Mixed messages: why diversification still matters

Article written by InvestNow – 1st April 2022

Over the last couple of years retail investors across the world have herded into online share-trading platforms at an astonishing rate.

In a new report on sector, the International Organization of Securities Commissions (IOSCO) notes: “Retail trading historically comprised, on average, roughly 10% of all U.S. equities trading volume (prior to the COVID-19 pandemic). That figure reportedly doubled to roughly 20% in 2020, and reached as high as 26% during the January 2021 market events.”

New Zealand closely followed the global trend with hundreds of thousands of first-time investors piling into local (and offshore-based) share-trading platforms, lured by adverts promising access to shoot-the-moon stocks like Tesla or the Kiwi shoe manufacturer, Allbirds, as it listed on the Nasdaq.

More recently, the equities-trading services have adopted more soft-core, lifestyle marketing campaigns such as comparing a first romantic kiss to making a debut bet on shares – sort-of awkward but necessary.

However, as with many first-kisses, newbie share-traders who ignored the key investment principle of diversification may have felt some regrets following the recent share market correction, which has battered some companies more than others.

For example, Allbirds, which was well supported by an army of online Kiwi investors when it joined the Nasdaq last November, saw its share price more than double from US$15 to over US$32 on listing before quickly slumping to its current level of about US$6.

Investors who bought Allbirds at the initial public offer (IPO) are down more than 60% while those who got in at the peak have seen the value of their holdings shrink by 81%.

If those numbers are bad enough, another piece of basic investment math might prove a little scary for those who went all-in on Allbirds: the company’s stock will have to rise by almost 150% just to reach the par IPO value again.

Allbirds is not the only share facing such tough odds of reclaiming recent highs after precipitous falls.

According to the Financial Times (FT), as at early March this year almost two-thirds of the 3,000-odd shares that make up the Nasdaq Composite Index were down 25% from their 52-week peaks.

Alarmingly, the FT article notes almost 43% of the Nasdaq stocks had more than halved in value while one-in-five firms were 75% below recent high points.

As with Allbirds, those investors with big exposures to the down-in-the-dumps Nasdaq stocks are now relying on stellar returns in the near term just to restore their capital base.

How to have a go (but not get gone)

Some investors encouraged to just ‘have a go’ by share-trading platform ads might be staring down the hard truth that much of their money is now simply gone.

Of course, many –probably most – of the first-timer stock-traders may have only small sums at stake and the recent losses may represent a pretty cheap lesson on the power of diversification.

For example, during the recent correction that smashed certain sectors of the share market, well-diversified balanced and growth funds returned -5 and -7%, respectively. While negative returns are never a great look, diversification clearly protected investors from the extreme losses associated with single-stock or narrow sector bets.

But how much diversification is enough?

