InvestNow Market Wrap-Up: January 2024

Written by Jason Choy, InvestNow Senior Portfolio Manager

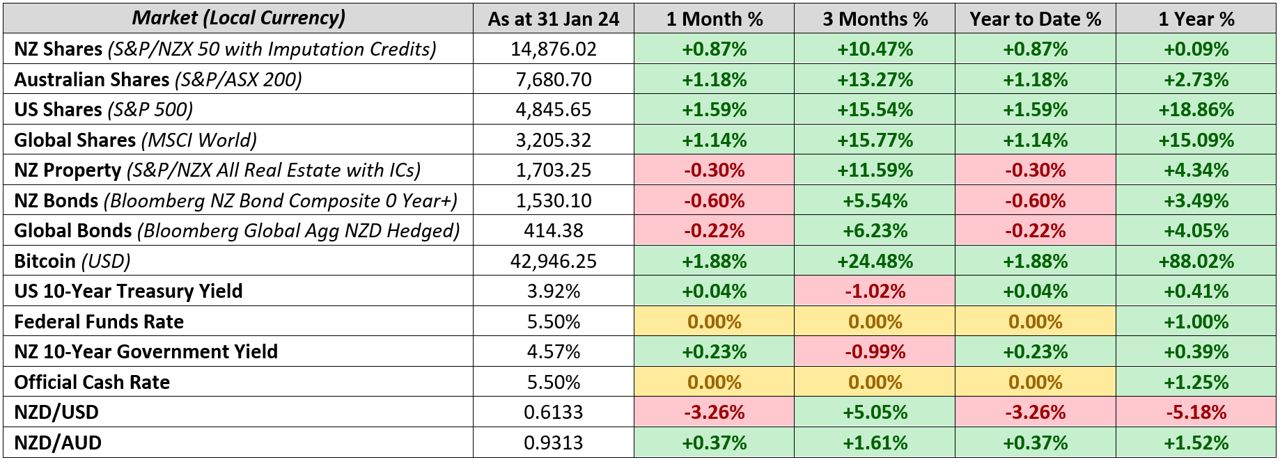

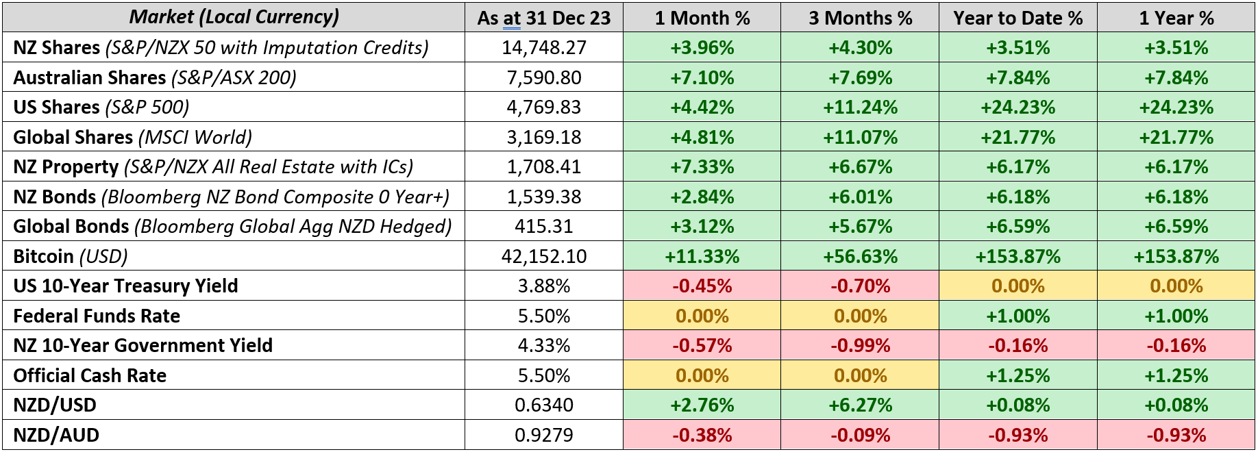

Market Dashboard

Share markets continue their winning ways while bond markets falter as robust economic data led by the US supported the notion of a ‘soft landing’. The negative correlation between bonds and equities returned, as the same strong economic data – when coupled with pushback from central bankers on the market’s dovish outlook for rate cuts – meant a less positive environment for fixed income. Bitcoin saw spot ETFs approved by US regulators over the month, opening up the cryptocurrency to a broader investor base. However, bitcoin performance in January was muted as ETF approval had largely been priced in.

Global Markets Summary: January 2024

Global share markets kick off 2024 on a largely positive note, fuelled by strong growth data and continued optimism that a recession can be avoided. Growth stocks were the notable outperformer, returning 2.1% over the month, while their value counterparts showed a relatively lacklustre performance, up just 0.3%. Developed market shares did most of the heavy lifting for global indices, returning 1.2% while emerging markets were down -4.6%. The MSCI All Country World Index (ACWI) ended the month up by 3.5% in unhedged New Zealand dollar terms, while finishing just 1.3% in hedged terms as the market prices in foreign interest rates remaining elevated for longer.

