InvestNow Market Wrap-Up: August 2023

Written by Jason Choy, InvestNow Senior Portfolio Manager

Welcome to the August edition of the InvestNow Market Wrap-Up.

Financial markets can often be unnecessarily noisy and complicated – with so many headlines clamouring for our attention, it’s hard to keep up with what’s actually relevant to each of our investing journeys.

Well, InvestNow’s here to help! Each month we’ll distill everything you need to know in the wide world of investments into digestible bites curated for the Kiwi investor. At InvestNow, we think an important guiding principle of being a successful investor is to stay informed, but avoid the noise. So, make sure you keep abreast of what is happening in markets, but resist the urge to change your long-term strategy in response to market volatility and noise.

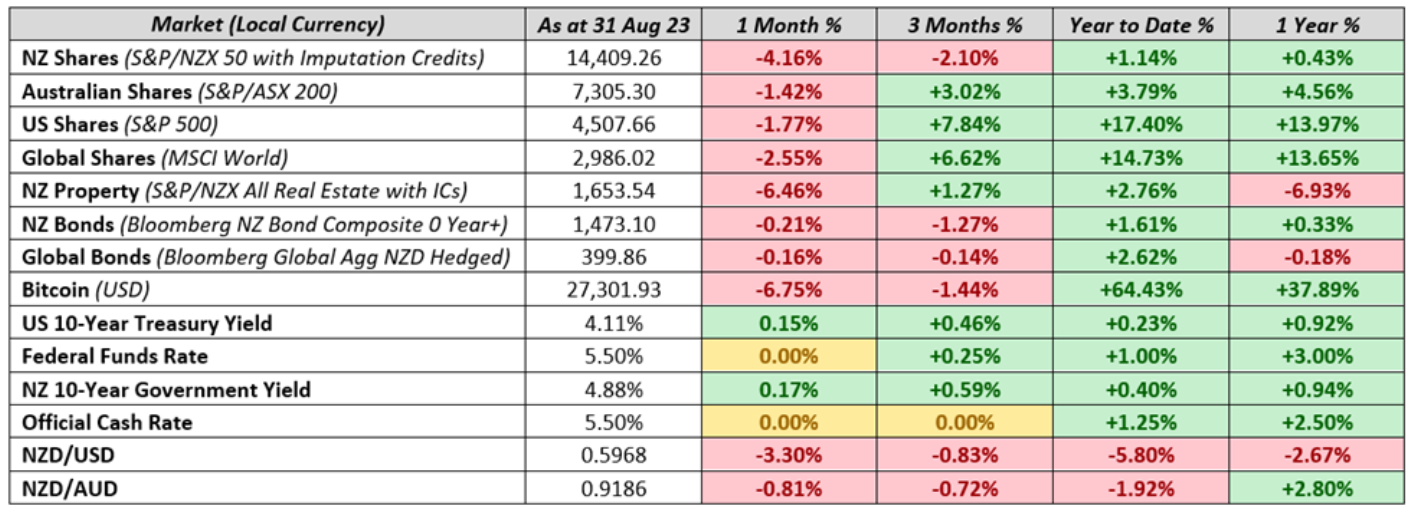

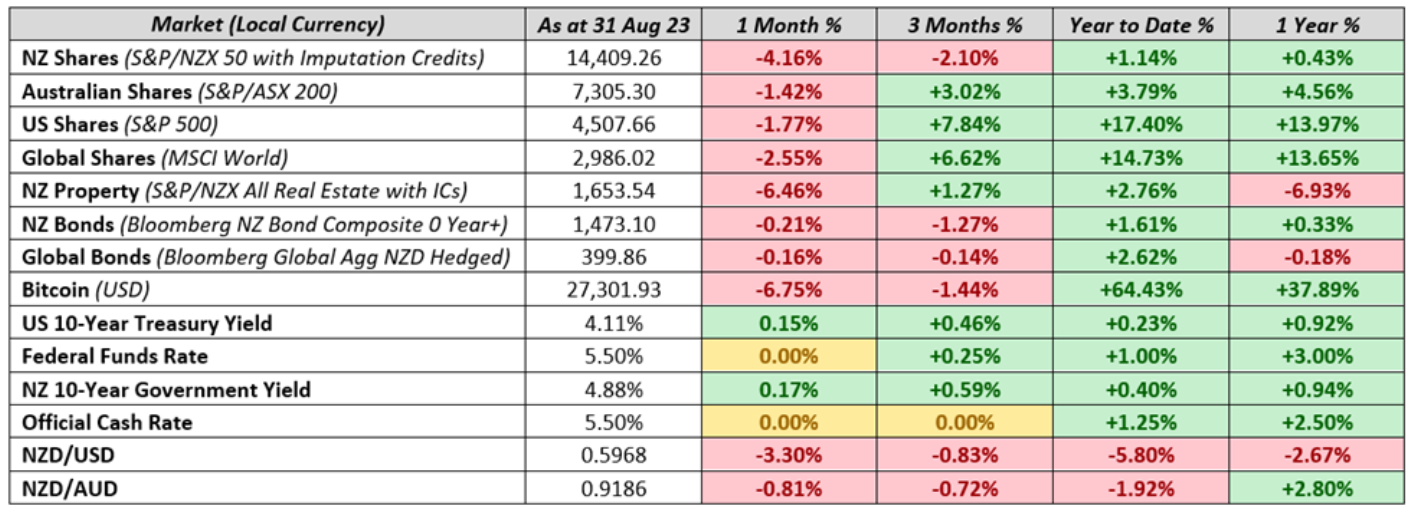

Market Dashboard

Global Markets Summary: August 2023

Markets retreat in August as volatility returns: Financial markets broke a streak of strong monthly gains in August, as mixed economic data reignited fears that central banks may need to keep interest rates higher for longer in order to offset inflation pressures. Concerns regarding the health of the Chinese economy, which contributes almost a third of global growth, also added to the downward pressure. Given this backdrop, global stocks sold off as the MSCI All Country World Index declined 2.8% over the month in USD terms, with developed markets (-2.3%) outperforming emerging markets (-6.1%).

Good news is bad news? The US reported robust economic data over the month, including GDP growing by 2.6%, retail sales remaining strong, and a rebound in consumer confidence being headline metrics that are ordinarily interpreted as positive news for investors. However, the solid economic data actually caused jitters in equity markets, as it raised concerns that there is still too much heat in the economy and could mean that the Federal Reserve’s interest rate tightening cycle isn’t quite finished yet.

Central Bank All-Star event well-received by markets: US Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde were just some of the names that headlined August’s marquee annual economic symposium of central bankers in Jackson Hole, Wyoming. Unlike last year’s speech, which spooked markets when the Fed Chair outlined a scorched-earth approach to the inflation fight, this year’s speech was more measured and indicated the Fed isn’t married to further rate hikes. This helped allay investor concerns, alongside news of a cooling US job market (187,000 jobs created vs. expectations of 200,000) and US inflation increasing only slightly from 3.0% to 3.2%. But it still wasn’t enough to bring the US equity market into positive territory, with the S&P 500 falling -1.8% in August.

