InvestNow News – 10th July – Harbour Asset Management – Harbour Outlook: Stimulus trumps rise in infections

Article written by Harbour Team – 8th July

Key points

- Equities continued to bounce back with the S&P/NZX 50 Index returning 5.3%, S&P/ASX 200 Index (in AUD) up 2.6% and the MSCI ACWI Index up 3.0%.

- US employment growth has continued to surprise to the upside, with the improving economic data providing a stark contrast to the worsening COVID case numbers.

- Global COVID-19 containment measures have eased in aggregate, allowing a partial recovery in economic activity. The average lockdown stringency for the world’s 10 largest economies, based on the Oxford University measure, reduced to 60 from 70 in May (where 100 is equivalent to Alert Level 4 and 0 is no restrictions).

- In New Zealand, higher frequency economic indicators are showing a sharp recovery in many sectors.

Key developments

Equity markets responded positively to ongoing financial stimulus, the earlier than expected re-opening of economies, and generally better than feared economic and corporate news. Performance of the equity market was in direct contrast to the news on the global spread of COVID-19, highlighting the preparedness of equity investors to look through the crisis and anticipate recovery. New Zealand bond yields drifted lower over the quarter, though were flat throughout June.

Global policy makers continue to provide stimulus, with a focus on providing household and business support to bridge the crisis. Most developed economy central banks are continuing to provide stimulus via policy rates being set at their effective lower bound, forward guidance that interest rates will stay low for the foreseeable future, large Quantitative Easing (QE) programmes and bank lending facilities. Separately, the amount of global fiscal stimulus announced so far by governments is equivalent to 3.8% of global Gross Domestic Product (GDP), more than double that seen during the Global Financial Crisis (GFC). The US Federal Reserve (the Fed) Chair, Jerome Powell, recently underscored the central bank’s commitment to low interest rates by saying “we’re not even thinking about thinking about raising rates”. This was followed by news that the Fed will provide further support to the corporate debt market by purchasing corporate bonds directly (in addition to corporate bond Exchange Traded Funds (ETFs)) in the secondary market.

The stimulus has been sufficient to offset fears raised by climbing COVID-19 infection rates in the US, and news of a second outbreak in Beijing. COVID-19 is still not under control in many countries, including the US and Emerging Markets, and global mobility remains restricted to varying degrees as a result. These control measures continue to hurt labour-intensive service sectors the most, and have a significant economic impact given the large size of the service sectors (60-80% of GDP for most developed countries). The high labour component within the sector has translated into job losses, reduced household income and lower consumer confidence. Global economic output will likely remain below potential for 1-2 years, creating a long period of disinflationary force that, when combined with large QE programmes, will limit the ability for interest rates to rise.

The New Zealand economy returned to Alert Level 1 sooner than many had expected, allowing for a sharp, but partial, rebound in economic activity. Job ads and workplace visits, according to Google mobility data, have returned to pre-COVID levels. Electricity demand is slightly below pre-COVID levels, and vehicle traffic is also 5-10% below pre-COVID levels. Business confidence, while still consistent with recession, has materially improved with a net 26% of businesses surveyed in June expecting their own activity to worsen, versus 55% in April. Consumer confidence has recovered to about 12% below its long-term average, from about 30% below in April.

What to watch

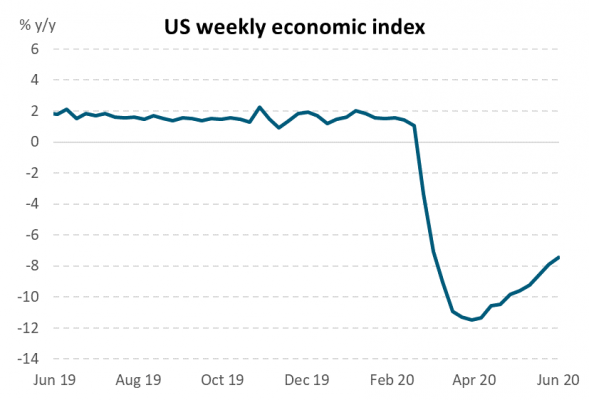

The speed of the recovery: As economies re-open, activity is rebounding earlier than many forecasters had expected. Government restrictions on peoples’ movement have eased in most of the world’s largest economies over the past month, and global business sentiment surveys have bounced off multi-decade lows, suggesting that global growth likely bottomed in April (see figures below). The US labour market has continued to beat expectations adding 4.8mn jobs in June, versus 3.2mn expected, this followed a large beat in May. The New York Fed’s weekly US economic index derives a common signal from several high frequency indicators and supports the bounce, suggesting US economic activity is 7.4% lower year on year.