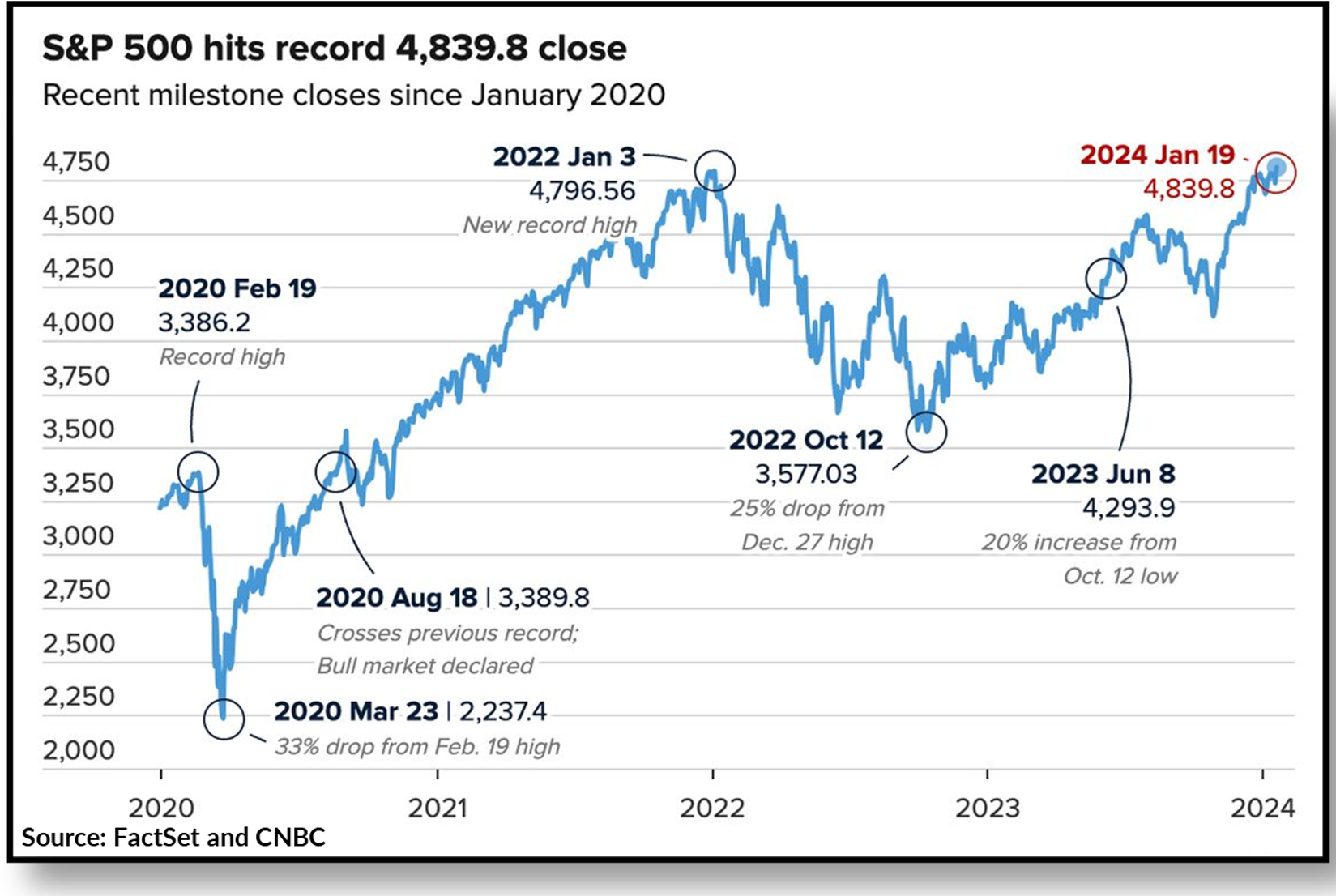

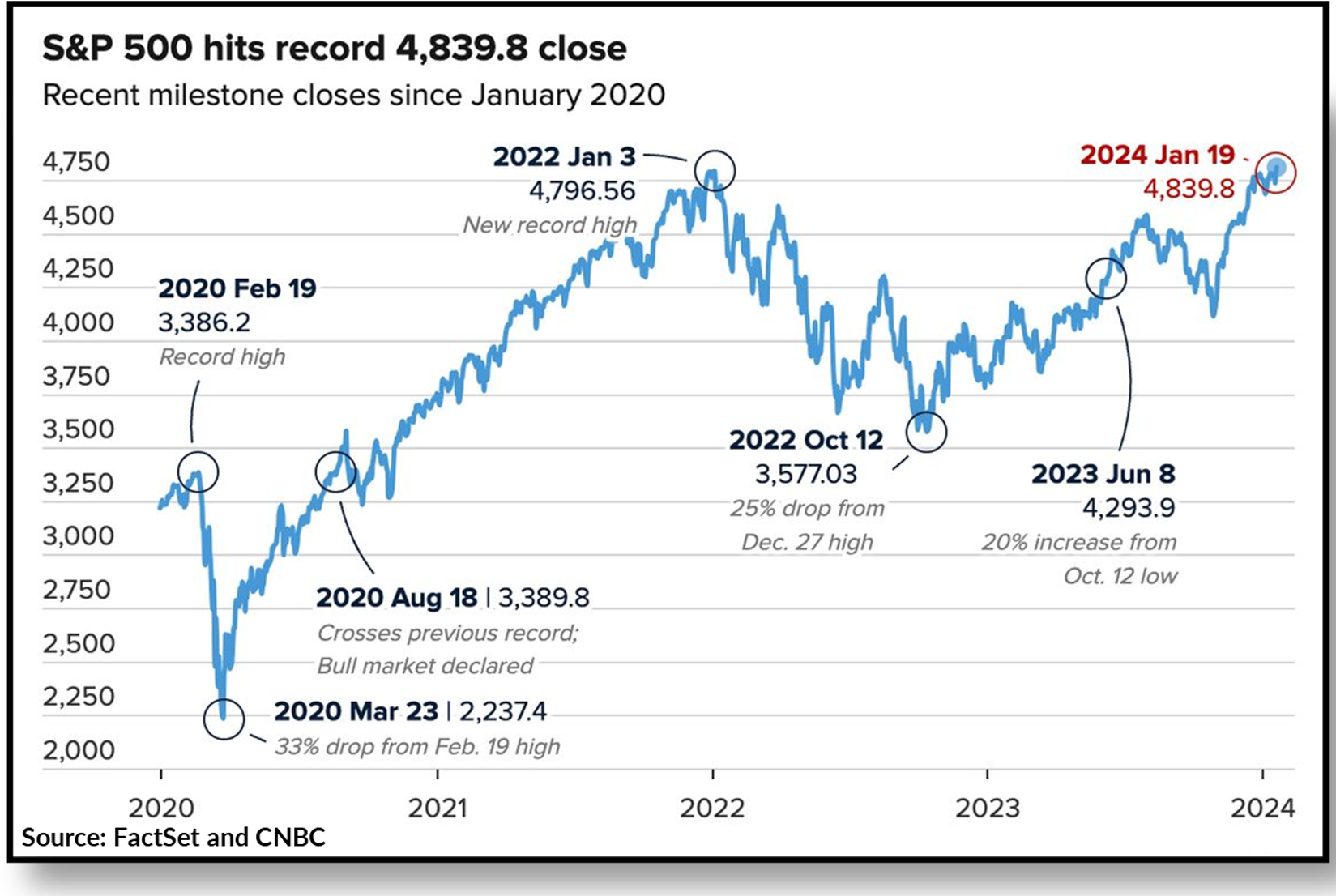

US stocks continue their remarkable rally as the S&P 500 notches new record high. January was the month the S&P 500 finally closed above its previous all-time high set in the first trading day of 2022. What ended up being a 2+ year wait saw the index erase all the losses and negative sentiment that was ubiquitous in the 2022 bear market. This latest record close was fuelled by a number of data releases that pointed to the ongoing resilience of the US economy, with headline figures including 216,000 jobs being added in December, unemployment remaining steady at 3.7% and the economy notching a blowout annual GDP growth rate of 3.3%. Overall, the S&P 500 would finish the month +1.6% higher in local terms.

Fuelled by strong growth in the US, the S&P 500 finally records a new all-time high following a 2-year wait.