Reverberations in emerging markets as second-largest economy stumbles: Many global markets were on edge in August as Chinese economic data fell well below expectations. The local Chinese equity benchmark fell -6.2% over the month, as investors worried about slowing economic growth momentum and problems in the Chinese property sector. Inflation in China turned negative at a year-on-year rate of -0.3% as consumer confidence remains weak, leading to authorities in Beijing lowering its interest rates twice and halving the stamp duty of stock trading in August to spur activity. This led to a sea of red in Asian markets due to China’s outsized influence in the region, although Japanese stocks managed to eke out a gain as corporate earnings remained solid.

Developed markets didn’t fare much better: UK equities also fell over the month as concerns around the Chinese economy weighed heavily on the region’s basic materials and financial stocks, despite headline inflation easing from 7.9% to 6.8% and the UK GDP surprising to the upside with +0.2% growth. Over in the Eurozone, markets are expecting at least another hike before the year-end, with inflation expectations remaining flat but at a still much too high 5.3%. Overall, the MSCI Europe ex-UK index would also be in the red, returning -2.2% in August.

Yields start their ascent in global bond markets: August proved to be eventful for bond markets, with Fitch, one of the ‘Big Three’ credit rating agencies downgrading US Treasuries down a notch, citing an ‘erosion of governance’. Markets were largely unfazed by the downgrade, as the US Government’s place in practice as the world’s safest issuer was never in doubt. The US 10-Year Treasury would rise 15 bp later in the month though to 4.11% as markets started pricing in a higher for longer interest rates outlook amid strong economic data. The UK 10-Year would also rise 5 bp to 4.36% following the Bank of England’s largely expected 25 bp hike in interest rates. Overall, this saw the Bloomberg Global Aggregate Bond Index (hedged to NZD) decrease slightly by -0.16% over the month as the US dollar continued to strengthen against all other major currencies.

