Adjusting to Low Interest Rates – The Alternatives

The world is flat – almost completely, if you measure it in money.

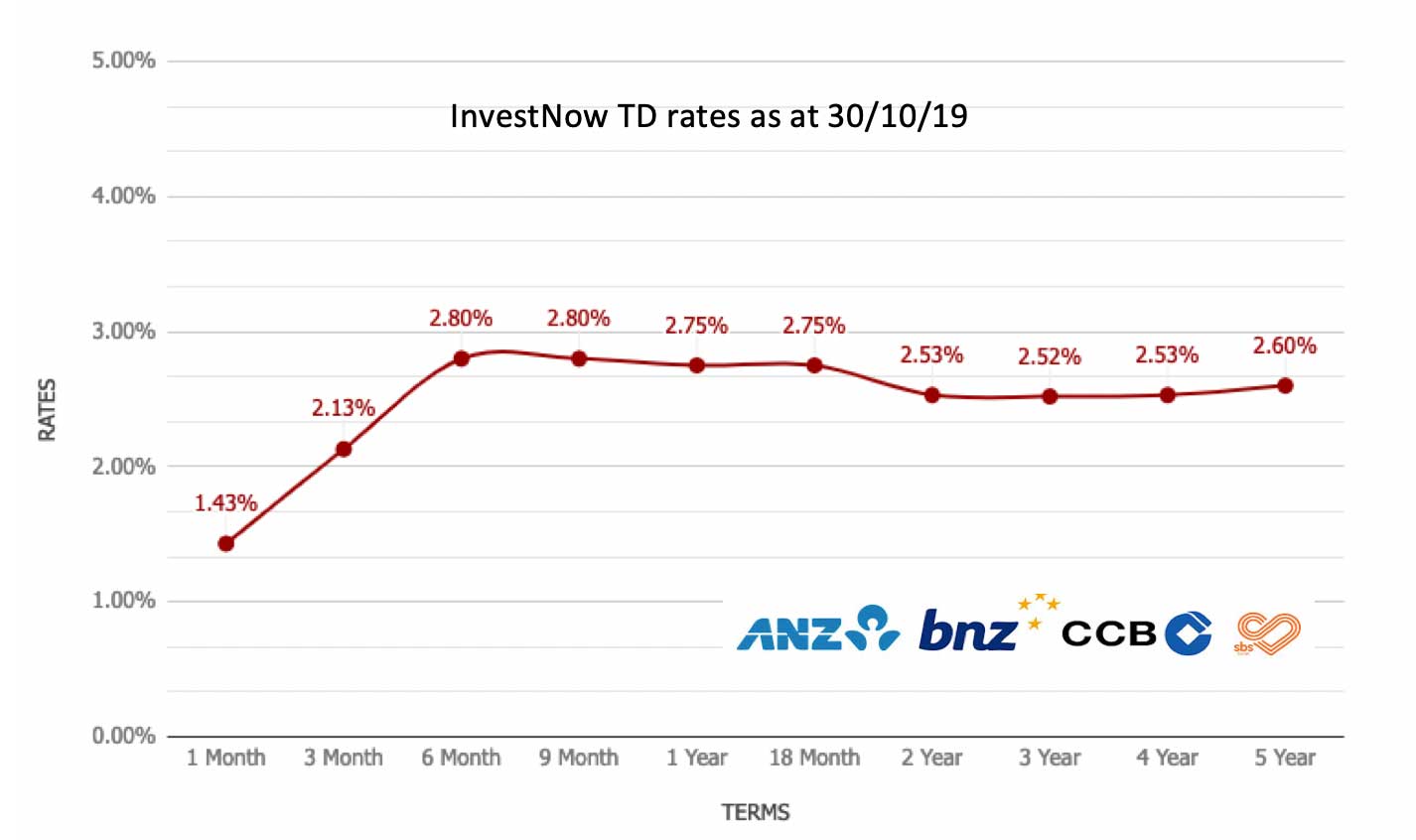

Here’s the proof. Interest rates on New Zealand Term Deposits (TDs) are almost the same stretching from 6 months out to 5 years. In fact, currently you’d be more likely to earn less on a 5 year term than a 6 month term. This is what is referred to as an inverted or negative yield curve, as depicted in the below InvestNow Term Deposit rate chart.

Rates are low and getting lower

At the time of writing this article, of the banks on InvestNow offering TDs, the best rates were 2.80% for a short-term 6 month period and 2.60% for a long-term 5 year period. The fact that TD investors can earn more on a short-term investment is in itself a prime example of the current topsy-turvy interest rate environment.