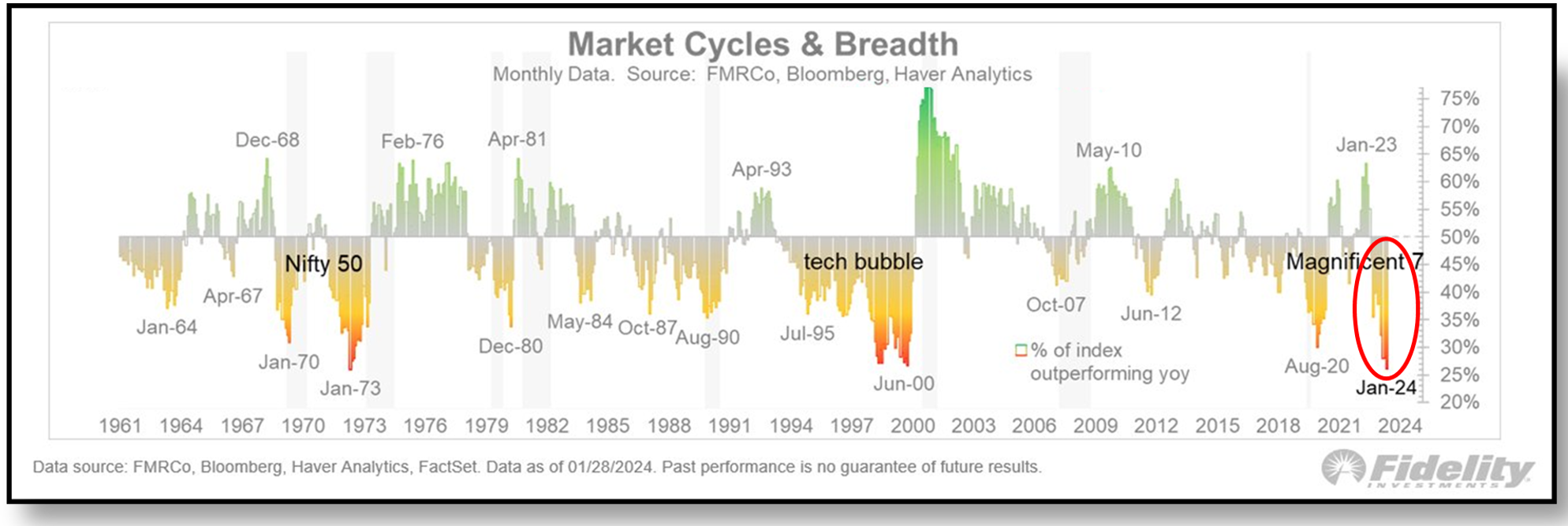

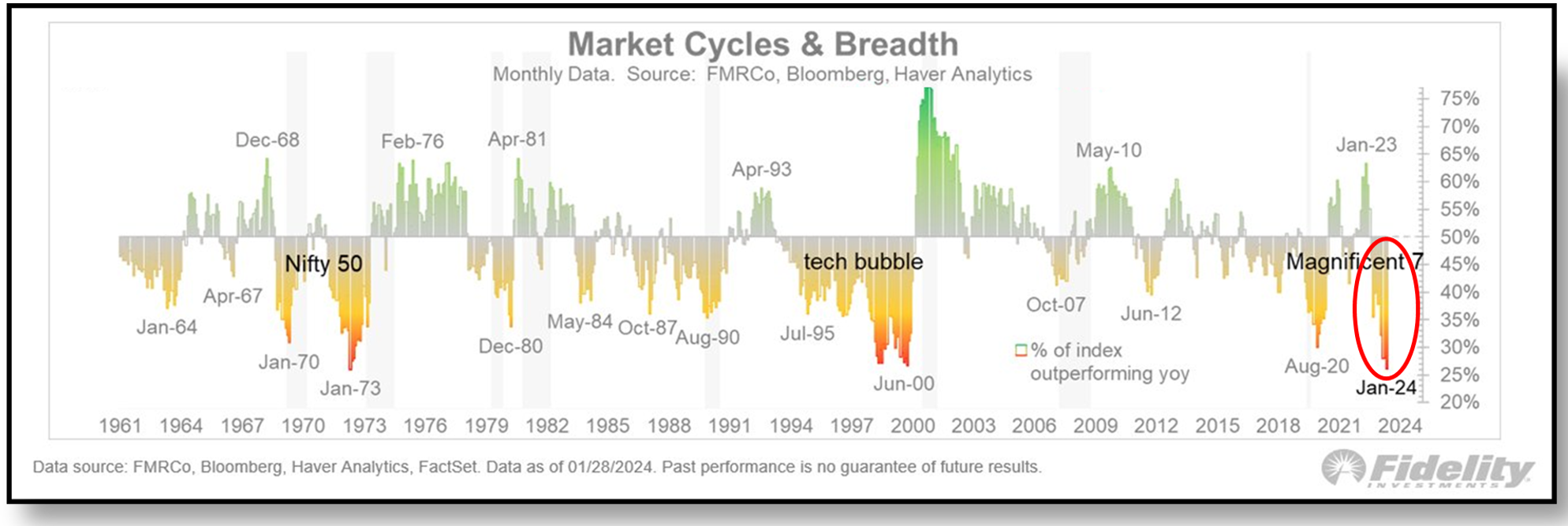

Handful of familiar names once again fuel the rally as strong fourth quarter earnings results from mega cap tech names propelled the S&P 500 to uncharted territory, while the NASDAQ also finished the month within 3.5% of its previous all-time high set in November 2021. Meta, Microsoft and Nvidia each marked new highs over the month, underscoring their significant influence on the markets. These three mainstays, along with the rest of their Magnificent Seven counterparts in Apple, Alphabet, Amazon and Tesla have ushered in one of the narrowest markets in history, with only 26% of stocks outperforming the index towards the end of January.

Market breadth, or the number of stocks within an index advancing relative to those declining, is near all-time lows at just 26% thanks to the outsized influence of the ‘Magnificent Seven’ tech stocks.

Wider developed markets remain robust despite mixed inflation news. Eurozone shares delivered a positive return of 2.1% in January, driven by manufacturing measures beating expectations and the economy returning to zero GDP growth following a -0.1% contraction in Q3. This is despite Eurozone inflation rising to 2.9% in December (from 2.4% in November), dampening hopes of an early interest rate cut from the European Central Bank, which held rates steady in January. UK stocks on the other hand fell -1.3% in January despite consumer confidence hitting two-year highs, as inflation increased to 4.0% in December (from 3.9% in November).

Japanese shares lead the way, while wider Asian and Emerging markets largely struggled – The best performing equity market over the month was Japan, which rose 7.8% despite dealing with a New Year’s Day earthquake. Chinese shares once again lagged, down -6.3% following disappointing retail sales and further deterioration in housing activities. While China’s GDP still grew 5.2% year-on-year, this was historically weak and the market remained unimpressed by Chinese policymaker’s stimulus measures. This saw emerging markets lag and Hong Kong shares also perform poorly. Indian stocks achieved modest gains though which saw their stock market’s capitalisation overtake Hong Kong’s for the first time ever.

The Indian stock market has overtaken Hong Kong’s for the first time ever, putting to question the future growth prospects of both India and China.

Global Bonds see lacklustre month, reversing some of the rally seen late last year. Strong economic data, while a boon for equity markets over January, has also cast doubt on the likelihood of central banks implementing rate cuts anytime soon. The Fed’s hawkish tone in its January meeting also dampened bond markets, with yields across all major government bonds rising. The UK 10-year led the pack, rising from 3.54% to 3.80% amid sticky services inflation and elevated wage growth, while German 10-year yields also moved from 2.03% to 2.16%. The US 10-year fared a bit better, rising just 8 bps to 3.95%. Overall this saw the Bloomberg Global Aggregate Index hedged to the NZD return -0.22% for the month.

Key updates for the Kiwi investor:

New Zealand share market saw more subdued gains, with the S&P/NZX 50 Gross Index (with imputation credits) returning 0.9% over January. This was led by a2 Milk (+12%) as sentiment improved around Chinese infant formula demand following the release of official statistics that 9 million babies were born – much higher than the 8 million expected due to fears of delayed pregnancies amid the Covid-induced environment. Summerset (+7%) was also a strong performer, after sales had increased 30% year-on-year, while Infratil (+5%) saw strong support after announcing plans to accelerate growth of the Canberra Data Centres. The NZ equity market performed in-line with our Trans-Tasman counterparts, with the S&P/ASX 200 returning 0.8% in NZD terms and 1.2% in local currency terms over January.

Local bonds followed their global counterparts, finishing mildly lower in January. The Bloomberg NZBond Composite 0+ Yr Index fell -0.6% over the month as the NZ 10-year government bond yields rose 23 bps to finish at 4.57%. Whilst some of these movements can be attributed to the broader global shift as markets scale back their expectations of rate cuts in 2024, much of the movement came down to hawkish sentiment from the Reserve Bank of New Zealand (RBNZ) themselves. RBNZ Chief Economist, Paul Conway, downplayed the dampening impact to inflation of the lower-than-expected NZ GDP figures, citing the economy’s lower productive capacity may mean inflation pressure doesn’t actually decrease.

