InvestNow News – 18th December – Franklin Templeton – THE YEAR OF LESS UNCERTAINTY, MORE CERTAINTY

Article written by Francis A. Scotland & Jack P. McIntyre, Franklin Templeton – 8th December 2020

Brandywine Global offers reasons for better global growth in 2021.

MACROECONOMIC OUTLOOK: POST-PANDEMIC BOOM?

A bevy of traditional macro-indicators point to better global economic growth for 2021. Some of these indicators include the lagged influence of falling bond yields, the cumulative effect of past policy stimulus measures, the low level of energy prices, and high household savings rates in China, the U.S., and Europe, which indicate pent-up purchasing power. Recoveries already have been stronger than expected, but economic policymakers in the developed world want to cushion any economic slippage caused by new social isolation measures and remain laser-focused on supporting a full recovery in employment.

The pandemic has triggered a major regime shift, which also plays to a stronger outlook, at least for the near term. For 40 years, the macro policy regime of the U.S. was to guard against the return of inflation, work toward fiscal balance, and keep monetary and fiscal policy separate. That regime is over for the time being. Paul Volcker put his stake in the ground nearly 40 years ago with his announcement that the Federal Reserve (Fed) would use the monetary aggregates to crush inflation. Fed Chair Jay Powell has put his own stake in the ground with the commitment to keep rates at zero until inflation rises above 2% and his encouragement to Congress that the risks of too little fiscal stimulus are much greater than too much. The vehicle for achieving the Fed’s goal of higher inflation will be coordinated fiscal spending. This new regime is a politician’s dream come true.

The only known-unknown standing in the way of this upbeat outlook is the COVID-19 virus and how governments and people react. However, promising vaccine developments significantly strengthen the case for a stronger-than-expected recovery for the year. China has already demonstrated this result. There, the authorities have effectively gained control of the epidemic through rigid compliance on social isolation measures and extensive testing. Within the Chinese economy, many sectors have rebounded back to normal while others are regaining momentum. So advanced is the progress that China’s monetary authorities already are throttling back stimulus. If the vaccines prove to be effective, the world recovery by the end of next year could be very surprising.

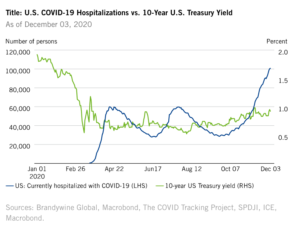

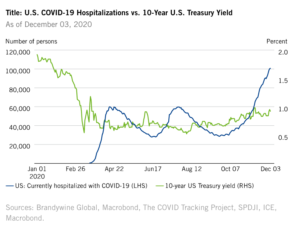

UNCERTAINTY SUBSIDES FOR GLOBAL BONDS

In determining where bond markets may head in 2021, there are three major developments to consider. First and right out of the gate is the remaining influence of COVID-19 on the global economy. The pandemic will impact economic activity through the first half of the year with a significant shift in the second half. However, this impact will not be linear across all economies. It also will be a case of “it’s darkest before the dawn,” as infection and mortality rates will remain elevated until the vaccine implementation program becomes more widespread. However, we need to consider what scenario is already being reflected in bond market sentiment. The Treasury market appears to be looking into 2021 when the vaccine will be readily available. The prior two times when hospitalization rates were in the vicinity of 60,000 people there was a flight to safety bid in Treasuries. Not this time, despite the hospitalization rate being at 100,000 and likely to rise. This change signals the Treasury market is more forward looking and starting to discount 2021’s normalization, aided by the widespread distribution of the vaccines.

The second key factor to figuring out the glide path for global bond markets involves expanding the uncertainty analysis to also include “political and economic” uncertainty. This factor is more concentrated on the U.S. but has a global reach. In early January, we will learn the outcome of the run-off Senate election in the state of Georgia, which is critical to the U.S. political and economic agendas. When push comes to shove, we will see an orderly transition of power at the White House in mid-January. Unlike President Trump, President-elect Biden is not known to “weaponize” uncertainty, so we expect to see overall political volatility diminish in 2021 and beyond. If the Senate remains under Republican control as expected, there will be less “economic” uncertainty. Gridlock will reallocate power to the “problem solver” caucus, which is a group of centrist politicians.

