InvestNow News – 24th July – Harbour Asset Management – ESG & COVID-19 – Did the long term add value in the short term?

Article written by Shane Solly, Harbour Asset Management – 22nd July

- Whilst Environmental, Social and Governance (ESG) policies take time to impact investment returns, we present evidence that ESG policies added value in the volatile first half of 2020

- Companies with better ESG credentials fell by less when the market dropped in the first quarter of 2020 and kept up with the market when it rallied in the second quarter of 2020

- Companies with lower ESG credentials dropped more in the first quarter, recovered less in the second quarter and underperformed the market over the first half of 2020.

Environmental, Social and Governance (ESG) policies and practices may take time to impact investment returns. ESG is often associated with a quality investment style as it may be associated with business resilience. For Harbour, analysing company ESG policies is an important part of risk assessment when considering potential investments. So, did stocks with better ESG credentials add more value, relative to those with lower ESG credentials, in the first half of 2020 as COVID-19 contributed to a volatile New Zealand equity market? We take a snapshot of how stocks have performed through the first half of calendar year 2020.

Harbour has incorporated its proprietary Corporate Behaviour Survey (CBS) into its investment process since its inception and our CBS includes questions covering many ESG issues. In our view, companies exhibiting good corporate behaviour will have strong corporate governance, environmental and social policies. Further, if a company creates value for all its stakeholders, then shareholders are more likely to do well also. Stakeholders include customers, suppliers, communities, financiers and shareholders. Firms that rate well are more likely to employ capital efficiently, be more fully valued by investors and produce superior returns relative to comparable companies that do not rate as well. Harbour constructively engages with companies to encourage ongoing improvement in their CBS scores (including ESG practices).

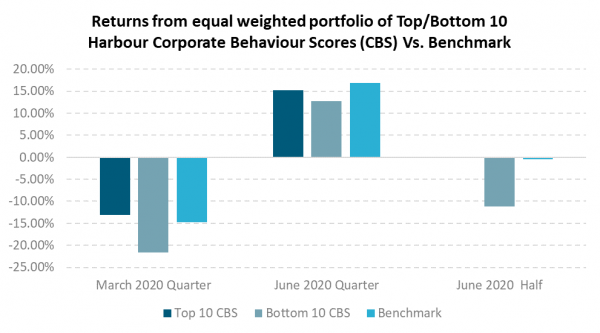

To test whether CBS scores improved investors’ outcomes during market dislocation periods, such as those observed over the first half of 2020, we created equally weighted portfolios of the CBS’ ten top- and bottom-ranking S&P/NZX50 index stocks. CBS scores were taken as at the first quarter of 2020 and then compared to the CBS score for the second quarter, to reflect the decline and recovery period. The portfolio of top-ranking CBS stocks significantly outperformed the bottom-ranking portfolio over both quarters as illustrated in figure 1:

Figure 1: Higher CBS stocks companies outperformed lower CBS score stocks in first half 2020

Source: Harbour, Forsyth Barr, Bloomberg. To 30 June 2020. Benchmark is the S&P/NZX50 Portfolio Index; equally weighted portfolios are composed of the 10 highest /lowest ranking index stocks using Harbour’s Corporate Behaviour Score rankings

While the top-ranking CBS stocks delivered a slightly better than market returns for the June 2020 half, the way they delivered the short-term value add is perhaps more interesting for long term investors. Higher-ranking CBS stocks significantly outperformed the broader New Zealand equity market in the March quarter and gave back a modest amount of relative performance against the benchmark in the June quarter. In our view, this supports the risk management benefits of favouring companies with a high CBS score.

Perhaps the key takeout is that companies with low CBS scores significantly eroded returns during the June half year. The fact that the bottom ten stocks underperformed the market recovery in the June quarter highlights the potential persistency of information in CBS scores. Investors remain concerned that lower CBS ranking stocks may not deliver appropriate returns relative to risk. Whilst not all high CBS ranking stocks are outperformers, poor CBS stocks are likely to be underperformers. Four of the top ten ranking CBS stocks outperformed the benchmark over the June half year. All ten of the bottom ten ranking CBS stocks underperformed the benchmark over the half.

Harbour has utilised its CBS framework over a long period of time and through several investment cycles. While the June 2020 half is a very short period of time, and as such some caution is warranted, the observations for the period are consistent with Harbour’s long term research – stocks with low CBS scores tend to struggle to deliver consistent returns through time. In our view, companies with higher CBS scores are more resilient, but the benefit from biasing investment to stocks with better ESG practices requires a patient long-term approach.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

InvestNow News – 24th July – Harbour Asset Management – ESG & COVID-19 – Did the long term add value in the short term?