Logically, investors should earn a higher rate the longer the term of the TD. When shorter term TDs offer higher rates than their longer-term counterparts, it is generally a sign that banks think interest rates are going to fall further from their current levels.

But while flat and lowering rates across time is an interesting phenomenon, investors are becoming more and more anxious about the overall low returns offered by bank TDs, especially the people relying on TD returns for income.

What’s the cause?

Sinking rates are, of course, tied to sharp declines in the Reserve Bank of New Zealand (RBNZ) official cash rate (OCR), which has been slashed from the already historical low 1.75% in March, to just 1.00% in August.

The RBNZ is expected to make further OCR reductions, probably this year, with talk of even going to zero.

According to the latest RBNZ data, Kiwis held about $172 billion in bank TDs at the end of August, just after the OCR cut – potentially leaving a lot of Kiwis vulnerable to the declining returns.

Investor options

In the current climate, TD investors who rely on TD returns for income are realistically left with 3 broad choices:

1. Hunt for and accept the best TD rate(s) available

The easiest option, of course, is to accept the low rates and adjust spending to suit. This however, may not sit well with everyone.

2. Cash Funds

Although Cash fund returns are on average pretty similar to TDs, as they tend to invest in similar low-risk assets, there are benefits to Cash funds – PIE tax and liquidity.

As the majority of Cash funds are Portfolio Investment Entities (PIE funds), the maximum tax applied is the 28% Prescribed Investor Rate (PIR) as opposed to the maximum 33% Resident Withholding Tax (RWT) rate that applies to bank TDs (only applies to those in the highest income tax bracket, earning over $70,000 a year).

Unlike TDs, where money is locked in for periods up to 5 years, Cash funds provide the ability to quickly liquidate your investment without incurring any penalties. When Cash funds are generating similar returns to TDs this is a material benefit as it gives investors the flexibility to put their capital in other investments that could produce a better return, or alternatively access their capital should they need it; For example, to buy a house.

Many Cash funds pay regular distributions but some do not pay distributions at all. This means, depending on the fund you select, you could be able to use a Cash fund to generate an accessible income or alternatively take advantage of compound interest via the default re-investing. You can find out if a fund pays distributions by reading the fund’s Product Disclosure Statement (PDS) or, for those funds offered on InvestNow, review this FAQ.

3. Income Funds

Income funds are funds that prioritise current income, often by investing exclusively in interest or dividend paying investments.

Similar to Cash funds, Income funds can produce a regular return in the form of distributions. Income funds however, come in all shapes, sizes and asset classes, giving investors the ability to slide up that risk/return scale by choosing income funds that invest in assets such as equities.

The tax benefits (28% maximum PIR tax) mentioned above in Cash funds, also apply to Income funds that are Portfolio Investment Entities (PIE) funds.

Once again, some Income funds pay regular distributions and some do not. You can find out in each funds PDS and reviewing this FAQ.

The Risk/Return scale

Mike Heath, General Manager InvestNow, says “sliding up the risk scale is a logical option in a low rate environment, but investors need to be aware that the more they move up that scale, the higher the risk of wobbly returns”. An understanding of volatility and how to handle it is a “must have” for investors.

For example, the New Zealand Fixed Interest funds (low-medium risk) on InvestNow have produced 12 month returns ranging from 6.05% to almost 8.57%. At the same time, the International Equities (medium-high risk) funds on InvestNow returned between -2.37% and close to 29.62%. Note the potential for both high and negative returns when moving up the risk scale.

Each fund manager employs different strategies in their efforts to earn income for their investors, which can show up in different allocations to equities, bonds, cash and other assets. It’s important that investors read the PDSs to understand these differences and what they could mean for the volatility of returns, prior to investing in funds.

Mike Heath says, “Investors, looking for income-generating assets, have a raft of choices available to them through InvestNow – bank TDs, institutional-grade cash funds, to products that derive a yield from bonds or equities; or a mix of these assets.”

Undoubtedly, TD’s are set to come under further pressure as the RBNZ follows global central banks down the interest rate slide.

In this flat-rate world, it’s very possible that investors might soon be pushed over the edge into more risky territory.

*Performance and rate information current as at the time of writing this article (30/10/19). Past performance is not a guarantee of future returns. Investors who are unsure of what investments are suitable for them should seek independent investment advice.