InvestNow Market Wrap-Up: March 2024

Written by Jason Choy, InvestNow Senior Portfolio Manager

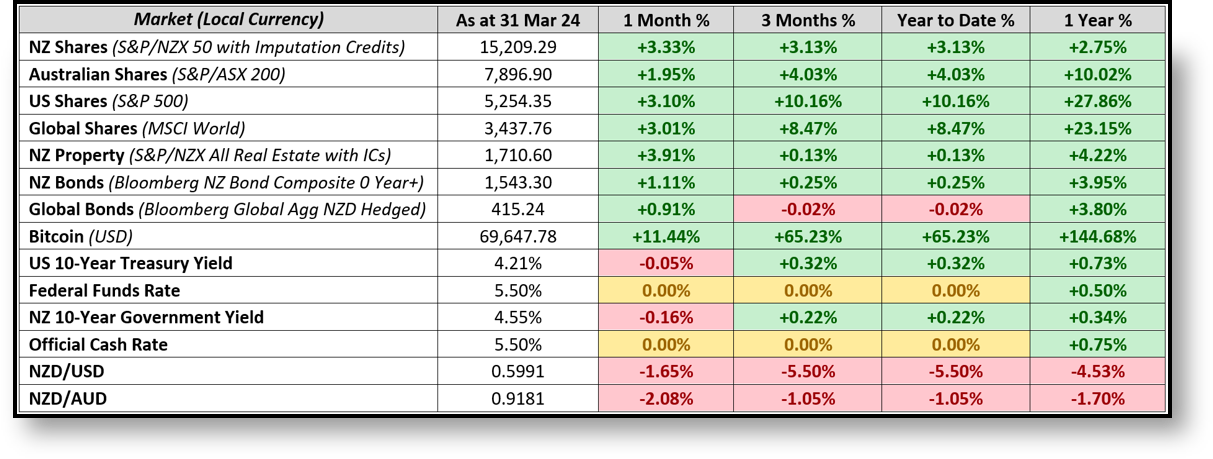

Market Dashboard

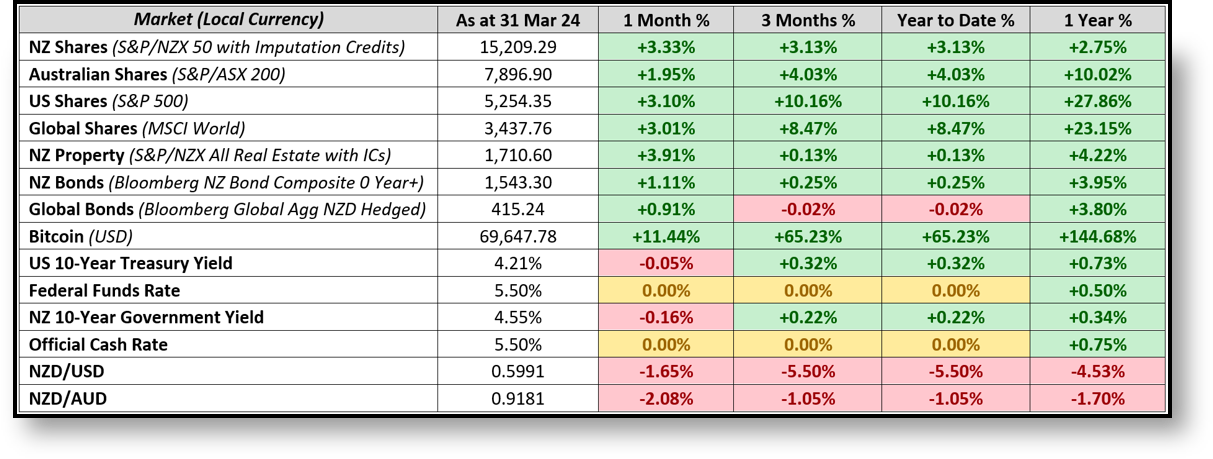

Share markets continued their sizzling run over March, while bonds also joined in on the fun. Globally, markets were paced by the US, whose stock indices performed strongly once again, although they were outdone by Japan’s local share market the Nikkei 225, which has continued to be 2024’s standout performer. Other notable assets included gold, which reached all-time highs in March, appreciating over 8% (in US dollar terms) over the quarter and over 22% since last October’s lows. These are substantial moves for the asset class that far outpace the simple hedge against inflation narrative it is known for, and could be portending to some jitters in the market, given gold demand typically reflects investor fears.

Global Markets Summary: March 2024

Global share markets added to their year of outstanding performance, bolstered by flatlining year-on-year inflation readings and central banks leaning towards rate cuts. Developed markets outperformed emerging markets over the month, which saw the MSCI World returning +3.4%, and the MSCI Emerging Markets Index up +3.0% (both in local currency terms). In a pivot from recent months, value stocks were up +6.6% in March and outperformed growth, which finished the month +3.7% higher (both in unhedged NZ dollar terms), as equity performance started to broaden beyond just tech stocks. Overall, the MSCI All Country World Index finished the month +5.1% higher in unhedged NZ dollar terms and +3.5% in hedged NZ dollar terms, with the NZD falling against most major currencies over March.