Key Updates for the Kiwi Investor

New Zealand share markets lag global counterparts: The S&P/NZX 50 fell -4.2% over the month, driven by softening sentiment amid mixed corporate earnings and mounting concerns around the wider economic environment. Notably, weakening commodity exports (which make up a large portion of NZ’s GDP with dairy alone 30% of all NZ’s trading exports), due to a slowing Chinese economy puts pressure on the NZ economy to attract foreign investment. This is seen via a weaker NZ dollar or higher yields on NZ bonds, which contributed to the NZ equity market weakening in August as higher rates of returns on safer bond assets make more risky equity investments less appealing.

Local bond yields begin lift-off: NZ bond yields climbed over the month, with the NZ 10-Year Government Bond starting August at 4.71% and ascending over 40 bp mid-month, before settling in 17 bp higher at month-end. Yields rose off the back of a continued global ‘higher for longer’ sentiment for this rate hiking cycle, and while the Reserve Bank of New Zealand kept interest rates unchanged in August at 5.50%, it forecasts that the OCR will remain at current levels until 2025. Overall, this saw the Bloomberg NZ Bond Composite 0+ Yr Index return -0.20% over August.

Election Day is coming – should Kiwis be changing their investment strategy? The media circus that surrounds the triennial event certainly dominates headlines as we approach Election Day. With news articles and even neighbouring fences littered with politicians’ faces, it’s easy to get swept up in the spectacle of the event and wonder whether the outcome of the election should trigger lifestyle changes. For many Kiwis, this is a natural question that extends to reassessing their investment approach. For example, some may wonder… Should money be moved in or out of the market if we get a new government? To what extent should politics and election day impact my investment strategy?

Stay informed about the policies and issues but ignore the noise – the election is just an event – the real substance is what policies actually get implemented by the elected government. So it’s important to stay informed of the policies that could have a material impact on your financial circumstances and therefore potentially your investment goals. But it’s equally important to recognise where politics may not be relevant to your financial or investing journeys (‘noise’).

For many Kiwis, staying the course is a perfectly logical response – headline-grabbing events like election time can often play to people’s political or emotional biases, and make investors overreact and think they need to reinvent their investment approach. However, it’s worth reflecting on whether the event will actually lead to circumstances that warrant a step-change in investment approach. Common goals for many Kiwis like saving for retirement, or funding a child’s education, aren’t likely to become irrelevant overnight once the election results are announced. If you already have a robust investment strategy in place to address these goals, then staying the course, continuing to follow your investment strategy and investing towards these goals is a tried-and-true recipe for success.

Focus on the relevant issues impacting your financial journey, rather than any preconceived feelings or emotions behind any one party being in power over another. This could involve a consideration of:

- What are the policies proposed?

- Do these policies actually have an impact on my financial goals or investment objectives?

- Is my current investment strategy robust enough to withstand the potential impact on my financial goals?

- If not, then consider ‘what is an appropriate strategy to address my new goals’?

