Foundation Series on InvestNow

The Foundation Series Funds are InvestNow’s house brand fund solutions. Currently, InvestNow offers four Foundation Series Funds, covering two global share strategies and two diversified portfolios. The two diversified funds, plus the Total World and US 500 funds are also available via the InvestNow KiwiSaver Scheme. Find out more about the InvestNow KiwiSaver Scheme here.

Introducing the Foundation Series Funds:

The mission for the Foundation Series is to help Kiwis achieve their investment goals through the most cost- and tax-efficient vehicles in the market.

We focus exclusively on creating value for investors by building competitively priced funds that offer some of the lowest fees available in New Zealand.

The Foundation Series also rests on a solid understanding of the often-neglected role of tax on investment returns. Our funds are constructed to institutional-grade tax-efficiency standards, which means more money in the pockets of Kiwi investors and less ‘donated’ to foreign governments.

We believe that robust, long-term investment outcomes are underpinned by the core principles of asset diversification and efficient portfolio construction, and incorporate these values in providing a broad set of fund offerings that are designed to form the ‘Foundation’ of any investment portfolio.

Foundation Series investment options

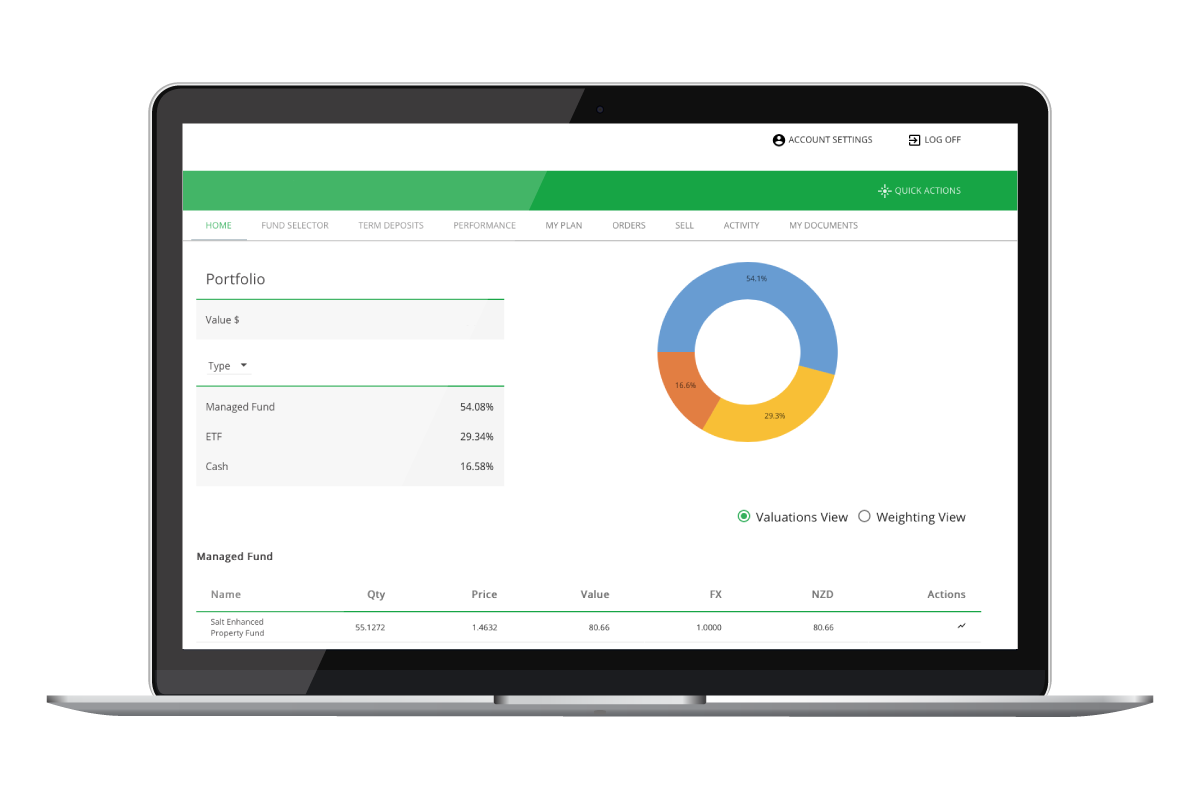

Below is the range of investment options from Foundation Series that are available through the InvestNow platform, either as Managed Fund investments or as options within the InvestNow KiwiSaver Scheme.

For fee information and links to relevant disclosure material:

- For their Managed Funds, click here.

- For their funds available in the InvestNow KiwiSaver Scheme, click here.

To invest in these investment options through InvestNow, create an online account.