Source: Daniel Lewis, Karel Mertens, and Jim Stock, “Monitoring Real Activity in Real Time: The Weekly Economic Index,” Federal Reserve Bank of New York Liberty Street Economics, March 30, 2020.

Market outlook and positioning

At a corporate level, the outlook remains very mixed and supports an active investment approach. A feature of COVID-19 has been a large dispersion between winners and losers. Trends that were evident prior to COVID-19, seem to be accelerating. Online growth, the adoption of automation and artificial intelligence, and more generally the investment in technology, seem likely to be key features. Additionally, household and government spending seem likely to increase on healthcare. In contrast, uncertainty with rising unemployment and the cessation of wage support probably limits upside to consumer discretionary spending; while the ongoing closure of borders is likely to dampen investor enthusiasm for travel and tourism stocks more generally, especially after large share price recovery rallies in these sectors in the last quarter.

Within growth equity portfolios, we have a solid anchor in the technology and consumer staples sectors. Additionally, we have added to a few more defensive growth positions, such as the Goodman Group, Charter Hall, Ebos and Ramsay Healthcare.

The fixed interest market is being dominated by the opposing forces of a massive increase in the supply of government stock and a central bank that is prepared to purchase enough bonds in the secondary market to prevent a meaningful rise in yields. A commitment to keeping the Official Cash Rate (OCR) low is anchoring short term rates near 0.25%. In this environment, our strategy is to break our portfolio positioning into near-term dynamics, while also considering where yields might go over a longer, 6-24-month horizon. In the near term, we are expecting bond yields to stay in a narrow range, mostly driven by the to-and-fro of supply and demand issues. The relevant short-term factors are, supply of bonds from the Treasury, how aggressive the Reserve Bank of New Zealand’s Large Scale Asset Purchases (LSAP) programme is and pricing relativities with other markets, notably Australia. There is enough volatility being driven by these factors to seek tactical gains. Longer term, we see an asymmetric bias, with a greater risk that bond yields rise. This is effectively priced into the yield curve, with longer-term yields sitting higher than short-term yields.

In multi-asset portfolios, we have trimmed our overweight position to equity markets. Equities are around fair value using normalised price to earnings measures and offer a good risk premium over bonds. Given the sharp bounce back we have seen in equity markets, the risk-return trade-off is not as attractive as it was during periods of market weakness. As a result, we will continue to be highly active in our positioning.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

InvestNow News – 10th July – Harbour Asset Management – Harbour Outlook: Stimulus trumps rise in infections

Article written by Harbour Team – 8th July

Key points

- Equities continued to bounce back with the S&P/NZX 50 Index returning 5.3%, S&P/ASX 200 Index (in AUD) up 2.6% and the MSCI ACWI Index up 3.0%.

- US employment growth has continued to surprise to the upside, with the improving economic data providing a stark contrast to the worsening COVID case numbers.

- Global COVID-19 containment measures have eased in aggregate, allowing a partial recovery in economic activity. The average lockdown stringency for the world’s 10 largest economies, based on the Oxford University measure, reduced to 60 from 70 in May (where 100 is equivalent to Alert Level 4 and 0 is no restrictions).

- In New Zealand, higher frequency economic indicators are showing a sharp recovery in many sectors.

Key developments

Equity markets responded positively to ongoing financial stimulus, the earlier than expected re-opening of economies, and generally better than feared economic and corporate news. Performance of the equity market was in direct contrast to the news on the global spread of COVID-19, highlighting the preparedness of equity investors to look through the crisis and anticipate recovery. New Zealand bond yields drifted lower over the quarter, though were flat throughout June.

Global policy makers continue to provide stimulus, with a focus on providing household and business support to bridge the crisis. Most developed economy central banks are continuing to provide stimulus via policy rates being set at their effective lower bound, forward guidance that interest rates will stay low for the foreseeable future, large Quantitative Easing (QE) programmes and bank lending facilities. Separately, the amount of global fiscal stimulus announced so far by governments is equivalent to 3.8% of global Gross Domestic Product (GDP), more than double that seen during the Global Financial Crisis (GFC). The US Federal Reserve (the Fed) Chair, Jerome Powell, recently underscored the central bank’s commitment to low interest rates by saying “we’re not even thinking about thinking about raising rates”. This was followed by news that the Fed will provide further support to the corporate debt market by purchasing corporate bonds directly (in addition to corporate bond Exchange Traded Funds (ETFs)) in the secondary market.