The third factor involves the global monetary policy front, where we also expect to see less uncertainty due to two key influences. First, and more important, is that inflation should not be a significant issue in 2021, which will keep global monetary policy biased toward more accommodative polices. This expectation is drastically different from the post-Global Financial Crisis (GFC) experience when there was a collective rush to remove policy stimulus. The use of “unorthodox” policies back then ignited a fear of monetary induced inflation. However, it never happened. Central bankers have since changed their tune on inflation coming into 2021 with a more welcoming attitude toward higher prices. Unlike in the past, they won’t fight it. If market rates were to spike higher, we would expect an increase in rhetoric on the potential use of yield curve manipulation, but we are not there yet.

What are the market implications of this “step function” lower in medical, political, economic, and monetary policy uncertainty? It means that bond market volatility will remain low, which will support the collective search for yield in 2021. Marry this development with a shortage of yield. There is now in excess of $17 trillion equivalent of negative-yielding nominal sovereign bonds. The bottom line is fixed income securities that offer a risk-adjusted yield relative to this giant pool of negative-yielding bonds will capture outsized capital flows. Yes, spreads have already narrowed across most non-sovereign credit, but there will be more room to go. However, we expect the primary beneficiary of these capital flows to be emerging market local currency bonds. On a real yield basis, they continue to look attractive outright and relative to developed market bonds

WHAT ARE THE RISKS?

Past performance is no guarantee of future results. Please note that an investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.

Equity securities are subject to price fluctuation and possible loss of principal. Fixed-income securities involve interest rate, credit, inflation and reinvestment risks; and possible loss of principal. As interest rates rise, the value of fixed income securities falls. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Commodities and currencies contain heightened risk that include market, political, regulatory, and natural conditions and may not be suitable for all investors.

U.S. Treasuries are direct debt obligations issued and backed by the “full faith and credit” of the U.S. government. The U.S. government guarantees the principal and interest payments on U.S. Treasuries when the securities are held to maturity. Unlike U.S. Treasuries, debt securities issued by the federal agencies and instrumentalities and related investments may or may not be backed by the full faith and credit of the U.S. government. Even when the U.S. government guarantees principal and interest payments on securities, this guarantee does not apply to losses resulting from declines in the market value of these securities.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

You need Adobe Acrobat Reader to view and print PDF documents. Download a free version from Adobe’s website.

Franklin Templeton Distributors, Inc.

InvestNow News – 18th December – Franklin Templeton – THE YEAR OF LESS UNCERTAINTY, MORE CERTAINTY

Article written by Francis A. Scotland & Jack P. McIntyre, Franklin Templeton – 8th December 2020

Brandywine Global offers reasons for better global growth in 2021.

MACROECONOMIC OUTLOOK: POST-PANDEMIC BOOM?

A bevy of traditional macro-indicators point to better global economic growth for 2021. Some of these indicators include the lagged influence of falling bond yields, the cumulative effect of past policy stimulus measures, the low level of energy prices, and high household savings rates in China, the U.S., and Europe, which indicate pent-up purchasing power. Recoveries already have been stronger than expected, but economic policymakers in the developed world want to cushion any economic slippage caused by new social isolation measures and remain laser-focused on supporting a full recovery in employment.

The pandemic has triggered a major regime shift, which also plays to a stronger outlook, at least for the near term. For 40 years, the macro policy regime of the U.S. was to guard against the return of inflation, work toward fiscal balance, and keep monetary and fiscal policy separate. That regime is over for the time being. Paul Volcker put his stake in the ground nearly 40 years ago with his announcement that the Federal Reserve (Fed) would use the monetary aggregates to crush inflation. Fed Chair Jay Powell has put his own stake in the ground with the commitment to keep rates at zero until inflation rises above 2% and his encouragement to Congress that the risks of too little fiscal stimulus are much greater than too much. The vehicle for achieving the Fed’s goal of higher inflation will be coordinated fiscal spending. This new regime is a politician’s dream come true.

The only known-unknown standing in the way of this upbeat outlook is the COVID-19 virus and how governments and people react. However, promising vaccine developments significantly strengthen the case for a stronger-than-expected recovery for the year. China has already demonstrated this result. There, the authorities have effectively gained control of the epidemic through rigid compliance on social isolation measures and extensive testing. Within the Chinese economy, many sectors have rebounded back to normal while others are regaining momentum. So advanced is the progress that China’s monetary authorities already are throttling back stimulus. If the vaccines prove to be effective, the world recovery by the end of next year could be very surprising.

