How to be a better-than-average investor by averaging

Article written by InvestNow – 30th November 2021

Buy-low, sell-high is the stock-standard advice for generating capital returns on investment assets.

Unfortunately, the self-evident piece of folk wisdom does not come with any practical guidance on how to spot the ideal buying and selling moments.

And anyone familiar with the ups and downs of investment markets has likely reached the frustrating conclusion that it’s nearly impossible to predict market behaviour on any given day.

In the real world of fast-moving – and accelerating – asset prices, investors today face an even more difficult task in timing their sale-and-purchase decisions to perfection.

Yet despite the old saying that “it’s time in the market, not timing the market” that matters over the long term, how much investors pay for assets does strongly influence future returns.

The COVID-19 market crash in early 2020 showed what a difference a day (or so) makes for longer-term investment performance.

For example, an investor who placed their life savings in an S&P500 US equities index fund at the peak of the market in mid-February 2020 would be sitting on returns of over 38% near the end of November this year.

Pretty good.

But if the same investor had just waited a few weeks until the market low on March 23 to put everything into an S&P500 index fund, they would be up more than 100%.

Much better.

Of course, few, if any, investors would have gone all-in at either extreme but the COVID-crash highlights the risks of making one-off bets in volatile markets.

Managing volatility the DCA way

Volatility is, and will always be, a feature of investment markets, especially with higher-risk assets like equities and cryptocurrencies.

While the degree of market uncertainty varies over time, investors must make decisions based on their own circumstances and risk tolerance regardless of background conditions.

However, there is a simple, time-honoured way to manage some of the volatility risk by drip-feeding cash into markets rather than making a big splash.

Known formally as dollar-cost-averaging (DCA), the process irons out the market wrinkles by setting investors to a disciplined, flat contribution plan.

DCA plans involve a program of regular – weekly or monthly, for instance – payments to purchase shares or funds over a targeted investing timeframe.

The DCA approach aims to average out the price of an asset (such as a fund) rather than risking all at a single moment in time when the valuation might have reached a high, or low, point.

Say, for instance, an investor with $500 to allocate to a global shares fund spent the lot on a day when the unit price was $5 – gaining 100 units (ignoring any buy-sell spreads).

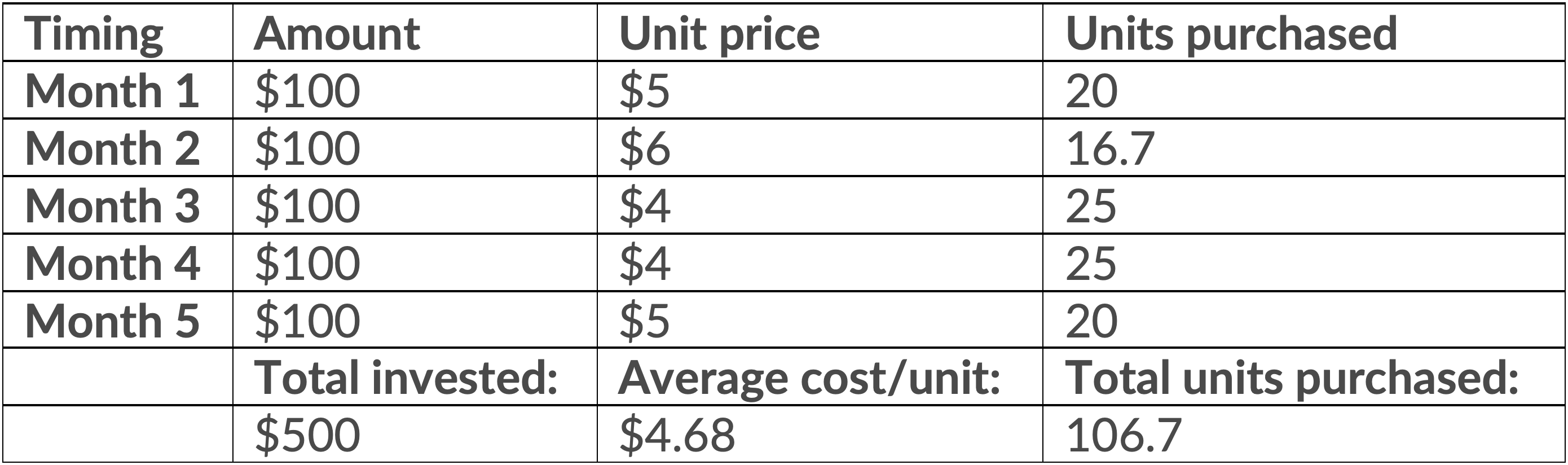

But if the same investor instead parceled out the $500 in five equal monthly purchases during a period of fluctuating market prices, the outcome could go as follows:

In this example, the investor now has 106.7 units with a unit price of $5, valued at $533.50. However, if they had placed the whole $500 at a unit price of $5, their investment would still only be worth the original face value.

The simplified example above shows the potential power of DCA by avoiding the buy-high risks associated with investing a large amount at one time.

