The role of Bonds in an investment portfolio, why you need them

Article written by Hunter Investment Management

Everyone is starting to talk about the risk of rising interest rates and inflation as central banks and regulators maintain strong fiscal and monetary stimulus while, at the same time, highlighting an improving economic growth outlook.

The thinking is that investors should switch out of bonds/fixed interest to avoid losses but even this thinking is compromised by a desire for returns in the very low interest rate environment.

There seems to be some misconception that “bonds” operate in isolation from other asset classes and that you can hide from rising interest rates in other asset classes.

This is not true, bond yields are generally instrumental in the pricing of other assets and you could easily make a case that interest rates have been the main driver of returns in equity markets over the last 10 years. Rising interest rates will see share markets repriced too but, unlike bonds, shares do not mature and investors will need to wait for an economic or company growth to recover any losses.

While we at Hunter Investments think markets are somewhat premature in their expectations for rising interest rates, if interest rates are expected to rise, moving into riskier assets is likely to exacerbate rather than ameliorate any losses.

What is a Bond?

A bond is a tradeable security used to borrow and lend money usually with interest.

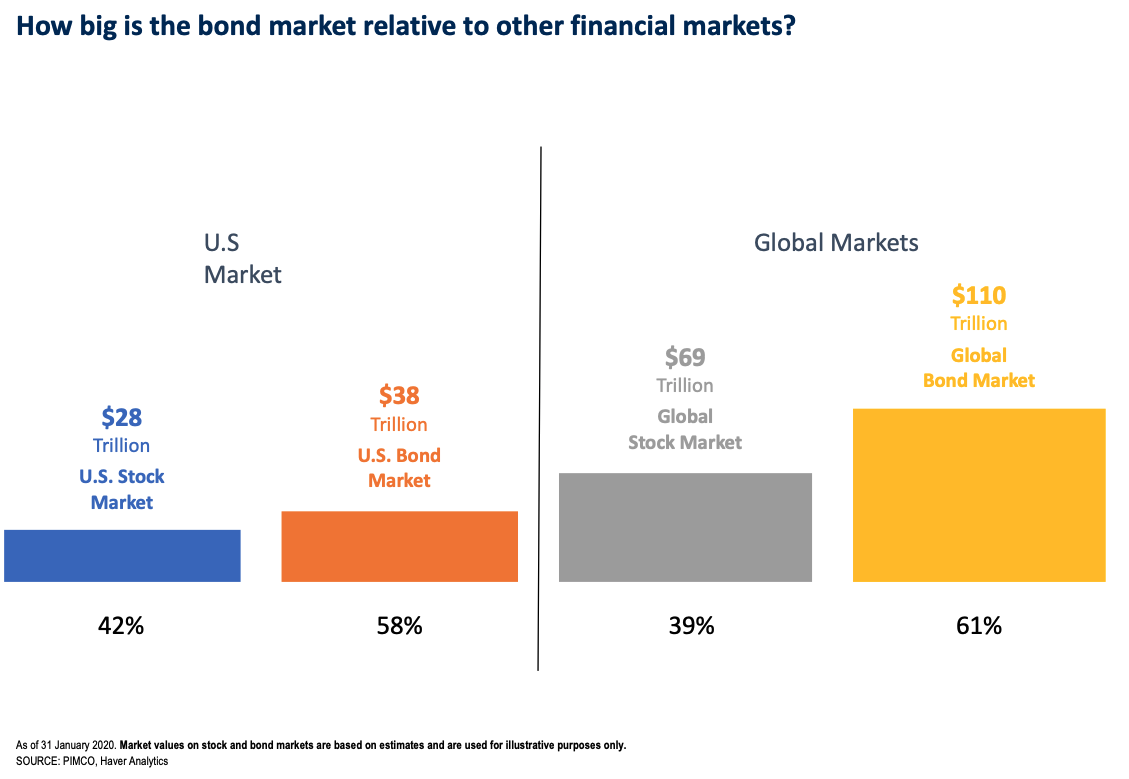

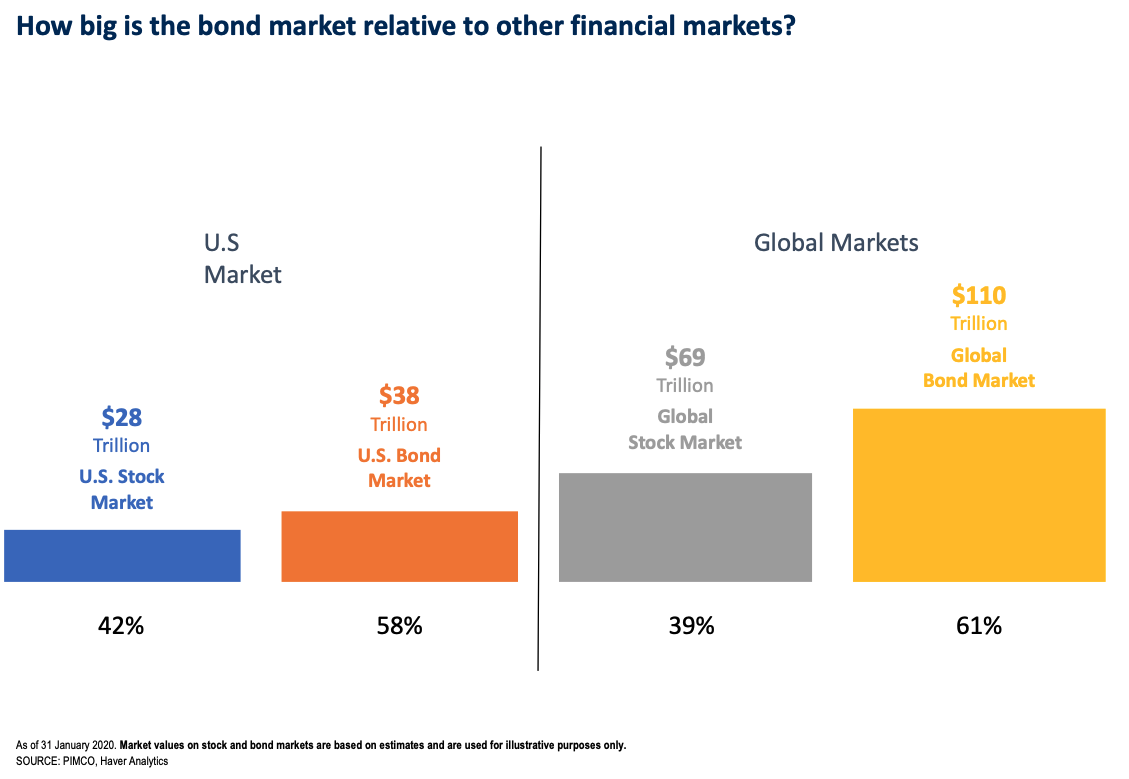

The global bond market is much larger than global share markets and funds the activities of a wide range of borrowers from Governments through to Corporate entities and everything in between.

