InvestNow News – 11th December – Franklin Templeton –

SOVEREIGN ESG ANALYSIS: ARE CURRENT LAGGARDS FUTURE RISING STARS?

Article written by Reina Berlien, Franklin Templeton – 5th October 2020

Brandywine Global: Improving ESG scores, higher credit ratings, and lower borrowing costs may be a few things to look forward to in 2021.

We are often asked, “is there a country we wouldn’t invest in based purely on ESG factors alone?” It’s a fair question, particularly as we advance our ESG analysis and integration. However, the short answer is “no.” There are a few reasons we don’t exclude countries based on ESG considerations alone, but for the sake of pithiness, it’s simply because we aren’t willing to ignore substantiated valuation opportunities—which is particularly germane in a low-yielding world. Oftentimes, the highest-yielding bonds are issued by countries with weaker ESG scores; the same tenet applies to sovereign credit ratings. The corollary holds true for the highest-rated countries according to our ESG scoring methodology.

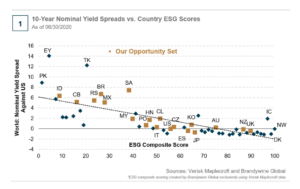

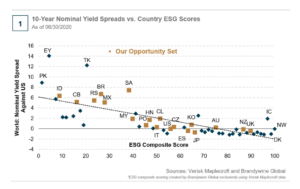

Just as we think a country’s asset prices will revert to the mean over a business cycle, we also believe its domestic ESG issues should change—by either improving or deteriorating—over a given period. The projected improvement over time explains why we invest in these countries, and a reason why our ESG analysis and integration are inherent to our investment process. There are two particular charts that illustrate how we think about our investment universe and ESG analysis.

COMPELLING ESG AND VALUATION OPPORTUNITIES

Chart 1 below ranks countries on their ESG scores on the x-axis and measures their 10-year government bond spreads relative to U.S. Treasuries on the y-axis. In our ESG scoring model, we emphasize the role of governance, as it ultimately affects social and environmental issues at the sovereign level. Together, the ESG score and any deviation from the fitted line flag potential opportunities to buy, sell, or completely avoid a government bond. The top and bottom deciles in Chart 1 exemplify the two cohorts’ dichotomous valuations and ESG rankings. Unsurprisingly, the Nordics and many other European countries have the highest ESG scores but offer paltry yields. The highest-yielding opportunities basically span the emerging market universe.

One could infer the top decile of countries has little incentive to improve in terms of ESG metrics—not to mention, they pose a significant amount of duration risk. Although countries in the bottom decile have ample reasons to improve on these factors, it doesn’t mean they are automatic candidates for investment either. In fact, the bottom decile warrants extreme caution and continuous monitoring for any potential deterioration. Even if a position is initiated, any real-time precipitous decline in governance and/or social conditions could be a reason to close the position entirely, as was the case in Egypt earlier in the year. Conversely, a country with a notably improving ESG risk profile and attractive valuations may signal an opportunistic time to invest.

Indonesia is also in the bottom decile, even as governance and social considerations surprised to the upside during the pandemic. For an emerging market with a dispersed geography and smaller-scale healthcare system, Indonesia managed the first wave of the coronavirus relatively well. Bank Indonesia has been a perennial favorite monetary authority of ours and indeed exhibited stewardship during periods of extreme market volatility. The pandemic will certainly test the mettle of government officials around the world, and we expect a country’s ESG score could change as a result of this watershed year. For example, Indonesia could see its overall score improve in 2020 due to a combination of targeted and prudent fiscal and monetary stimulus and/or improved access to healthcare. There are a myriad of ways for lower-ranked countries to improve, which then begs the question, how should countries be incentivized to improve on ESG factors?

USING BORROWING COSTS AS ESG MOTIVATION

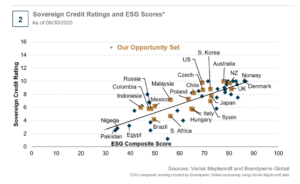

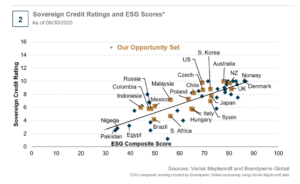

Sovereign credit ratings could be a useful tool in compelling a country to improve upon a variety of ESG metrics. Chart 2 once again plots country ESG scores on the x-axis, but this time against a sovereign’s average credit rating on the y-axis.

