Investors Float on, in Sink-or-Swim Times

Article written by InvestNow

From deep down in a hole on March 23, the benchmark NZ shares index had clawed its way back about 25% by late April.

Despite the extraordinary resurrection of the NZX – an effort mirrored in most other world equity markets – the index remains 10%, or so, below its February peak.

Share markets appear to have developed immunity to COVID-19 well ahead of any real-world cure for the viral disease.

But the sharp turnaround in equity markets from the March low has not convinced everyone that the worst is over. An April headline in the Financial Times, for instance, illustrates the sentiment: “Investors baffled by soaring stocks in ‘monster’ depression”.

If there is a disconnection between reality and market sentiment, however, the huge response from governments and central banks to support shutdown economies has played a part.

Drink up: investors cheered by liquid injections

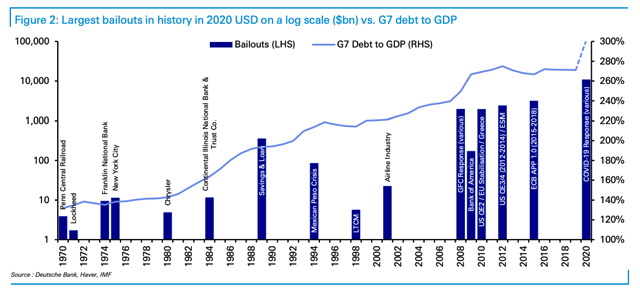

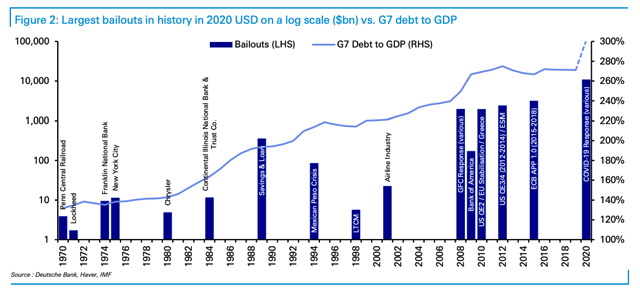

The global effort to prop up economies during COVID-19 lockdowns has been off the charts. In fact, chart-makers have had to invent new charts to accommodate the extent of recent government and central bank support in historical context.

For example, this Deutsche Bank graph comparing various bailouts since 1970 had to be reconfigured using a logarithmic scale to squeeze the COVID-19 figures in a reasonable screen view.

The extreme ‘liquidity’ injection into markets and households (via measures such as the NZ government’s $10 billion plus ‘wage subsidy’) has buoyed the price of almost all assets. And with interest rates at all-time lows, investors are still looking to equity markets for returns.

The COVID-19 shock, however, has left some deep scars on global stock markets, including the NZX, as companies adjust to a radically changed environment.

Rinse, repeat and dilute

Certain sectors of the NZ share market have clearly been hit harder than others by the COVID-19 shutdown: tourism and hospitality, in particular.

Among the tourism sector, two NZX-listed companies – Air NZ and Auckland Airport – stand out as big-ticket items for investors. The two stocks are among the largest on the NZX and feature in most portfolios.

Since the COVID-19 crash in March, both Air NZ and Auckland Airport have had to recapitalise to survive, albeit via different routes. Air NZ tapped the government for a $900 million loan on harsh commercial terms while Auckland Airport issued $1.2 billion in new equity, raising the money from a select group of institutional investors (including some funds offered on InvestNow).

Under the Air NZ deal, the government could assume full control of the airline if it defaults on the debt, wiping out all other shareholders. By contrast, all Auckland Airport shareholders would’ve seen the value of their stocks ‘diluted’ (to the tune of about 1 per cent) after the recent equity placement.

In spite of the divergent risks now associated with Air NZ and Auckland Airport, the two stocks have both rocketed up from the March lows.

According to data from Reuters, large NZ companies had raised about $1.5 billion (excluding the Air NZ loan) in debt or equity since the crisis began with many others expected to follow suit in the race to raise capital.

Over the medium-term, or even, short-term the COVID-19 economic ‘event’ could dramatically reshape the NZX, along with other global share markets.

What came out in the wash

Investors making bets on single stocks in the current, fast-changing environment would need a strong stomach. But the volatility won’t be quite as intense for those investing in diversified funds.

Figures from NZ investment consultancy, Melville Jessup Weaver (MJW), show that during the three months ending March 31 – that included the market nadir – the S&P/NZX 50 index fell 14.5%, well below the -20% for the currency-hedged global equities benchmark. (On an unhedged basis, though, global shares were down just 10%, showing the buffering effect of a falling NZ dollar over the period.)

The high market turbulence in March did spark some behavioural changes among InvestNow members, according to general manager of the platform, Mike Heath.

“We saw a reasonably significant increase in withdrawals and a slight decline in deposits in March,” Heath says. “But, overall, March was still net positive for deposits by a large margin.”

He says fund investor strategies have also altered course a little.

Across all InvestNow investors, the number of sell orders spiked upwards (a trend beginning this January) to rise above buy orders mid-March. Although, the number of fund buy orders only fell a small amount in March compared to the previous month.

The InvestNow trading data for Smartshares exchange-traded funds (ETFs), however, follows a reverse trend over the period, Heath says.