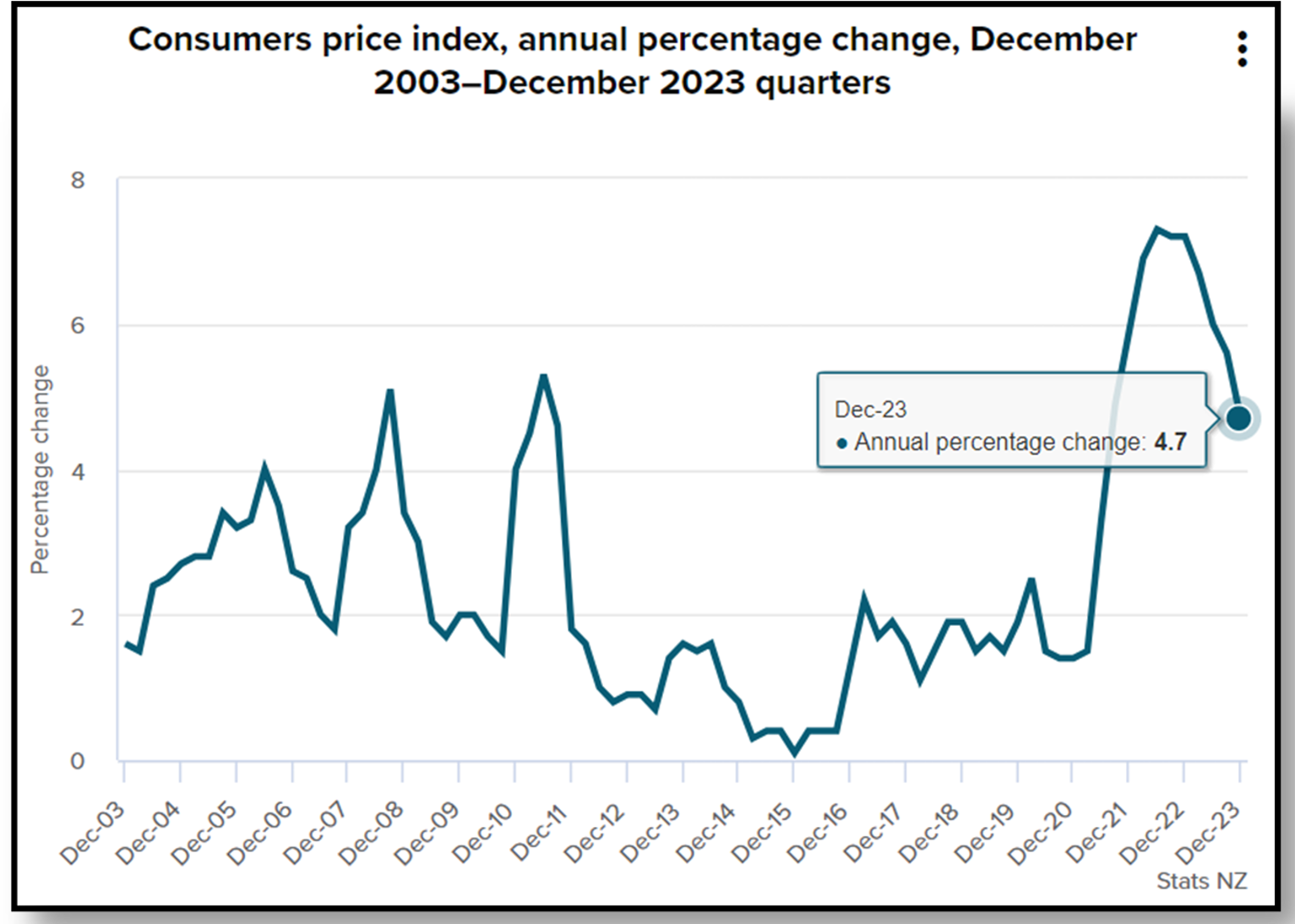

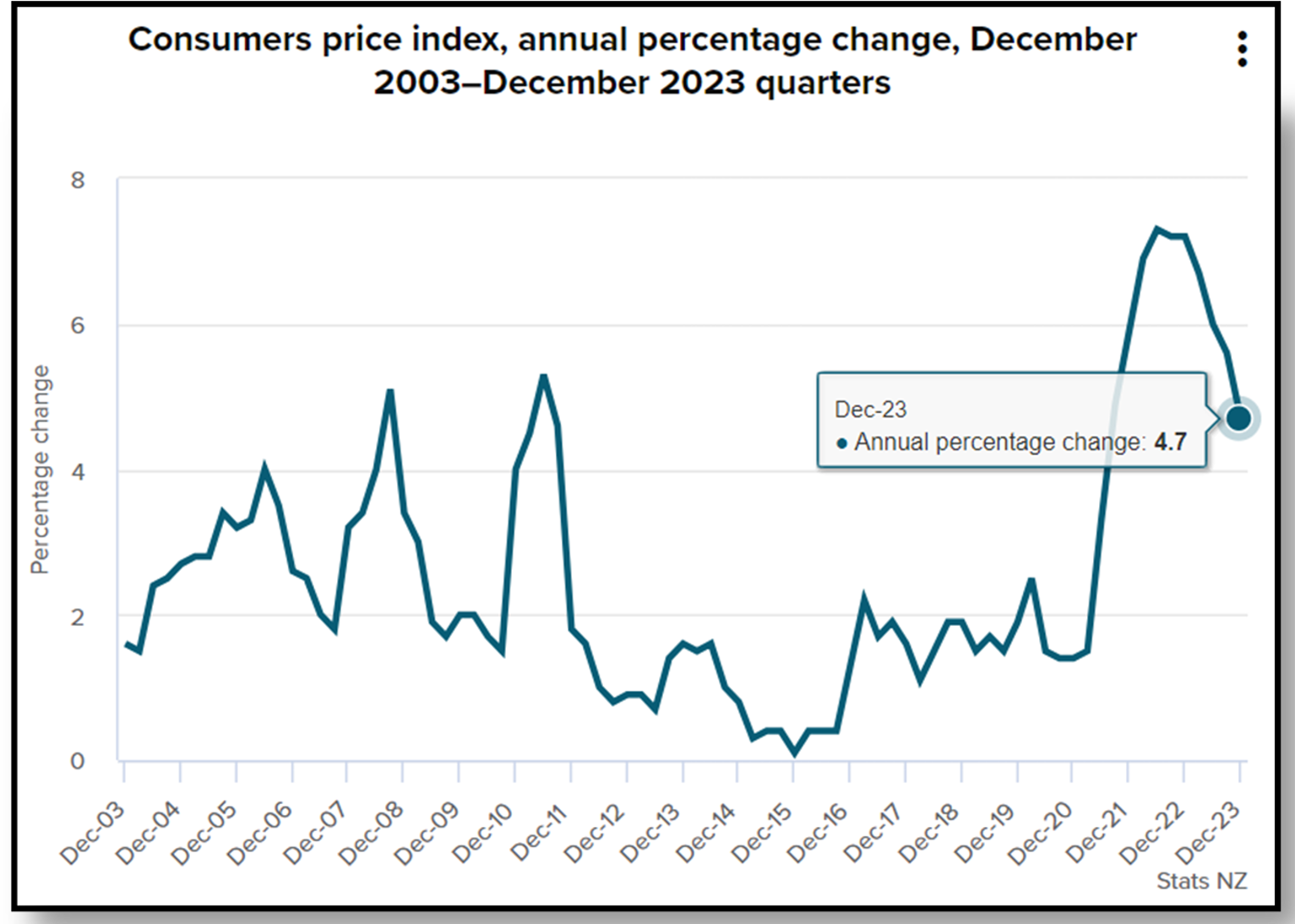

The RBNZ Chief Economist remains unsatisfied with inflation figures, despite finally retreating under 5%. While Q4 2023’s inflation reading at 4.7% is the lowest reading in over 2 years, the devil is in the details as to whether the country’s actually on track towards more sustainable price levels. While tradeable inflation (inflation that is imported or impacted by foreign markets) has decreased from 4.7% to 3.0% over the quarter, non-tradeable inflation, or inflation that is not impacted by foreign markets (and a good indicator of domestic demand and supply conditions) still remains elevated and beyond RBNZ forecasts at 5.9% year-on-year.