US shares saw another strong month, with the S&P 500 notching its best first quarter since 2019. The main drivers included a resilient economy which was reflected in a strong earnings season, falling inflation (despite pockets of persistence), and a Fed that has an eye towards multiple interest rate cuts in 2024, although they have yet to provide a firm timeline. The S&P 500 is now on a 5-month winning streak, finishing the month of March +3.1% higher and +10.2% over the quarter – marking only the fifth instance in the last 30 years where first quarter returns exceeded 10%.

While the past year’s returns in the US have been dominated by a handful of names, help is on the way. The outstanding growth of the Magnificent Seven (Apple, Amazon, Alphabet, Meta, Microsoft, NVIDIA and Tesla) has pushed the market to new heights, but the remainder of the S&P 500 is now starting to pick up the slack. Earnings growth expectations for the other 493 companies in the S&P 500 are ramping up and forecasted to be in line with the Magnificent Seven by Q3 this year and far outpace it by Q4. This will likely lead to a broadening in the performance of the US market, which is typically a positive sign for investors as it generally reflects more sustainable long-term performance (versus relying on a handful of names in a concentrated sector continuing to outperform).

Bank of America research suggests that a broader market rally is on the way in the US, given expectations of earnings growth ramping up this year for the non-Magnificent Seven companies within the S&P 500.

Several European share markets hit all-time highs, while the UK comes up shy, despite being viewed by many as one of the world’s cheapest markets. Eurozone indices such as France’s CAC 40 (+9.4% over the quarter) and Germany’s DAX (+10.4% year-to-date) were notable outperformers in the first quarter, despite Germany being in a recession. Gains were fuelled by signs of improving business activity in the Eurozone and optimism that the European Central Bank is prepped for rate cuts. Meanwhile, economic data out of the UK was relatively upbeat, with GDP growing modestly and business activity in expansionary territory throughout the first quarter.

