InvestNow Market Wrap-Up: October 2024

Introducing Greg Fleming, Head of Global Diversified Funds at SALT Funds Management, this month’s guest author of the InvestNow Market Wrap-Up.

October was a volatile month for markets. Developed market equities gave back a fraction of their strong overall gains in 2024, falling -2.0% over the month. The global aggregate bond index also posted a negative return for the month, falling -1.5% in NZD-hedged terms. These negative moves were largely on the back on the recalibration of the likely pace of interest rate cuts by the US Federal Reserve, to a slower pace than markets had previously assumed. The realisation that interest rate cuts won’t be accelerated also boosted the US dollar against most currencies.

The New Zealand dollar was weakest among developed market currencies in its October performance against the Greenback, dropping -5.9% for the month and closing October -5.4% lower in 2024 to date. The silver lining from a New Zealand investor’s point of view, of course, is that for funds that hold unhedged international equities, the monthly return was boosted by the NZD’s fall into positive territory. Thus, world equities (in NZ dollar terms) gained 4.8% in October and just under 24% for the year-to-date.

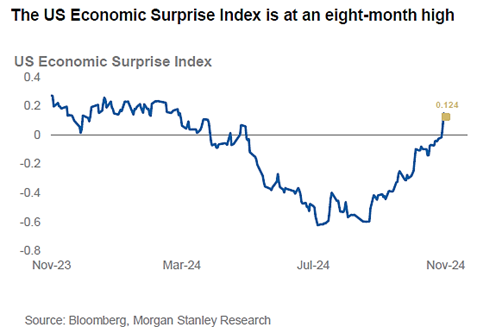

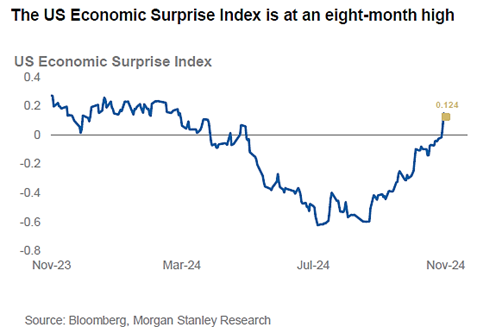

On the economic front in the US, inflation data for September came in hotter than expected. Headline CPI posted its lowest annual rate in over three years, though core remained sticky at 3.3% year-on-year. Activity and labour market data also came in stronger than expected. After cutting the Fed Funds rate by 50bp in September, markets now expect the Fed to deliver smaller, staggered 25bp reductions in November and December.

Diminished, but still noticeable inflation played into the US election campaign and clearly contributed to its outcome on 5 November. Associated uncertainty surrounding the pathway for US taxes, Federal spending and longer-term inflation pressure is also contributing to higher bond yields. The market is now focussed on fiscal sustainability and likely additional bond issuance, as well as the prospect of the trade restrictions and tariffs that the Trump victory in the Presidential race and gains for the Republicans in the US House and Senate now make a certainty, in some form. As of now, the details are too sketchy to drive investment decisions.

In Europe, annual inflation moved up to 2.0% in October, but this was primarily due to energy price fluctuations. There were signs of weakening European economic momentum over the month, particularly in the manufacturing sector. The Manufacturing industry in the European Union is vulnerable to current subdued Chinese demand for the key European exports of industrial equipment and precision machinery, automotive and luxury goods. This softening in economic conditions, which was particularly marked in Germany, prompted the European Central Bank (ECB) to deliver a third 25bp cut in the deposit rate, taking it down to 3.25%.

Some deep, structural challenges facing Europe were put firmly in the spotlight at the beginning of October, when Mario Draghi, the former ECB Head and former Italian Prime Minister, presented his long-awaited report into “The Future of European Competitiveness.” Draghi’s report addressed three key challenges for the European Union in the years to come: closing the innovation gap with the United States, harmonizing the need for decarbonization (to which the EU remains strongly committed) with competitiveness, and enhancing economic security by reducing dependencies on the world’s other large trade powers, China and the USA.

The report acknowledged that the era in which the European Union relied on cheap Russian energy, boundless Chinese markets, and an American security umbrella is over. It is now up to the EU’s member states—some of which are very reluctant to accept far-reaching reforms or to coordinate their policies—not to block the proposals, and to finance them adequately.