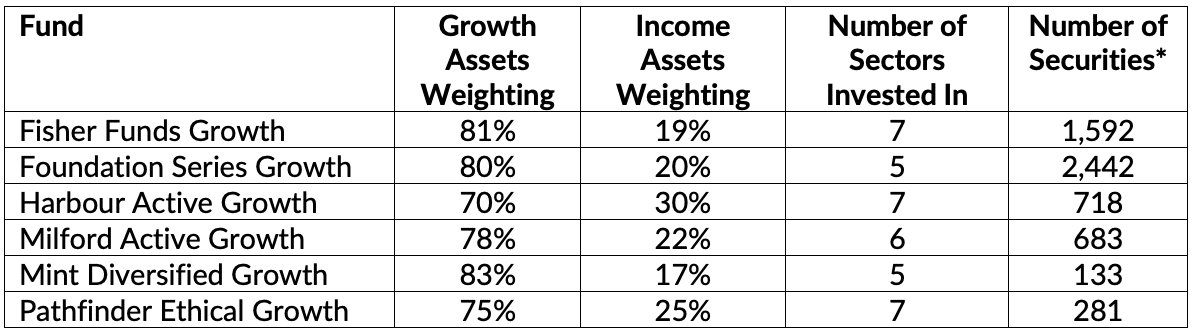

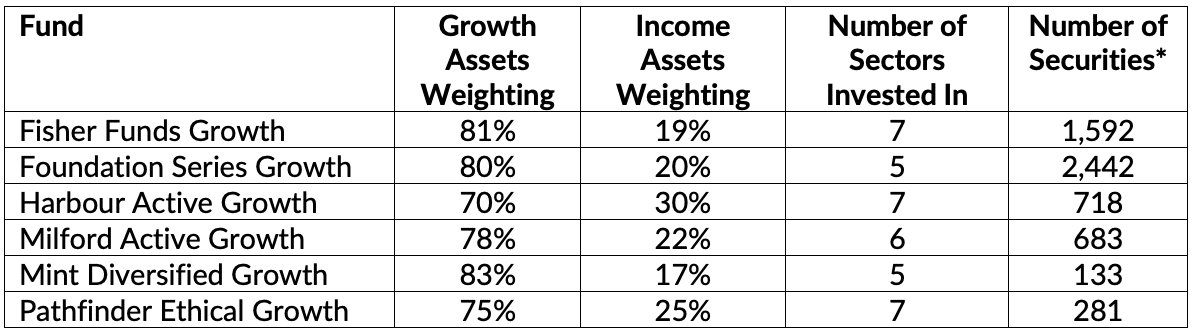

Some of the diversified growth funds used as a core portfolio by many InvestNow KiwiSaver Scheme members offer a good snapshot of how professional investors approach the question. The table below shows the asset allocation of the respective growth funds as well as the number of underlying securities.

*Includes securities in underlying funds. As at 30 September 2021

As the table illustrates, diversification in the growth funds covers a wide range from 133 underlying securities (Mint) to almost 2,500 in the Foundation Series Growth Fund. Foundation has a much larger number of underlying securities due to its passive exposure to a global equities index and diverse holdings in an international fixed interest portfolio managed by PIMCO. Even at 133 securities, though, the Mint fund has much greater diversification than the average direct share investor.

Likewise, the popular Milford clearly sees the value in a broadly diversified portfolio, boasting more than 500 securities in its flagship growth fund.

And while the share-trading platforms push the ‘have a crack, it’s easy’ message to hesitant first-time equity investors, the glossy ads ignore the importance of diversification.

Serious investors build diversified portfolios to protect against the impact of potential future events that could wipe out a single-stock or decimate an entire sector.

For example, holding the shares of only one company leaves investors vulnerable to all the regular market risks plus specific factors linked to the country, sector and the firm itself (such as the entry of a new competitor).

By contrast, diversifying across multiple asset classes, countries, and even investment managers, investors can lessen the affect of different events on their portfolio. For instance, often things that might be negative for shares, like a downturn in economic growth, have a positive impact on bonds (and vice versa).

In the investment industry diversification is often referred to as the only true ‘free-lunch’ due to its ability to reduce overall risk while enhancing returns. Different assets tend to vary in performance behaviour over market cycles where laggards and winners can swap places.

By holding a diversified portfolio, investors significantly reduce the risks associated with any one asset. Naturally, the strategy comes with a trade-off of potentially underperforming single asset classes (or star stocks) during a bull-phase but the net effect of diversification is smoother, steadier returns over time.

Encouragingly, most of the investors with large portfolios on InvestNow have adopted the diversification message. On average, the l,000 largest investors on the platform hold eight funds each; while not quite as diversified, the average InvestNow KiwiSaver Scheme member has invested in three funds, which implies a much wider spread of assets than a few stocks.