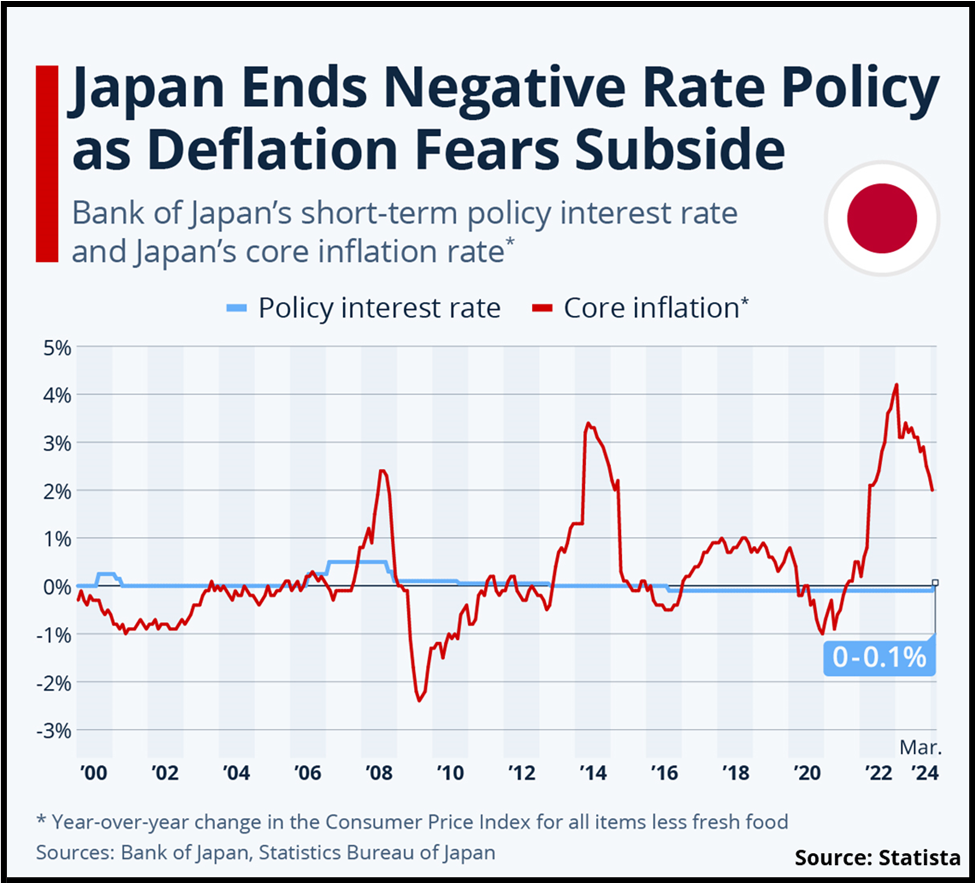

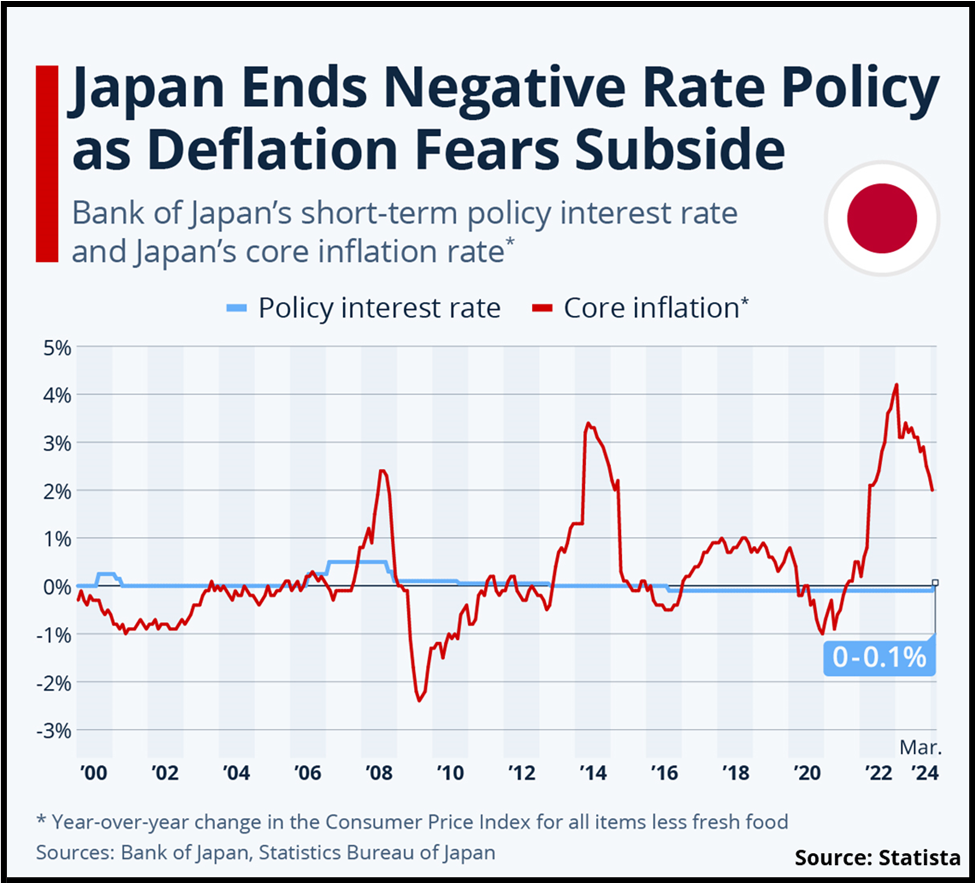

A strong Japanese economy continues to bolster its share market and sees the first rate hike in 17 years. Japan’s local share index, the Nikkei 225, continued to shine bright in 2024, finishing the quarter over +20% higher to lead all share markets. Returns for Japanese investors in local currency terms haven’t been as stellar, as the Japanese Yen has depreciated substantially due to domestic monetary policy. This included a pivotal call in March when the Bank of Japan ended the era of negative interest rates, hiking rates for the first time in 17 years – if only to a meagre 0.1%. The hike reflected local wage growth of over 5% and almost two years of inflation above the Bank of Japan’s 2% target.

The negative interest rate policy was a novel concept to address a unique problem in Japan. Introduced in February 2016, the -0.1% interest rate regime meant that instead of deposits earning money, they would lose money! This was implemented to address decades of very low or negative inflation (deflation) in Japan following the 1992 bubble crash, where Japanese real estate and stock prices crumbled following a rampant period of overconfidence and speculation. Witnessing their entire net worth crumble scarred a generation of Japanese citizens, deterring them from engaging in even modest spending or investing. Naturally, prices plateaued, with companies issuing apologies and walkbacks for even considering price increases in their products. But with economic activity on the rise, the so-called ‘Lost Decades’ have ended in 2024 with the Japanese stock market finally hitting new highs and negative interest rates abolished.

The Bank of Japan ended the negative interest rates era in March, hiking rates for the first time in 17 years.

Wider Asian and Emerging markets were more subdued over the month. Despite China seeing an equity market rally in February, there has been little in the way of follow through in March. While officials in China have committed to a growth rate of 5% this year – the same as that achieved in 2023 – this won’t be easy without further stimulus, although some pockets of positive data on the Chinese manufacturing front have some market watchers more optimistic. Meanwhile, the strength of the US economy has been a mixed blessing for Emerging Market stocks, as while strong activity boosts trade in developing economies, delays in US rate cuts have strengthened the US dollar, which provides headwinds for emerging market stocks.

