InvestNow Market Wrap-Up: March 2025

Introducing Stuart Millar, Chief Investment Officer at Smartshares Ltd (Smart), this month’s guest author of the InvestNow Market Wrap-Up.

Before we dive into the March 2025 Market Wrap Up, we just wanted to acknowledge the significant market volatility we have seen so far in early April, which has certainly tested investors’ resolve with global markets experiencing their sharpest decline since the pandemic era.

A sudden escalation in global trade tensions—headlined by sweeping U.S. tariffs—triggered the sharpest equity selloff since 2020, with the S&P 500 plunging 10.5% in just two days and European stocks wiping out year-to-date gains. The Trump administration’s announcement of a 90-day pause before the full extent of these tariffs will take effect for most countries—with China being a notable exception—sparked an immediate market rebound, sending the S&P 500 soaring 9.5% (its largest single-day gain since 2008), but volatility has still persisted in the following days, with significant daily declines.

Yet history shows these moments are precisely when discipline matters most: long-term investors who maintained diversified portfolios, stayed the course, and avoided reactive decisions during past crises were ultimately rewarded as markets recovered. While today’s headlines feel urgent, the fundamentals of successful investing haven’t changed—staying committed to your strategy during downturns has consistently proven wiser than attempting to time the market’s unpredictable swings.

Navigating uncertainty amid US volatility

Global markets faced significant challenges in Q1 2025 as escalating trade tensions and geopolitical uncertainty triggered market volatility. President Trump’s trade policies, marked by widespread tariffs, have affected business and consumer confidence. This uncertainty led to a sharp sell-off in US equity markets, lower US bond yields and a lower USD.

The narrative of “US exceptionalism” seems to be fading as the US economy loses momentum faster than anticipated. Meanwhile, strong earnings in Europe, optimism over a potential Ukraine-Russia peace deal, and a tech-driven rally in China fuelled a rotation out of US equity markets.

The current levels of uncertainty are not uncommon in equity markets. The reality is that investor sentiment ebbs and flows and is a common feature of global markets. But remaining well diversified will be crucial through on-going geopolitical uncertainty.

Central Banks & Monetary Policy

The US Federal Reserve (Fed) paused rate cuts in January and March. Despite rising inflation projections, the Fed continues to project two more 25 basis point cuts in 2025 and a longer-term Federal Funds Rate of 3%.

In New Zealand, the Reserve Bank (RBNZ) continued its easing cycle with a third consecutive 50-basis point cut at its February meeting. The Governor noted that inflation remains near the midpoint of the 1-3% target, the exchange rate is at fair value, and the economy has passed the low point—a perfect position for handling future shocks. This optimistic outlook helped lift yields over the quarter. However, Adrian Orr’s unexpected resignation as Governor added uncertainty around what the future direction of monetary policy will be. The market expects the RBNZ to continue cutting towards a more neutral OCR of 3% throughout 2025.

Global Equities

Global share markets showed positive signs at the beginning of January following on from a strong finish to 2024. This didn’t last long with markets pulling back with trade tensions, policy changes and tariffs dominating headlines. Business and consumer confidence declined over the quarter, with consumer confidence declining more than 20%. The introduction of tariffs reignited fears of inflation and lower levels of growth.

US equities, particularly tech stocks, fell. Falling US stocks made way for other regions to outperform. European shares benefitted from a rotation out of large US tech stocks and into relatively cheaper European value stocks. Europe outperformed US stocks by the widest margin in 30 years and helped reduce the current valuation gap between the two regions.

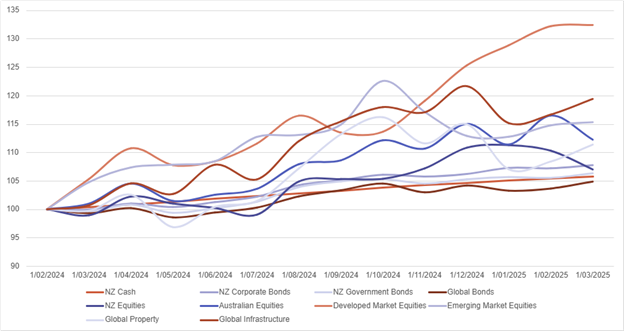

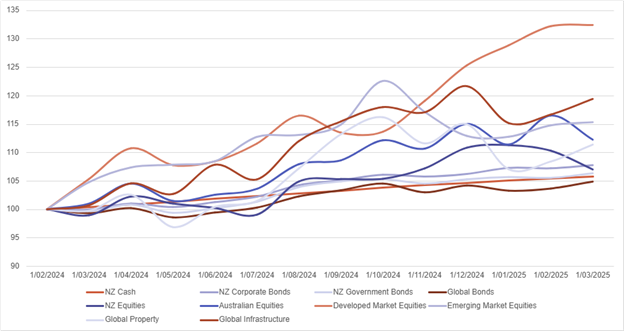

Chart 1: Major market performance over the past year

Source: Bloomberg

Global Infrastructure, Global Property and Emerging Markets proved more resilient over the quarter with flat or positive returns, highlighting the role diversification plays in a portfolio.