Across the Channel in the now Labour-party led United Kingdom, headline inflation fell to 1.7% year-on-year, though core remained higher at 3.2%. The British labour market remains tight, with the unemployment rate falling to 4.0%, while the UK Budget announcement released by newly-installed Chancellor Rachel Reeves put upward pressure on Gilts (Sovereign bonds.) The higher taxes and government spending and investment plans laid out in the Labour government’s first Budget had been well-foreshadowed, but markets adjusting to a fiscally-looser policy direction have driven up UK 10-year bond yields from 3.8% in mid-September to 4.5% now.

Japan acquired a new Prime Minister, Shigeru Ishiba, who only had a month in the job before leading the ruling Liberal Democratic Party into nationwide elections. The LDP did poorly, achieving its second-lowest number of seats in its history, but remained the largest party in the Japanese parliament. Playing it safe for the turbulent election period and not wishing to trigger volatility in the Japanese Yen, the Bank of Japan left interest rates unchanged in October, though the tone of their statement was hawkish. Annual Tokyo inflation came in at 1.8% y/y, providing evidence that higher wage increases after many years of stagnant wage growth are now flowing through into more generalised inflation.

The Chinese authorities announced further support measures for the ailing property market over the month. The raft of support and stimulus measures taken to date should result in improved activity levels, but we still think more is required, particularly more meaningful action to boost Chinese consumption. The current round helped the Chinese equity market to surge, though the sustainability of gains is challenged by US political developments. Over the next year or so, the Chinese economic package is likely to succeed in its limited aims: reversing the decline in housing sales and providing local governments with relief from interest payments.

The labour market remains tight in Australia. Jobs growth beat expectations for the sixth consecutive month in September. For now, that demand is being met by increased labour supply. The disinflation process is continuing, but the risk for the central bank is that labour supply growth cools before demand does, reigniting wage inflation. No interest rate cuts are expected across the Ditch until next year.

Finally, in New Zealand the annual CPI inflation came in at 2.2% in the year to September, the first time it has been in the RBNZ’s 1-3% target band since the March quarter of 2021. Most of the work has been done by the lower cost of imports and import competing goods (-1.6% y/y), while non-tradeable inflation remains too high (+4.9% y/y). The RBNZ will be watching the latter closely as they now muse on the challenge of sustaining inflation within the target band. The third quarter saw the unemployment rate rise from 4.6% to 4.8%, below the forecast for 5.0%, but wage growth moderated.

With the US election now out of the way and solid Republican control of government assured for 2025, investors should be aware that bond yields can remain higher for somewhat longer. At the same time, the promise of corporate tax cuts and a de-regulation drive can improve the outlook for corporate earnings, although serious medium-term risks arise from the yet-to-be-clarified import tariff agenda that has been a major economic platform for the Trump campaign.

If you want to see which SALT investments are available on InvestNow, plus read any other opinion or commentary pieces from Greg and the team at SALT, please visit their page on our website.

InvestNow Market Wrap-Up: October 2024

Introducing Greg Fleming, Head of Global Diversified Funds at SALT Funds Management, this month’s guest author of the InvestNow Market Wrap-Up.

October was a volatile month for markets. Developed market equities gave back a fraction of their strong overall gains in 2024, falling -2.0% over the month. The global aggregate bond index also posted a negative return for the month, falling -1.5% in NZD-hedged terms. These negative moves were largely on the back on the recalibration of the likely pace of interest rate cuts by the US Federal Reserve, to a slower pace than markets had previously assumed. The realisation that interest rate cuts won’t be accelerated also boosted the US dollar against most currencies.

The New Zealand dollar was weakest among developed market currencies in its October performance against the Greenback, dropping -5.9% for the month and closing October -5.4% lower in 2024 to date. The silver lining from a New Zealand investor’s point of view, of course, is that for funds that hold unhedged international equities, the monthly return was boosted by the NZD’s fall into positive territory. Thus, world equities (in NZ dollar terms) gained 4.8% in October and just under 24% for the year-to-date.

On the economic front in the US, inflation data for September came in hotter than expected. Headline CPI posted its lowest annual rate in over three years, though core remained sticky at 3.3% year-on-year. Activity and labour market data also came in stronger than expected. After cutting the Fed Funds rate by 50bp in September, markets now expect the Fed to deliver smaller, staggered 25bp reductions in November and December.

Diminished, but still noticeable inflation played into the US election campaign and clearly contributed to its outcome on 5 November. Associated uncertainty surrounding the pathway for US taxes, Federal spending and longer-term inflation pressure is also contributing to higher bond yields. The market is now focussed on fiscal sustainability and likely additional bond issuance, as well as the prospect of the trade restrictions and tariffs that the Trump victory in the Presidential race and gains for the Republicans in the US House and Senate now make a certainty, in some form. As of now, the details are too sketchy to drive investment decisions.