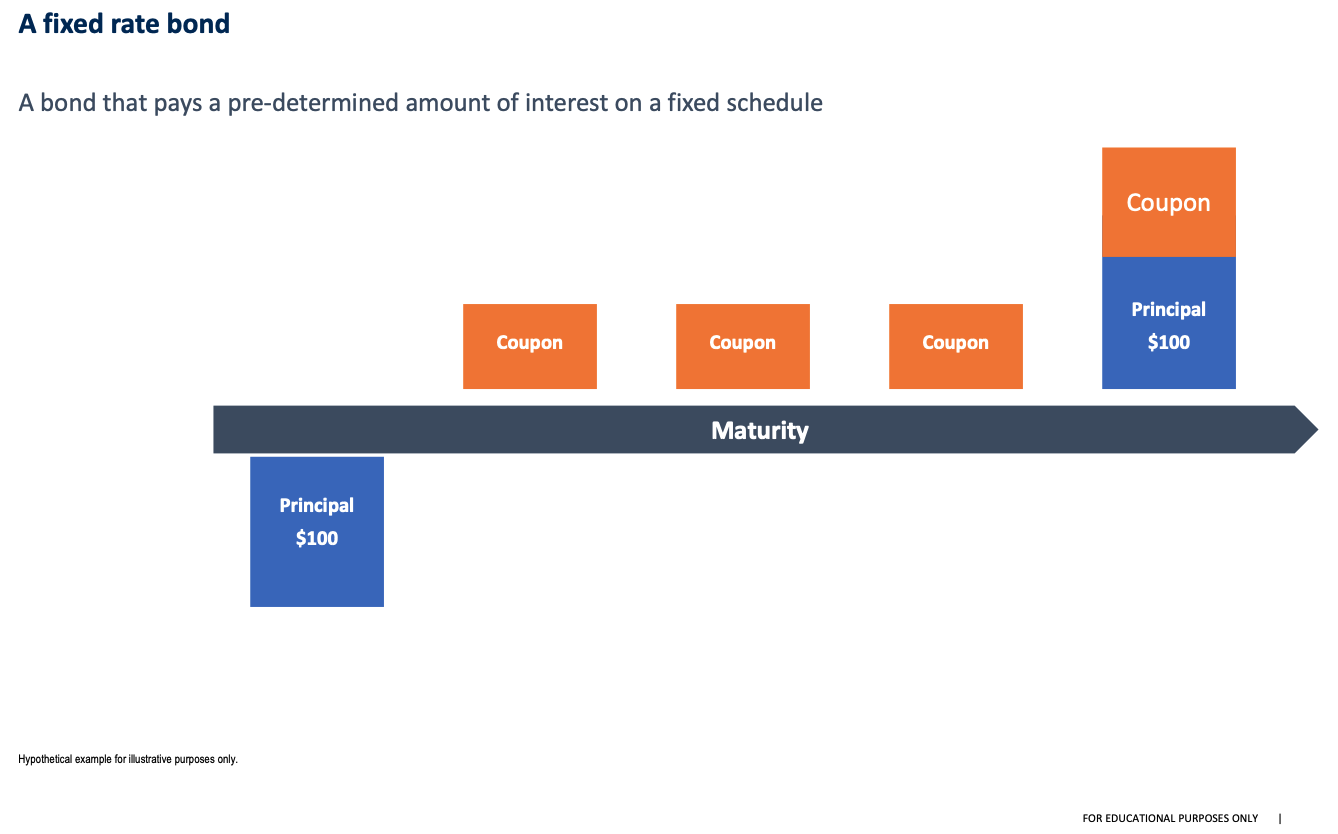

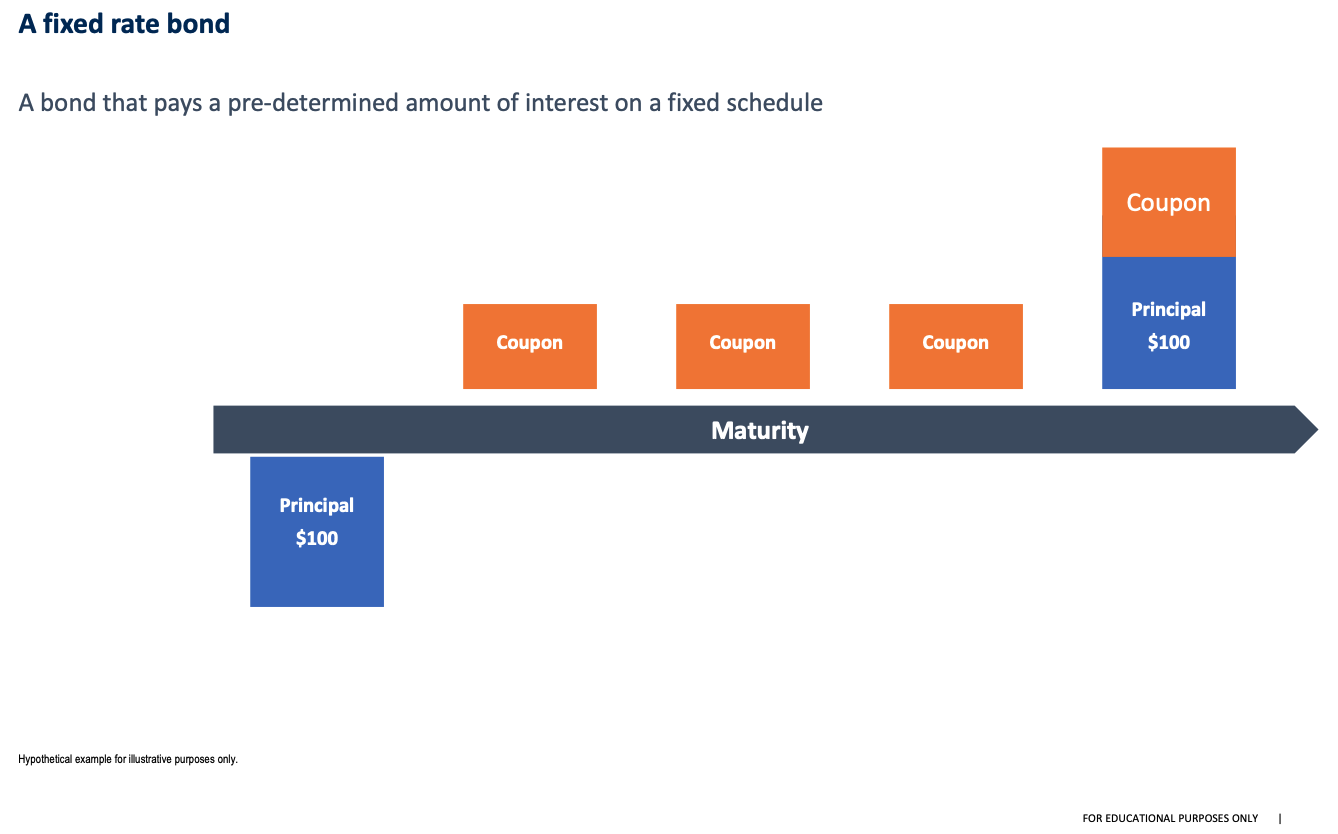

The most common bonds are issued/borrowed with a fixed maturity and a regular, say six-monthly, interest payment, often called the coupon. At maturity, you get your principal back together with your final interest payment.

If you know all the future cash flows, you can calculate the “present value” of the bond making it tradeable.

