Analysis: The six-figure difference in saving for retirement early

Article written by InvestNow – 22nd May 2024

One of the first tips any adviser will give to someone investing for retirement is to ‘start early’. The sooner you start, the more you’ll earn and the bigger your nest egg will be.

But how much bigger exactly? And what are the barriers that stop people investing early?

Investing early

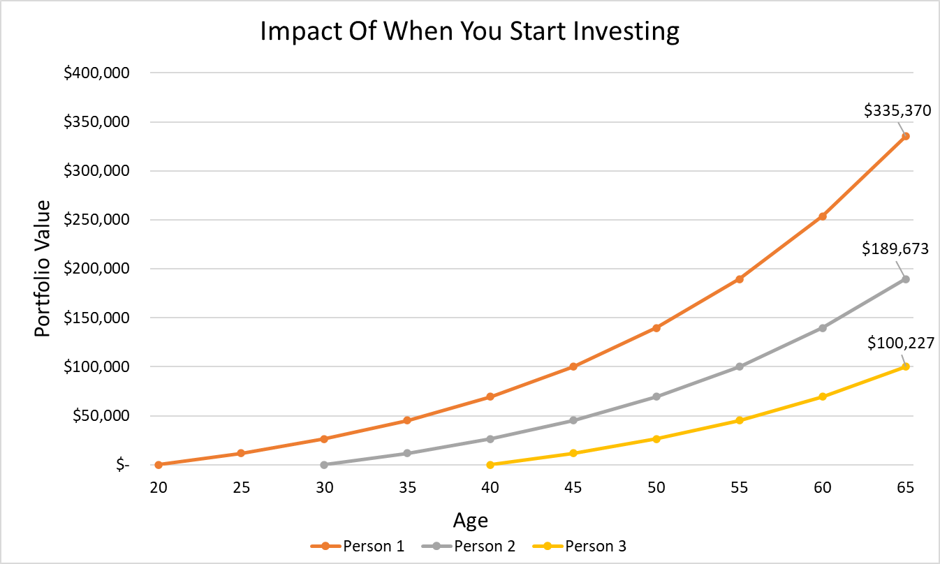

We ran three scenarios to figure out how much money someone would have by the time they reached retirement age.

- Person 1 started investing at 20

- Person 2 started at 30

- Person 3 started at 40

They each contribute $2,000 a year, and receive a 5% average annual return, after fees and tax.

By the age of 65:

- Person 1 has $335,370

- Person 2 has $189,673

- Person 3 has $100,227

The standout is how much more Person 1 has compared to Person 3. In the 20 years before Person 3 started investing, Person 1 invested $40,000, which has turned into a $235,000 difference when they both hit 65.

Read more: See how much money you’ll have for your retirement using our free retirement savings calculator.

The incremental increase in returns takes a while to become significant, but when it takes off, it takes off rapidly.

It took Person 1 25 years to hit $100,000, but in the last five years, their portfolio increased by approximately $81,700, compared to Person 3’s portfolio, which only gained around $30,800. This is the effect of compounding, which Einstein famously once called the eighth wonder of the world.

This $2,000 annual contribution is much lower than what many people would set aside. Investing higher amounts inflates the difference even more, so these numbers are just a starting point.

The confidence conundrum

The benefit of investing early is relatively well understood, but the numbers above, while insightful, may not be enough to encourage some to start investing.

This may be due in large part to confidence, or rather, a lack of it.

In an InvestNow-sponsored Informed Investor survey carried out in March, 72% and 77% of respondents said they were ‘reasonably’ and ‘very’ confident to make decisions across managed funds and term deposits respectively.

In a separate survey of InvestNow customers in September 2023, 76% of respondents said they would have personally benefited from financial literacy being taught at school.

“I would have invested my money in shares earlier, I would have been savvier with how and who I set my KiwiSaver up with, I wouldn’t have gotten into credit card debt as often, I would have developed budgeting skills a lot earlier and had less fails,” one respondent said.

Combining these two surveys, we can say that knowledge is the key to confidence. If we can educate our young people about how and why investing is important, we can encourage them to reap the rewards.

Mandatory school-level financial education, which was promised by the National Party ahead of the last election, will accelerate the money learning process for New Zealanders, and help them get into building wealth sooner.

Where to start?

Starting investing is actually quite simple in New Zealand. You have a handful of options.

On going into paid work for the first time, make sure you sign up for KiwiSaver and start making contributions. KiwiSaver is an excellent vehicle for saving for a first home, and for retirement.

If you want to invest beyond KiwiSaver, you can talk to a financial adviser – you will pay for advice, but you’ll get help to set yourself up.

You can also start learning and invest by yourself. Tools like Sorted’s Investor Profile and the InvestNow Investment Principles are a great way to start developing an investment strategy.

Whatever you go with, the best thing you can do is start. You can refine your approach as you go, but as long as you’re in the market, you stand to benefit.

Good tip !

I have had difficulty actually engaging a financial advisor – where on earth do you actually find them?

Thank you for your post on the InvestNow website regarding where to find financial advisers.

The easiest place to find a financial adviser near you is on the Financial Advice website, which allows you to search all advisers that are near you. This will give you the contact details and you can reach out to the ones you wish.