InvestNow News – 3rd July – ANZ Investments – Weekly Snapshot

Article written by ANZ – 3rd July

ANZ Investments brings you a brief snapshot of the week in markets

International equity markets finished the week lower after a Friday sell-off saw weekly gains erased. For the week the three main indices in the US lost between 2% and 3%, while Europe, most stock indices recorded losses of around 1%.

In New Zealand, the NZX 50 declined around 1%, while in Australia, the ASX 200 fell around 0.5%.

What’s happening in markets

It was a relatively quiet week on the economic data front. In the US, the final reading of first-quarter GDP confirmed that the economy contracted by 5.0%, its steepest decline since 2008. Meanwhile, the Michigan Consumer Sentiment fell slightly. Finally, jobless claims data showed another 1.38 million people filed for unemployment benefits in the US for the week ending 20 June.

The Friday sell-off came as the coronavirus situation appeared to show signs of worsening, especially in some parts of the US where case numbers and the positive test rate are climbing. In particular, Florida, Texas and Arizona have seen marked increases with concerns around hospital capacity and ICU beds. In fact, the US reported its single-day record case count of 37,000 infections on Thursday.

Elsewhere, shares of Facebook fell nearly 10% over the week after a number of companies announced they would be pulling advertising amid concerns the company is not doing enough to address misinformation and hate speech on its platform.

In other news, the International Monetary Fund downgraded its global growth forecast to -4.9% from – 3%. The IMF said the economic activity would be “more gradual” than it had originally thought, adding they see particular concerns for labour markets and with demographic implications.

“The hit to the labour market has been particularly acute for low-skilled workers who don’t have the option of working from home. Income losses also appear to have been uneven across genders, with women among lower-income groups bearing a larger brunt of the impact in some countries,” the IMF said in a press release.

You can read the IMF’s full “World Economic Outlook” update here.

What’s on the calendar

Coming off a quiet week, things are a little busier on the data calendar this week, especially offshore.

In the US, manufacturing PMI (Purchasers Managers’ Index) data will give an indication as to the extent of the recovery since some states began to reopen over the past 3-4 weeks. Meanwhile, on Thursday (the US is closed for July 4th celebrations on Friday) the US employment report is expected to show a decline in hiring. However, after May’s surprisingly good number, a second-consecutive upside surprise could confirm a true pickup in hiring after a spree of layoffs in April and May.

Elsewhere in the US, minutes from the most recent Federal Reserve meeting are released. There

shouldn’t be too many surprises with communication unlikely to change, with the Fed reiterating it will do what is needed to support the economy.

In China, the Caixin and NBS services and manufacturing PMI reports will be closely watched after a recent setback in China’s recovery with some new coronavirus cases popping up in Beijing, raising fears of a ‘second wave’ in the country the virus originated.

Finally, in Europe, inflation data could show that the eurozone has slipped into deflation when June inflation data is released. Any below-consensus number is likely to confirm the European Central Bank policy will remain heavily accommodative for the foreseeable future.

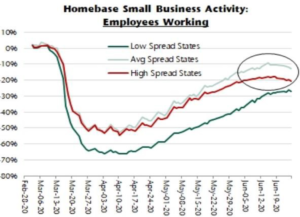

Chart of the week

High-frequency data shows small business activity is starting to slow. It will be interesting to see if this shows up in economic data over the coming weeks.

Here’s what we’re reading

Social bond growth is currently outpacing green bonds and is becoming an increasingly important tool to help the coronavirus recover, according to S&P – https://www.ai-cio.com/news/pandemic-spurs-investor- interest-social-bonds/

Disclaimer: This information is issued by ANZ Bank New Zealand Limited (ANZ). The information is current as at 29 June and is subject to change. The information is general in nature and does not take into account your personal objectives, needs and financial circumstances. You should consider the appropriateness of the information, having regard to your personal objectives, needs and financial circumstances. This information is not to be construed as personal advice, and should not be relied upon as a substitute for professional advice. Although all the information in this document is obtained in good faith from sources believed to be reliable, no representation of warranty, express or implied is made as to its accuracy or completeness. To the extent permitted by law ANZ does not accept any responsibility or liability arising from your use of this information. Past performance is not indicative of future performance. The actual performance any given investor realises will depend on many things, is not guaranteed and may be negative as well as positive.