Key drivers of bond returns

1. The direction of interest rates

- A rise or fall in interest rates changes the present value of a bond, the price.

- Bond supply, inflation expectations, fiscal and monetary policy are the main drivers of the direction of interest rates

2. Duration

- This is a measure of the sensitivity of a bond to a change in interest rates

3. Maturity and shape of the yield curve

- As a bond nears maturity its yield moves along the yield curve towards the cash rate

4. Credit/default risk

- This is the probability of bond principal and interest being paid when due

- The riskier the borrower the more of a premium (credit margin) is required by the lender/investor

- Credit margins can change independently from underlying interest rates depending on the creditworthiness of the borrower at any point in time.

Not all bonds are created equal

The biggest risk in bond investing is not whether interest rates rise or fall, that only affects the present value of the bond if you decided to sell, a bit like deciding to break a “Term Deposit” investment.

If you hold to maturity you will get your principal back and, in fact, slowly rising interest rates actually improve your longer-term returns as you can invest your regular coupons at the higher rate and eventually the principal at a new higher interest rate.

Rather, the biggest risk in the bond world is a credit default where the borrower fails to repay interest and/or principal. This is what results in a “permanent” loss of capital rather than just a short-term “mark to market” loss.

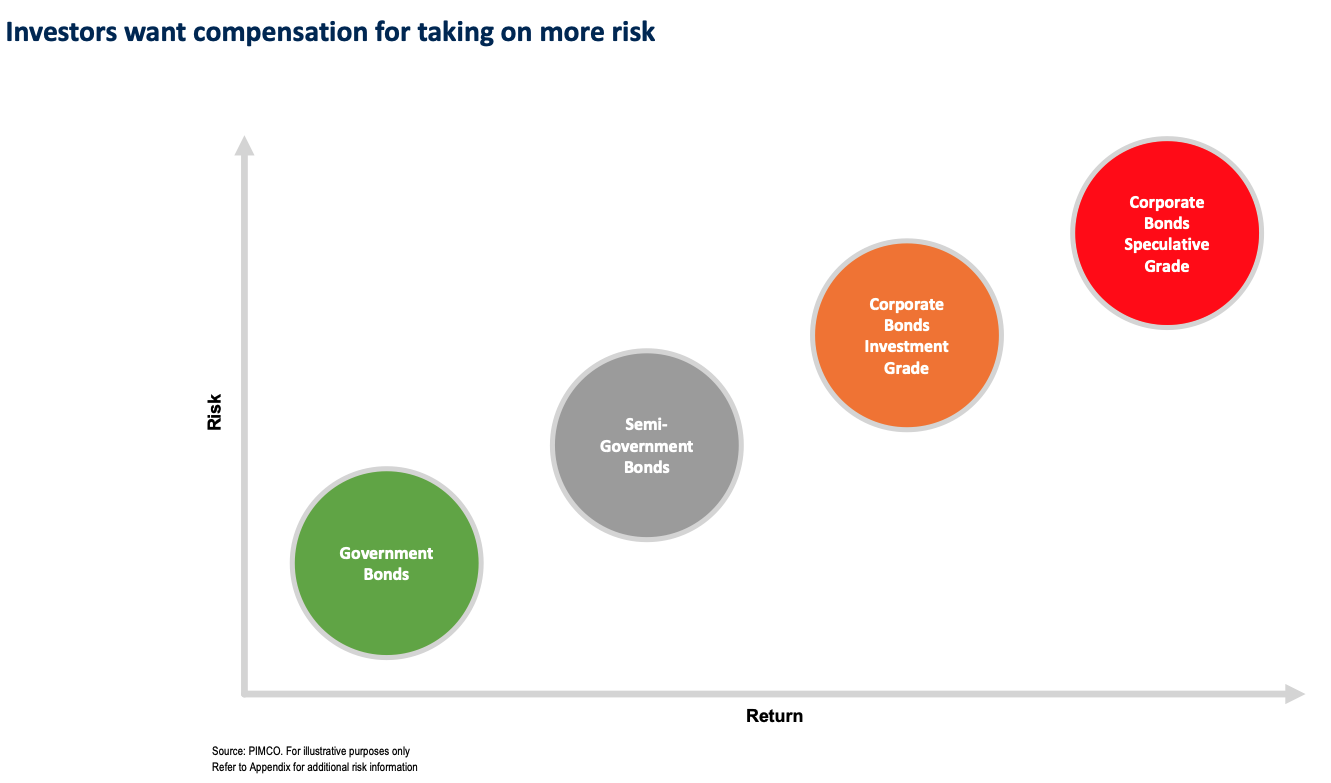

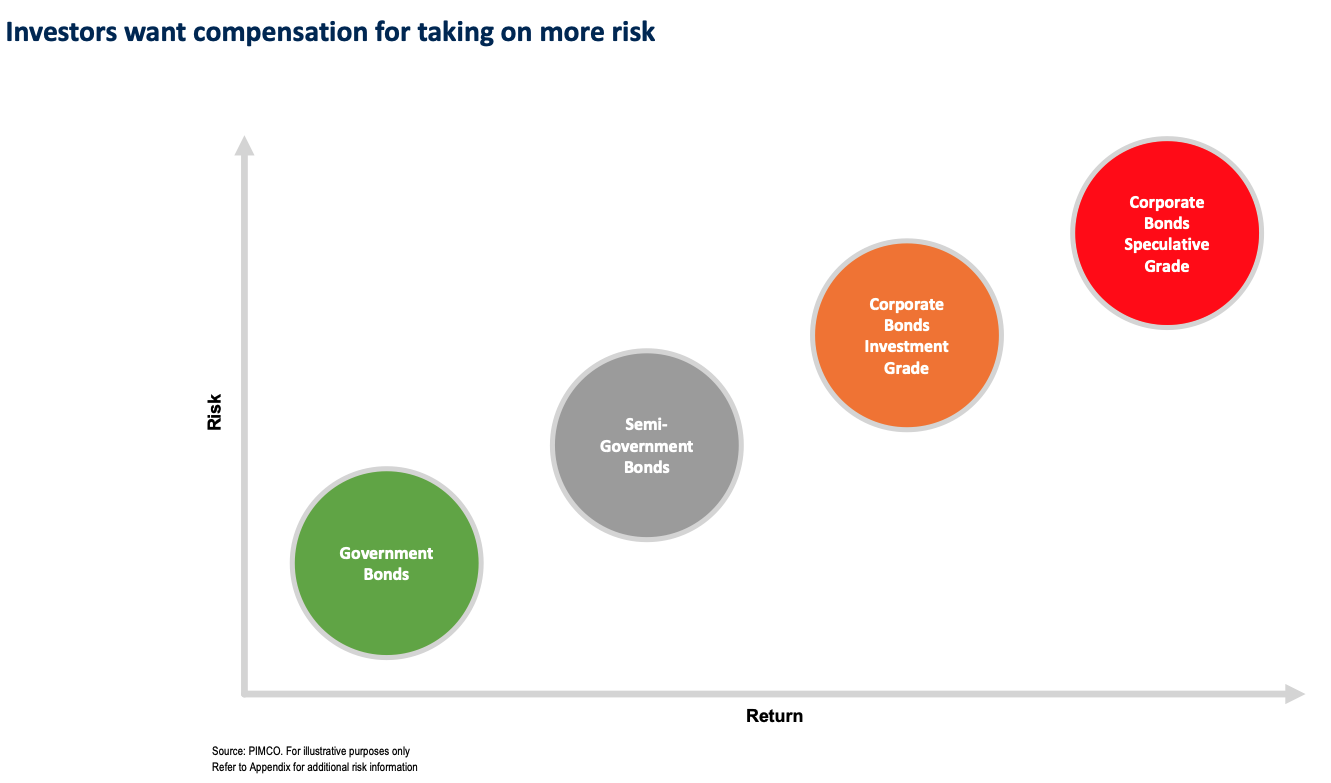

The bond market comprises many different levels of default or credit risk ranging from developed markets’ government-issued or guaranteed debt through to highly speculative-grade corporate bonds that rank just above shares in repayment priority, in some cases these borrowers can even suspend coupons without penalty as long as they don’t pay dividends on their shares.

Credit rating agencies such as Moodys and Standard & Poors provide a guide to the relative security of different bond issues but it is important to remember that this a “point in time rating” and creditworthiness can change over time. Credit risk is an active risk and should be managed as such.

Accordingly, investors need to carefully differentiate between the bonds they invest in, typically you are paid more the higher default risk you accept but this only helps in a well diversified credit portfolio, a single default in a concentrated portfolio overwhelms any additional credit margin earned.

So, the question becomes, why do you invest in bonds?