NZ inflation has retreated to under 5% for the first time in over 2 years, but the RBNZ remains unimpressed

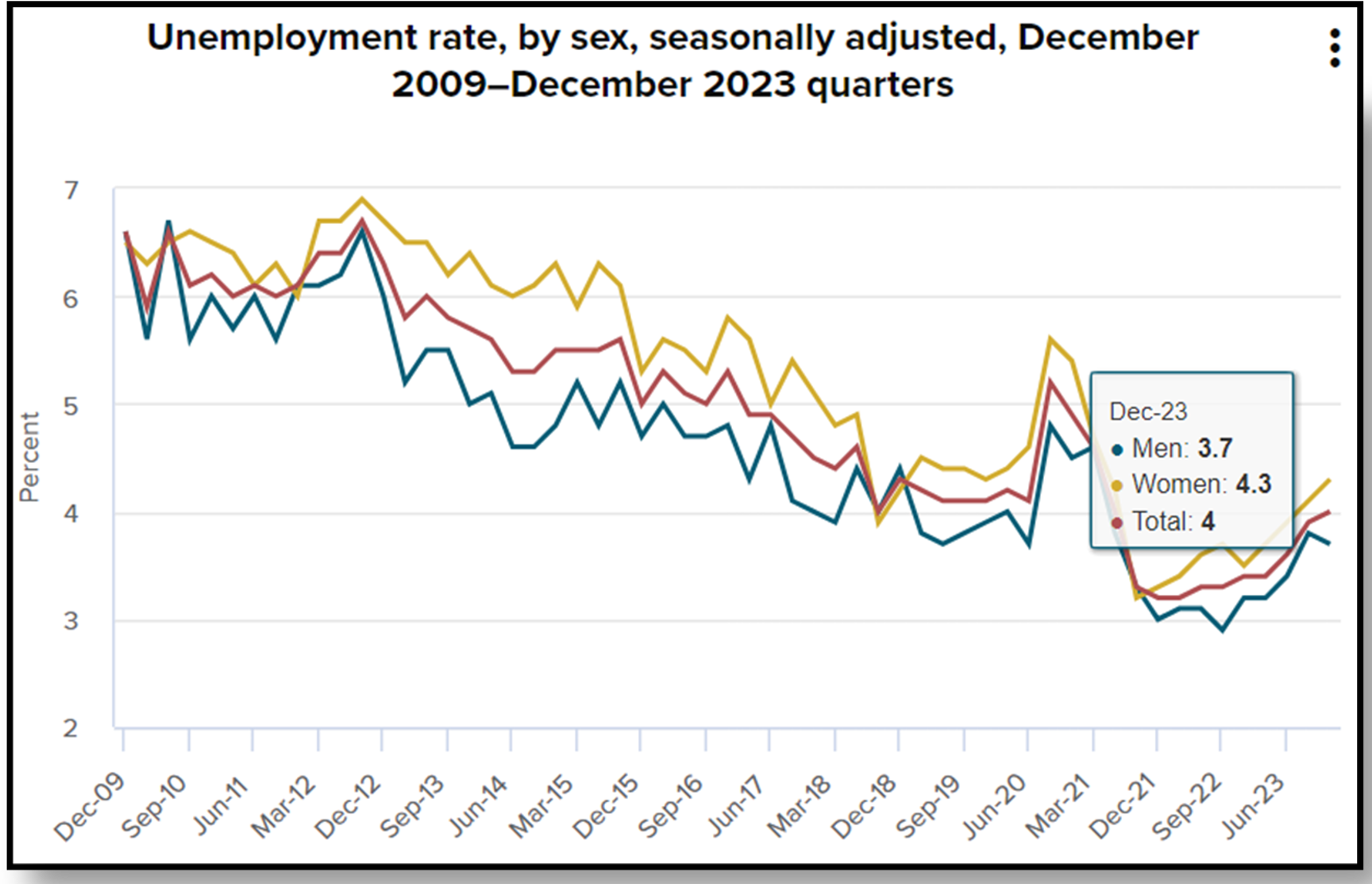

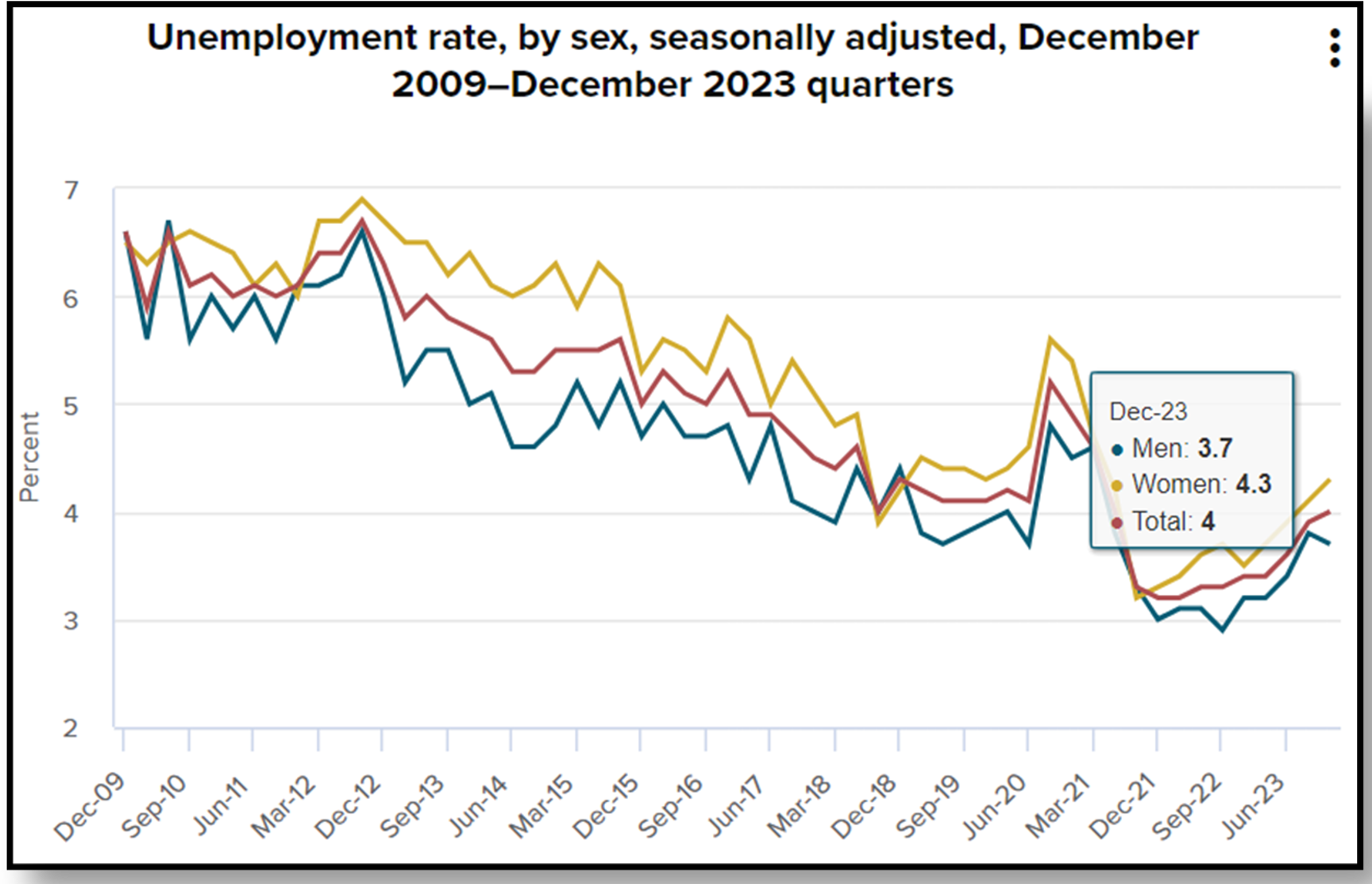

Good news or bad news? Rising unemployment figures in NZ could balance the equation – another key data point the RBNZ will deliberate in their first meeting of the year will be unemployment figures, which rose to 4% over Q4. While ordinarily, more people out of work is associated with negative news, it could actually be a positive thing for markets. With unemployment rates returning back to pre-pandemic levels and above the historic lows we saw in 2021 to 2022, this could be a signal to the RBNZ that tight monetary policy is working and that interest rate cuts may be warranted sooner rather than later.

NZ unemployment has increased to 4% – but this traditionally ‘bad news’ can be ‘good news’ for markets

However, it’s unlikely the RBNZ will want to proactively signal rate cuts to start the year and rather favour a holding pattern, even if it is confident inflation is back on the right track. A conservative communications plan is a tactical approach employed by many central banks to ensure markets don’t get ahead of themselves by spending frivolously on the first signs that like rate cuts are on the horizon. An overly enthusiastic reaction can further compound the inflation issue and ironically push rate cuts further out. Particularly with wage inflation still elevated and rising to 6.9%, the RBNZ will be especially mindful to avoid a wage-price spiral caused by being overly optimistic in its views.