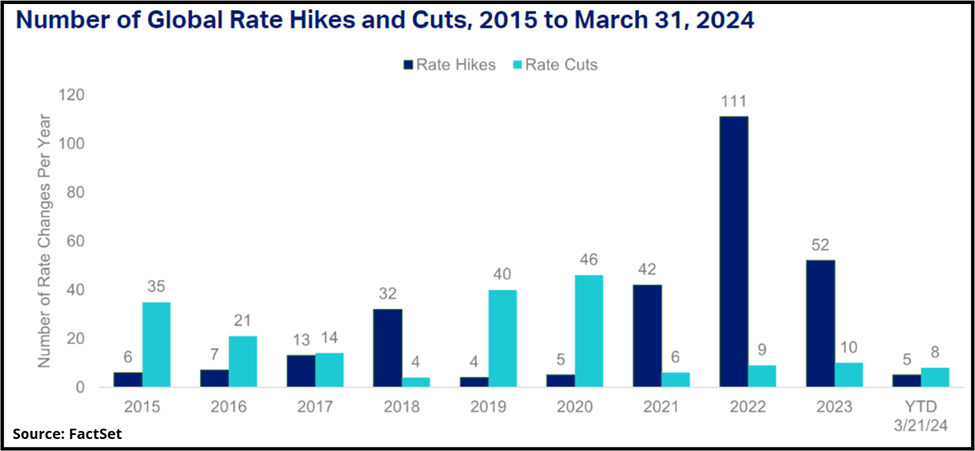

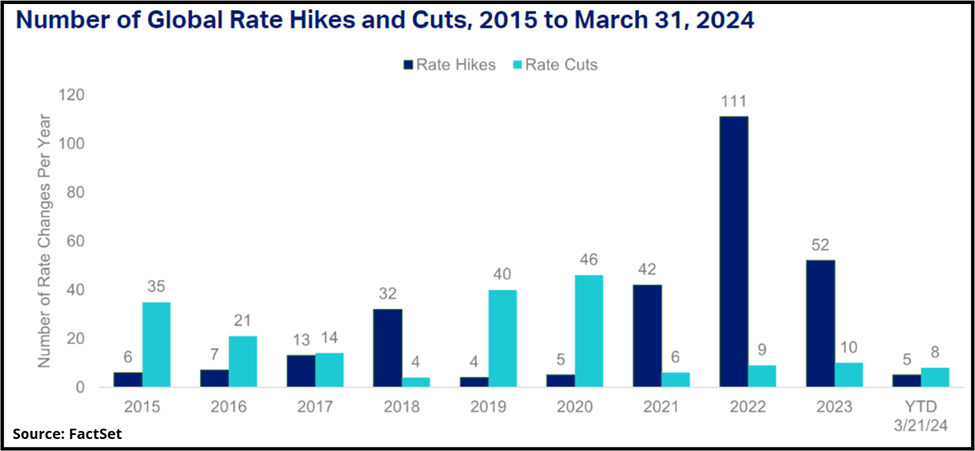

Global bonds bucked the recent trend and fared well in March, driven by an increasingly dovish sentiment coming out of many global central banks. The US 10-year Treasury yields finished relatively flat over the month at around 4.2%, while the UK 10-year yields fell by about 20 bps to around 3.9%. In contrast to the Bank of Japan’s hike, just two days later the Swiss National Bank became the first developed market central bank to cut interest rates. In terms of next steps for wider developed market central banks, the Fed and European Central Bank will likely follow in the footsteps of the Swiss rather than the Japanese, with there already being more rate cuts than hikes so far in 2024 – something that hasn’t occurred since 2020. Overall, the Bloomberg Global Aggregate Index hedged to the NZD would return +0.91% for the month but remain relatively flat for the quarter.

So far in 2024, there have been more interest rate cuts than hikes, something we haven’t seen since 2020.

Key updates for the Kiwi investor:

The New Zealand share market bounced back in March after a slow start to the year, with the S&P/NZX 50 Gross Index (with imputation credits) returning +3.3% over the month. The positive return was despite some less favourable data releases, including ANZ’s business confidence measure showing a drop in sentiment for February, as well as a challenging earnings season for NZ listed companies. In contrast, over in Australia, the benchmark S&P/ASX 200 hit an all-time high in March, bolstered by momentum from the big banks.

Local bond markets also joined in on the fun, notching its first positive month in 2024, with the Bloomberg NZBond Composite 0+ Yr Index returning +1.1% over March. Growing expectations of rate cuts put downward pressure on bond yields, with the NZ 10-year government bond yields falling 16 bps over the month to 4.55%. Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr noted that while rate cuts were getting closer, the battle against inflation is far from over.