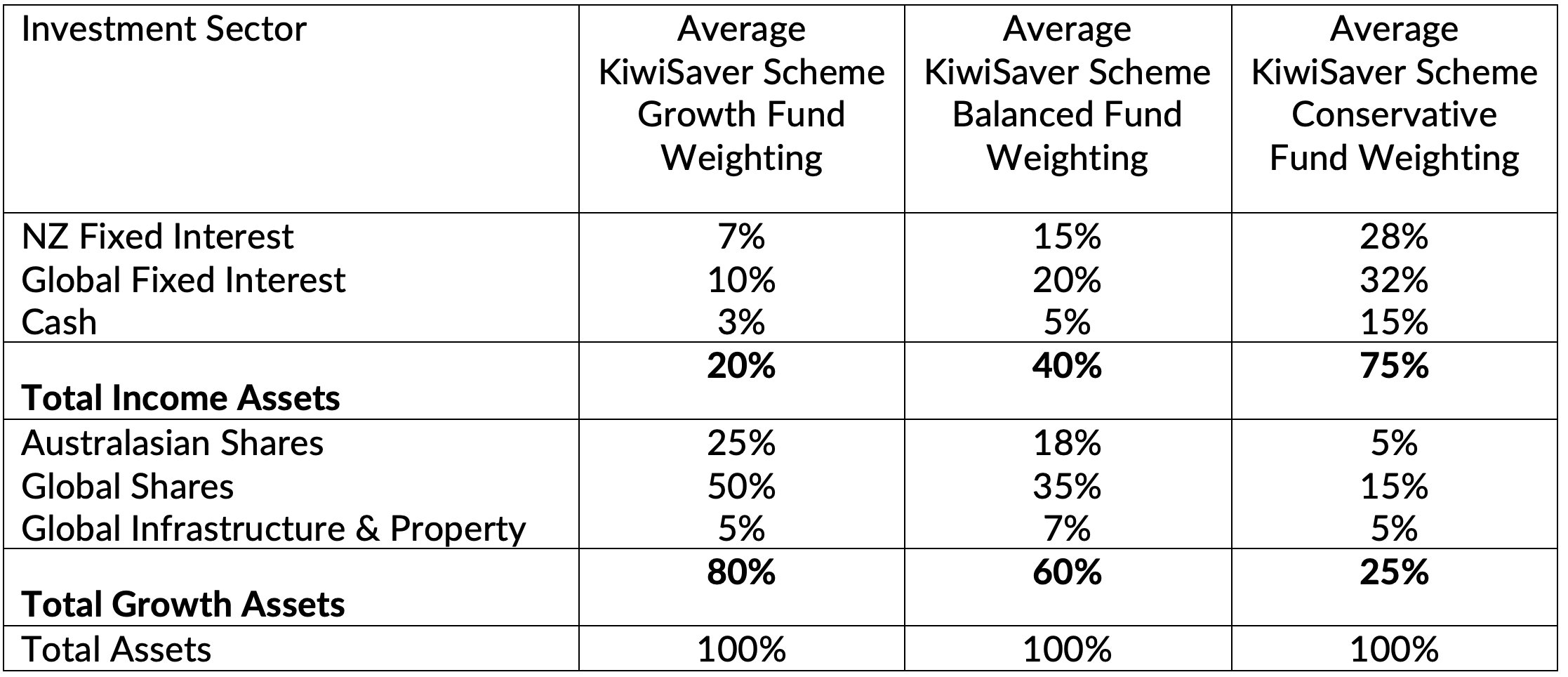

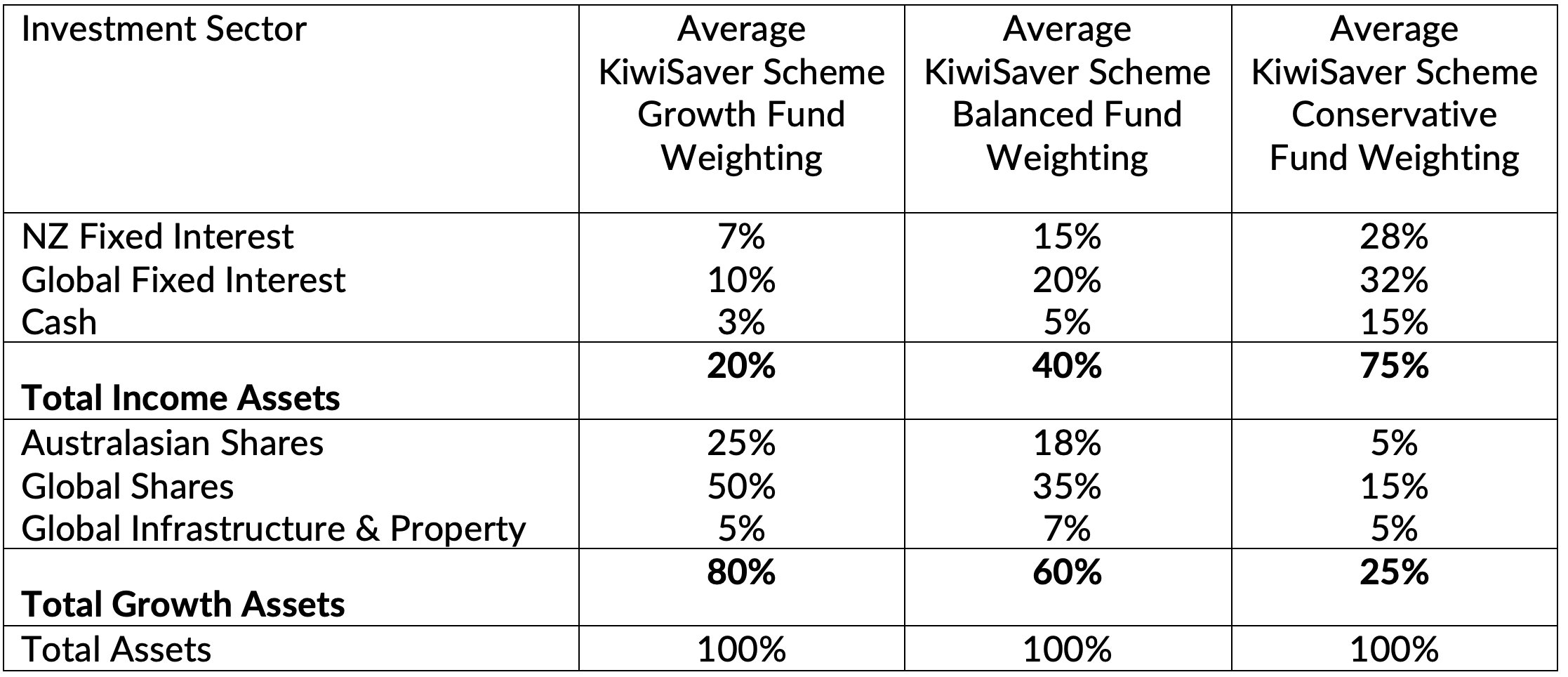

Professionally managed diversified funds (InvestNow offers many) are often the first – and simplest – way for investors to access a broad range of underlying assets. Alternatively, investors can build their own portfolios by using the typical asset mix of the diversified funds within the KiwiSaver universe (see table below) as a guide.

InvestNow categorises all funds on the platform according to sector, enabling members to easily construct a diversified portfolio. Investors who understand their risk profile (as assessed by the Sorted Investor kickstarter tool, for example) can use the InvestNow categories to create a diversified portfolio suitable to their own needs.

Investors might also consider including a range of different investment managers, diversifying away some of the risk of a single manager dropping an ‘Allbirds’ on their overall portfolio return.

The need for investors to diversify their portfolios was highlighted by a recent report by IOSCO, which represents most of the world’s financial regulators, noting that “increasing market volatility as an important potential magnifier of retail investor risk, with the risk of a ‘market correction’ exposing retail investors to severe losses if they have overinvested, followed a short-term trend into a market, or used leverage”.

InvestNow backs the important principle, also promoted by share-trading platforms, that Kiwis should start investing today.

But rather than forming an exclusive relationship with the first pretty stock they see, investors need to embrace diversification from the get-go or risk the heartbreak of a devastating loss when markets disappoint.

Mixed messages: why diversification still matters

Article written by InvestNow – 1st April 2022

Over the last couple of years retail investors across the world have herded into online share-trading platforms at an astonishing rate.

