KiwiSaver default shakeup – who’s out and who’s in

Article written by InvestNow

The government put the KiwiSaver market in a temporary tail-spin this May after giving five default KiwiSaver providers the boot.

While not a total surprise, the decision to slash the number of default KiwiSaver schemes from the current nine to six as of December 1 this year, went further than many expected.

The dramatic move will see AMP, ANZ, ASB, Fisher Funds and Mercer lose any default fund members (excluding those who have made an ‘active choice’ to stay) remaining at the November 30 cut-off date.

From December 1, members in the ex-default schemes will be distributed evenly among the four surviving incumbents – BNZ, Booster, Kiwi Wealth and Westpac – and two new appointees, Simplicity and SuperLife.

It’s not clear yet how many default members will actually change schemes under the government forced march but as at the end of March 2020, about 380,000 individuals and $4 billion were classified as true default members, and about 85% of these reside in the to-be-retired default providers.

Either way, the November 30 transition process looms as the largest and most disruptive event in KiwiSaver history since launching in 2007.

The default fund regime was designed as a catch-all system to house automatically enrolled KiwiSaver members who fail to choose their own schemes.

According to Inland Revenue Department (IRD) figures, about 1.3 million KiwiSaver members have joined via default auto-enrolment since inception in 2007 to the end of March this year. Just over half of this group subsequently made active scheme choices while a further 200,000 or so elected to remain in their default fund – leaving the 380,000 rump default members as defined by the Financial Markets Authority (FMA).

More tellingly, the IRD statistics show that post-launch in 2007, a total 2.1 million New Zealanders chose to join KiwiSaver without going through the default process.

Mike Heath, InvestNow General Manager, says the IRD data indicates the vast majority of KiwiSaver members have entered the savings scheme with their eyes open.

“We think most Kiwis are smarter than the government gives them credit for,” Heath says. “The IRD numbers provide clear evidence that only a small proportion – about 12% – of KiwiSaver members have not made a conscious scheme choice.

“And we expect the latest government decision will encourage even some of the most disengaged default members to make a decision about their KiwiSaver accounts.”

He says the providers that lost default status in the latest round could see some short-term fall-out with both KiwiSaver and non-KiwiSaver investors, simply due to the impending ‘What’s wrong with them?’ thought that the deselection vote will no doubt prompt among retail investors.

All of the outgoing default providers offer institutionally-backed investment and member services.

The selection process – all about the fees

“For the most part, the government selected the new default schemes based on a race to the bottom on fees,” Heath says.

The incoming default scheme fees range from 0.2% for the NZX-owned Smartshares and 0.4% for the Westpac KiwiSaver Scheme. As well, the remaining default schemes have all dropped the use of annual, fixed dollar administration fees.

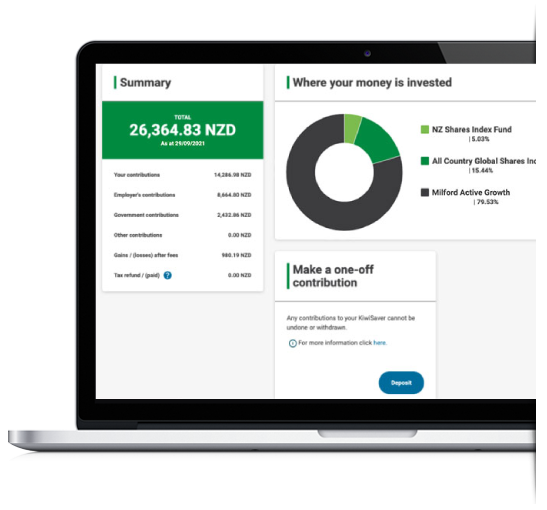

“It’s good to see that all the default providers have followed the lead of the InvestNow KiwiSaver Scheme by not including KiwiSaver administration fees,” he says. “We set up the InvestNow KiwiSaver Scheme last year to offer clean, simple, transparent all-in fees – and we’ve advocated for that across the industry.”