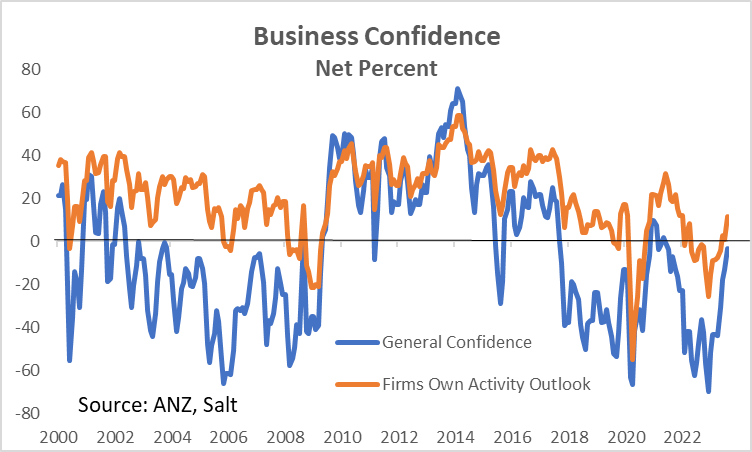

Chart of the Month

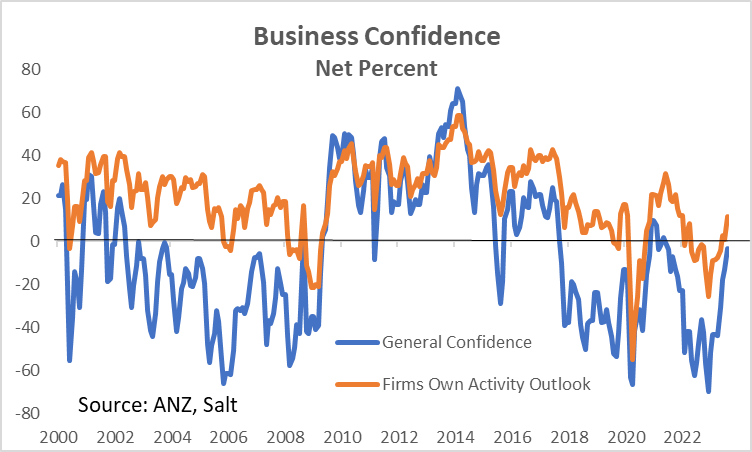

Our Chart of the Month is from Salt with data sourced from ANZ, which outlines the difference between general confidence in the economy and the firms’ expectations of their own economic activity outlook.

Expanding on the previous election discussion, we see here that political bias can often cloud investment outlooks – the chart outlines a strong political bias depending on which government is in power. A large gap between a firm’s general confidence in the economy and expectations of their own outlook exists whenever there is a Labour-led Government. This gap in general confidence in the economy and a firm’s own business outlook closes up when there is a National-led government. This gap persists despite different policies and economic conditions in the early 2000s versus the post-COVID environment today. These inherent biases are why economists always put more weight on firms’ assessment of their own outlook when gauging the outlook for the economy, rather than a firm’s assessment of the economy more generally.

Political biases can cloud an investor’s view of when is a good time to be invested in the market, depending on if they favour any particular political party over another. In many cases, the performance of the market isn’t inherently tied to the colour of the political party in charge, but rather the wider global macroeconomic environment at the time. Choosing to limit your exposure to the market for example just because your preferred political party is or isn’t in power can be a risky strategy!

Biases can come in other forms too, such as emotional biases – elections are by their nature uncertain events and many investors don’t have a great track record of investing prudently amidst fear and uncertainty. This is where emotions can come into play and cloud our better judgment and was certainly the case when COVID-19 first hit the market in March 2020 and many people immediately turned to cash amidst the uncertainty. Looking at the performance period from January 2020 to March 2023, an investor in a balanced fund who switched to cash in March 2020 and stayed there for just 3 months, would’ve been 15% worse off than investors who stayed invested in the balanced fund the entire time.

Kiwis who are mindful of avoiding any inherent biases in their investing journey tend to do well! By remaining resolute in focusing on only the most relevant issues and understanding how this may or may not actually impact your investing journey, you can avoid the common pitfalls that others fall into and always remain on track in progressing towards your investment goals.

What we’ve been reading

- Harbour: What you need to know about neutral interest rates

- Mint: Diversification – Markowitz’s greatest gift explained

- Russell Investments: Value For Adviser Report

- Salt: Worry about China (again)

- Octagon: Currency hedging: a financial markets free lunch?

- Pathfinder: KiwiSaver: improving workplace wellness and reducing climate panic

- India rises: most populous nation readies for time in the sun

- Money class: why financial literacy is on the timetable

- Financial Markets Authority: KiwiSaver Annual Report 2023

InvestNow Market Wrap-Up: August 2023

Written by Jason Choy, InvestNow Senior Portfolio Manager

Welcome to the August edition of the InvestNow Market Wrap-Up.

Financial markets can often be unnecessarily noisy and complicated – with so many headlines clamouring for our attention, it’s hard to keep up with what’s actually relevant to each of our investing journeys.

Well, InvestNow’s here to help! Each month we’ll distill everything you need to know in the wide world of investments into digestible bites curated for the Kiwi investor. At InvestNow, we think an important guiding principle of being a successful investor is to stay informed, but avoid the noise. So, make sure you keep abreast of what is happening in markets, but resist the urge to change your long-term strategy in response to market volatility and noise.