In a new report on sector, the International Organization of Securities Commissions (IOSCO) notes: “Retail trading historically comprised, on average, roughly 10% of all U.S. equities trading volume (prior to the COVID-19 pandemic). That figure reportedly doubled to roughly 20% in 2020, and reached as high as 26% during the January 2021 market events.”

New Zealand closely followed the global trend with hundreds of thousands of first-time investors piling into local (and offshore-based) share-trading platforms, lured by adverts promising access to shoot-the-moon stocks like Tesla or the Kiwi shoe manufacturer, Allbirds, as it listed on the Nasdaq.

More recently, the equities-trading services have adopted more soft-core, lifestyle marketing campaigns such as comparing a first romantic kiss to making a debut bet on shares – sort-of awkward but necessary.

However, as with many first-kisses, newbie share-traders who ignored the key investment principle of diversification may have felt some regrets following the recent share market correction, which has battered some companies more than others.

For example, Allbirds, which was well supported by an army of online Kiwi investors when it joined the Nasdaq last November, saw its share price more than double from US$15 to over US$32 on listing before quickly slumping to its current level of about US$6.

Investors who bought Allbirds at the initial public offer (IPO) are down more than 60% while those who got in at the peak have seen the value of their holdings shrink by 81%.

If those numbers are bad enough, another piece of basic investment math might prove a little scary for those who went all-in on Allbirds: the company’s stock will have to rise by almost 150% just to reach the par IPO value again.

Allbirds is not the only share facing such tough odds of reclaiming recent highs after precipitous falls.