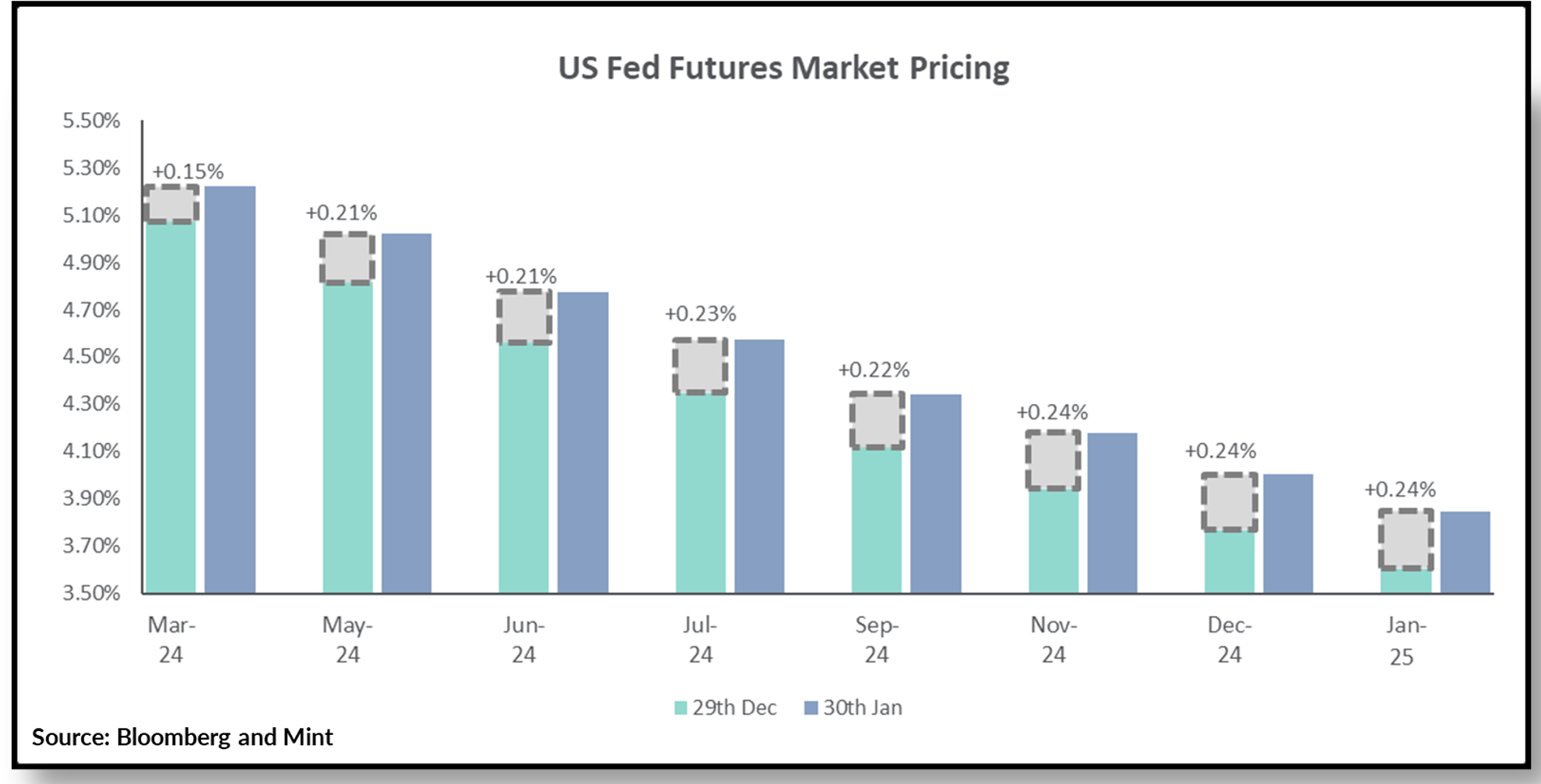

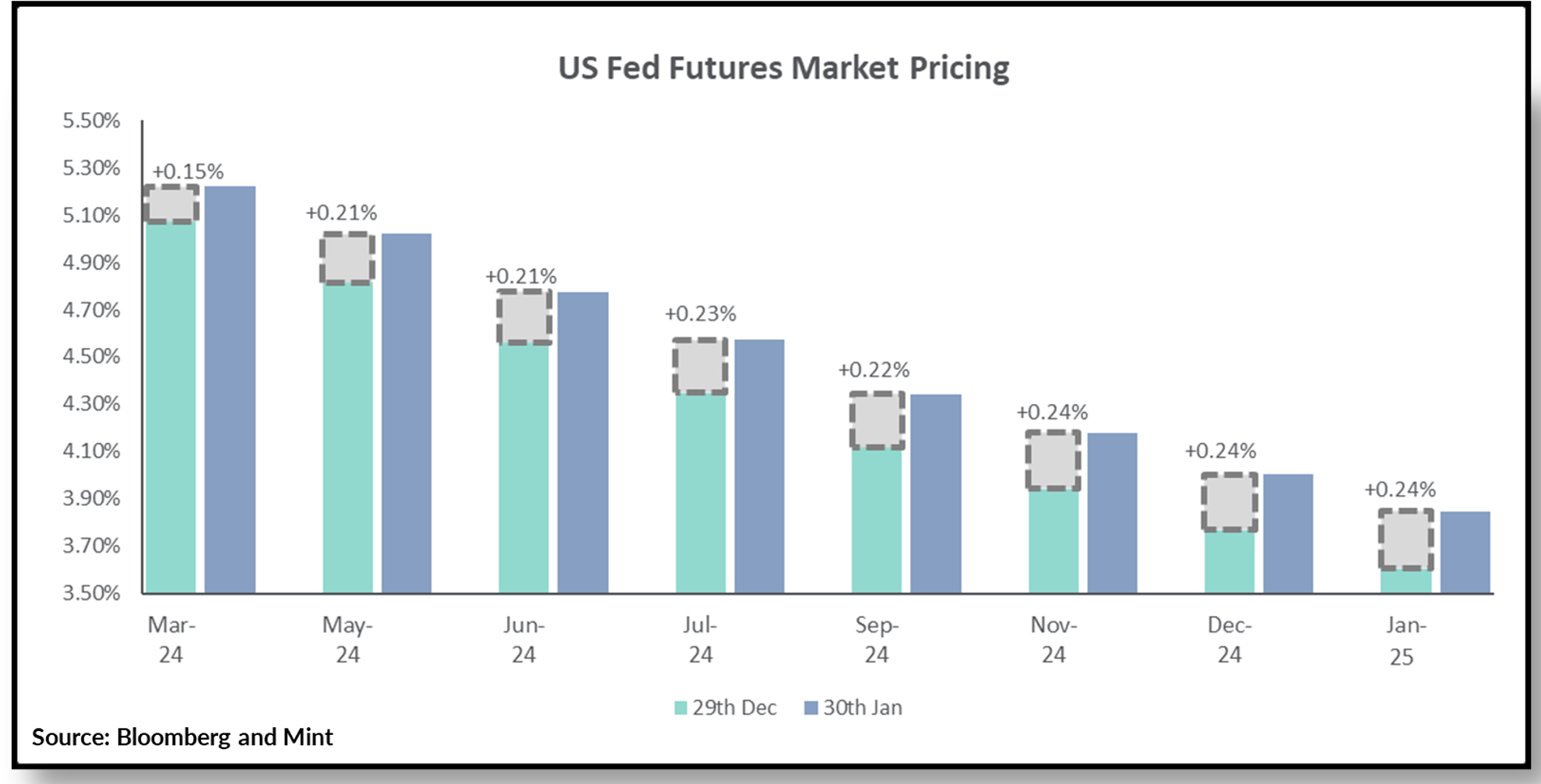

Chart of the month:

Markets have quickly repriced their expectations for interest rate cuts following robust economic data

Our Chart of the Month is from Mint Asset Management with data from Bloomberg. It outlines how the market’s expectations for the path of US interest rates have changed over the month of January, as expressed through the pricing of Federal Funds Futures contracts.

Fed Funds Futures contracts are products that offer a rate of return derived from the Fed Funds Rate, or the target interest rate range set by the Federal Reserve. Investors will broadly achieve a return in line with the Fed Funds Rate at the time the Fed Funds Futures contracts settle. Fed Funds Futures contracts settle across multiple horizons well into the future, where the Fed Funds Rate is not yet known. While the return is uncertain, the market still determines a price for this product, based on what it thinks interest rates will be at that point in the future, using information available today.

Fed Funds Futures pricing therefore represent market expectations of what the Fed Funds Rate will be at that point in the future. The pricing of these products can also be expressed as probabilities of whether interest rate hikes or cuts can be expected at that meeting. Note however that these probabilities don’t reflect the objective likelihood of a given Federal Reserve interest rate decision, but rather the current market odds of a decision based on current Fed Funds Futures trading.

Mint highlights that Fed Funds Futures have repriced upwards from initial expectations at the end of December (green bars) to the end of January (blue bars). This means that while markets were more optimistic in December that we would see the Fed undertake its first rate cut in their March meeting, by the end of January the markets repriced their expectations to no rate cut in March, which then impacted the expectations of the path of interest rates over 2024.

The repricing upwards was largely due to robust economic data, where strong growth in US GDP and a healthy jobs report highlighted just how resilient the US economy has been. This could inevitably delay inflation’s path back down to the Fed’s target levels and therefore warrant interest rates staying higher for longer, which is then reflected in pricing for the Fed Funds Futures. All-in-all, the market is bracing itself for a bit more pain in the short-term, despite being optimistic just a month ago – which highlights just how dynamic markets can be and why it is important to understand the short-term risks of investing when sentiment can seemingly reverse at the drop of hat.

What we’ve been reading:

- Asset: KiwiSaver Special – Experts Wishlist for the future

- Fisher Funds: The $200,000 coffee club

- Harbour: Top 10 Risks and Opportunities for 2024

- Investment News: Concentrate – How Active Managers might be (relatively) more magnificent

- Morningstar: KiwiSaver Survey December 2023

- Nikko: The Future Quality Approach to Navigating the AI Arms Race

- Pathfinder: Orange Bonds Positively Impacting Women

- Russell Investments: The Re-Emergence of Global Bonds