Of course, if instead, the fund price rose continuously each month in the scenario above, then the lump-sump punt would outperform the DCA method. Given volatility remains the norm in financial markets, though, DCA remains an effective way to manage the risk over time.

DCA also has other side benefits such as establishing disciplined investment habits and helping prevent emotion-based reactions to market volatility.

At the height of the COVID panic in March 2020, for instance, a Financial Markets Authority (FMA) analysis released about a year later found a seven-fold increase in fund-switching behaviour – most moving to lower-risk strategies just as share markets bottomed out.

Gillian Boyes, FMA investor capability manager, said at the time that the study highlights some common behavioural quirks.

“Action bias means people felt the need to ‘do something’ to gain a sense of control over their falling balance, other factors provoking this activity were emotionally-charged public conversations about KiwiSaver at the time, a herd mentality, and a desire to mitigate short-term losses,” Boyes said. “A panic decision to switch because of shorter term events can have long term consequences.”

Stay regular with InvestNow plans

Even so, the majority of KiwiSaver members stayed on track during the March 2020 market dive, probably because the system operates very much like a DCA program: employee and employer KiwiSaver contributions are tied to payroll cycles that usually follow weekly, fortnightly or monthly patterns.

Mike Heath, InvestNow general manager, says KiwiSaver offers a good model for other fund contribution plans too.

Heath says the InvestNow ‘Regular Investment Plans’ provide platform users with an efficient, flexible and automated way to harness the benefits of DCA to reach their savings goals.

“We introduced the Regular Investment Plans soon after launching InvestNow to meet a growing client need,” he says. “Our members appreciate the simple click-a-button process to establish highly personalised contribution schedules across their chosen investments.”

The InvestNow Regular Investment Plans allow members to arrange automatic contributions (of a minimum $50 per fund) on a weekly, fortnightly, monthly, quarterly or six-monthly basis over any pre-determined time period.

“Members can choose when they want to start and end their plans,” Heath says. “And they can also create automatic investment plans covering any fund, or funds, on our platform.”

With share market volatility rising of late, he says the automated, regular contribution plans provide an easy solution for investors to ride out any bumps ahead.

Similarly, Heath says investors looking to access the cryptocurrency markets via the new Vault International Bitcoin Fund recently listed on InvestNow could consider limiting the volatility risk with regular contributions.

“Bitcoin is a famously volatile asset but investors who want exposure to it through the Vault fund don’t have to make a big bet on its price on any one day,” he says.

Click here for further information on how to set up an InvestNow Regular Investment Plan.

How to be a better-than-average investor by averaging

Article written by InvestNow – 30th November 2021

Buy-low, sell-high is the stock-standard advice for generating capital returns on investment assets.

Unfortunately, the self-evident piece of folk wisdom does not come with any practical guidance on how to spot the ideal buying and selling moments.

And anyone familiar with the ups and downs of investment markets has likely reached the frustrating conclusion that it’s nearly impossible to predict market behaviour on any given day.

In the real world of fast-moving – and accelerating – asset prices, investors today face an even more difficult task in timing their sale-and-purchase decisions to perfection.

Yet despite the old saying that “it’s time in the market, not timing the market” that matters over the long term, how much investors pay for assets does strongly influence future returns.

The COVID-19 market crash in early 2020 showed what a difference a day (or so) makes for longer-term investment performance.

For example, an investor who placed their life savings in an S&P500 US equities index fund at the peak of the market in mid-February 2020 would be sitting on returns of over 38% near the end of November this year.

Pretty good.

But if the same investor had just waited a few weeks until the market low on March 23 to put everything into an S&P500 index fund, they would be up more than 100%.

Much better.

Of course, few, if any, investors would have gone all-in at either extreme but the COVID-crash highlights the risks of making one-off bets in volatile markets.

Managing volatility the DCA way

Volatility is, and will always be, a feature of investment markets, especially with higher-risk assets like equities and cryptocurrencies.

While the degree of market uncertainty varies over time, investors must make decisions based on their own circumstances and risk tolerance regardless of background conditions.

However, there is a simple, time-honoured way to manage some of the volatility risk by drip-feeding cash into markets rather than making a big splash.

Known formally as dollar-cost-averaging (DCA), the process irons out the market wrinkles by setting investors to a disciplined, flat contribution plan.

DCA plans involve a program of regular – weekly or monthly, for instance – payments to purchase shares or funds over a targeted investing timeframe.

The DCA approach aims to average out the price of an asset (such as a fund) rather than risking all at a single moment in time when the valuation might have reached a high, or low, point.

Say, for instance, an investor with $500 to allocate to a global shares fund spent the lot on a day when the unit price was $5 – gaining 100 units (ignoring any buy-sell spreads).

