InvestNow News – 18th September – Milford – Insurance meets Global Warming

Article written by David Rigby, Milford – 9th September 2020

Airlines. Oil & Gas. Car manufacturing. Agriculture. Viticulture. Cement and Steel production. Even Bitcoin mining. The list of industries that most people now know either significantly impact or are impacted by global warming is long and growing. But another industry that belongs on this list may come as a bit of a surprise: Insurance.

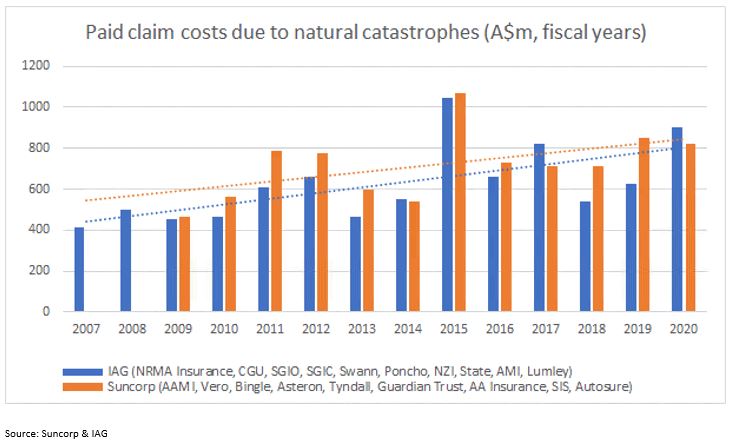

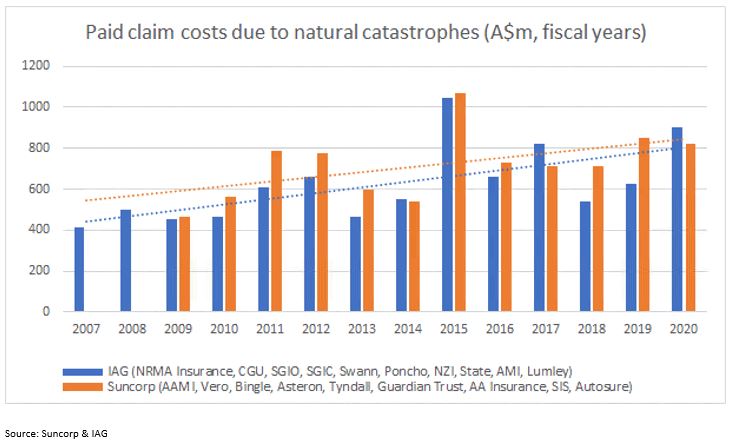

Apart from a desire to be good corporate citizens, the companies behind household Kiwi names such as NZI, State, AMI and Lumley (Insurance Australia Group) as well as Vero, AA Insurance and Autosure (Suncorp) care deeply about global warming because it is driving up their costs. A lot.

In fact, the amount they’ve paid out for damage caused by increasingly frequent and severe floods, bushfires, hailstorms, cyclones and the like has been rising for well over a decade.

And it’s not just local weather events that result in higher costs for our local providers. The chart above shows figures after including a meaningful offset from insurers’ own insurance (i.e. reinsurance).

Reinsurance is a global market, and in recent years prices have fallen as ever lower interest rates sent a flood (excuse the pun) of cash into less conventional investments. But only so many losses can be easily absorbed. The rising toll of global warming related disasters, most recently in the guise of bushfires in Australia and California, hurricanes in the Gulf of Mexico and a bad year for US crops, had started to turn the tide of reinsurance prices just before the pandemic struck.

But insurance is kind of abstract, complicated and boring, right? Why should we care that insurers are under the pump when it comes to global warming?

The answer comes in three parts:

- Most experts now accept that global warming will lead to even more frequent and intense weather events – at least in the near to medium term.

- If extreme weather is becoming more likely, then not having insurance is getting ever riskier.

- In order to make a decent return on their investments (and survive to cover us for another year), when insurers’ costs rise they eventually pass it on to you and me by charging us more to cover our homes and cars (and boats, livestock …).

And its not just you and me who end up paying higher premiums. Most local companies do too. Certainly, companies as diverse as bottle and can manufacturer Orora to energy infrastructure company APA have started to flag headwinds from years of compounded insurance rate increases. Of course, this eventually gets passed on to consumers (i.e. us) as higher prices too.

So the next time any of us is silently cursing yet another seemingly egregious rise in our Home & Contents premium (a sad inevitability, I’m afraid), think of it as yet another reason (if we needed one) to rethink how we travel, the extent we recycle, and the amount of food we waste.

Disclaimer: The material contained herein is based on information believed to be accurate and reliable although no guarantee can be given that this is the case. This is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Before making any financial decisions, you may wish to seek independent financial advice.

Disclosure of interests: Milford holds shares in APA on behalf of its clients

InvestNow News – 18th September – Milford – Insurance meets Global Warming

Article written by David Rigby, Milford – 9th September 2020

Airlines. Oil & Gas. Car manufacturing. Agriculture. Viticulture. Cement and Steel production. Even Bitcoin mining. The list of industries that most people now know either significantly impact or are impacted by global warming is long and growing. But another industry that belongs on this list may come as a bit of a surprise: Insurance.

Apart from a desire to be good corporate citizens, the companies behind household Kiwi names such as NZI, State, AMI and Lumley (Insurance Australia Group) as well as Vero, AA Insurance and Autosure (Suncorp) care deeply about global warming because it is driving up their costs. A lot.

In fact, the amount they’ve paid out for damage caused by increasingly frequent and severe floods, bushfires, hailstorms, cyclones and the like has been rising for well over a decade.

And it’s not just local weather events that result in higher costs for our local providers. The chart above shows figures after including a meaningful offset from insurers’ own insurance (i.e. reinsurance).

Reinsurance is a global market, and in recent years prices have fallen as ever lower interest rates sent a flood (excuse the pun) of cash into less conventional investments. But only so many losses can be easily absorbed. The rising toll of global warming related disasters, most recently in the guise of bushfires in Australia and California, hurricanes in the Gulf of Mexico and a bad year for US crops, had started to turn the tide of reinsurance prices just before the pandemic struck.

But insurance is kind of abstract, complicated and boring, right? Why should we care that insurers are under the pump when it comes to global warming?

The answer comes in three parts:

- Most experts now accept that global warming will lead to even more frequent and intense weather events – at least in the near to medium term.

- If extreme weather is becoming more likely, then not having insurance is getting ever riskier.

- In order to make a decent return on their investments (and survive to cover us for another year), when insurers’ costs rise they eventually pass it on to you and me by charging us more to cover our homes and cars (and boats, livestock …).

And its not just you and me who end up paying higher premiums. Most local companies do too. Certainly, companies as diverse as bottle and can manufacturer Orora to energy infrastructure company APA have started to flag headwinds from years of compounded insurance rate increases. Of course, this eventually gets passed on to consumers (i.e. us) as higher prices too.

So the next time any of us is silently cursing yet another seemingly egregious rise in our Home & Contents premium (a sad inevitability, I’m afraid), think of it as yet another reason (if we needed one) to rethink how we travel, the extent we recycle, and the amount of food we waste.

Disclaimer: The material contained herein is based on information believed to be accurate and reliable although no guarantee can be given that this is the case. This is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Before making any financial decisions, you may wish to seek independent financial advice.

Disclosure of interests: Milford holds shares in APA on behalf of its clients