InvestNow News – 9th July – Pie Funds – CIO Report: Goldilocks scenario

Article written by Mark Devcich, Pie Funds – 8th July 2021

Chief Investment Officer Mark Devcich discusses the latest market conditions.

June was a good month as markets rallied around the world, led by the US, and also the NZ dollar was weaker.

It has been a strong first half of the year, particularly for stocks in the cyclical sectors such as resources and financials, as investors have become more accepting of a strong economic rebound post lockdowns. Buoyant economic growth, combined with low interest rates, have meant a goldilocks scenario for equities. Interest rates remain stubbornly low (US 10-year rate is 1.355% currently), despite higher inflation readings recently. In May, the US consumer price index increased by 5% year on year, although some of the rise is attributable to temporary factors such as the rise in used car prices.

Consumers have not been able to spend freely on travel and hospitality which, combined with generous government assistance, has meant personal balance sheets are in extremely good shape. This bodes well for a strong recovery in spending in the second half of the year. We continue to believe the payments sector is a great way to get exposure to the increased consumer spending that will flow through in the next 6 to 12 months.

NZ market underperforms

The NZ market has struggled against global peers YTD, which is a rare occurrence in the last 10 years. A combination of a retreat of some of the large utility stocks, such as Meridian, on the back of a severe index-buying frenzy late last year, and poor performance from some of the larger constituents such as A2 Milk and Fisher and Paykel Healthcare, have meant the NZ market has underperformed. We have very little exposure to the NZ market currently in our portfolios.

Global markets power up again

The S&P 500 US market continues to power ahead as its economy looks to be one of the first major economies to successfully make a comeback from Covid-induced lockdowns. The market there has now doubled since its March 23 lows last year and is up ~28% from pre-Covid levels in February 2020 which is quite remarkable. It makes more sense when you consider that the M2 money supply is up over 30% since that time, and more money in circulation has pushed asset prices higher. This has caused serious asset inflation but money creation must translate into increased lending and spending in order for it to be inflationary. We are monitoring inflation concerns, especially as government fiscal spending has been high to offset some of the demand destruction that occurred during lockdowns.

European and UK markets have performed well in the first six months of the year closely following behind the US, They’re supported by an improving vaccination rollout and reopening of economies.

Surfing the right waves

Reminiscing of the wild ride over the last 18 months reminds me of the basics of what we are trying to achieve. Investing in businesses is one of the most fruitful endeavours possible. If you can surf on the wave of a great business for a long-time, the rewards are plentiful and it does not require much more than identifying a great business, buying at a reasonable price, and holding on – all of which is easier said than done.

You don’t get the benefits of compounding in other asset classes. Instead, we invest in great businesses that earn a strong return on capital and then have the managers intelligently deploy further capital for us at equally attractive rates. Those investments could be investing more for growth organically, doing acquisitions, buying back their own company stocks if they feel it is undervalued, or paying dividends if there is no alternative use. Property or bonds don’t provide this compounding nature of reinvestment. Essentially we are backing human progress and, by investing in great businesses, outsized rewards can accrue to these companies.

Like in tennis, where aside from the top echelon of the sport, most of the nearly 2,000 men who are considered “professional” (anyone with at least one ranking point), cannot provide for themselves based on their prize money earnings, most companies in the world struggle to earn above their cost of capital and produce unattractive long-term buy and hold returns. Economist Hendrik Bessembinder has found that from 1990 to 2018, the best performing 811 firms (or 1.33%) accounted for all the net global wealth creation. The point is these super-compounder type companies are rare. We continue to hunt for them, find them early and, most importantly, hold on!

Proof is in the pudding

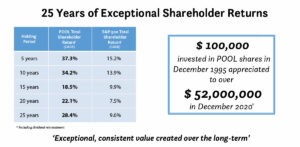

The best returns can come from the most unassuming companies with great cultures and the most basic Powerpoint slides! US company Pool Corp (a company we don’t own unfortunately) is a distributor of swimming pool supplies which has turned an initial $100k investment 25 years ago into $52m by December 2020. It is also up another 25% YTD, which would now take your initial investment to $65m!See more information in the chart below. The proof is in the pudding: the top 10 richest people in the world, shown below from Investopedia’s list, have all made their riches from investing in great businesses and typically, as founders, have held a large portion of the ownership for a long period of time.

1. Jeff Bezos, Amazon

2. Elon Musk, Tesla

3. Bernard Arnault, Louis Vuitton Moët Hennessy

4. Bill Gates, Microsoft

5. Mark Zuckerberg, Facebook

6. Warren Buffett, Berkshire Hathaway

7. Larry Ellison, Oracle

8. Larry Page, Google

9. Sergey Brin, Google

10. Mukesh Ambani, Reliance Industries

Once again, thank you for entrusting your capital with us.

Source: Investor presentation, 44th Annual NASDAQ Investor Conference

Information is current as at 30 June 2021. Pie Funds Management Limited is the manager of the funds in the Pie Funds Management Scheme. Any advice is given by Pie Funds Management Limited and is general only. Our advice relates only to the specific financial products mentioned and does not account for personal circumstances or financial goals. Please see a financial adviser for tailored advice. You may have to pay product or other fees, like brokerage, if you act on any advice. As manager of the Pie Funds Management Scheme investment funds, we receive fees determined by your balance and we benefit financially if you invest in our products. We manage this conflict of interest via an internal compliance framework designed to help us meet our duties to you. For information about how we can help you, our duties and complaint process and how disputes can be resolved, or to see our product disclosure statement, please visit www.piefunds.co.nz. Please let us know if you would like a hard copy of this disclosure information. Past performance is not a guarantee of future returns. Returns can be negative as well as positive and returns over different periods may vary.