The stimulus has been sufficient to offset fears raised by climbing COVID-19 infection rates in the US, and news of a second outbreak in Beijing. COVID-19 is still not under control in many countries, including the US and Emerging Markets, and global mobility remains restricted to varying degrees as a result. These control measures continue to hurt labour-intensive service sectors the most, and have a significant economic impact given the large size of the service sectors (60-80% of GDP for most developed countries). The high labour component within the sector has translated into job losses, reduced household income and lower consumer confidence. Global economic output will likely remain below potential for 1-2 years, creating a long period of disinflationary force that, when combined with large QE programmes, will limit the ability for interest rates to rise.

The New Zealand economy returned to Alert Level 1 sooner than many had expected, allowing for a sharp, but partial, rebound in economic activity. Job ads and workplace visits, according to Google mobility data, have returned to pre-COVID levels. Electricity demand is slightly below pre-COVID levels, and vehicle traffic is also 5-10% below pre-COVID levels. Business confidence, while still consistent with recession, has materially improved with a net 26% of businesses surveyed in June expecting their own activity to worsen, versus 55% in April. Consumer confidence has recovered to about 12% below its long-term average, from about 30% below in April.

What to watch

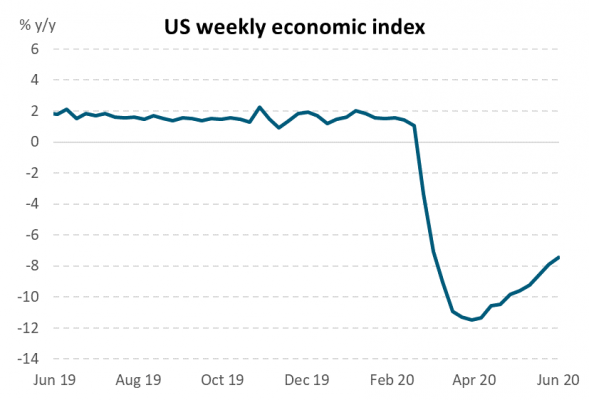

The speed of the recovery: As economies re-open, activity is rebounding earlier than many forecasters had expected. Government restrictions on peoples’ movement have eased in most of the world’s largest economies over the past month, and global business sentiment surveys have bounced off multi-decade lows, suggesting that global growth likely bottomed in April (see figures below). The US labour market has continued to beat expectations adding 4.8mn jobs in June, versus 3.2mn expected, this followed a large beat in May. The New York Fed’s weekly US economic index derives a common signal from several high frequency indicators and supports the bounce, suggesting US economic activity is 7.4% lower year on year.

Source: Daniel Lewis, Karel Mertens, and Jim Stock, “Monitoring Real Activity in Real Time: The Weekly Economic Index,” Federal Reserve Bank of New York Liberty Street Economics, March 30, 2020.

Market outlook and positioning

At a corporate level, the outlook remains very mixed and supports an active investment approach. A feature of COVID-19 has been a large dispersion between winners and losers. Trends that were evident prior to COVID-19, seem to be accelerating. Online growth, the adoption of automation and artificial intelligence, and more generally the investment in technology, seem likely to be key features. Additionally, household and government spending seem likely to increase on healthcare. In contrast, uncertainty with rising unemployment and the cessation of wage support probably limits upside to consumer discretionary spending; while the ongoing closure of borders is likely to dampen investor enthusiasm for travel and tourism stocks more generally, especially after large share price recovery rallies in these sectors in the last quarter.

Within growth equity portfolios, we have a solid anchor in the technology and consumer staples sectors. Additionally, we have added to a few more defensive growth positions, such as the Goodman Group, Charter Hall, Ebos and Ramsay Healthcare.

The fixed interest market is being dominated by the opposing forces of a massive increase in the supply of government stock and a central bank that is prepared to purchase enough bonds in the secondary market to prevent a meaningful rise in yields. A commitment to keeping the Official Cash Rate (OCR) low is anchoring short term rates near 0.25%. In this environment, our strategy is to break our portfolio positioning into near-term dynamics, while also considering where yields might go over a longer, 6-24-month horizon. In the near term, we are expecting bond yields to stay in a narrow range, mostly driven by the to-and-fro of supply and demand issues. The relevant short-term factors are, supply of bonds from the Treasury, how aggressive the Reserve Bank of New Zealand’s Large Scale Asset Purchases (LSAP) programme is and pricing relativities with other markets, notably Australia. There is enough volatility being driven by these factors to seek tactical gains. Longer term, we see an asymmetric bias, with a greater risk that bond yields rise. This is effectively priced into the yield curve, with longer-term yields sitting higher than short-term yields.

In multi-asset portfolios, we have trimmed our overweight position to equity markets. Equities are around fair value using normalised price to earnings measures and offer a good risk premium over bonds. Given the sharp bounce back we have seen in equity markets, the risk-return trade-off is not as attractive as it was during periods of market weakness. As a result, we will continue to be highly active in our positioning.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.