- Squirrel: Why Interest Rates could be likely to tumble

- Vanguard: APAC Economic and Market Outlook for 2024

InvestNow Market Wrap-Up: January 2024

Written by Jason Choy, InvestNow Senior Portfolio Manager

Market Dashboard

Share markets continue their winning ways while bond markets falter as robust economic data led by the US supported the notion of a ‘soft landing’. The negative correlation between bonds and equities returned, as the same strong economic data – when coupled with pushback from central bankers on the market’s dovish outlook for rate cuts – meant a less positive environment for fixed income. Bitcoin saw spot ETFs approved by US regulators over the month, opening up the cryptocurrency to a broader investor base. However, bitcoin performance in January was muted as ETF approval had largely been priced in.

Global Markets Summary: January 2024

Global share markets kick off 2024 on a largely positive note, fuelled by strong growth data and continued optimism that a recession can be avoided. Growth stocks were the notable outperformer, returning 2.1% over the month, while their value counterparts showed a relatively lacklustre performance, up just 0.3%. Developed market shares did most of the heavy lifting for global indices, returning 1.2% while emerging markets were down -4.6%. The MSCI All Country World Index (ACWI) ended the month up by 3.5% in unhedged New Zealand dollar terms, while finishing just 1.3% in hedged terms as the market prices in foreign interest rates remaining elevated for longer.

US stocks continue their remarkable rally as the S&P 500 notches new record high. January was the month the S&P 500 finally closed above its previous all-time high set in the first trading day of 2022. What ended up being a 2+ year wait saw the index erase all the losses and negative sentiment that was ubiquitous in the 2022 bear market. This latest record close was fuelled by a number of data releases that pointed to the ongoing resilience of the US economy, with headline figures including 216,000 jobs being added in December, unemployment remaining steady at 3.7% and the economy notching a blowout annual GDP growth rate of 3.3%. Overall, the S&P 500 would finish the month +1.6% higher in local terms.

Fuelled by strong growth in the US, the S&P 500 finally records a new all-time high following a 2-year wait.

Handful of familiar names once again fuel the rally as strong fourth quarter earnings results from mega cap tech names propelled the S&P 500 to uncharted territory, while the NASDAQ also finished the month within 3.5% of its previous all-time high set in November 2021. Meta, Microsoft and Nvidia each marked new highs over the month, underscoring their significant influence on the markets. These three mainstays, along with the rest of their Magnificent Seven counterparts in Apple, Alphabet, Amazon and Tesla have ushered in one of the narrowest markets in history, with only 26% of stocks outperforming the index towards the end of January.

Market breadth, or the number of stocks within an index advancing relative to those declining, is near all-time lows at just 26% thanks to the outsized influence of the ‘Magnificent Seven’ tech stocks.