InvestNow News – 9th July – Pie Funds – CIO Report: Goldilocks scenario

Article written by Mark Devcich, Pie Funds – 8th July 2021

Chief Investment Officer Mark Devcich discusses the latest market conditions.

June was a good month as markets rallied around the world, led by the US, and also the NZ dollar was weaker.

It has been a strong first half of the year, particularly for stocks in the cyclical sectors such as resources and financials, as investors have become more accepting of a strong economic rebound post lockdowns. Buoyant economic growth, combined with low interest rates, have meant a goldilocks scenario for equities. Interest rates remain stubbornly low (US 10-year rate is 1.355% currently), despite higher inflation readings recently. In May, the US consumer price index increased by 5% year on year, although some of the rise is attributable to temporary factors such as the rise in used car prices.

Consumers have not been able to spend freely on travel and hospitality which, combined with generous government assistance, has meant personal balance sheets are in extremely good shape. This bodes well for a strong recovery in spending in the second half of the year. We continue to believe the payments sector is a great way to get exposure to the increased consumer spending that will flow through in the next 6 to 12 months.

NZ market underperforms

The NZ market has struggled against global peers YTD, which is a rare occurrence in the last 10 years. A combination of a retreat of some of the large utility stocks, such as Meridian, on the back of a severe index-buying frenzy late last year, and poor performance from some of the larger constituents such as A2 Milk and Fisher and Paykel Healthcare, have meant the NZ market has underperformed. We have very little exposure to the NZ market currently in our portfolios.

Global markets power up again

The S&P 500 US market continues to power ahead as its economy looks to be one of the first major economies to successfully make a comeback from Covid-induced lockdowns. The market there has now doubled since its March 23 lows last year and is up ~28% from pre-Covid levels in February 2020 which is quite remarkable. It makes more sense when you consider that the M2 money supply is up over 30% since that time, and more money in circulation has pushed asset prices higher. This has caused serious asset inflation but money creation must translate into increased lending and spending in order for it to be inflationary. We are monitoring inflation concerns, especially as government fiscal spending has been high to offset some of the demand destruction that occurred during lockdowns.

European and UK markets have performed well in the first six months of the year closely following behind the US, They’re supported by an improving vaccination rollout and reopening of economies.

Surfing the right waves

Reminiscing of the wild ride over the last 18 months reminds me of the basics of what we are trying to achieve. Investing in businesses is one of the most fruitful endeavours possible. If you can surf on the wave of a great business for a long-time, the rewards are plentiful and it does not require much more than identifying a great business, buying at a reasonable price, and holding on – all of which is easier said than done.

You don’t get the benefits of compounding in other asset classes. Instead, we invest in great businesses that earn a strong return on capital and then have the managers intelligently deploy further capital for us at equally attractive rates. Those investments could be investing more for growth organically, doing acquisitions, buying back their own company stocks if they feel it is undervalued, or paying dividends if there is no alternative use. Property or bonds don’t provide this compounding nature of reinvestment. Essentially we are backing human progress and, by investing in great businesses, outsized rewards can accrue to these companies.

Like in tennis, where aside from the top echelon of the sport, most of the nearly 2,000 men who are considered “professional” (anyone with at least one ranking point), cannot provide for themselves based on their prize money earnings, most companies in the world struggle to earn above their cost of capital and produce unattractive long-term buy and hold returns. Economist Hendrik Bessembinder has found that from 1990 to 2018, the best performing 811 firms (or 1.33%) accounted for all the net global wealth creation. The point is these super-compounder type companies are rare. We continue to hunt for them, find them early and, most importantly, hold on!

Proof is in the pudding

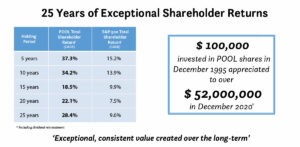

The best returns can come from the most unassuming companies with great cultures and the most basic Powerpoint slides! US company Pool Corp (a company we don’t own unfortunately) is a distributor of swimming pool supplies which has turned an initial $100k investment 25 years ago into $52m by December 2020. It is also up another 25% YTD, which would now take your initial investment to $65m!See more information in the chart below. The proof is in the pudding: the top 10 richest people in the world, shown below from Investopedia’s list, have all made their riches from investing in great businesses and typically, as founders, have held a large portion of the ownership for a long period of time.

1. Jeff Bezos, Amazon

2. Elon Musk, Tesla

3. Bernard Arnault, Louis Vuitton Moët Hennessy

4. Bill Gates, Microsoft

5. Mark Zuckerberg, Facebook

6. Warren Buffett, Berkshire Hathaway

7. Larry Ellison, Oracle

8. Larry Page, Google

9. Sergey Brin, Google

10. Mukesh Ambani, Reliance Industries

Once again, thank you for entrusting your capital with us.

Source: Investor presentation, 44th Annual NASDAQ Investor Conference

Information is current as at 30 June 2021. Pie Funds Management Limited is the manager of the funds in the Pie Funds Management Scheme. Any advice is given by Pie Funds Management Limited and is general only. Our advice relates only to the specific financial products mentioned and does not account for personal circumstances or financial goals. Please see a financial adviser for tailored advice. You may have to pay product or other fees, like brokerage, if you act on any advice. As manager of the Pie Funds Management Scheme investment funds, we receive fees determined by your balance and we benefit financially if you invest in our products. We manage this conflict of interest via an internal compliance framework designed to help us meet our duties to you. For information about how we can help you, our duties and complaint process and how disputes can be resolved, or to see our product disclosure statement, please visit www.piefunds.co.nz. Please let us know if you would like a hard copy of this disclosure information. Past performance is not a guarantee of future returns. Returns can be negative as well as positive and returns over different periods may vary.