Weaker-scoring countries generally have lower credit ratings, likely because of the agencies’ negative outlook on their economies and skepticism surrounding the sovereign’s ability to manage outstanding debt. Lowering the cost of capital should be a welcome reprieve for any sovereign issuer, particularly those that already pay a premium on their debt. In theory, a country’s credit rating should be upgraded as its economic fundamentals improve, especially those facets that help manage outstanding debt and budgetary demands. A country’s borrowing costs should decline as it receives a ratings upgrade. The amount that a country was paying in interest could then be reallocated to a variety of ESG-centric causes, whether it’s building sustainable infrastructure, improving healthcare, or providing access to better education.

South Africa is an example of a country that received a credit rating downgrade at the onset of the pandemic, continually tries to reconcile a significant budget shortfall with huge funding demands, and has abundant opportunity to improve across several ESG considerations. However, South Africa certainly isn’t alone—most countries irrespective of credit quality and ESG scores are facing widening deficits and increased funding demands as a result of the pandemic. South Africa’s overall ESG score has gradually declined over time due to weakness across all three factors. Despite some of the highest real yields in our universe, we have approached South Africa with caution given the country’s elevated risk profile, particularly regarding matters of governance.

ESG MOMENTUM KEEPS BUILDING

We will continue to improve our statistical research on the relationships between ESG scores, bond yields, and credit ratings. Our goal is to build predictive ESG models that identify potential changes in price and information risk. The next steps in our research initiatives include determining the degree to which governance and social factors are priced into bond yields. Although environmental risks have been largely underpriced until this point, market sentiment is poised to change as countries set their own aggressive climate agendas. Egypt issued its first five-year green bond very recently, while China announced its 40-year carbon neutral plan. The latter country was also the world’s second-largest source of green bond issuance in 2019. Although both countries have weaker ESG rankings, perhaps they might focus on reducing climate risks as a strategy to improve their overall scoring. Demonstrating the ability to manage shorter-term debt and verify use of proceeds will be paramount in gaining credibility with investors and ratings agencies alike.

In the meantime, we’ll leave you with these parting thoughts: analyzing economic fundamentals and ESG factors are not mutually exclusive. There is a relationship between the two that explains possible valuation anomalies in global bond and currency markets; any changes to both components should be reflected in asset prices. It will be interesting to see how countries’ ESG scores change as a result of how they handled the pandemic, and the economic impact of those policies. Hopefully, improving ESG scores, higher credit ratings, and lower borrowing costs will be a few things to look forward to in 2021.

DEFINITIONS

ESG (environmental, social and governance) refers to an investment philosophy which takes into account the impact of policies in these three areas by the issuer of an investment.

Emerging markets (EM) are nations with social or business activity in the process of rapid growth and industrialization. These nations are sometimes also referred to as developing or less developed countries.

A global pandemic is the worldwide spread of a new disease. The World Health Organization declared COVID-19 to be a pandemic when it became clear that the illness was severe and that it was spreading quickly over a wide area.

Bank Indonesia is the central bank of the Republic of Indonesia.

A green bond is a type of fixed-income instrument that is specifically earmarked to raise money for climate and environmental projects.

Carbon Neutral is a term used to describe the state of an entity (such as a company, service, product or event), where the carbon emissions caused by them have been balanced out by funding an equivalent amount of carbon savings elsewhere in the world.

WHAT ARE THE RISKS?

Past performance is no guarantee of future results. Please note that an investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.

Equity securities are subject to price fluctuation and possible loss of principal. Fixed-income securities involve interest rate, credit, inflation and reinvestment risks; and possible loss of principal. As interest rates rise, the value of fixed income securities falls. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Commodities and currencies contain heightened risk that include market, political, regulatory, and natural conditions and may not be suitable for all investors.

U.S. Treasuries are direct debt obligations issued and backed by the “full faith and credit” of the U.S. government. The U.S. government guarantees the principal and interest payments on U.S. Treasuries when the securities are held to maturity. Unlike U.S. Treasuries, debt securities issued by the federal agencies and instrumentalities and related investments may or may not be backed by the full faith and credit of the U.S. government. Even when the U.S. government guarantees principal and interest payments on securities, this guarantee does not apply to losses resulting from declines in the market value of these securities.