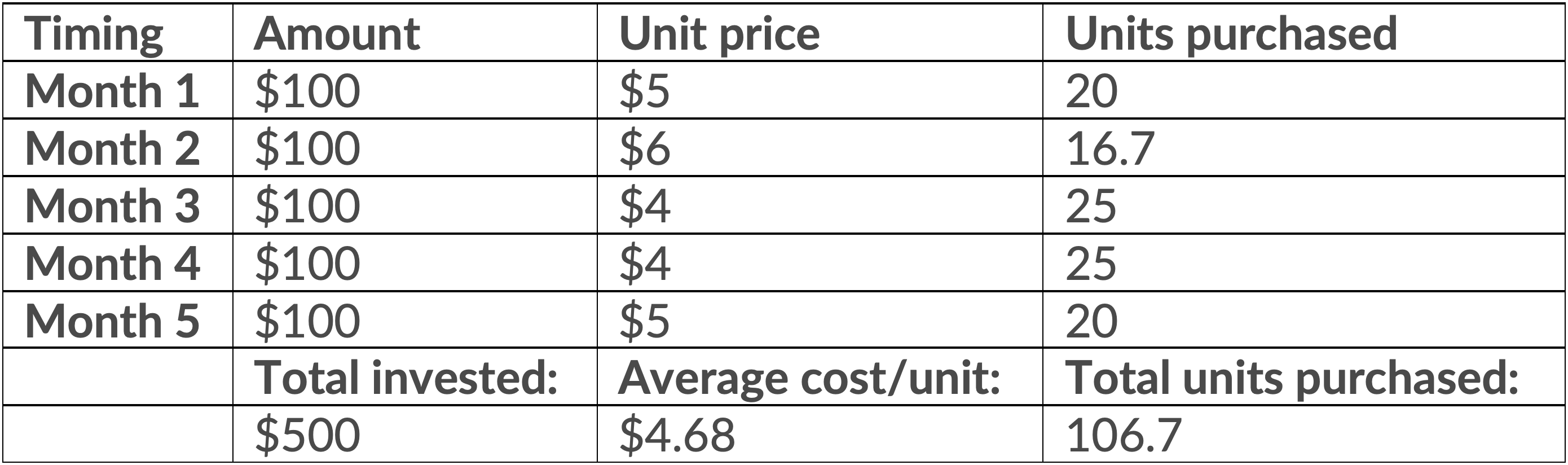

But if the same investor instead parceled out the $500 in five equal monthly purchases during a period of fluctuating market prices, the outcome could go as follows:

In this example, the investor now has 106.7 units with a unit price of $5, valued at $533.50. However, if they had placed the whole $500 at a unit price of $5, their investment would still only be worth the original face value.

The simplified example above shows the potential power of DCA by avoiding the buy-high risks associated with investing a large amount at one time.

Of course, if instead, the fund price rose continuously each month in the scenario above, then the lump-sump punt would outperform the DCA method. Given volatility remains the norm in financial markets, though, DCA remains an effective way to manage the risk over time.

DCA also has other side benefits such as establishing disciplined investment habits and helping prevent emotion-based reactions to market volatility.

At the height of the COVID panic in March 2020, for instance, a Financial Markets Authority (FMA) analysis released about a year later found a seven-fold increase in fund-switching behaviour – most moving to lower-risk strategies just as share markets bottomed out.

Gillian Boyes, FMA investor capability manager, said at the time that the study highlights some common behavioural quirks.

“Action bias means people felt the need to ‘do something’ to gain a sense of control over their falling balance, other factors provoking this activity were emotionally-charged public conversations about KiwiSaver at the time, a herd mentality, and a desire to mitigate short-term losses,” Boyes said. “A panic decision to switch because of shorter term events can have long term consequences.”

Stay regular with InvestNow plans

Even so, the majority of KiwiSaver members stayed on track during the March 2020 market dive, probably because the system operates very much like a DCA program: employee and employer KiwiSaver contributions are tied to payroll cycles that usually follow weekly, fortnightly or monthly patterns.

Mike Heath, InvestNow general manager, says KiwiSaver offers a good model for other fund contribution plans too.

Heath says the InvestNow ‘Regular Investment Plans’ provide platform users with an efficient, flexible and automated way to harness the benefits of DCA to reach their savings goals.

“We introduced the Regular Investment Plans soon after launching InvestNow to meet a growing client need,” he says. “Our members appreciate the simple click-a-button process to establish highly personalised contribution schedules across their chosen investments.”

The InvestNow Regular Investment Plans allow members to arrange automatic contributions (of a minimum $50 per fund) on a weekly, fortnightly, monthly, quarterly or six-monthly basis over any pre-determined time period.

“Members can choose when they want to start and end their plans,” Heath says. “And they can also create automatic investment plans covering any fund, or funds, on our platform.”

With share market volatility rising of late, he says the automated, regular contribution plans provide an easy solution for investors to ride out any bumps ahead.

Similarly, Heath says investors looking to access the cryptocurrency markets via the new Vault International Bitcoin Fund recently listed on InvestNow could consider limiting the volatility risk with regular contributions.

“Bitcoin is a famously volatile asset but investors who want exposure to it through the Vault fund don’t have to make a big bet on its price on any one day,” he says.

Click here for further information on how to set up an InvestNow Regular Investment Plan.

Leave A Comment