Role of bonds in a portfolio

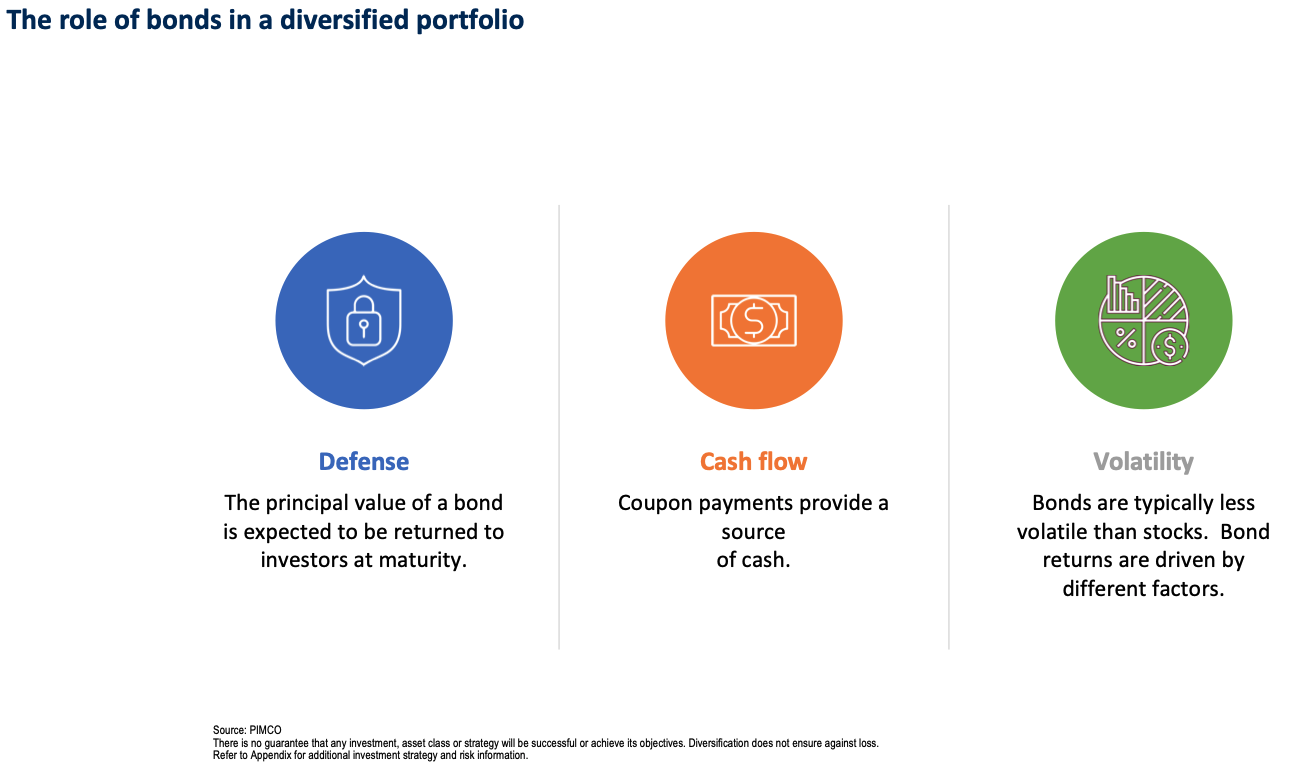

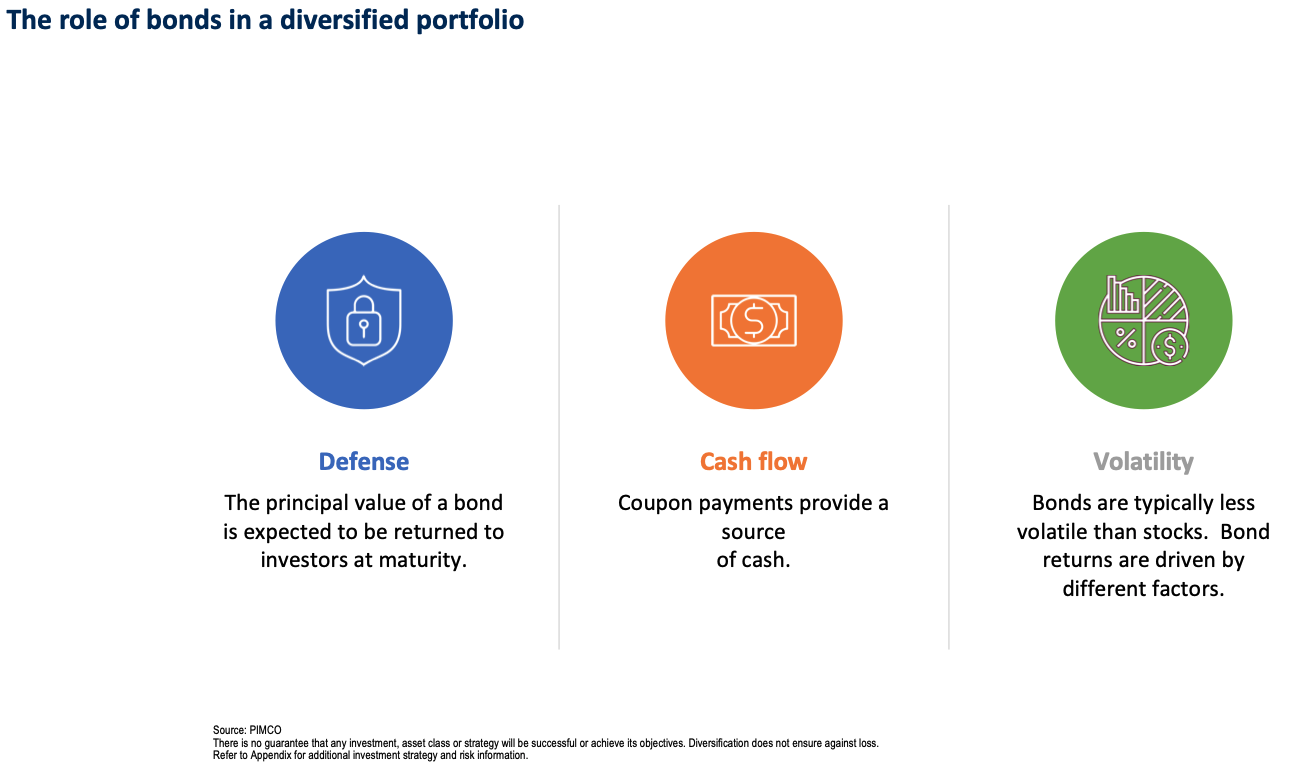

High credit quality bonds can perform a number of roles in a diversified portfolio:

- Defence: Assuming an investor avoids default, a bond will mature and return capital (and interest) in full. The return of capital/principal does not depend on the growth or profitability of the borrower, just their ability to meet their obligations in a timely manner.

- Cash flow or income: Bonds pay a regular known coupon or interest amount providing investors with some income certainty even as the price of the bond fluctuates with interest rates. Coupon rates in fixed interest are known at the time you purchase a bond.

- Reduce volatility: Bonds are less volatile than shares as the impending maturity and regular coupon helps reduce price volatility, bonds values progressively revert towards “Par” as a bond nears maturity. High-quality bond returns are also less correlated to share outcomes providing some portfolio diversification benefits, the factors affecting bond prices are often quite different than those affecting shares.

- Active opportunity: Actively managed bonds can be a source of additional return above the running yield of the bond.

Lower credit quality bonds tend to be more closely correlated with shares, the payment of principal and interest more dependent on the business performance of the borrower and significantly more exposed to default risk. As such the main function of higher yielding speculative-grade bonds is to harvest a higher yield by taking advantage of the higher credit risk margin these bonds attract. Credit risk, however, is not a fixed risk and will change with the fortunes of the borrower, high yield bonds should be well diversified and actively managed to minimise the risk of a default compromising this high yield investment strategy.

Summing up

Bonds play a useful role in an investment portfolio. They:

- Reduce overall portfolio risk acting as a volatility moderator for equity holdings with typically uncorrelated returns

- Can provide some cashflow/income certainty with coupons generally fixed through to maturity

- High-quality bonds have defensive qualities and offer principal protection

- Are a source of return

Rising interest rates, while hurting bond prices in the short term, actually improve long term return outcomes as cash flows (principal and interest payments) are reinvested at higher rates.

Investors cannot avoid the effects of rising interest rates by investing in other asset classes. Bond yields/interest rates form the basis of the valuations of most asset types while the rising cost of borrowing will also negatively impact borrowers and their business outcomes.