In New Zealand, the S&P/NZX 50 Index fell over 7% as at the end of Q1, with Spark and Infratil the worst performers. Ryman Healthcare announced a $1 billion equity raise in February at a 30% discount to reduce debt, but weak retail participation left underwriters holding 53 million shares. Ryman Healthcare shares are down over 40% for the year. On a positive note, A2 Milk surged nearly 40% after announcing it would pay a dividend for the first time.

Australia’s S&P/ASX 200 Index also declined, down almost 3%—impacted by global politics and upcoming elections. Information Technology has been the worst performing sector down over 16%, with mining and utilities companies some of the few to see positive returns in 2025.

Investor sentiment ebbs and flows are a common feature of global markets

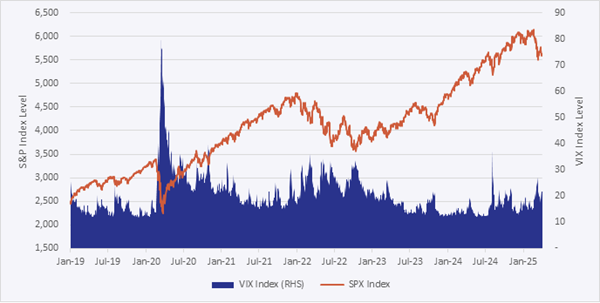

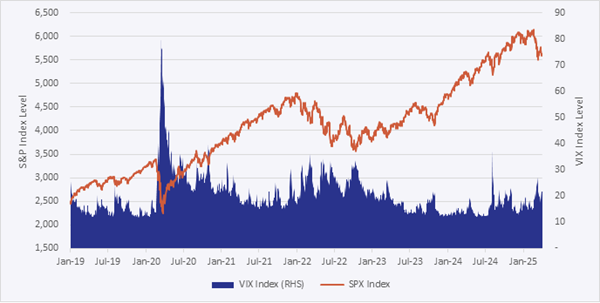

The chart below shows how the US share market (S&P500 – orange line) has moved over the last five years, alongside the VIX Index (blue bars), often referred to as the ‘fear index’, reflecting how nervous or calm investors are feeling.

When the VIX is high, it means markets expect more ups and downs—usually during times of uncertainty or bad news. Right now, uncertainty is being driven by President Trump’s tough trade talk and what it could mean for the US economy.

Short term volatility is a constant—history has shown that markets tend to rise over time.