Wider developed markets remain robust despite mixed inflation news. Eurozone shares delivered a positive return of 2.1% in January, driven by manufacturing measures beating expectations and the economy returning to zero GDP growth following a -0.1% contraction in Q3. This is despite Eurozone inflation rising to 2.9% in December (from 2.4% in November), dampening hopes of an early interest rate cut from the European Central Bank, which held rates steady in January. UK stocks on the other hand fell -1.3% in January despite consumer confidence hitting two-year highs, as inflation increased to 4.0% in December (from 3.9% in November).

Japanese shares lead the way, while wider Asian and Emerging markets largely struggled – The best performing equity market over the month was Japan, which rose 7.8% despite dealing with a New Year’s Day earthquake. Chinese shares once again lagged, down -6.3% following disappointing retail sales and further deterioration in housing activities. While China’s GDP still grew 5.2% year-on-year, this was historically weak and the market remained unimpressed by Chinese policymaker’s stimulus measures. This saw emerging markets lag and Hong Kong shares also perform poorly. Indian stocks achieved modest gains though which saw their stock market’s capitalisation overtake Hong Kong’s for the first time ever.

The Indian stock market has overtaken Hong Kong’s for the first time ever, putting to question the future growth prospects of both India and China.

Global Bonds see lacklustre month, reversing some of the rally seen late last year. Strong economic data, while a boon for equity markets over January, has also cast doubt on the likelihood of central banks implementing rate cuts anytime soon. The Fed’s hawkish tone in its January meeting also dampened bond markets, with yields across all major government bonds rising. The UK 10-year led the pack, rising from 3.54% to 3.80% amid sticky services inflation and elevated wage growth, while German 10-year yields also moved from 2.03% to 2.16%. The US 10-year fared a bit better, rising just 8 bps to 3.95%. Overall this saw the Bloomberg Global Aggregate Index hedged to the NZD return -0.22% for the month.

Key updates for the Kiwi investor:

New Zealand share market saw more subdued gains, with the S&P/NZX 50 Gross Index (with imputation credits) returning 0.9% over January. This was led by a2 Milk (+12%) as sentiment improved around Chinese infant formula demand following the release of official statistics that 9 million babies were born – much higher than the 8 million expected due to fears of delayed pregnancies amid the Covid-induced environment. Summerset (+7%) was also a strong performer, after sales had increased 30% year-on-year, while Infratil (+5%) saw strong support after announcing plans to accelerate growth of the Canberra Data Centres. The NZ equity market performed in-line with our Trans-Tasman counterparts, with the S&P/ASX 200 returning 0.8% in NZD terms and 1.2% in local currency terms over January.

Local bonds followed their global counterparts, finishing mildly lower in January. The Bloomberg NZBond Composite 0+ Yr Index fell -0.6% over the month as the NZ 10-year government bond yields rose 23 bps to finish at 4.57%. Whilst some of these movements can be attributed to the broader global shift as markets scale back their expectations of rate cuts in 2024, much of the movement came down to hawkish sentiment from the Reserve Bank of New Zealand (RBNZ) themselves. RBNZ Chief Economist, Paul Conway, downplayed the dampening impact to inflation of the lower-than-expected NZ GDP figures, citing the economy’s lower productive capacity may mean inflation pressure doesn’t actually decrease.

The RBNZ Chief Economist remains unsatisfied with inflation figures, despite finally retreating under 5%. While Q4 2023’s inflation reading at 4.7% is the lowest reading in over 2 years, the devil is in the details as to whether the country’s actually on track towards more sustainable price levels. While tradeable inflation (inflation that is imported or impacted by foreign markets) has decreased from 4.7% to 3.0% over the quarter, non-tradeable inflation, or inflation that is not impacted by foreign markets (and a good indicator of domestic demand and supply conditions) still remains elevated and beyond RBNZ forecasts at 5.9% year-on-year.

NZ inflation has retreated to under 5% for the first time in over 2 years, but the RBNZ remains unimpressed

Good news or bad news? Rising unemployment figures in NZ could balance the equation – another key data point the RBNZ will deliberate in their first meeting of the year will be unemployment figures, which rose to 4% over Q4. While ordinarily, more people out of work is associated with negative news, it could actually be a positive thing for markets. With unemployment rates returning back to pre-pandemic levels and above the historic lows we saw in 2021 to 2022, this could be a signal to the RBNZ that tight monetary policy is working and that interest rate cuts may be warranted sooner rather than later.

NZ unemployment has increased to 4% – but this traditionally ‘bad news’ can be ‘good news’ for markets

However, it’s unlikely the RBNZ will want to proactively signal rate cuts to start the year and rather favour a holding pattern, even if it is confident inflation is back on the right track. A conservative communications plan is a tactical approach employed by many central banks to ensure markets don’t get ahead of themselves by spending frivolously on the first signs that like rate cuts are on the horizon. An overly enthusiastic reaction can further compound the inflation issue and ironically push rate cuts further out. Particularly with wage inflation still elevated and rising to 6.9%, the RBNZ will be especially mindful to avoid a wage-price spiral caused by being overly optimistic in its views.

Chart of the month:

Markets have quickly repriced their expectations for interest rate cuts following robust economic data

Our Chart of the Month is from Mint Asset Management with data from Bloomberg. It outlines how the market’s expectations for the path of US interest rates have changed over the month of January, as expressed through the pricing of Federal Funds Futures contracts.

Fed Funds Futures contracts are products that offer a rate of return derived from the Fed Funds Rate, or the target interest rate range set by the Federal Reserve. Investors will broadly achieve a return in line with the Fed Funds Rate at the time the Fed Funds Futures contracts settle. Fed Funds Futures contracts settle across multiple horizons well into the future, where the Fed Funds Rate is not yet known. While the return is uncertain, the market still determines a price for this product, based on what it thinks interest rates will be at that point in the future, using information available today.

Fed Funds Futures pricing therefore represent market expectations of what the Fed Funds Rate will be at that point in the future. The pricing of these products can also be expressed as probabilities of whether interest rate hikes or cuts can be expected at that meeting. Note however that these probabilities don’t reflect the objective likelihood of a given Federal Reserve interest rate decision, but rather the current market odds of a decision based on current Fed Funds Futures trading.

Mint highlights that Fed Funds Futures have repriced upwards from initial expectations at the end of December (green bars) to the end of January (blue bars). This means that while markets were more optimistic in December that we would see the Fed undertake its first rate cut in their March meeting, by the end of January the markets repriced their expectations to no rate cut in March, which then impacted the expectations of the path of interest rates over 2024.

The repricing upwards was largely due to robust economic data, where strong growth in US GDP and a healthy jobs report highlighted just how resilient the US economy has been. This could inevitably delay inflation’s path back down to the Fed’s target levels and therefore warrant interest rates staying higher for longer, which is then reflected in pricing for the Fed Funds Futures. All-in-all, the market is bracing itself for a bit more pain in the short-term, despite being optimistic just a month ago – which highlights just how dynamic markets can be and why it is important to understand the short-term risks of investing when sentiment can seemingly reverse at the drop of hat.

What we’ve been reading:

- Asset: KiwiSaver Special – Experts Wishlist for the future

- Fisher Funds: The $200,000 coffee club

- Harbour: Top 10 Risks and Opportunities for 2024

- Investment News: Concentrate – How Active Managers might be (relatively) more magnificent

- Morningstar: KiwiSaver Survey December 2023

- Nikko: The Future Quality Approach to Navigating the AI Arms Race

- Pathfinder: Orange Bonds Positively Impacting Women

- Russell Investments: The Re-Emergence of Global Bonds

- Squirrel: Why Interest Rates could be likely to tumble

- Vanguard: APAC Economic and Market Outlook for 2024