InvestNow News – 12th February – Fisher Funds – IT’S BEEN EMOTIONAL – Panic selling gives way to euphoria and panic buying

Article written by Ashley Gardyne, Fisher Funds – 27th January 2021

Emotions and investing don’t mix well. We have seen both rampant greed and fear at play in markets in the past 12-months and it is worth exploring how recent market euphoria could impact investors in 2021.

We have a new type of panic in 2021 it seems. Unlike early 2020 when there was panic selling in response to Covid-19, in late 2020 and early 2021 we have seen panic buying! Investors are being spurred on by the fear of missing out (FOMO) on gains they are seeing friends and other investors making. This is resulting in extremely bubbly behaviour in some parts of the market.

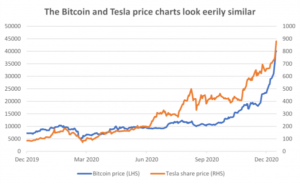

Bitcoin and Tesla head for the moon

Bitcoin seems to be flavour of the month with new retail investors at the moment. You can understand why when its price hit US$40,000 earlier this month and had gained over 700% since its lows during the Covid sell-off. New investors feel like they have been missing out on the fun and have been piling in. Bitcoin doesn’t produce any cash flow, it doesn’t have any physical uses like precious metals, and is therefore only worth what the next person will pay for it. Buying bitcoin is not investing, it is pure speculation.

Electric vehicle (EV) stocks are a similar story. On the back of the share market success of Tesla (which recently joined the S&P 500 and saw its share price gain 743% in 2020) there has been a bull market in all things EV related. We have seen electric truck manufacturer Nikola (that doesn’t even have a working vehicle) list on the stock market and skyrocket to a market valuation of nearly US$30bn – before falling rapidly back to earth. We have seen countless other EV companies raise capital at stratospheric valuations (eg. Fisker, Hyliion, NIO), as have companies involved with battery technology (eg. QuantumScape) and companies planning to roll out EV charging stations (eg. Blink Charging). Nothing has really changed fundamentally with these businesses in the last year. It is just that investors – driven by FOMO – are flocking to invest in them and now seem willing to pay multiples of what they were a year ago for the same asset.

Excesses becoming evident more broadly

There are countless other examples of excess. Some recent IPOs have raised capital at extremely high valuations (eg. Snowflake, the cloud database company, that has only US$265m of revenue, but a market valuation of US$80bn). Some covid-beneficiaries like Zoom were up close to 400% in 2020. Some of this may be warranted given accelerated video conferencing adoption due to lockdowns, but at a US$109bn market valuation you had better be sure that its well-heeled competitors like Microsoft (Teams), Slack and Alphabet (Google Meet) don’t carve out too much market share, or start a price war.

The point here isn’t that you should always avoid investing in a company that has seen its share price rise significantly. And, who knows, maybe one of these businesses will be the next Amazon or Microsoft. But if you are wrong about your assessment and pay too much – even for a great business – you can lose a lot of money very quickly indeed.

Being careful when others are greedy

Esteemed investor Warren Buffett once said that investors should be “fearful when others are greedy, and greedy when others are fearful”. This is very good advice indeed. While we don’t think investors necessarily need to be fearful after the recent market rally – there are certainly reasons to be very careful in 2021 given the bubbles that are appearing in parts of the market.

There currently seems to be a comfortable consensus in markets: The economy is starting to recover; the vaccine will result in a move towards normalcy later in 2021; pent-up demand will come flooding back; central banks globally will continue to support markets; and governments will step in where needed. However, when there is such a cheery consensus it pays to be vigilant as these conditions are the breeding ground for complacency and bubbles forming. And as we saw with Covid-19, the catalyst for a sudden change in sentiment is almost never seen ahead of time – only with the benefit of hindsight.

Sticking to the middle of the fairway

So what can investors do about this? In investing it is always important to be disciplined and not get caught up in all the excitement around the latest themes and trends. We believe this is even more relevant at this point in the investment cycle given how stretched valuations are.

However, if you look carefully you can still find high quality companies to invest in at reasonable prices. Sometimes these are in parts of the market that simply don’t grow as rapidly and hence aren’t attracting stratospheric valuations (eg. our Dollar General and Dollar Tree discount store investments, or medical device company Boston Scientific). Sometimes these companies may be temporarily out of favour (eg. the UK food-to-go and coffee chain Greggs, or Signature Bank – both of which have been temporarily impacted by Covid-19). Sometimes these businesses are simply less glamourous than the latest crop of tech market darlings. For example, our investments in Facebook, Alphabet and Alibaba provide exposure to rapidly growing and dominant tech businesses – at a fraction of the valuations of Tesla, Snowflake or Zoom.

We believe sticking to the middle of the fairway in times like these will pay off over the long term. There is a chance that this discipline could hurt in the short term if the market darlings like Tesla continue to surge higher, but over the longer term we have no doubt this is the right approach to help our clients build and preserve their wealth.

To paraphrase Kipling “if you can keep your head when all about you are losing theirs – yours is the Earth and everything in it”.