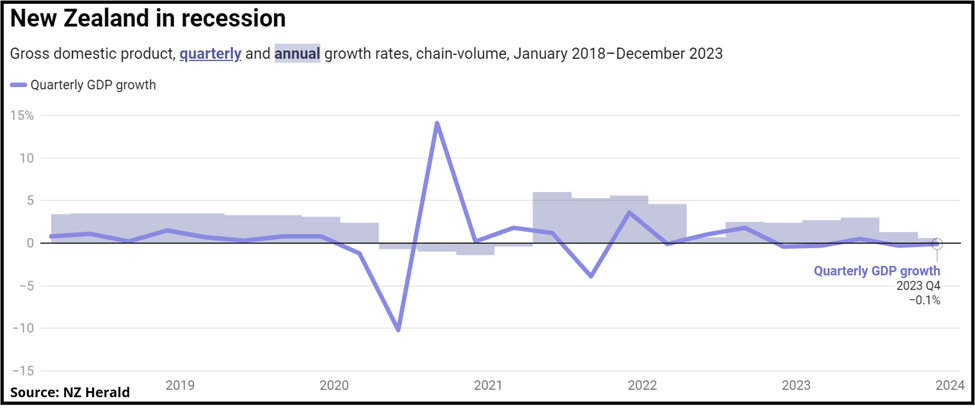

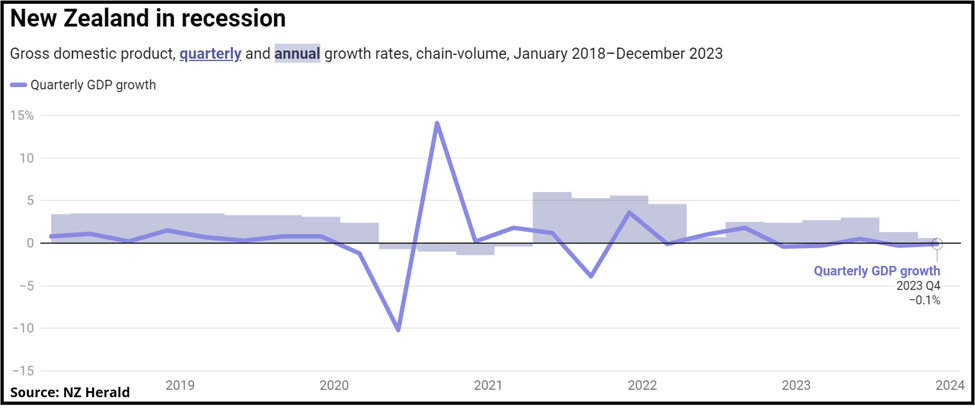

New Zealand officially entered a recession with the release of the quarterly GDP figures in March, which saw the New Zealand economy shrink -0.1% in the December quarter, following a -0.3% reading in the September quarter. It was the fourth quarter in five where the New Zealand economy contracted, with activity weighed down by weakness in the goods-based sectors such as manufacturing, wholesale trade, retail and construction – sectors that are generally sensitive to interest rates.

New Zealand is officially in a recession, following back-to-back negative growth quarters in Q3 and Q4.

The New Zealand economy is in an even tougher shape than headline figures suggest. The already concerning GDP figures have been propped up by record net migration into the country, which bolsters GDP in absolute terms. On a per capita basis, however, GDP fell -0.7% over the December quarter and has been negative since 2022. New Zealanders are certainly feeling the pinch as well, with the cost-of-living strained consumer evident in sentiment surveys and dipping credit card spending figures. And with nearly 60% of mortgage holders yet to reset to higher rates, there appear to be plenty of challenges ahead.

However, it could be a case of bad news is good news for investors, as the negative economic news of a recession is increasingly leading to ‘optimism’ that it could mean the RBNZ starts cutting interest rates earlier than anticipated. The market’s monetary policy expectations have the RBNZ starting to cut rates from August 2024, versus the RBNZ’s current 2025 timeline. Given the interest rate sensitive nature of the New Zealand share market, earlier than anticipated rate cuts could be a boon for the local market, despite all the doom and gloom within the media headlines.

Just because we are in a recession, doesn’t necessarily mean your investment strategy needs to change. Recession news makes Kiwis jittery, and the fear-mongering often attracts knee-jerk reactions. It can be tempting to feel like changes need to be made now that the economy is struggling, or that New Zealand-based investments no longer look attractive and that investors should be running towards another asset class. While there could be some volatility ahead, it is important to understand that short-term swings are a normal part of investing, and it shouldn’t impact your long-term investment strategies.

Investors that stay calm and stick to their long-term investment plans are often well served. Avoid being the type of investor who looks to sell off their holdings at the first signs of volatility (e.g. during the early days of Covid, those who ran to cash missed out on the market’s remarkable subsequent rally). That doesn’t mean there are no good reasons to change investment approaches though. If your personal circumstances and therefore investment goals or constraints change, then this could warrant changing tact. Stay invested, stay informed, and stay vigilant in reviewing your investment goals and constraints, and most Kiwi investors will find that they’ll be well-placed to weather any storm.

Chart of the month:

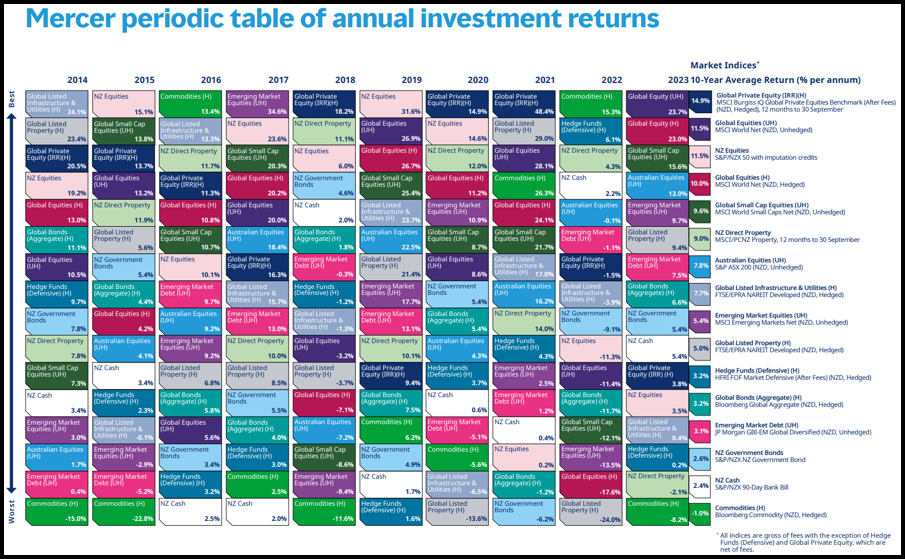

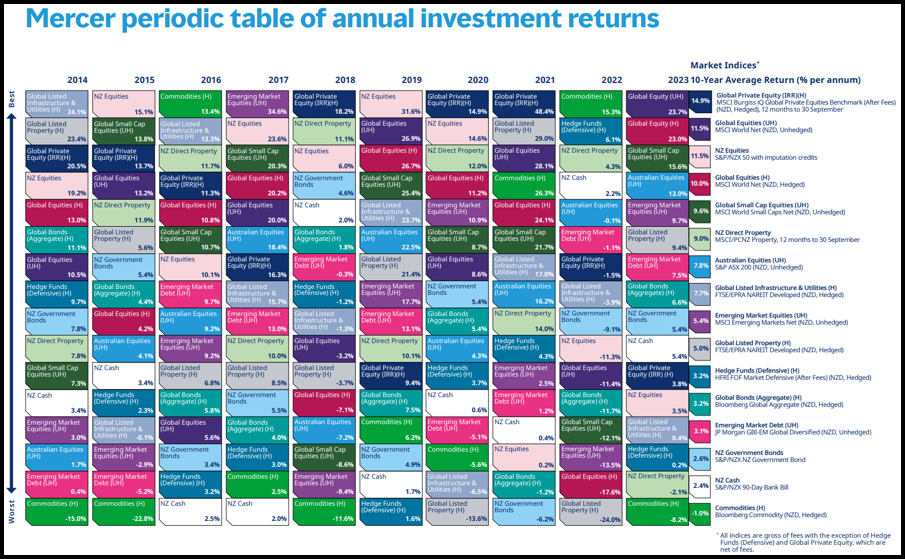

Mercer’s Periodic Table of Annual Investment Returns ranks how major asset classes performed each year, and highlights just how hard it is to forecast how investments will perform year-to-year.

Our Chart of the Month is Mercer’s Periodic Table of Annual Investment Returns, which ranks the annual performance of 16 major asset classes over the past 10 years. Mercer’s Periodic Table has recently been updated to reflect 2023’s returns, with the helpful colour-coding of asset classes highlighting a patchwork quilt of results that best encapsulates just how fickle Mr. Market can be year-to-year.

Looking at the Periodic Table’s results in 2023 as well as over the past 10 years, a few of the key insights from the results included the following:

- Global Equities was the undisputed king in 2023, whether on an unhedged basis (up +23.7%) or a hedged basis (up +23.0%), it outperformed all other asset classes last year. Led by mega-cap tech stocks and the Magnificent Seven, few would have expected following the bear market of 2022 that 2023 would provide such a furious rally, particularly given unhedged Global Equities were near the bottom of the pack in 2022, returning -17.6%.

- Global Private Equity, up just 3.8% in 2023 was well behind the pack last year, however the long-term value proposition is hard to ignore, with it consistently avoiding lower quartile finishes and being the overall winner on 10-year basis, averaging a nearly 15% return each year.

- The previous chart-topper, Commodities had finished 2022 over 15.3% higher, only to fall right to the bottom of all asset classes in 2023, returning -8.2%. On a longer-term horizon, it has also failed to perform, delivering a -1.0% average return over 10 years, highlighting the dangers of piling into a single asset class based on a single year’s performance window.

The 2023 version of the Periodic Table highlights that with markets, we should expect the unexpected. Mercer notes that financial markets rarely deliver, on a year-to-year basis, quite what we expect. Anything can happen over a year, and trying to base long-term investment decisions or even trying to predict returns over a single year is fraught with danger and uncertainty. The myriad of returns that markets can produce underscores the challenges of forecasting but also highlights the benefits of being diversified across asset classes, so that your portfolio is well-positioned to roll with any of punches the market dishes.

What we’ve been reading:

- AMP: Understanding Market Volatility and How to Handle It

- Dexus: Global REITs – As the Cycle Turns, Opportunities Abound

- Fisher Funds: Finances and Neurodiversity

- Good Returns: KiwiSaver Portability Settings Blocking Investors from Private Asset Benefits

- Harbour: Harbour Investment Horizon: Long Term Investment Return Assumptions

- Investment News: ETF: The ‘Best Wrapper in the World’ Records Another Hit

- MoneyHub: Investing in Vanguard Funds from New Zealand

- Nikko: Global Investment Committee’s Outlook: Stronger for Longer

- Squirrel: The RBNZ needs to start cutting rates, ASAP

InvestNow Market Wrap-Up: March 2024

Written by Jason Choy, InvestNow Senior Portfolio Manager

Market Dashboard

Share markets continued their sizzling run over March, while bonds also joined in on the fun. Globally, markets were paced by the US, whose stock indices performed strongly once again, although they were outdone by Japan’s local share market the Nikkei 225, which has continued to be 2024’s standout performer. Other notable assets included gold, which reached all-time highs in March, appreciating over 8% (in US dollar terms) over the quarter and over 22% since last October’s lows. These are substantial moves for the asset class that far outpace the simple hedge against inflation narrative it is known for, and could be portending to some jitters in the market, given gold demand typically reflects investor fears.

Global Markets Summary: March 2024

Global share markets added to their year of outstanding performance, bolstered by flatlining year-on-year inflation readings and central banks leaning towards rate cuts. Developed markets outperformed emerging markets over the month, which saw the MSCI World returning +3.4%, and the MSCI Emerging Markets Index up +3.0% (both in local currency terms). In a pivot from recent months, value stocks were up +6.6% in March and outperformed growth, which finished the month +3.7% higher (both in unhedged NZ dollar terms), as equity performance started to broaden beyond just tech stocks. Overall, the MSCI All Country World Index finished the month +5.1% higher in unhedged NZ dollar terms and +3.5% in hedged NZ dollar terms, with the NZD falling against most major currencies over March.