In Europe, annual inflation moved up to 2.0% in October, but this was primarily due to energy price fluctuations. There were signs of weakening European economic momentum over the month, particularly in the manufacturing sector. The Manufacturing industry in the European Union is vulnerable to current subdued Chinese demand for the key European exports of industrial equipment and precision machinery, automotive and luxury goods. This softening in economic conditions, which was particularly marked in Germany, prompted the European Central Bank (ECB) to deliver a third 25bp cut in the deposit rate, taking it down to 3.25%.

Some deep, structural challenges facing Europe were put firmly in the spotlight at the beginning of October, when Mario Draghi, the former ECB Head and former Italian Prime Minister, presented his long-awaited report into “The Future of European Competitiveness.” Draghi’s report addressed three key challenges for the European Union in the years to come: closing the innovation gap with the United States, harmonizing the need for decarbonization (to which the EU remains strongly committed) with competitiveness, and enhancing economic security by reducing dependencies on the world’s other large trade powers, China and the USA.

The report acknowledged that the era in which the European Union relied on cheap Russian energy, boundless Chinese markets, and an American security umbrella is over. It is now up to the EU’s member states—some of which are very reluctant to accept far-reaching reforms or to coordinate their policies—not to block the proposals, and to finance them adequately.

Across the Channel in the now Labour-party led United Kingdom, headline inflation fell to 1.7% year-on-year, though core remained higher at 3.2%. The British labour market remains tight, with the unemployment rate falling to 4.0%, while the UK Budget announcement released by newly-installed Chancellor Rachel Reeves put upward pressure on Gilts (Sovereign bonds.) The higher taxes and government spending and investment plans laid out in the Labour government’s first Budget had been well-foreshadowed, but markets adjusting to a fiscally-looser policy direction have driven up UK 10-year bond yields from 3.8% in mid-September to 4.5% now.

Japan acquired a new Prime Minister, Shigeru Ishiba, who only had a month in the job before leading the ruling Liberal Democratic Party into nationwide elections. The LDP did poorly, achieving its second-lowest number of seats in its history, but remained the largest party in the Japanese parliament. Playing it safe for the turbulent election period and not wishing to trigger volatility in the Japanese Yen, the Bank of Japan left interest rates unchanged in October, though the tone of their statement was hawkish. Annual Tokyo inflation came in at 1.8% y/y, providing evidence that higher wage increases after many years of stagnant wage growth are now flowing through into more generalised inflation.

The Chinese authorities announced further support measures for the ailing property market over the month. The raft of support and stimulus measures taken to date should result in improved activity levels, but we still think more is required, particularly more meaningful action to boost Chinese consumption. The current round helped the Chinese equity market to surge, though the sustainability of gains is challenged by US political developments. Over the next year or so, the Chinese economic package is likely to succeed in its limited aims: reversing the decline in housing sales and providing local governments with relief from interest payments.

The labour market remains tight in Australia. Jobs growth beat expectations for the sixth consecutive month in September. For now, that demand is being met by increased labour supply. The disinflation process is continuing, but the risk for the central bank is that labour supply growth cools before demand does, reigniting wage inflation. No interest rate cuts are expected across the Ditch until next year.

Finally, in New Zealand the annual CPI inflation came in at 2.2% in the year to September, the first time it has been in the RBNZ’s 1-3% target band since the March quarter of 2021. Most of the work has been done by the lower cost of imports and import competing goods (-1.6% y/y), while non-tradeable inflation remains too high (+4.9% y/y). The RBNZ will be watching the latter closely as they now muse on the challenge of sustaining inflation within the target band. The third quarter saw the unemployment rate rise from 4.6% to 4.8%, below the forecast for 5.0%, but wage growth moderated.

With the US election now out of the way and solid Republican control of government assured for 2025, investors should be aware that bond yields can remain higher for somewhat longer. At the same time, the promise of corporate tax cuts and a de-regulation drive can improve the outlook for corporate earnings, although serious medium-term risks arise from the yet-to-be-clarified import tariff agenda that has been a major economic platform for the Trump campaign.

If you want to see which SALT investments are available on InvestNow, plus read any other opinion or commentary pieces from Greg and the team at SALT, please visit their page on our website.