Furthermore, the InvestNow KiwiSaver Scheme boasts low-fee options starting from just 0.27%p.a – some of the lowest in the KiwiSaver market. Specifically appealing, is the range of Growth, Balanced and Conservative funds with competitive management fees.

Hunter Investments leads the low-fee charge with Balanced and Growth funds, with management fees of just 0.37% for a hybrid passive/active management style and a focus on addressing tax leakage, according to Heath.

Market implications – high volume trades predicted

Somewhat lost in the noise surrounding the change in providers was the perhaps more significant shift in the default fund asset allocation due to take effect on December 1.

Under the incoming asset allocation rules, providers will be required to move default funds from the current conservative settings to a balanced approach. In practice, this will see winning providers establish new balanced fund options that will be open to all KiwiSaver members – default or not.

The final asset allocation limits have yet to be revealed but preliminary documents published by the Ministry of Business, Innovation and Employment (MBIE) last year indicated providers “must not, in relation to the default investment product invest less than 45% or more than 63% of default product assets in growth assets”.

Current conservative default funds must invest between 25-35% in growth assets (essentially, shares) with the remainder in fixed income and cash. “It will be fascinating to see what happens to the New Zealand investment market, because we will have a huge amount of money flowing from bonds to shares in a very short period,” says Heath.

The government is touting the shift to balanced funds as a long-term win for KiwiSaver default members. And, according to investment theory, a higher allocation to growth assets should deliver better longer-term returns to investors.

However, Heath says the move up the risk scale may not suit all default investors.

“KiwiSaver members have to take into account their own goals and risk appetites,” he says. “We would encourage all default members – and, in fact, all investors – to regularly review their targets and risk exposure.”

“Based on our research and engagement with InvestNow customers, we can see there’s a natural preference for growth funds, reflecting a longer-term investment time-frame – a characteristic, by proxy, of the KiwiSaver structure,” he says.

In a recent article with the Scoop, FMA’s Investment Capability Manager, Gillian Boyes can be quoted “Generally speaking, you should be in a high growth fund the younger you are and the further you are from retirement. Growth funds provide the greatest opportunity to maximise returns and although the balance might jump around, young people have plenty of time until retirement age to recover any losses,”.

As the last year has proven, KiwiSaver investors might have a bumpy road to retirement – selecting an appropriate asset allocation remains the most effective way of managing those risks.

KiwiSaver default shakeup – who’s out and who’s in

Article written by InvestNow

The government put the KiwiSaver market in a temporary tail-spin this May after giving five default KiwiSaver providers the boot.

While not a total surprise, the decision to slash the number of default KiwiSaver schemes from the current nine to six as of December 1 this year, went further than many expected.

The dramatic move will see AMP, ANZ, ASB, Fisher Funds and Mercer lose any default fund members (excluding those who have made an ‘active choice’ to stay) remaining at the November 30 cut-off date.

From December 1, members in the ex-default schemes will be distributed evenly among the four surviving incumbents – BNZ, Booster, Kiwi Wealth and Westpac – and two new appointees, Simplicity and SuperLife.

It’s not clear yet how many default members will actually change schemes under the government forced march but as at the end of March 2020, about 380,000 individuals and $4 billion were classified as true default members, and about 85% of these reside in the to-be-retired default providers.

Either way, the November 30 transition process looms as the largest and most disruptive event in KiwiSaver history since launching in 2007.

The default fund regime was designed as a catch-all system to house automatically enrolled KiwiSaver members who fail to choose their own schemes.

According to Inland Revenue Department (IRD) figures, about 1.3 million KiwiSaver members have joined via default auto-enrolment since inception in 2007 to the end of March this year. Just over half of this group subsequently made active scheme choices while a further 200,000 or so elected to remain in their default fund – leaving the 380,000 rump default members as defined by the Financial Markets Authority (FMA).