According to the Financial Times (FT), as at early March this year almost two-thirds of the 3,000-odd shares that make up the Nasdaq Composite Index were down 25% from their 52-week peaks.

Alarmingly, the FT article notes almost 43% of the Nasdaq stocks had more than halved in value while one-in-five firms were 75% below recent high points.

As with Allbirds, those investors with big exposures to the down-in-the-dumps Nasdaq stocks are now relying on stellar returns in the near term just to restore their capital base.

How to have a go (but not get gone)

Some investors encouraged to just ‘have a go’ by share-trading platform ads might be staring down the hard truth that much of their money is now simply gone.

Of course, many –probably most – of the first-timer stock-traders may have only small sums at stake and the recent losses may represent a pretty cheap lesson on the power of diversification.

For example, during the recent correction that smashed certain sectors of the share market, well-diversified balanced and growth funds returned -5 and -7%, respectively. While negative returns are never a great look, diversification clearly protected investors from the extreme losses associated with single-stock or narrow sector bets.

But how much diversification is enough?

Some of the diversified growth funds used as a core portfolio by many InvestNow KiwiSaver Scheme members offer a good snapshot of how professional investors approach the question. The table below shows the asset allocation of the respective growth funds as well as the number of underlying securities.

*Includes securities in underlying funds. As at 30 September 2021

As the table illustrates, diversification in the growth funds covers a wide range from 133 underlying securities (Mint) to almost 2,500 in the Foundation Series Growth Fund. Foundation has a much larger number of underlying securities due to its passive exposure to a global equities index and diverse holdings in an international fixed interest portfolio managed by PIMCO. Even at 133 securities, though, the Mint fund has much greater diversification than the average direct share investor.

Likewise, the popular Milford clearly sees the value in a broadly diversified portfolio, boasting more than 500 securities in its flagship growth fund.

And while the share-trading platforms push the ‘have a crack, it’s easy’ message to hesitant first-time equity investors, the glossy ads ignore the importance of diversification.

Serious investors build diversified portfolios to protect against the impact of potential future events that could wipe out a single-stock or decimate an entire sector.

For example, holding the shares of only one company leaves investors vulnerable to all the regular market risks plus specific factors linked to the country, sector and the firm itself (such as the entry of a new competitor).

By contrast, diversifying across multiple asset classes, countries, and even investment managers, investors can lessen the affect of different events on their portfolio. For instance, often things that might be negative for shares, like a downturn in economic growth, have a positive impact on bonds (and vice versa).

In the investment industry diversification is often referred to as the only true ‘free-lunch’ due to its ability to reduce overall risk while enhancing returns. Different assets tend to vary in performance behaviour over market cycles where laggards and winners can swap places.

By holding a diversified portfolio, investors significantly reduce the risks associated with any one asset. Naturally, the strategy comes with a trade-off of potentially underperforming single asset classes (or star stocks) during a bull-phase but the net effect of diversification is smoother, steadier returns over time.

Encouragingly, most of the investors with large portfolios on InvestNow have adopted the diversification message. On average, the l,000 largest investors on the platform hold eight funds each; while not quite as diversified, the average InvestNow KiwiSaver Scheme member has invested in three funds, which implies a much wider spread of assets than a few stocks.

Professionally managed diversified funds (InvestNow offers many) are often the first – and simplest – way for investors to access a broad range of underlying assets. Alternatively, investors can build their own portfolios by using the typical asset mix of the diversified funds within the KiwiSaver universe (see table below) as a guide.

InvestNow categorises all funds on the platform according to sector, enabling members to easily construct a diversified portfolio. Investors who understand their risk profile (as assessed by the Sorted Investor kickstarter tool, for example) can use the InvestNow categories to create a diversified portfolio suitable to their own needs.

Investors might also consider including a range of different investment managers, diversifying away some of the risk of a single manager dropping an ‘Allbirds’ on their overall portfolio return.

The need for investors to diversify their portfolios was highlighted by a recent report by IOSCO, which represents most of the world’s financial regulators, noting that “increasing market volatility as an important potential magnifier of retail investor risk, with the risk of a ‘market correction’ exposing retail investors to severe losses if they have overinvested, followed a short-term trend into a market, or used leverage”.

InvestNow backs the important principle, also promoted by share-trading platforms, that Kiwis should start investing today.

But rather than forming an exclusive relationship with the first pretty stock they see, investors need to embrace diversification from the get-go or risk the heartbreak of a devastating loss when markets disappoint.

Leave A Comment