The exception, perhaps, is “cash” but this can mean investors earn a very low interest rate, even negative interest rate, while they wait for bond rates to peak. Currently, cash rates are well below the rate of inflation so, in real terms, the value of your investment is declining while you wait.

So, what should investors do if they expect core interest rates to rise significantly (minor fluctuations don’t matter):

- Accept that all asset classes will be affected;

- Make sure your portfolio is well diversified with many different sources of risk and return;

- Bias your portfolio towards high-quality borrowers and stocks /shares to avoid the risk of default and a permanent loss of capital.

- Ensure you have adequate liquidity so that you can minimise the need to sell assets when prices are depressed.

The role of Bonds in an investment portfolio, why you need them

Article written by Hunter Investment Management

Everyone is starting to talk about the risk of rising interest rates and inflation as central banks and regulators maintain strong fiscal and monetary stimulus while, at the same time, highlighting an improving economic growth outlook.

The thinking is that investors should switch out of bonds/fixed interest to avoid losses but even this thinking is compromised by a desire for returns in the very low interest rate environment.

There seems to be some misconception that “bonds” operate in isolation from other asset classes and that you can hide from rising interest rates in other asset classes.

This is not true, bond yields are generally instrumental in the pricing of other assets and you could easily make a case that interest rates have been the main driver of returns in equity markets over the last 10 years. Rising interest rates will see share markets repriced too but, unlike bonds, shares do not mature and investors will need to wait for an economic or company growth to recover any losses.

While we at Hunter Investments think markets are somewhat premature in their expectations for rising interest rates, if interest rates are expected to rise, moving into riskier assets is likely to exacerbate rather than ameliorate any losses.

What is a Bond?

A bond is a tradeable security used to borrow and lend money usually with interest.

The global bond market is much larger than global share markets and funds the activities of a wide range of borrowers from Governments through to Corporate entities and everything in between.

The most common bonds are issued/borrowed with a fixed maturity and a regular, say six-monthly, interest payment, often called the coupon. At maturity, you get your principal back together with your final interest payment.