Market Dashboard

Global Markets Summary: August 2023

Markets retreat in August as volatility returns: Financial markets broke a streak of strong monthly gains in August, as mixed economic data reignited fears that central banks may need to keep interest rates higher for longer in order to offset inflation pressures. Concerns regarding the health of the Chinese economy, which contributes almost a third of global growth, also added to the downward pressure. Given this backdrop, global stocks sold off as the MSCI All Country World Index declined 2.8% over the month in USD terms, with developed markets (-2.3%) outperforming emerging markets (-6.1%).

Good news is bad news? The US reported robust economic data over the month, including GDP growing by 2.6%, retail sales remaining strong, and a rebound in consumer confidence being headline metrics that are ordinarily interpreted as positive news for investors. However, the solid economic data actually caused jitters in equity markets, as it raised concerns that there is still too much heat in the economy and could mean that the Federal Reserve’s interest rate tightening cycle isn’t quite finished yet.

Central Bank All-Star event well-received by markets: US Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde were just some of the names that headlined August’s marquee annual economic symposium of central bankers in Jackson Hole, Wyoming. Unlike last year’s speech, which spooked markets when the Fed Chair outlined a scorched-earth approach to the inflation fight, this year’s speech was more measured and indicated the Fed isn’t married to further rate hikes. This helped allay investor concerns, alongside news of a cooling US job market (187,000 jobs created vs. expectations of 200,000) and US inflation increasing only slightly from 3.0% to 3.2%. But it still wasn’t enough to bring the US equity market into positive territory, with the S&P 500 falling -1.8% in August.

Reverberations in emerging markets as second-largest economy stumbles: Many global markets were on edge in August as Chinese economic data fell well below expectations. The local Chinese equity benchmark fell -6.2% over the month, as investors worried about slowing economic growth momentum and problems in the Chinese property sector. Inflation in China turned negative at a year-on-year rate of -0.3% as consumer confidence remains weak, leading to authorities in Beijing lowering its interest rates twice and halving the stamp duty of stock trading in August to spur activity. This led to a sea of red in Asian markets due to China’s outsized influence in the region, although Japanese stocks managed to eke out a gain as corporate earnings remained solid.

Developed markets didn’t fare much better: UK equities also fell over the month as concerns around the Chinese economy weighed heavily on the region’s basic materials and financial stocks, despite headline inflation easing from 7.9% to 6.8% and the UK GDP surprising to the upside with +0.2% growth. Over in the Eurozone, markets are expecting at least another hike before the year-end, with inflation expectations remaining flat but at a still much too high 5.3%. Overall, the MSCI Europe ex-UK index would also be in the red, returning -2.2% in August.

Yields start their ascent in global bond markets: August proved to be eventful for bond markets, with Fitch, one of the ‘Big Three’ credit rating agencies downgrading US Treasuries down a notch, citing an ‘erosion of governance’. Markets were largely unfazed by the downgrade, as the US Government’s place in practice as the world’s safest issuer was never in doubt. The US 10-Year Treasury would rise 15 bp later in the month though to 4.11% as markets started pricing in a higher for longer interest rates outlook amid strong economic data. The UK 10-Year would also rise 5 bp to 4.36% following the Bank of England’s largely expected 25 bp hike in interest rates. Overall, this saw the Bloomberg Global Aggregate Bond Index (hedged to NZD) decrease slightly by -0.16% over the month as the US dollar continued to strengthen against all other major currencies.

Key Updates for the Kiwi Investor

New Zealand share markets lag global counterparts: The S&P/NZX 50 fell -4.2% over the month, driven by softening sentiment amid mixed corporate earnings and mounting concerns around the wider economic environment. Notably, weakening commodity exports (which make up a large portion of NZ’s GDP with dairy alone 30% of all NZ’s trading exports), due to a slowing Chinese economy puts pressure on the NZ economy to attract foreign investment. This is seen via a weaker NZ dollar or higher yields on NZ bonds, which contributed to the NZ equity market weakening in August as higher rates of returns on safer bond assets make more risky equity investments less appealing.

Local bond yields begin lift-off: NZ bond yields climbed over the month, with the NZ 10-Year Government Bond starting August at 4.71% and ascending over 40 bp mid-month, before settling in 17 bp higher at month-end. Yields rose off the back of a continued global ‘higher for longer’ sentiment for this rate hiking cycle, and while the Reserve Bank of New Zealand kept interest rates unchanged in August at 5.50%, it forecasts that the OCR will remain at current levels until 2025. Overall, this saw the Bloomberg NZ Bond Composite 0+ Yr Index return -0.20% over August.