UNCERTAINTY SUBSIDES FOR GLOBAL BONDS

In determining where bond markets may head in 2021, there are three major developments to consider. First and right out of the gate is the remaining influence of COVID-19 on the global economy. The pandemic will impact economic activity through the first half of the year with a significant shift in the second half. However, this impact will not be linear across all economies. It also will be a case of “it’s darkest before the dawn,” as infection and mortality rates will remain elevated until the vaccine implementation program becomes more widespread. However, we need to consider what scenario is already being reflected in bond market sentiment. The Treasury market appears to be looking into 2021 when the vaccine will be readily available. The prior two times when hospitalization rates were in the vicinity of 60,000 people there was a flight to safety bid in Treasuries. Not this time, despite the hospitalization rate being at 100,000 and likely to rise. This change signals the Treasury market is more forward looking and starting to discount 2021’s normalization, aided by the widespread distribution of the vaccines.

The second key factor to figuring out the glide path for global bond markets involves expanding the uncertainty analysis to also include “political and economic” uncertainty. This factor is more concentrated on the U.S. but has a global reach. In early January, we will learn the outcome of the run-off Senate election in the state of Georgia, which is critical to the U.S. political and economic agendas. When push comes to shove, we will see an orderly transition of power at the White House in mid-January. Unlike President Trump, President-elect Biden is not known to “weaponize” uncertainty, so we expect to see overall political volatility diminish in 2021 and beyond. If the Senate remains under Republican control as expected, there will be less “economic” uncertainty. Gridlock will reallocate power to the “problem solver” caucus, which is a group of centrist politicians.

The third factor involves the global monetary policy front, where we also expect to see less uncertainty due to two key influences. First, and more important, is that inflation should not be a significant issue in 2021, which will keep global monetary policy biased toward more accommodative polices. This expectation is drastically different from the post-Global Financial Crisis (GFC) experience when there was a collective rush to remove policy stimulus. The use of “unorthodox” policies back then ignited a fear of monetary induced inflation. However, it never happened. Central bankers have since changed their tune on inflation coming into 2021 with a more welcoming attitude toward higher prices. Unlike in the past, they won’t fight it. If market rates were to spike higher, we would expect an increase in rhetoric on the potential use of yield curve manipulation, but we are not there yet.

What are the market implications of this “step function” lower in medical, political, economic, and monetary policy uncertainty? It means that bond market volatility will remain low, which will support the collective search for yield in 2021. Marry this development with a shortage of yield. There is now in excess of $17 trillion equivalent of negative-yielding nominal sovereign bonds. The bottom line is fixed income securities that offer a risk-adjusted yield relative to this giant pool of negative-yielding bonds will capture outsized capital flows. Yes, spreads have already narrowed across most non-sovereign credit, but there will be more room to go. However, we expect the primary beneficiary of these capital flows to be emerging market local currency bonds. On a real yield basis, they continue to look attractive outright and relative to developed market bonds

WHAT ARE THE RISKS?

Past performance is no guarantee of future results. Please note that an investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.

Equity securities are subject to price fluctuation and possible loss of principal. Fixed-income securities involve interest rate, credit, inflation and reinvestment risks; and possible loss of principal. As interest rates rise, the value of fixed income securities falls. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Commodities and currencies contain heightened risk that include market, political, regulatory, and natural conditions and may not be suitable for all investors.

U.S. Treasuries are direct debt obligations issued and backed by the “full faith and credit” of the U.S. government. The U.S. government guarantees the principal and interest payments on U.S. Treasuries when the securities are held to maturity. Unlike U.S. Treasuries, debt securities issued by the federal agencies and instrumentalities and related investments may or may not be backed by the full faith and credit of the U.S. government. Even when the U.S. government guarantees principal and interest payments on securities, this guarantee does not apply to losses resulting from declines in the market value of these securities.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

You need Adobe Acrobat Reader to view and print PDF documents. Download a free version from Adobe’s website.

Franklin Templeton Distributors, Inc.