InvestNow News – 3rd July – ANZ Investments – Weekly Snapshot

Article written by ANZ – 3rd July

ANZ Investments brings you a brief snapshot of the week in markets

International equity markets finished the week lower after a Friday sell-off saw weekly gains erased. For the week the three main indices in the US lost between 2% and 3%, while Europe, most stock indices recorded losses of around 1%.

In New Zealand, the NZX 50 declined around 1%, while in Australia, the ASX 200 fell around 0.5%.

What’s happening in markets

It was a relatively quiet week on the economic data front. In the US, the final reading of first-quarter GDP confirmed that the economy contracted by 5.0%, its steepest decline since 2008. Meanwhile, the Michigan Consumer Sentiment fell slightly. Finally, jobless claims data showed another 1.38 million people filed for unemployment benefits in the US for the week ending 20 June.

The Friday sell-off came as the coronavirus situation appeared to show signs of worsening, especially in some parts of the US where case numbers and the positive test rate are climbing. In particular, Florida, Texas and Arizona have seen marked increases with concerns around hospital capacity and ICU beds. In fact, the US reported its single-day record case count of 37,000 infections on Thursday.

Elsewhere, shares of Facebook fell nearly 10% over the week after a number of companies announced they would be pulling advertising amid concerns the company is not doing enough to address misinformation and hate speech on its platform.

In other news, the International Monetary Fund downgraded its global growth forecast to -4.9% from – 3%. The IMF said the economic activity would be “more gradual” than it had originally thought, adding they see particular concerns for labour markets and with demographic implications.

“The hit to the labour market has been particularly acute for low-skilled workers who don’t have the option of working from home. Income losses also appear to have been uneven across genders, with women among lower-income groups bearing a larger brunt of the impact in some countries,” the IMF said in a press release.

You can read the IMF’s full “World Economic Outlook” update here.

What’s on the calendar

Coming off a quiet week, things are a little busier on the data calendar this week, especially offshore.

In the US, manufacturing PMI (Purchasers Managers’ Index) data will give an indication as to the extent of the recovery since some states began to reopen over the past 3-4 weeks. Meanwhile, on Thursday (the US is closed for July 4th celebrations on Friday) the US employment report is expected to show a decline in hiring. However, after May’s surprisingly good number, a second-consecutive upside surprise could confirm a true pickup in hiring after a spree of layoffs in April and May.

Elsewhere in the US, minutes from the most recent Federal Reserve meeting are released. There

shouldn’t be too many surprises with communication unlikely to change, with the Fed reiterating it will do what is needed to support the economy.

In China, the Caixin and NBS services and manufacturing PMI reports will be closely watched after a recent setback in China’s recovery with some new coronavirus cases popping up in Beijing, raising fears of a ‘second wave’ in the country the virus originated.

Finally, in Europe, inflation data could show that the eurozone has slipped into deflation when June inflation data is released. Any below-consensus number is likely to confirm the European Central Bank policy will remain heavily accommodative for the foreseeable future.

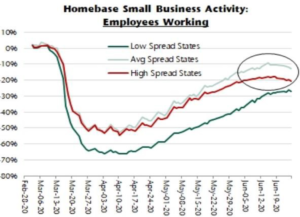

Chart of the week

High-frequency data shows small business activity is starting to slow. It will be interesting to see if this shows up in economic data over the coming weeks.

Here’s what we’re reading

Social bond growth is currently outpacing green bonds and is becoming an increasingly important tool to help the coronavirus recover, according to S&P – https://www.ai-cio.com/news/pandemic-spurs-investor- interest-social-bonds/

Disclaimer: This information is issued by ANZ Bank New Zealand Limited (ANZ). The information is current as at 29 June and is subject to change. The information is general in nature and does not take into account your personal objectives, needs and financial circumstances. You should consider the appropriateness of the information, having regard to your personal objectives, needs and financial circumstances. This information is not to be construed as personal advice, and should not be relied upon as a substitute for professional advice. Although all the information in this document is obtained in good faith from sources believed to be reliable, no representation of warranty, express or implied is made as to its accuracy or completeness. To the extent permitted by law ANZ does not accept any responsibility or liability arising from your use of this information. Past performance is not indicative of future performance. The actual performance any given investor realises will depend on many things, is not guaranteed and may be negative as well as positive.