Election Day is coming – should Kiwis be changing their investment strategy? The media circus that surrounds the triennial event certainly dominates headlines as we approach Election Day. With news articles and even neighbouring fences littered with politicians’ faces, it’s easy to get swept up in the spectacle of the event and wonder whether the outcome of the election should trigger lifestyle changes. For many Kiwis, this is a natural question that extends to reassessing their investment approach. For example, some may wonder… Should money be moved in or out of the market if we get a new government? To what extent should politics and election day impact my investment strategy?

Stay informed about the policies and issues but ignore the noise – the election is just an event – the real substance is what policies actually get implemented by the elected government. So it’s important to stay informed of the policies that could have a material impact on your financial circumstances and therefore potentially your investment goals. But it’s equally important to recognise where politics may not be relevant to your financial or investing journeys (‘noise’).

For many Kiwis, staying the course is a perfectly logical response – headline-grabbing events like election time can often play to people’s political or emotional biases, and make investors overreact and think they need to reinvent their investment approach. However, it’s worth reflecting on whether the event will actually lead to circumstances that warrant a step-change in investment approach. Common goals for many Kiwis like saving for retirement, or funding a child’s education, aren’t likely to become irrelevant overnight once the election results are announced. If you already have a robust investment strategy in place to address these goals, then staying the course, continuing to follow your investment strategy and investing towards these goals is a tried-and-true recipe for success.

Focus on the relevant issues impacting your financial journey, rather than any preconceived feelings or emotions behind any one party being in power over another. This could involve a consideration of:

- What are the policies proposed?

- Do these policies actually have an impact on my financial goals or investment objectives?

- Is my current investment strategy robust enough to withstand the potential impact on my financial goals?

- If not, then consider ‘what is an appropriate strategy to address my new goals’?

Chart of the Month

Our Chart of the Month is from Salt with data sourced from ANZ, which outlines the difference between general confidence in the economy and the firms’ expectations of their own economic activity outlook.

Expanding on the previous election discussion, we see here that political bias can often cloud investment outlooks – the chart outlines a strong political bias depending on which government is in power. A large gap between a firm’s general confidence in the economy and expectations of their own outlook exists whenever there is a Labour-led Government. This gap in general confidence in the economy and a firm’s own business outlook closes up when there is a National-led government. This gap persists despite different policies and economic conditions in the early 2000s versus the post-COVID environment today. These inherent biases are why economists always put more weight on firms’ assessment of their own outlook when gauging the outlook for the economy, rather than a firm’s assessment of the economy more generally.

Political biases can cloud an investor’s view of when is a good time to be invested in the market, depending on if they favour any particular political party over another. In many cases, the performance of the market isn’t inherently tied to the colour of the political party in charge, but rather the wider global macroeconomic environment at the time. Choosing to limit your exposure to the market for example just because your preferred political party is or isn’t in power can be a risky strategy!

Biases can come in other forms too, such as emotional biases – elections are by their nature uncertain events and many investors don’t have a great track record of investing prudently amidst fear and uncertainty. This is where emotions can come into play and cloud our better judgment and was certainly the case when COVID-19 first hit the market in March 2020 and many people immediately turned to cash amidst the uncertainty. Looking at the performance period from January 2020 to March 2023, an investor in a balanced fund who switched to cash in March 2020 and stayed there for just 3 months, would’ve been 15% worse off than investors who stayed invested in the balanced fund the entire time.

Kiwis who are mindful of avoiding any inherent biases in their investing journey tend to do well! By remaining resolute in focusing on only the most relevant issues and understanding how this may or may not actually impact your investing journey, you can avoid the common pitfalls that others fall into and always remain on track in progressing towards your investment goals.

What we’ve been reading

- Harbour: What you need to know about neutral interest rates

- Mint: Diversification – Markowitz’s greatest gift explained

- Russell Investments: Value For Adviser Report

- Salt: Worry about China (again)

- Octagon: Currency hedging: a financial markets free lunch?

- Pathfinder: KiwiSaver: improving workplace wellness and reducing climate panic

- India rises: most populous nation readies for time in the sun

- Money class: why financial literacy is on the timetable

- Financial Markets Authority: KiwiSaver Annual Report 2023