US shares saw another strong month, with the S&P 500 notching its best first quarter since 2019. The main drivers included a resilient economy which was reflected in a strong earnings season, falling inflation (despite pockets of persistence), and a Fed that has an eye towards multiple interest rate cuts in 2024, although they have yet to provide a firm timeline. The S&P 500 is now on a 5-month winning streak, finishing the month of March +3.1% higher and +10.2% over the quarter – marking only the fifth instance in the last 30 years where first quarter returns exceeded 10%.

While the past year’s returns in the US have been dominated by a handful of names, help is on the way. The outstanding growth of the Magnificent Seven (Apple, Amazon, Alphabet, Meta, Microsoft, NVIDIA and Tesla) has pushed the market to new heights, but the remainder of the S&P 500 is now starting to pick up the slack. Earnings growth expectations for the other 493 companies in the S&P 500 are ramping up and forecasted to be in line with the Magnificent Seven by Q3 this year and far outpace it by Q4. This will likely lead to a broadening in the performance of the US market, which is typically a positive sign for investors as it generally reflects more sustainable long-term performance (versus relying on a handful of names in a concentrated sector continuing to outperform).

Bank of America research suggests that a broader market rally is on the way in the US, given expectations of earnings growth ramping up this year for the non-Magnificent Seven companies within the S&P 500.

Several European share markets hit all-time highs, while the UK comes up shy, despite being viewed by many as one of the world’s cheapest markets. Eurozone indices such as France’s CAC 40 (+9.4% over the quarter) and Germany’s DAX (+10.4% year-to-date) were notable outperformers in the first quarter, despite Germany being in a recession. Gains were fuelled by signs of improving business activity in the Eurozone and optimism that the European Central Bank is prepped for rate cuts. Meanwhile, economic data out of the UK was relatively upbeat, with GDP growing modestly and business activity in expansionary territory throughout the first quarter.

A strong Japanese economy continues to bolster its share market and sees the first rate hike in 17 years. Japan’s local share index, the Nikkei 225, continued to shine bright in 2024, finishing the quarter over +20% higher to lead all share markets. Returns for Japanese investors in local currency terms haven’t been as stellar, as the Japanese Yen has depreciated substantially due to domestic monetary policy. This included a pivotal call in March when the Bank of Japan ended the era of negative interest rates, hiking rates for the first time in 17 years – if only to a meagre 0.1%. The hike reflected local wage growth of over 5% and almost two years of inflation above the Bank of Japan’s 2% target.

The negative interest rate policy was a novel concept to address a unique problem in Japan. Introduced in February 2016, the -0.1% interest rate regime meant that instead of deposits earning money, they would lose money! This was implemented to address decades of very low or negative inflation (deflation) in Japan following the 1992 bubble crash, where Japanese real estate and stock prices crumbled following a rampant period of overconfidence and speculation. Witnessing their entire net worth crumble scarred a generation of Japanese citizens, deterring them from engaging in even modest spending or investing. Naturally, prices plateaued, with companies issuing apologies and walkbacks for even considering price increases in their products. But with economic activity on the rise, the so-called ‘Lost Decades’ have ended in 2024 with the Japanese stock market finally hitting new highs and negative interest rates abolished.

The Bank of Japan ended the negative interest rates era in March, hiking rates for the first time in 17 years.

Wider Asian and Emerging markets were more subdued over the month. Despite China seeing an equity market rally in February, there has been little in the way of follow through in March. While officials in China have committed to a growth rate of 5% this year – the same as that achieved in 2023 – this won’t be easy without further stimulus, although some pockets of positive data on the Chinese manufacturing front have some market watchers more optimistic. Meanwhile, the strength of the US economy has been a mixed blessing for Emerging Market stocks, as while strong activity boosts trade in developing economies, delays in US rate cuts have strengthened the US dollar, which provides headwinds for emerging market stocks.

Global bonds bucked the recent trend and fared well in March, driven by an increasingly dovish sentiment coming out of many global central banks. The US 10-year Treasury yields finished relatively flat over the month at around 4.2%, while the UK 10-year yields fell by about 20 bps to around 3.9%. In contrast to the Bank of Japan’s hike, just two days later the Swiss National Bank became the first developed market central bank to cut interest rates. In terms of next steps for wider developed market central banks, the Fed and European Central Bank will likely follow in the footsteps of the Swiss rather than the Japanese, with there already being more rate cuts than hikes so far in 2024 – something that hasn’t occurred since 2020. Overall, the Bloomberg Global Aggregate Index hedged to the NZD would return +0.91% for the month but remain relatively flat for the quarter.

So far in 2024, there have been more interest rate cuts than hikes, something we haven’t seen since 2020.

Key updates for the Kiwi investor:

The New Zealand share market bounced back in March after a slow start to the year, with the S&P/NZX 50 Gross Index (with imputation credits) returning +3.3% over the month. The positive return was despite some less favourable data releases, including ANZ’s business confidence measure showing a drop in sentiment for February, as well as a challenging earnings season for NZ listed companies. In contrast, over in Australia, the benchmark S&P/ASX 200 hit an all-time high in March, bolstered by momentum from the big banks.

Local bond markets also joined in on the fun, notching its first positive month in 2024, with the Bloomberg NZBond Composite 0+ Yr Index returning +1.1% over March. Growing expectations of rate cuts put downward pressure on bond yields, with the NZ 10-year government bond yields falling 16 bps over the month to 4.55%. Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr noted that while rate cuts were getting closer, the battle against inflation is far from over.