Impact investing and/or Environmental, Social and Governance (ESG) managers may take into consideration factors beyond traditional financial information to select securities, which could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. Further, ESG strategies may rely on certain values based criteria to eliminate exposures found in similar strategies or broad market benchmarks, which could also result in relative investment performance deviating.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

You need Adobe Acrobat Reader to view and print PDF documents. Download a free version from Adobe’s website.

Franklin Templeton Distributors, Inc.

InvestNow News – 11th December – Franklin Templeton –

SOVEREIGN ESG ANALYSIS: ARE CURRENT LAGGARDS FUTURE RISING STARS?

Article written by Reina Berlien, Franklin Templeton – 5th October 2020

Brandywine Global: Improving ESG scores, higher credit ratings, and lower borrowing costs may be a few things to look forward to in 2021.

We are often asked, “is there a country we wouldn’t invest in based purely on ESG factors alone?” It’s a fair question, particularly as we advance our ESG analysis and integration. However, the short answer is “no.” There are a few reasons we don’t exclude countries based on ESG considerations alone, but for the sake of pithiness, it’s simply because we aren’t willing to ignore substantiated valuation opportunities—which is particularly germane in a low-yielding world. Oftentimes, the highest-yielding bonds are issued by countries with weaker ESG scores; the same tenet applies to sovereign credit ratings. The corollary holds true for the highest-rated countries according to our ESG scoring methodology.

Just as we think a country’s asset prices will revert to the mean over a business cycle, we also believe its domestic ESG issues should change—by either improving or deteriorating—over a given period. The projected improvement over time explains why we invest in these countries, and a reason why our ESG analysis and integration are inherent to our investment process. There are two particular charts that illustrate how we think about our investment universe and ESG analysis.

COMPELLING ESG AND VALUATION OPPORTUNITIES

Chart 1 below ranks countries on their ESG scores on the x-axis and measures their 10-year government bond spreads relative to U.S. Treasuries on the y-axis. In our ESG scoring model, we emphasize the role of governance, as it ultimately affects social and environmental issues at the sovereign level. Together, the ESG score and any deviation from the fitted line flag potential opportunities to buy, sell, or completely avoid a government bond. The top and bottom deciles in Chart 1 exemplify the two cohorts’ dichotomous valuations and ESG rankings. Unsurprisingly, the Nordics and many other European countries have the highest ESG scores but offer paltry yields. The highest-yielding opportunities basically span the emerging market universe.

One could infer the top decile of countries has little incentive to improve in terms of ESG metrics—not to mention, they pose a significant amount of duration risk. Although countries in the bottom decile have ample reasons to improve on these factors, it doesn’t mean they are automatic candidates for investment either. In fact, the bottom decile warrants extreme caution and continuous monitoring for any potential deterioration. Even if a position is initiated, any real-time precipitous decline in governance and/or social conditions could be a reason to close the position entirely, as was the case in Egypt earlier in the year. Conversely, a country with a notably improving ESG risk profile and attractive valuations may signal an opportunistic time to invest.

Indonesia is also in the bottom decile, even as governance and social considerations surprised to the upside during the pandemic. For an emerging market with a dispersed geography and smaller-scale healthcare system, Indonesia managed the first wave of the coronavirus relatively well. Bank Indonesia has been a perennial favorite monetary authority of ours and indeed exhibited stewardship during periods of extreme market volatility. The pandemic will certainly test the mettle of government officials around the world, and we expect a country’s ESG score could change as a result of this watershed year. For example, Indonesia could see its overall score improve in 2020 due to a combination of targeted and prudent fiscal and monetary stimulus and/or improved access to healthcare. There are a myriad of ways for lower-ranked countries to improve, which then begs the question, how should countries be incentivized to improve on ESG factors?

USING BORROWING COSTS AS ESG MOTIVATION

Sovereign credit ratings could be a useful tool in compelling a country to improve upon a variety of ESG metrics. Chart 2 once again plots country ESG scores on the x-axis, but this time against a sovereign’s average credit rating on the y-axis.

Weaker-scoring countries generally have lower credit ratings, likely because of the agencies’ negative outlook on their economies and skepticism surrounding the sovereign’s ability to manage outstanding debt. Lowering the cost of capital should be a welcome reprieve for any sovereign issuer, particularly those that already pay a premium on their debt. In theory, a country’s credit rating should be upgraded as its economic fundamentals improve, especially those facets that help manage outstanding debt and budgetary demands. A country’s borrowing costs should decline as it receives a ratings upgrade. The amount that a country was paying in interest could then be reallocated to a variety of ESG-centric causes, whether it’s building sustainable infrastructure, improving healthcare, or providing access to better education.