If you know all the future cash flows, you can calculate the “present value” of the bond making it tradeable.

Key drivers of bond returns

1. The direction of interest rates

- A rise or fall in interest rates changes the present value of a bond, the price.

- Bond supply, inflation expectations, fiscal and monetary policy are the main drivers of the direction of interest rates

2. Duration

- This is a measure of the sensitivity of a bond to a change in interest rates

3. Maturity and shape of the yield curve

- As a bond nears maturity its yield moves along the yield curve towards the cash rate

4. Credit/default risk

- This is the probability of bond principal and interest being paid when due

- The riskier the borrower the more of a premium (credit margin) is required by the lender/investor

- Credit margins can change independently from underlying interest rates depending on the creditworthiness of the borrower at any point in time.

Not all bonds are created equal

The biggest risk in bond investing is not whether interest rates rise or fall, that only affects the present value of the bond if you decided to sell, a bit like deciding to break a “Term Deposit” investment.

If you hold to maturity you will get your principal back and, in fact, slowly rising interest rates actually improve your longer-term returns as you can invest your regular coupons at the higher rate and eventually the principal at a new higher interest rate.

Rather, the biggest risk in the bond world is a credit default where the borrower fails to repay interest and/or principal. This is what results in a “permanent” loss of capital rather than just a short-term “mark to market” loss.

The bond market comprises many different levels of default or credit risk ranging from developed markets’ government-issued or guaranteed debt through to highly speculative-grade corporate bonds that rank just above shares in repayment priority, in some cases these borrowers can even suspend coupons without penalty as long as they don’t pay dividends on their shares.

Credit rating agencies such as Moodys and Standard & Poors provide a guide to the relative security of different bond issues but it is important to remember that this a “point in time rating” and creditworthiness can change over time. Credit risk is an active risk and should be managed as such.

Accordingly, investors need to carefully differentiate between the bonds they invest in, typically you are paid more the higher default risk you accept but this only helps in a well diversified credit portfolio, a single default in a concentrated portfolio overwhelms any additional credit margin earned.

So, the question becomes, why do you invest in bonds?

Role of bonds in a portfolio

High credit quality bonds can perform a number of roles in a diversified portfolio:

- Defence: Assuming an investor avoids default, a bond will mature and return capital (and interest) in full. The return of capital/principal does not depend on the growth or profitability of the borrower, just their ability to meet their obligations in a timely manner.

- Cash flow or income: Bonds pay a regular known coupon or interest amount providing investors with some income certainty even as the price of the bond fluctuates with interest rates. Coupon rates in fixed interest are known at the time you purchase a bond.

- Reduce volatility: Bonds are less volatile than shares as the impending maturity and regular coupon helps reduce price volatility, bonds values progressively revert towards “Par” as a bond nears maturity. High-quality bond returns are also less correlated to share outcomes providing some portfolio diversification benefits, the factors affecting bond prices are often quite different than those affecting shares.

- Active opportunity: Actively managed bonds can be a source of additional return above the running yield of the bond.

Lower credit quality bonds tend to be more closely correlated with shares, the payment of principal and interest more dependent on the business performance of the borrower and significantly more exposed to default risk. As such the main function of higher yielding speculative-grade bonds is to harvest a higher yield by taking advantage of the higher credit risk margin these bonds attract. Credit risk, however, is not a fixed risk and will change with the fortunes of the borrower, high yield bonds should be well diversified and actively managed to minimise the risk of a default compromising this high yield investment strategy.

Summing up

Bonds play a useful role in an investment portfolio. They:

- Reduce overall portfolio risk acting as a volatility moderator for equity holdings with typically uncorrelated returns

- Can provide some cashflow/income certainty with coupons generally fixed through to maturity

- High-quality bonds have defensive qualities and offer principal protection

- Are a source of return

Rising interest rates, while hurting bond prices in the short term, actually improve long term return outcomes as cash flows (principal and interest payments) are reinvested at higher rates.

Investors cannot avoid the effects of rising interest rates by investing in other asset classes. Bond yields/interest rates form the basis of the valuations of most asset types while the rising cost of borrowing will also negatively impact borrowers and their business outcomes.

The exception, perhaps, is “cash” but this can mean investors earn a very low interest rate, even negative interest rate, while they wait for bond rates to peak. Currently, cash rates are well below the rate of inflation so, in real terms, the value of your investment is declining while you wait.

So, what should investors do if they expect core interest rates to rise significantly (minor fluctuations don’t matter):

- Accept that all asset classes will be affected;

- Make sure your portfolio is well diversified with many different sources of risk and return;

- Bias your portfolio towards high-quality borrowers and stocks /shares to avoid the risk of default and a permanent loss of capital.

- Ensure you have adequate liquidity so that you can minimise the need to sell assets when prices are depressed.