InvestNow News – 12th February – Fisher Funds – IT’S BEEN EMOTIONAL – Panic selling gives way to euphoria and panic buying

Article written by Ashley Gardyne, Fisher Funds – 27th January 2021

Emotions and investing don’t mix well. We have seen both rampant greed and fear at play in markets in the past 12-months and it is worth exploring how recent market euphoria could impact investors in 2021.

We have a new type of panic in 2021 it seems. Unlike early 2020 when there was panic selling in response to Covid-19, in late 2020 and early 2021 we have seen panic buying! Investors are being spurred on by the fear of missing out (FOMO) on gains they are seeing friends and other investors making. This is resulting in extremely bubbly behaviour in some parts of the market.

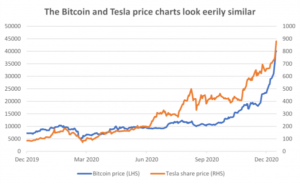

Bitcoin and Tesla head for the moon

Bitcoin seems to be flavour of the month with new retail investors at the moment. You can understand why when its price hit US$40,000 earlier this month and had gained over 700% since its lows during the Covid sell-off. New investors feel like they have been missing out on the fun and have been piling in. Bitcoin doesn’t produce any cash flow, it doesn’t have any physical uses like precious metals, and is therefore only worth what the next person will pay for it. Buying bitcoin is not investing, it is pure speculation.

Electric vehicle (EV) stocks are a similar story. On the back of the share market success of Tesla (which recently joined the S&P 500 and saw its share price gain 743% in 2020) there has been a bull market in all things EV related. We have seen electric truck manufacturer Nikola (that doesn’t even have a working vehicle) list on the stock market and skyrocket to a market valuation of nearly US$30bn – before falling rapidly back to earth. We have seen countless other EV companies raise capital at stratospheric valuations (eg. Fisker, Hyliion, NIO), as have companies involved with battery technology (eg. QuantumScape) and companies planning to roll out EV charging stations (eg. Blink Charging). Nothing has really changed fundamentally with these businesses in the last year. It is just that investors – driven by FOMO – are flocking to invest in them and now seem willing to pay multiples of what they were a year ago for the same asset.

Excesses becoming evident more broadly

There are countless other examples of excess. Some recent IPOs have raised capital at extremely high valuations (eg. Snowflake, the cloud database company, that has only US$265m of revenue, but a market valuation of US$80bn). Some covid-beneficiaries like Zoom were up close to 400% in 2020. Some of this may be warranted given accelerated video conferencing adoption due to lockdowns, but at a US$109bn market valuation you had better be sure that its well-heeled competitors like Microsoft (Teams), Slack and Alphabet (Google Meet) don’t carve out too much market share, or start a price war.

The point here isn’t that you should always avoid investing in a company that has seen its share price rise significantly. And, who knows, maybe one of these businesses will be the next Amazon or Microsoft. But if you are wrong about your assessment and pay too much – even for a great business – you can lose a lot of money very quickly indeed.

Being careful when others are greedy

Esteemed investor Warren Buffett once said that investors should be “fearful when others are greedy, and greedy when others are fearful”. This is very good advice indeed. While we don’t think investors necessarily need to be fearful after the recent market rally – there are certainly reasons to be very careful in 2021 given the bubbles that are appearing in parts of the market.

There currently seems to be a comfortable consensus in markets: The economy is starting to recover; the vaccine will result in a move towards normalcy later in 2021; pent-up demand will come flooding back; central banks globally will continue to support markets; and governments will step in where needed. However, when there is such a cheery consensus it pays to be vigilant as these conditions are the breeding ground for complacency and bubbles forming. And as we saw with Covid-19, the catalyst for a sudden change in sentiment is almost never seen ahead of time – only with the benefit of hindsight.

Sticking to the middle of the fairway

So what can investors do about this? In investing it is always important to be disciplined and not get caught up in all the excitement around the latest themes and trends. We believe this is even more relevant at this point in the investment cycle given how stretched valuations are.

However, if you look carefully you can still find high quality companies to invest in at reasonable prices. Sometimes these are in parts of the market that simply don’t grow as rapidly and hence aren’t attracting stratospheric valuations (eg. our Dollar General and Dollar Tree discount store investments, or medical device company Boston Scientific). Sometimes these companies may be temporarily out of favour (eg. the UK food-to-go and coffee chain Greggs, or Signature Bank – both of which have been temporarily impacted by Covid-19). Sometimes these businesses are simply less glamourous than the latest crop of tech market darlings. For example, our investments in Facebook, Alphabet and Alibaba provide exposure to rapidly growing and dominant tech businesses – at a fraction of the valuations of Tesla, Snowflake or Zoom.

We believe sticking to the middle of the fairway in times like these will pay off over the long term. There is a chance that this discipline could hurt in the short term if the market darlings like Tesla continue to surge higher, but over the longer term we have no doubt this is the right approach to help our clients build and preserve their wealth.

To paraphrase Kipling “if you can keep your head when all about you are losing theirs – yours is the Earth and everything in it”.