The InvestNow KiwiSaver Scheme

Build your own online KiwiSaver portfolio from 40+ available funds

The traditional KiwiSaver design pushes you to invest your KiwiSaver dollars into a single investment manager’s investment options, limiting your ability to diversify your KiwiSaver portfolio, which could impact your investment outcomes and retirement savings goals.

We’ve side-stepped this limitation by giving you the power of ‘And’ – you’re no longer limited by one investment manager’s expertise. We’ve built a single KiwiSaver Scheme that offers you the ability to truly diversify your investment – offering 40+ investment options from 15 expert investment managers.

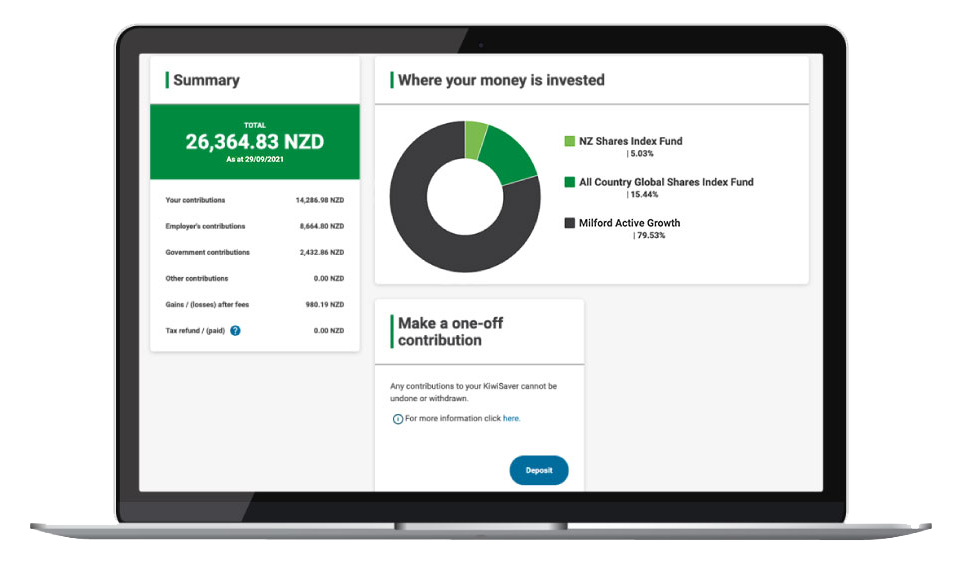

The InvestNow KiwiSaver Scheme lets you choose what's best for you

Split your KiwiSaver investment across your choice of funds!

40+ Diversified & Single-Sector Funds to choose from

View and filter the full range of funds by various fund characteristics, including fee,

performance and product disclosure information here.

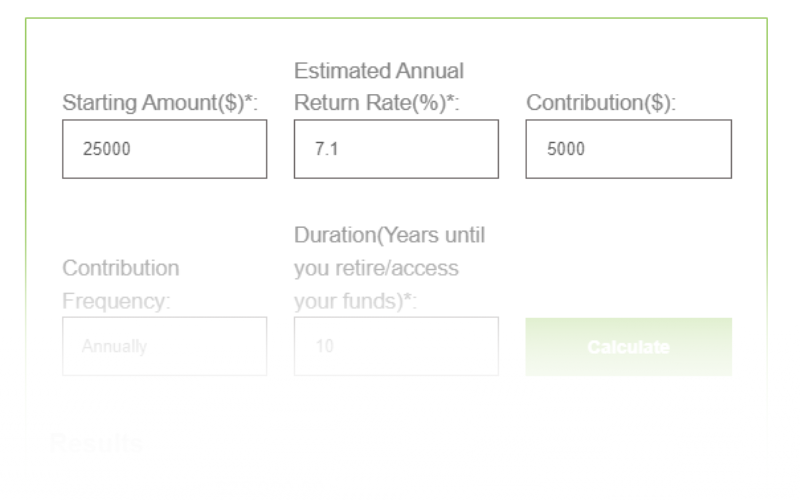

Retirement Fund Calculator

Will your estimated retirement savings/investments be enough? Use our calculator to find out

Using the findings of the Massey University study, in addition to the current NZ Super entitlement, a two-person household would need a retirement nest egg of up to $252k for a simple ‘no-frills’ basic retirement in a provincial area, and over $1 million for a more comfortable ‘choices’ lifestyle in a main city (assuming you retire at age 65, earn no other income, live until age 90 and only draw on your lump sum savings when needed).

Things to know to help you do your KiwiSaver research…

Who manages your investment

The InvestNow KiwiSaver Scheme provides a vehicle for you to invest your KiwiSaver portfolio into investment options managed directly by leading New Zealand and global investment managers. These investment managers go through a detailed quality screening process to make sure they’re fit to handle your funds with care.

Learn more.

Historical fund performance

Each underlying fund in the InvestNow KiwiSaver Scheme exists outside of KiwiSaver with the same fees and charges, and is expected to perform in-line with the underlying fund. Your KiwiSaver investments are managed directly by the investment managers you choose in the InvestNow KiwiSaver Scheme.

Learn more.

Switching KiwiSaver providers

It takes less than 2 minutes to get started with the InvestNow KiwiSaver Scheme. You can choose your investments and submit your application online. Once your application is submitted, it takes approximately 10 days for the transfer from your current provider to be complete.

Start online application.