Chart 2: S&P500 Index and VIX Index shows market sentiment v performance

Source: Bloomberg

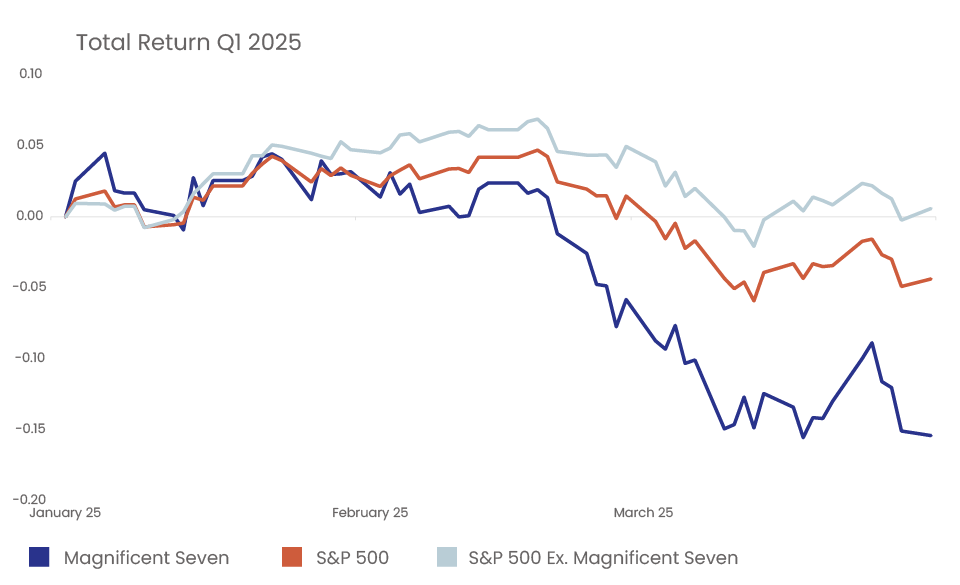

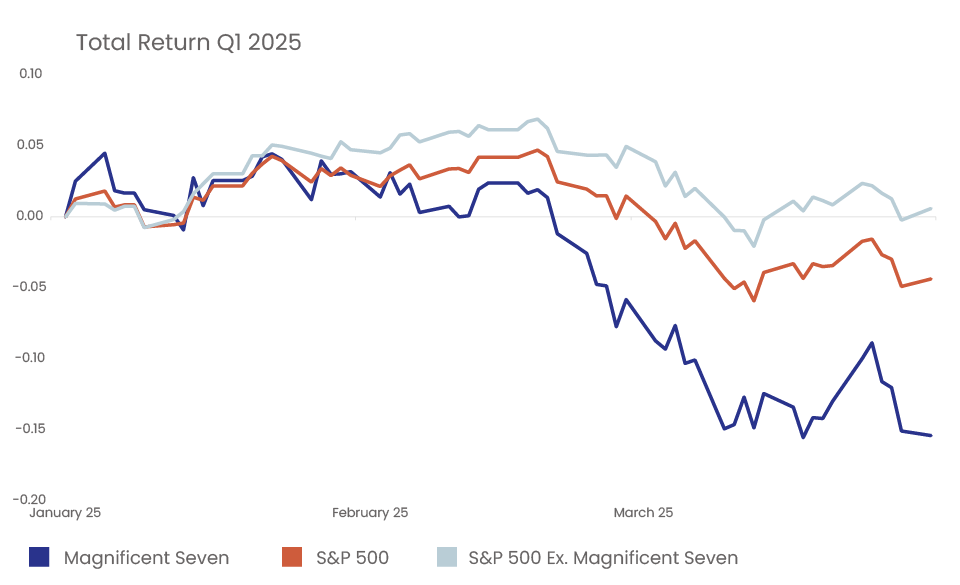

In our view, investors had become overly optimistic about the US economy and Trump’s return to power. It’s worth noting that most of the S&P 500’s gains came from a few large companies, known as the “Magnificent Seven,” (Apple, Microsoft, Google parent Alphabet, Amazon.com, Nvidia, Meta Platforms and Tesla) and their drop is responsible for nearly all of the recent market decline, as seen in the graph below. This highlights why diversification is so important.

Chart 3: Attribution of S&P 500 Decline to the Magnificent Seven

Source: Bloomberg

Looking Ahead

Market volatility will persist as geopolitical uncertainty and policy decisions unfold. Looking at the bigger picture, we’re still in an environment of global monetary policy easing. The market is currently being supported by lower policy rates in the US and Europe and fiscal support in China which should pave the way for the business cycle to continue.

In 2025, it is undeniable that policy and economic uncertainty will persist in driving market volatility, but this is why we strongly believe in building diverse and resilient portfolios.

Smart’s Exchange Traded Funds (ETFs) offer a low-cost pathway to a build a diversified portfolio with a wide range of investments that can easily be tailored to suit your personal investment goals. Through the Smart ETFs you can access a broad set of assets, markets and sectors.

A long-term perspective and diverse portfolios remain crucial as global markets navigate ongoing challenges.

If you want to see which Smart investments are available on InvestNow, plus read any other opinion or commentary pieces from Stuart and the team at Smart, please visit their page on our website.

InvestNow Market Wrap-Up: March 2025

Introducing Stuart Millar, Chief Investment Officer at Smartshares Ltd (Smart), this month’s guest author of the InvestNow Market Wrap-Up.

Before we dive into the March 2025 Market Wrap Up, we just wanted to acknowledge the significant market volatility we have seen so far in early April, which has certainly tested investors’ resolve with global markets experiencing their sharpest decline since the pandemic era.

A sudden escalation in global trade tensions—headlined by sweeping U.S. tariffs—triggered the sharpest equity selloff since 2020, with the S&P 500 plunging 10.5% in just two days and European stocks wiping out year-to-date gains. The Trump administration’s announcement of a 90-day pause before the full extent of these tariffs will take effect for most countries—with China being a notable exception—sparked an immediate market rebound, sending the S&P 500 soaring 9.5% (its largest single-day gain since 2008), but volatility has still persisted in the following days, with significant daily declines.

Yet history shows these moments are precisely when discipline matters most: long-term investors who maintained diversified portfolios, stayed the course, and avoided reactive decisions during past crises were ultimately rewarded as markets recovered. While today’s headlines feel urgent, the fundamentals of successful investing haven’t changed—staying committed to your strategy during downturns has consistently proven wiser than attempting to time the market’s unpredictable swings.

Navigating uncertainty amid US volatility

Global markets faced significant challenges in Q1 2025 as escalating trade tensions and geopolitical uncertainty triggered market volatility. President Trump’s trade policies, marked by widespread tariffs, have affected business and consumer confidence. This uncertainty led to a sharp sell-off in US equity markets, lower US bond yields and a lower USD.

