AEOI, CRS and why it’s vital that you keep your tax residency information updated

Following increasing global concern about money laundering and international tax evasion, highlighted by leaks such as the Panama Papers, New Zealand joined the OECD and many other countries in committing to a new global standard (the CRS, or Common Reporting Standard) on the automatic exchange of financial account information (AEOI). This information is required by law to be collected by financial institutions, including InvestNow, and reported to tax authorities around the world, who exchange this information to ensure everyone pays the right amount of tax.

We’ve made some changes to the InvestNow website to make it easier for you to keep us up to date regarding your tax information.

What does this mean for me?

If you have an InvestNow account, you are required by law to comply with all AEOI obligations. This includes making sure that we are aware of all countries or jurisdiction where you are a tax resident, and providing us with all information that we request, for example your Tax Identification Number (TIN) for each country. You also need to tell us if your situation changes – for example, if you move to a different country.

- If we request information from you under CRS/AEOI, and you do not respond correctly and completely, we are legally required to freeze and/or close your account

- If you provide false or misleading information, fail to provide this information, or fail to provide an update if there is a material change to the information you have provided, you could face civil penalties of up to $1000 per offence

- In some circumstances, criminal offences could apply, with penalties of up to $25,000 for the first offence

If you have a trust account with InvestNow, this obligation will usually extend to all “controlling persons” of the trust – this can include settlors, trustees, beneficiaries, protectors, directors or shareholders of trustee companies, and any other natural person who can exercise effective control over your trust.

If your trust or company itself is a foreign tax resident, or if you believe that your trust falls into a different category so that we aren’t required to record the tax details of the controlling persons, please contact us.

If you have questions about your tax residence status, you should either contact the IRD or another tax authority in a relevant country, or seek advice from a tax agent or advisor.

How do I update my foreign tax details

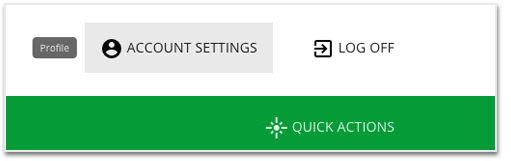

1. Log in and click on “Account Settings” in the top right corner of the page:

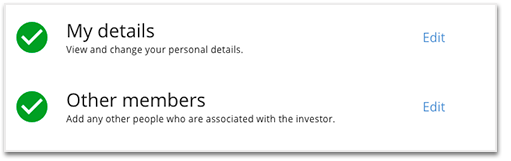

2. Click “Edit” next to “My details” to tell us about your personal tax details, or next to “Other members” if you need to update the details for another member of your account:

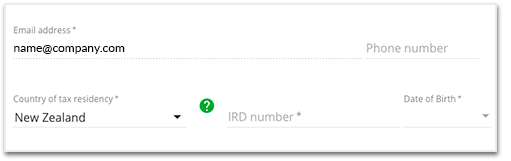

3. Below your email address, you can enter your primary country of tax residency (usually the country that you live in):

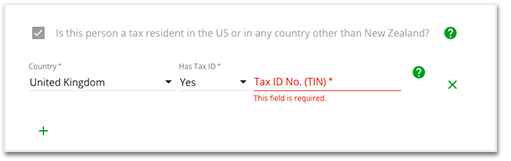

4. If you’ve entered a foreign country or if you also need to report a foreign country of tax residence, tick the box and select the country from the drop-down list:

5. Please enter your Tax Identification Number (TIN) for that country. If you don’t have a TIN, change the answer to “No” and then select the reason why you don’t have a TIN (you may need to provide an explanation). A TIN is the equivalent of New Zealand’s IRD number. You can find more information about TIN numbers for different countries here.

6. Click the cross to remove a country, or click the plus symbol to add another country. When you’ve finished updating your details, just click “Save” in the bottom right corner.

7. If you also need to change the country of tax residency listed on your account under “Investor Details”, please contact us to have this changed. This is because we may need to change your other tax settings as a result, e.g. your PIR.