Article written by Shane Solly, Harbour Asset Management – 22nd July

- Whilst Environmental, Social and Governance (ESG) policies take time to impact investment returns, we present evidence that ESG policies added value in the volatile first half of 2020

- Companies with better ESG credentials fell by less when the market dropped in the first quarter of 2020 and kept up with the market when it rallied in the second quarter of 2020

- Companies with lower ESG credentials dropped more in the first quarter, recovered less in the second quarter and underperformed the market over the first half of 2020.

Environmental, Social and Governance (ESG) policies and practices may take time to impact investment returns. ESG is often associated with a quality investment style as it may be associated with business resilience. For Harbour, analysing company ESG policies is an important part of risk assessment when considering potential investments. So, did stocks with better ESG credentials add more value, relative to those with lower ESG credentials, in the first half of 2020 as COVID-19 contributed to a volatile New Zealand equity market? We take a snapshot of how stocks have performed through the first half of calendar year 2020.

Harbour has incorporated its proprietary Corporate Behaviour Survey (CBS) into its investment process since its inception and our CBS includes questions covering many ESG issues. In our view, companies exhibiting good corporate behaviour will have strong corporate governance, environmental and social policies. Further, if a company creates value for all its stakeholders, then shareholders are more likely to do well also. Stakeholders include customers, suppliers, communities, financiers and shareholders. Firms that rate well are more likely to employ capital efficiently, be more fully valued by investors and produce superior returns relative to comparable companies that do not rate as well. Harbour constructively engages with companies to encourage ongoing improvement in their CBS scores (including ESG practices).

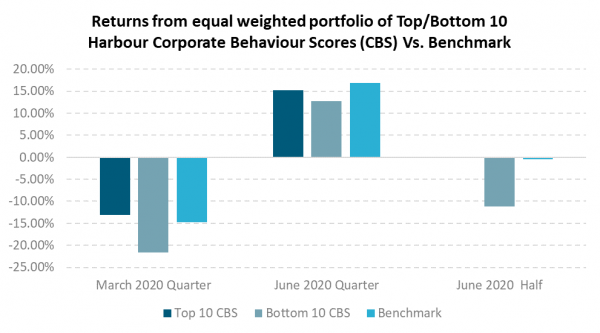

To test whether CBS scores improved investors’ outcomes during market dislocation periods, such as those observed over the first half of 2020, we created equally weighted portfolios of the CBS’ ten top- and bottom-ranking S&P/NZX50 index stocks. CBS scores were taken as at the first quarter of 2020 and then compared to the CBS score for the second quarter, to reflect the decline and recovery period. The portfolio of top-ranking CBS stocks significantly outperformed the bottom-ranking portfolio over both quarters as illustrated in figure 1:

Figure 1: Higher CBS stocks companies outperformed lower CBS score stocks in first half 2020

Source: Harbour, Forsyth Barr, Bloomberg. To 30 June 2020. Benchmark is the S&P/NZX50 Portfolio Index; equally weighted portfolios are composed of the 10 highest /lowest ranking index stocks using Harbour’s Corporate Behaviour Score rankings

While the top-ranking CBS stocks delivered a slightly better than market returns for the June 2020 half, the way they delivered the short-term value add is perhaps more interesting for long term investors. Higher-ranking CBS stocks significantly outperformed the broader New Zealand equity market in the March quarter and gave back a modest amount of relative performance against the benchmark in the June quarter. In our view, this supports the risk management benefits of favouring companies with a high CBS score.

Perhaps the key takeout is that companies with low CBS scores significantly eroded returns during the June half year. The fact that the bottom ten stocks underperformed the market recovery in the June quarter highlights the potential persistency of information in CBS scores. Investors remain concerned that lower CBS ranking stocks may not deliver appropriate returns relative to risk. Whilst not all high CBS ranking stocks are outperformers, poor CBS stocks are likely to be underperformers. Four of the top ten ranking CBS stocks outperformed the benchmark over the June half year. All ten of the bottom ten ranking CBS stocks underperformed the benchmark over the half.

Harbour has utilised its CBS framework over a long period of time and through several investment cycles. While the June 2020 half is a very short period of time, and as such some caution is warranted, the observations for the period are consistent with Harbour’s long term research – stocks with low CBS scores tend to struggle to deliver consistent returns through time. In our view, companies with higher CBS scores are more resilient, but the benefit from biasing investment to stocks with better ESG practices requires a patient long-term approach.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.