions, January has delivered much to digest. The most headline-grabbing of these events was no doubt President Donald Trump’s bold move to escalate the US trade war. Tariffs of 25% on Canada and Mexico, and 10% on China, reignited fears of inflationary pressures and increased costs for American consumers. The historic use of tariffs by Trump, echoing the protectionist policies of the 1930s, is being met with mixed reactions. While some argue it’s a negotiating tactic, the risk of stoking inflation and slowing US growth is undeniable. The question remains – how far will this escalation go, and how much damage will it inflict?

Trump’s tariffs come at a time of mounting geopolitical tensions, and the consequences could ripple across the globe. The trade war threatens not only US relations with its allies but also risks higher costs for essentials like food, housing, and gasoline. The US’s three largest sources of imports – Canada, Mexico, and China – are now directly impacted, raising questions about the long-term consequences for the economy. Ultimately, the increased costs to consumers may push Trump to reconsider his stance, given the impact on his base. The electoral landscape, with inflation a key concern, will likely add pressure to the White House’s position.

Source: Visual Capitalist

In the tech sphere, China’s unveiling of DeepSeek, an AI alternative to ChatGPT, has propelled the US-China tech rivalry into a new gear. Offered at a fraction of the price of its American counterpart, DeepSeek highlights the impressive strides China is making in technology. With Chinese tech companies like BYD and GWM making waves in the automotive and tech sectors, this AI race between the US and China is set to intensify. While some may view this as a threat to American dominance, the broader impact on the global economy could be positive. This technological revolution will enhance productivity and efficiency, driving economic growth. As a result, AI stocks are likely to benefit, as this secular trend continues to play out over the long term.

We’ve seen discrepancies in market pricing over the past couple of years, and some of those distortions have become less evident in recent weeks. One of the notable trends we’re keeping an eye on is the overcrowding in US big tech stocks, with names like Apple, Microsoft, and Amazon becoming increasingly expensive. According to Bank of America’s Michael Hartnett, US exceptionalism has reached a point of “exceptional” pricing. We anticipate that big tech may underperform or perform in-line with the market in 2025. Smaller-cap names and more traditional industries are also being closely watched to see if there’s a rotation out of big tech and back into older economy sectors.

In Europe and the UK, markets had a somewhat mixed start to 2025. While global equity markets were influenced by the U.S. President’s policies and the emergence of China’s AI platform DeepSeek discussed above, Europe had its own set of challenges, including the upcoming German election, a newly formed government in France, and rising bond yields in the UK. Despite these uncertainties, European markets remained relatively resilient.

Markets saw positive momentum across the Tasman, with Australian equities benefiting from a strong global risk-on rally. The Small Ordinaries index rose 4.6%, pushing the market to new highs. Despite a relatively quiet corporate news flow ahead of the February reporting season, sentiment remained optimistic, with many sectors showing resilience. Gold stocks outperformed, benefiting from rising prices, while resources as a whole saw strong performance driven by expectations of softer inflation and potential rate cuts. As reporting season approaches, markets remain poised to adjust to any volatility, with opportunities expected from potential mispricing and shifting market dynamics.

Despite all the turbulence, January saw a generally positive start to 2025. As the year progresses, much will depend on the actions of central banks, corporate earnings, and the ongoing dynamics of inflation and economic growth. The pressure of uncertainty will continue, and volatility is likely to remain a feature of the investment landscape for some time yet. Global events will move at breakneck speed and there’ll be shifts in sentiment as markets navigate these twists and turns – it promises to be anything but boring!

After two years dominated by the “Magnificent 7” (M7), 2025 is shaping up to be a broader market story. We expect the rally to extend beyond these tech giants, with the rest of the market either keeping pace or even outperforming the M7. This would mark a stark shift from 2024, where the M7 delivered an average return of 60.5%, leaving the remaining S&P 493 far behind at just +13%.

Source: Goldman Sachs

More broadly, global equity markets have never been more concentrated. While diversification may have felt unnecessary in recent years, history suggests that relying too heavily on a handful of stocks can be risky. From the Nifty Fifty era to the late-1990s tech bubble, top-heavy markets have often faced sharp reversals – even in less index-driven environments.

The rise of passive investing has undoubtedly amplified the M7’s gains, but for contrarian investors, opportunities still exist beyond this elite group. As capital rotates into undervalued sectors, those willing to look beyond the obvious winners may uncover the next breakout stock – or even the next member of the Magnificent 7.

If you want to see which Pie Funds investments are available on InvestNow, plus read any other opinion or commentary pieces from Mike and the team at Pie Funds, please visit their page on our website.