New Zealand officially entered a recession with the release of the quarterly GDP figures in March, which saw the New Zealand economy shrink -0.1% in the December quarter, following a -0.3% reading in the September quarter. It was the fourth quarter in five where the New Zealand economy contracted, with activity weighed down by weakness in the goods-based sectors such as manufacturing, wholesale trade, retail and construction – sectors that are generally sensitive to interest rates.

New Zealand is officially in a recession, following back-to-back negative growth quarters in Q3 and Q4.

The New Zealand economy is in an even tougher shape than headline figures suggest. The already concerning GDP figures have been propped up by record net migration into the country, which bolsters GDP in absolute terms. On a per capita basis, however, GDP fell -0.7% over the December quarter and has been negative since 2022. New Zealanders are certainly feeling the pinch as well, with the cost-of-living strained consumer evident in sentiment surveys and dipping credit card spending figures. And with nearly 60% of mortgage holders yet to reset to higher rates, there appear to be plenty of challenges ahead.

However, it could be a case of bad news is good news for investors, as the negative economic news of a recession is increasingly leading to ‘optimism’ that it could mean the RBNZ starts cutting interest rates earlier than anticipated. The market’s monetary policy expectations have the RBNZ starting to cut rates from August 2024, versus the RBNZ’s current 2025 timeline. Given the interest rate sensitive nature of the New Zealand share market, earlier than anticipated rate cuts could be a boon for the local market, despite all the doom and gloom within the media headlines.

Just because we are in a recession, doesn’t necessarily mean your investment strategy needs to change. Recession news makes Kiwis jittery, and the fear-mongering often attracts knee-jerk reactions. It can be tempting to feel like changes need to be made now that the economy is struggling, or that New Zealand-based investments no longer look attractive and that investors should be running towards another asset class. While there could be some volatility ahead, it is important to understand that short-term swings are a normal part of investing, and it shouldn’t impact your long-term investment strategies.

Investors that stay calm and stick to their long-term investment plans are often well served. Avoid being the type of investor who looks to sell off their holdings at the first signs of volatility (e.g. during the early days of Covid, those who ran to cash missed out on the market’s remarkable subsequent rally). That doesn’t mean there are no good reasons to change investment approaches though. If your personal circumstances and therefore investment goals or constraints change, then this could warrant changing tact. Stay invested, stay informed, and stay vigilant in reviewing your investment goals and constraints, and most Kiwi investors will find that they’ll be well-placed to weather any storm.

Chart of the month:

Mercer’s Periodic Table of Annual Investment Returns ranks how major asset classes performed each year, and highlights just how hard it is to forecast how investments will perform year-to-year.

Our Chart of the Month is Mercer’s Periodic Table of Annual Investment Returns, which ranks the annual performance of 16 major asset classes over the past 10 years. Mercer’s Periodic Table has recently been updated to reflect 2023’s returns, with the helpful colour-coding of asset classes highlighting a patchwork quilt of results that best encapsulates just how fickle Mr. Market can be year-to-year.

Looking at the Periodic Table’s results in 2023 as well as over the past 10 years, a few of the key insights from the results included the following:

- Global Equities was the undisputed king in 2023, whether on an unhedged basis (up +23.7%) or a hedged basis (up +23.0%), it outperformed all other asset classes last year. Led by mega-cap tech stocks and the Magnificent Seven, few would have expected following the bear market of 2022 that 2023 would provide such a furious rally, particularly given unhedged Global Equities were near the bottom of the pack in 2022, returning -17.6%.

- Global Private Equity, up just 3.8% in 2023 was well behind the pack last year, however the long-term value proposition is hard to ignore, with it consistently avoiding lower quartile finishes and being the overall winner on 10-year basis, averaging a nearly 15% return each year.

- The previous chart-topper, Commodities had finished 2022 over 15.3% higher, only to fall right to the bottom of all asset classes in 2023, returning -8.2%. On a longer-term horizon, it has also failed to perform, delivering a -1.0% average return over 10 years, highlighting the dangers of piling into a single asset class based on a single year’s performance window.

The 2023 version of the Periodic Table highlights that with markets, we should expect the unexpected. Mercer notes that financial markets rarely deliver, on a year-to-year basis, quite what we expect. Anything can happen over a year, and trying to base long-term investment decisions or even trying to predict returns over a single year is fraught with danger and uncertainty. The myriad of returns that markets can produce underscores the challenges of forecasting but also highlights the benefits of being diversified across asset classes, so that your portfolio is well-positioned to roll with any of punches the market dishes.

What we’ve been reading:

- AMP: Understanding Market Volatility and How to Handle It

- Dexus: Global REITs – As the Cycle Turns, Opportunities Abound

- Fisher Funds: Finances and Neurodiversity

- Good Returns: KiwiSaver Portability Settings Blocking Investors from Private Asset Benefits

- Harbour: Harbour Investment Horizon: Long Term Investment Return Assumptions

- Investment News: ETF: The ‘Best Wrapper in the World’ Records Another Hit

- MoneyHub: Investing in Vanguard Funds from New Zealand

- Nikko: Global Investment Committee’s Outlook: Stronger for Longer

- Squirrel: The RBNZ needs to start cutting rates, ASAP