South Africa is an example of a country that received a credit rating downgrade at the onset of the pandemic, continually tries to reconcile a significant budget shortfall with huge funding demands, and has abundant opportunity to improve across several ESG considerations. However, South Africa certainly isn’t alone—most countries irrespective of credit quality and ESG scores are facing widening deficits and increased funding demands as a result of the pandemic. South Africa’s overall ESG score has gradually declined over time due to weakness across all three factors. Despite some of the highest real yields in our universe, we have approached South Africa with caution given the country’s elevated risk profile, particularly regarding matters of governance.

ESG MOMENTUM KEEPS BUILDING

We will continue to improve our statistical research on the relationships between ESG scores, bond yields, and credit ratings. Our goal is to build predictive ESG models that identify potential changes in price and information risk. The next steps in our research initiatives include determining the degree to which governance and social factors are priced into bond yields. Although environmental risks have been largely underpriced until this point, market sentiment is poised to change as countries set their own aggressive climate agendas. Egypt issued its first five-year green bond very recently, while China announced its 40-year carbon neutral plan. The latter country was also the world’s second-largest source of green bond issuance in 2019. Although both countries have weaker ESG rankings, perhaps they might focus on reducing climate risks as a strategy to improve their overall scoring. Demonstrating the ability to manage shorter-term debt and verify use of proceeds will be paramount in gaining credibility with investors and ratings agencies alike.

In the meantime, we’ll leave you with these parting thoughts: analyzing economic fundamentals and ESG factors are not mutually exclusive. There is a relationship between the two that explains possible valuation anomalies in global bond and currency markets; any changes to both components should be reflected in asset prices. It will be interesting to see how countries’ ESG scores change as a result of how they handled the pandemic, and the economic impact of those policies. Hopefully, improving ESG scores, higher credit ratings, and lower borrowing costs will be a few things to look forward to in 2021.

DEFINITIONS

ESG (environmental, social and governance) refers to an investment philosophy which takes into account the impact of policies in these three areas by the issuer of an investment.

Emerging markets (EM) are nations with social or business activity in the process of rapid growth and industrialization. These nations are sometimes also referred to as developing or less developed countries.

A global pandemic is the worldwide spread of a new disease. The World Health Organization declared COVID-19 to be a pandemic when it became clear that the illness was severe and that it was spreading quickly over a wide area.

Bank Indonesia is the central bank of the Republic of Indonesia.

A green bond is a type of fixed-income instrument that is specifically earmarked to raise money for climate and environmental projects.

Carbon Neutral is a term used to describe the state of an entity (such as a company, service, product or event), where the carbon emissions caused by them have been balanced out by funding an equivalent amount of carbon savings elsewhere in the world.

WHAT ARE THE RISKS?

Past performance is no guarantee of future results. Please note that an investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.

Equity securities are subject to price fluctuation and possible loss of principal. Fixed-income securities involve interest rate, credit, inflation and reinvestment risks; and possible loss of principal. As interest rates rise, the value of fixed income securities falls. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Commodities and currencies contain heightened risk that include market, political, regulatory, and natural conditions and may not be suitable for all investors.

U.S. Treasuries are direct debt obligations issued and backed by the “full faith and credit” of the U.S. government. The U.S. government guarantees the principal and interest payments on U.S. Treasuries when the securities are held to maturity. Unlike U.S. Treasuries, debt securities issued by the federal agencies and instrumentalities and related investments may or may not be backed by the full faith and credit of the U.S. government. Even when the U.S. government guarantees principal and interest payments on securities, this guarantee does not apply to losses resulting from declines in the market value of these securities.

Impact investing and/or Environmental, Social and Governance (ESG) managers may take into consideration factors beyond traditional financial information to select securities, which could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. Further, ESG strategies may rely on certain values based criteria to eliminate exposures found in similar strategies or broad market benchmarks, which could also result in relative investment performance deviating.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

You need Adobe Acrobat Reader to view and print PDF documents. Download a free version from Adobe’s website.

Franklin Templeton Distributors, Inc.