More tellingly, the IRD statistics show that post-launch in 2007, a total 2.1 million New Zealanders chose to join KiwiSaver without going through the default process.

Mike Heath, InvestNow General Manager, says the IRD data indicates the vast majority of KiwiSaver members have entered the savings scheme with their eyes open.

“We think most Kiwis are smarter than the government gives them credit for,” Heath says. “The IRD numbers provide clear evidence that only a small proportion – about 12% – of KiwiSaver members have not made a conscious scheme choice.

“And we expect the latest government decision will encourage even some of the most disengaged default members to make a decision about their KiwiSaver accounts.”

He says the providers that lost default status in the latest round could see some short-term fall-out with both KiwiSaver and non-KiwiSaver investors, simply due to the impending ‘What’s wrong with them?’ thought that the deselection vote will no doubt prompt among retail investors.

All of the outgoing default providers offer institutionally-backed investment and member services.

The selection process – all about the fees

“For the most part, the government selected the new default schemes based on a race to the bottom on fees,” Heath says.

The incoming default scheme fees range from 0.2% for the NZX-owned Smartshares and 0.4% for the Westpac KiwiSaver Scheme. As well, the remaining default schemes have all dropped the use of annual, fixed dollar administration fees.

“It’s good to see that all the default providers have followed the lead of the InvestNow KiwiSaver Scheme by not including KiwiSaver administration fees,” he says. “We set up the InvestNow KiwiSaver Scheme last year to offer clean, simple, transparent all-in fees – and we’ve advocated for that across the industry.”

Furthermore, the InvestNow KiwiSaver Scheme boasts low-fee options starting from just 0.27%p.a – some of the lowest in the KiwiSaver market. Specifically appealing, is the range of Growth, Balanced and Conservative funds with competitive management fees.

Hunter Investments leads the low-fee charge with Balanced and Growth funds, with management fees of just 0.37% for a hybrid passive/active management style and a focus on addressing tax leakage, according to Heath.

Market implications – high volume trades predicted

Somewhat lost in the noise surrounding the change in providers was the perhaps more significant shift in the default fund asset allocation due to take effect on December 1.

Under the incoming asset allocation rules, providers will be required to move default funds from the current conservative settings to a balanced approach. In practice, this will see winning providers establish new balanced fund options that will be open to all KiwiSaver members – default or not.

The final asset allocation limits have yet to be revealed but preliminary documents published by the Ministry of Business, Innovation and Employment (MBIE) last year indicated providers “must not, in relation to the default investment product invest less than 45% or more than 63% of default product assets in growth assets”.

Current conservative default funds must invest between 25-35% in growth assets (essentially, shares) with the remainder in fixed income and cash. “It will be fascinating to see what happens to the New Zealand investment market, because we will have a huge amount of money flowing from bonds to shares in a very short period,” says Heath.

The government is touting the shift to balanced funds as a long-term win for KiwiSaver default members. And, according to investment theory, a higher allocation to growth assets should deliver better longer-term returns to investors.

However, Heath says the move up the risk scale may not suit all default investors.

“KiwiSaver members have to take into account their own goals and risk appetites,” he says. “We would encourage all default members – and, in fact, all investors – to regularly review their targets and risk exposure.”

“Based on our research and engagement with InvestNow customers, we can see there’s a natural preference for growth funds, reflecting a longer-term investment time-frame – a characteristic, by proxy, of the KiwiSaver structure,” he says.

In a recent article with the Scoop, FMA’s Investment Capability Manager, Gillian Boyes can be quoted “Generally speaking, you should be in a high growth fund the younger you are and the further you are from retirement. Growth funds provide the greatest opportunity to maximise returns and although the balance might jump around, young people have plenty of time until retirement age to recover any losses,”.

As the last year has proven, KiwiSaver investors might have a bumpy road to retirement – selecting an appropriate asset allocation remains the most effective way of managing those risks.