“From mid-February to late-March the number of Smartshares buy orders actually jumped above the sell orders, which were more-or-less flat month-on-month,” he says. “It seems some investors are using the ETFs to make contrarian calls or perhaps to follow ‘buy the dip’ strategies.

“Either way, the platform has enabled InvestNow members to execute their plans very efficiently in spite of historic market disruptions.”

The ultra-volatility certainly hasn’t dampened demand for InvestNow, Heath says, with a flood of new members joining in March and April.

“We are on track to add 2,000 net new members in April, breaking the previous monthly record set earlier this year,” he says. “Possibly, Kiwis have had more time to consider their financial futures during the Level 4 lockdown and view the current slump as a once-in-a-lifetime opportunity to enter the market cheaply.”

Investors Float on, in Sink-or-Swim Times

Article written by InvestNow

From deep down in a hole on March 23, the benchmark NZ shares index had clawed its way back about 25% by late April.

Despite the extraordinary resurrection of the NZX – an effort mirrored in most other world equity markets – the index remains 10%, or so, below its February peak.

Share markets appear to have developed immunity to COVID-19 well ahead of any real-world cure for the viral disease.

But the sharp turnaround in equity markets from the March low has not convinced everyone that the worst is over. An April headline in the Financial Times, for instance, illustrates the sentiment: “Investors baffled by soaring stocks in ‘monster’ depression”.

If there is a disconnection between reality and market sentiment, however, the huge response from governments and central banks to support shutdown economies has played a part.

Drink up: investors cheered by liquid injections

The global effort to prop up economies during COVID-19 lockdowns has been off the charts. In fact, chart-makers have had to invent new charts to accommodate the extent of recent government and central bank support in historical context.

For example, this Deutsche Bank graph comparing various bailouts since 1970 had to be reconfigured using a logarithmic scale to squeeze the COVID-19 figures in a reasonable screen view.

The extreme ‘liquidity’ injection into markets and households (via measures such as the NZ government’s $10 billion plus ‘wage subsidy’) has buoyed the price of almost all assets. And with interest rates at all-time lows, investors are still looking to equity markets for returns.

The COVID-19 shock, however, has left some deep scars on global stock markets, including the NZX, as companies adjust to a radically changed environment.

Rinse, repeat and dilute

Certain sectors of the NZ share market have clearly been hit harder than others by the COVID-19 shutdown: tourism and hospitality, in particular.

Among the tourism sector, two NZX-listed companies – Air NZ and Auckland Airport – stand out as big-ticket items for investors. The two stocks are among the largest on the NZX and feature in most portfolios.

Since the COVID-19 crash in March, both Air NZ and Auckland Airport have had to recapitalise to survive, albeit via different routes. Air NZ tapped the government for a $900 million loan on harsh commercial terms while Auckland Airport issued $1.2 billion in new equity, raising the money from a select group of institutional investors (including some funds offered on InvestNow).

Under the Air NZ deal, the government could assume full control of the airline if it defaults on the debt, wiping out all other shareholders. By contrast, all Auckland Airport shareholders would’ve seen the value of their stocks ‘diluted’ (to the tune of about 1 per cent) after the recent equity placement.

In spite of the divergent risks now associated with Air NZ and Auckland Airport, the two stocks have both rocketed up from the March lows.

According to data from Reuters, large NZ companies had raised about $1.5 billion (excluding the Air NZ loan) in debt or equity since the crisis began with many others expected to follow suit in the race to raise capital.

Over the medium-term, or even, short-term the COVID-19 economic ‘event’ could dramatically reshape the NZX, along with other global share markets.

What came out in the wash

Investors making bets on single stocks in the current, fast-changing environment would need a strong stomach. But the volatility won’t be quite as intense for those investing in diversified funds.

Figures from NZ investment consultancy, Melville Jessup Weaver (MJW), show that during the three months ending March 31 – that included the market nadir – the S&P/NZX 50 index fell 14.5%, well below the -20% for the currency-hedged global equities benchmark. (On an unhedged basis, though, global shares were down just 10%, showing the buffering effect of a falling NZ dollar over the period.)

The high market turbulence in March did spark some behavioural changes among InvestNow members, according to general manager of the platform, Mike Heath.

“We saw a reasonably significant increase in withdrawals and a slight decline in deposits in March,” Heath says. “But, overall, March was still net positive for deposits by a large margin.”

He says fund investor strategies have also altered course a little.

Across all InvestNow investors, the number of sell orders spiked upwards (a trend beginning this January) to rise above buy orders mid-March. Although, the number of fund buy orders only fell a small amount in March compared to the previous month.

The InvestNow trading data for Smartshares exchange-traded funds (ETFs), however, follows a reverse trend over the period, Heath says.

“From mid-February to late-March the number of Smartshares buy orders actually jumped above the sell orders, which were more-or-less flat month-on-month,” he says. “It seems some investors are using the ETFs to make contrarian calls or perhaps to follow ‘buy the dip’ strategies.

“Either way, the platform has enabled InvestNow members to execute their plans very efficiently in spite of historic market disruptions.”

The ultra-volatility certainly hasn’t dampened demand for InvestNow, Heath says, with a flood of new members joining in March and April.

“We are on track to add 2,000 net new members in April, breaking the previous monthly record set earlier this year,” he says. “Possibly, Kiwis have had more time to consider their financial futures during the Level 4 lockdown and view the current slump as a once-in-a-lifetime opportunity to enter the market cheaply.”