The narrative of “US exceptionalism” seems to be fading as the US economy loses momentum faster than anticipated. Meanwhile, strong earnings in Europe, optimism over a potential Ukraine-Russia peace deal, and a tech-driven rally in China fuelled a rotation out of US equity markets.

The current levels of uncertainty are not uncommon in equity markets. The reality is that investor sentiment ebbs and flows and is a common feature of global markets. But remaining well diversified will be crucial through on-going geopolitical uncertainty.

Central Banks & Monetary Policy

The US Federal Reserve (Fed) paused rate cuts in January and March. Despite rising inflation projections, the Fed continues to project two more 25 basis point cuts in 2025 and a longer-term Federal Funds Rate of 3%.

In New Zealand, the Reserve Bank (RBNZ) continued its easing cycle with a third consecutive 50-basis point cut at its February meeting. The Governor noted that inflation remains near the midpoint of the 1-3% target, the exchange rate is at fair value, and the economy has passed the low point—a perfect position for handling future shocks. This optimistic outlook helped lift yields over the quarter. However, Adrian Orr’s unexpected resignation as Governor added uncertainty around what the future direction of monetary policy will be. The market expects the RBNZ to continue cutting towards a more neutral OCR of 3% throughout 2025.

Global Equities

Global share markets showed positive signs at the beginning of January following on from a strong finish to 2024. This didn’t last long with markets pulling back with trade tensions, policy changes and tariffs dominating headlines. Business and consumer confidence declined over the quarter, with consumer confidence declining more than 20%. The introduction of tariffs reignited fears of inflation and lower levels of growth.

US equities, particularly tech stocks, fell. Falling US stocks made way for other regions to outperform. European shares benefitted from a rotation out of large US tech stocks and into relatively cheaper European value stocks. Europe outperformed US stocks by the widest margin in 30 years and helped reduce the current valuation gap between the two regions.

Chart 1: Major market performance over the past year

Source: Bloomberg

Global Infrastructure, Global Property and Emerging Markets proved more resilient over the quarter with flat or positive returns, highlighting the role diversification plays in a portfolio.

In New Zealand, the S&P/NZX 50 Index fell over 7% as at the end of Q1, with Spark and Infratil the worst performers. Ryman Healthcare announced a $1 billion equity raise in February at a 30% discount to reduce debt, but weak retail participation left underwriters holding 53 million shares. Ryman Healthcare shares are down over 40% for the year. On a positive note, A2 Milk surged nearly 40% after announcing it would pay a dividend for the first time.

Australia’s S&P/ASX 200 Index also declined, down almost 3%—impacted by global politics and upcoming elections. Information Technology has been the worst performing sector down over 16%, with mining and utilities companies some of the few to see positive returns in 2025.

Investor sentiment ebbs and flows are a common feature of global markets

The chart below shows how the US share market (S&P500 – orange line) has moved over the last five years, alongside the VIX Index (blue bars), often referred to as the ‘fear index’, reflecting how nervous or calm investors are feeling.

When the VIX is high, it means markets expect more ups and downs—usually during times of uncertainty or bad news. Right now, uncertainty is being driven by President Trump’s tough trade talk and what it could mean for the US economy.

Short term volatility is a constant—history has shown that markets tend to rise over time.

Chart 2: S&P500 Index and VIX Index shows market sentiment v performance

Source: Bloomberg

In our view, investors had become overly optimistic about the US economy and Trump’s return to power. It’s worth noting that most of the S&P 500’s gains came from a few large companies, known as the “Magnificent Seven,” (Apple, Microsoft, Google parent Alphabet, Amazon.com, Nvidia, Meta Platforms and Tesla) and their drop is responsible for nearly all of the recent market decline, as seen in the graph below. This highlights why diversification is so important.

Chart 3: Attribution of S&P 500 Decline to the Magnificent Seven

Source: Bloomberg

Looking Ahead

Market volatility will persist as geopolitical uncertainty and policy decisions unfold. Looking at the bigger picture, we’re still in an environment of global monetary policy easing. The market is currently being supported by lower policy rates in the US and Europe and fiscal support in China which should pave the way for the business cycle to continue.

In 2025, it is undeniable that policy and economic uncertainty will persist in driving market volatility, but this is why we strongly believe in building diverse and resilient portfolios.

Smart’s Exchange Traded Funds (ETFs) offer a low-cost pathway to a build a diversified portfolio with a wide range of investments that can easily be tailored to suit your personal investment goals. Through the Smart ETFs you can access a broad set of assets, markets and sectors.

A long-term perspective and diverse portfolios remain crucial as global markets navigate ongoing challenges.

If you want to see which Smart investments are available on InvestNow, plus read any other opinion or commentary pieces from Stuart and the team at Smart, please visit their page on our website.

Leave A Comment